Best of Beauhurst: Our Biggest Reports & Product Updates of 2021

Category: Uncategorized

From reporting on the country’s most innovative challenger banks and cleantech startups to introducing new product features and brand visuals, this has been a rather busy year for Beauhurst.

Throughout 2021, we’ve continued to bring you in-depth data on the UK’s high-growth ecosystem, so you can discover the most ambitious businesses across the country, and the funds and accelerators that back them.

Despite fears that investment would falter amidst COVID-19, the equity market has been booming. A total of 22 new unicorn companies joined the billion-dollar herd this year, compared to just six in 2020. This includes all three of the UK’s insurtech unicorns, evidently one of 2021’s hottest new sectors. Over 500 UK companies announced their first VC funding round in 2021, whilst a record 34 megadeals were secured in Q3—more on the full-year funding trends and figures in our upcoming annual equity report.

Here at Beauhurst, our Data team has been diligently researching the UK’s startups and scaleups, with 4,261 newly tracked companies added to the Beauhurst platform this year. On top of this, they identified and verified data on an impressive 11,251 new funding rounds. Meanwhile, thanks to our Product and Development teams’ work to keep the platform in tip-top shape, our subscribers have run over 333k Advanced Searches, and collectively received over 700k Collection updates!

Since January, we’ve also published a total of 92 articles, alongside 23 in-depth research reports. We sent all of these out to you via our Thursday newsletter, which also saw the addition of a new section this year, tracking the latest announced and unannounced deals secured by high-growth UK companies each week.

And last but not least, we’ve continued to grow the Beauhurst team, with 35 new permanent hires and 20 interns in 2021. But we’re not stopping there—we’ve got a ton of roles still live on our jobs page (why not take a look while you’re here…).

In our final article of 2021, we’re taking a look over the past year, to celebrate our team’s biggest achievements and a job well done. We’ve selected a handful of Beauhurst’s biggest milestones, headline publications, and platform updates from each month of the year.

We’d also like to say a big thank you to all of our brilliant subscribers and partners who have continued to support us during the year—we truly couldn’t have done it without you!

We kicked off the new year by adding a much-requested feature to the Beauhurst platform. It enabled our subscribers to start exporting charts across the platform, for easy visuals. You can also export the data behind these charts, to run your own offline analysis, or to reproduce them in your company’s branding.

Also in January, we published our blog on some of the most successful young founders across the country. At the time, we were tracking almost 2k founders of high-growth companies under the age of 30, but these 11 student entrepreneurs were particularly impressive, having secured equity funding for their startups whilst working towards their university degrees. That’s no mean feat!

Once again, February saw us publish our annual flagship report on the UK equity market. It found the Government’s Future Fund had boosted deal numbers to a new high in 2020, amidst the uncertainty of the coronavirus pandemic. But the ecosystem had done surprisingly well even without this support, leaning on digital sectors for growth.

At the start of the year, we set out to quantify the potential impact of the Government’s proposed changes to Capital Gains Tax on the UK’s entrepreneurial ecosystem. This report showed the results of our founder survey, alongside analysis of the issues facing UK startups and scaleups if the reforms were to go ahead—including the proportion of jobs at risk, and the proportion of entrepreneurs who would consider moving operations abroad. The figures were rather scary, but thankfully the proposed changes have remained in Rishi’s draft folder for the time being…

In celebration of International Women’s Day this year, we narrowed down the 4k+ female entrepreneurs in the UK that have raised equity finance to our top 50 ones to watch. Each of their companies have raised several million pounds in investment (some hundreds of millions), despite how significantly underrepresented women are in the UK equity market. Speaking to these successful business owners, we explored their journeys so far.

This piece took a closer look at IPO trends in the UK, and discussed alternative exit routes that are becoming increasingly popular in the country’s high-growth space. We also set out our predictions for eight companies likely to go public this year. Take a look to see if we were right…

Did you know that, in the UK, 48% of announced equity deals involving private equity or venture capital firms go to companies based in London? Given this predilection, we began Q2 with a rundown of the UK’s top 23 VC funds, based on the number of deals they’d backed since 2011 that went to fast-growing businesses in the Capital.

In collaboration with JP Morgan, we analysed the 6,085 high-growth UK companies led, founded, or managed by women—out of a pressing need to provide a more nuanced understanding of the role of women in enterprise. It included investment trends, sectoral representation, and the impact of COVID-19, plus a complete list of the country’s top 200 female-powered businesses.

At the start of May, we updated the dashboard on the Beauhurst platform, with a version that’s better tailored to subscriber activity, and that bridges the gap between our analysis and yours. The Latest From Beauhurst panel links to our recent articles and reports, as well as the data that powers them (pre-filled Advanced Search criteria, and featured companies or funds). Meanwhile, the News And Transactions panel got a bit of a glow up, and we added a Recently Viewed section, so you can easily pick up where you left off.

In this piece, we delved into the world of high-net-worth individuals, specifically those supporting the high-growth ecosystem as angel investors. Drawing on Beauhurst stakeholder data, we ranked the people who had shareholdings in more than 30 private UK tech companies, many of whom are entrepreneurs themselves and now mentoring the next generation of tech founders.

In the past, our Similar Companies tab on the Beauhurst platform was based on matching sectors, buzzwords, and description words. But in the summer, we set out to improve this tool, introducing a machine learning language model to understand and match meanings of descriptions (even if there are no common words). Alongside more relevant company matches, with an algorithm that’s always improving, this update also had the added bonus of a faster loading time!

Craft breweries have seen rapid growth in equity investment over the past decade, with just two deals announced in 2011, compared to 23 deals in 2018. Since then, funding has slowed slightly, particularly amidst the coronavirus pandemic, as pubs and taprooms shut up shop. Here, we explore all the data on the craft beer sector, including some of the UK’s key players and more niche brewers. Did your favourite tipple make the cut?

July saw the release of our Seeding to Succeed report, an in-depth analysis of seed-stage investment in the UK’s high-growth ecosystem, created in partnership with SFC Capital. The report examined the worrying decline in first-time deals secured over the past few years. We concluded the research with our recommendations for how public funding and changes to SEIS could help to correct this trend.

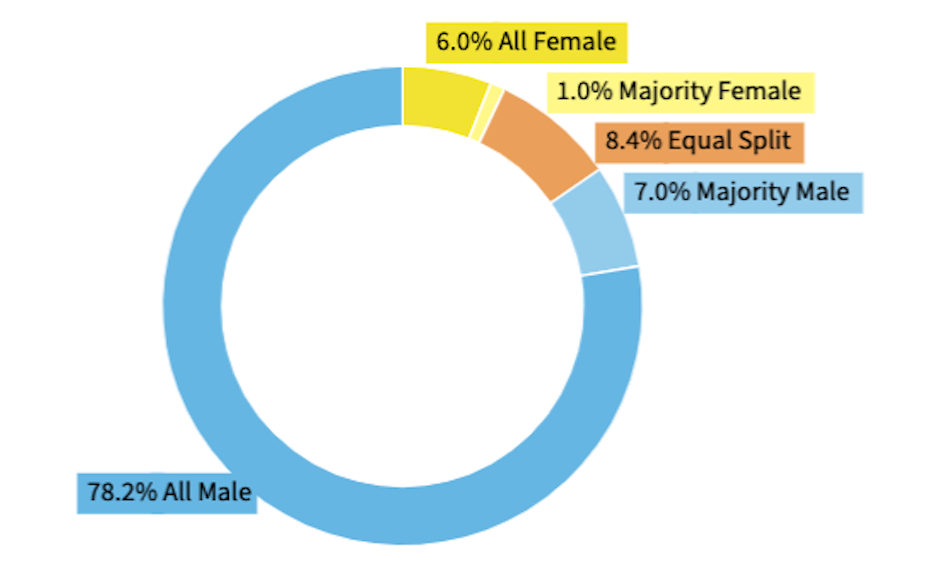

Also in July, we introduced new search criteria and charts for our subscribers that have access to our Networks add-on. Now, you can find companies according to the gender balance of their founders, directors and key people—so you can search for female-led startups, report on gender diversity in any industry, or visualise the gender divide of leadership teams within your region (and how it’s changed over time). We also added a new age chart to the platform, for insight into director age brackets.

With over 1 in 3 high-growth companies calling it home, London is at the heart of UK innovation. That’s why we created this visual representation of the Capital’s leading startups and scaleups, mapped onto each London Underground tube stop in Zone 1. The map was described by one reader as “so pointlessly interesting! Like a cat video for startup nerds.” We were pretty chuffed with that.

This collaboration with Barclays saw us investigate global opportunities for UK entrepreneurship. We analysed how the country’s high-growth companies were tapping into international markets and talent, including how much money they’d raised from overseas investors, the proportion of founders that were foreign nationals, and the proportion that were looking to hire employees from Europe and the US.

As our team in Nottingham continued to expand, we were in need of a bigger home. In September, we officially moved into our new office! You’ll now find us at Cubo Nottingham, in the heart of the city centre, crunching the numbers and training up our subscribers just as before.

Remember those megadeals we mentioned earlier? Well, here’s a whole report dedicated to them! In collaboration with Shoosmiths, we analysed the skyrocketing number of megadeals in the UK, the companies raising them, the investors backing them, and the impact they’re having on public markets. We also predicted which companies were likely to secure the next set of megadeals this year and next.

Midway through October, we reached a new milestone on the Beauhurst platform, with profiles of 45k startups and scaleups across the UK! Each of these ambitious businesses had hit one or more of our eight high-growth tracking triggers.

But it didn’t stop there… The UK’s high-growth ecosystem hit another major milestone in October. After a record Q3, UK companies crossed the £20b investment mark for the first time, with annual funding figures almost doubling in just three years.

2021 has been a record year for both equity investment and public market floats in the UK. So we partnered with Singer Capital Markets to determine the highest valued growth companies in the UK, analysing equity transactions over the last three years. The report includes pre-money valuations for the top 200 businesses, where in the country they’re based, their most common sectors, and so much more.

Beauhurst got a fresh new look! To prepare for the next stage of our growth, we knew we needed to develop a visual brand that had our company vision at its heart: great data, applied intelligently, benefits society. We were so excited to share our new logo and brand assets with you all, and we’ll continue rolling this out in the new year.

In one of our final articles of the year, we ranked the top 10 startup hubs in the UK (outside of London), based on the number of ambitious businesses currently operating in each local authority. From Edinburgh and Manchester to Belfast and Cambridge, we were pleased to discover that every UK region saw one of its cities make the list.

Just when we thought we were done for the year, we closed out the final quarter with 70k fundraisings tracked on the Beauhurst platform. That’s 70k deals secured by high-growth UK companies—a cause for celebration, don’t you think?