Will These Companies Be the Next to Raise a Megadeal?

Category: Uncategorized

We recently partnered with leading law firm Shoosmiths to investigate established and emerging trends in UK megadeals over the past decade. We define megadeals as equity investments of £50m or more.

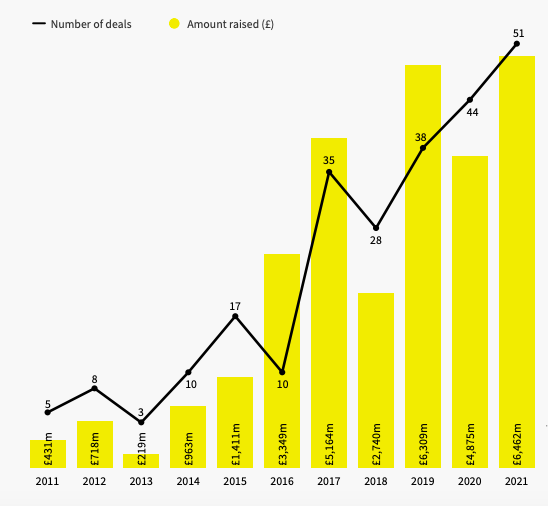

The number of megadeals has risen tenfold between 2011 and 2021, which is particularly impressive given that 2021 isn’t even through yet. In the first half of 2021, 51 deals of £50m or more took place, 26 of which were ‘gigadeals’ of £100m or more. The big bucks seem to be going primarily towards the tech industry, with mobile apps and fintech being the top sectors for megadeal investment.

Have you read our latest analysis on the biggest investments in the UK?

It’s interesting to note that US investors were involved in most of these deals, raising potential concerns about whether the value created by these businesses is benefitting the UK. Whilst foreign investment is essential for growing these businesses and creating real value for the tech sector, it also means that any returns from investment would leave the country.

Megadeal investment volume and deal numbers (2011-Q2 2021)

We’ve also analysed the UK’s top scaling companies to predict which are most likely to raise a megadeal in the next year and beyond. We’ve approached this as an art, rather than a science, taking into account a number of quantitative and qualitative factors, ranging from company stage of evolution, to presence in the media.

Our data shows that the majority of companies that raise a megadeal are growth or established companies that have already raised at least £30m, and had a fundraising that valued the company at £60m or more pre-money, nine to 18 months prior to the megadeal.

On a more qualitative level, these companies are also likely to make it onto several high-growth lists, as well as having a very clear product strategy and a competitive advantage in their field. After carefully researching and considering all these factors, we’ve built a list of six companies we think will be looking to raise high-value rounds in the near future.

1

Gousto is a subscription-based meal delivery service that provides ingredients in exact portions for recipes, together with instruction cards on how to prepare the dish. This is aimed at people who might not have the time or inspiration to come up with meals from scratch, or don’t want to do their own shopping. It also has the benefit of eliminating food waste, which is a key part of the brand’s sustainability mission.

Gousto partnered with body coach and health guru Joe Wicks in 2018, launching a new range of healthy recipes boxes that not only raised its profile, but distinguished it from competitors such as HelloFresh.

The scaleup raised an impressive £160m across 12 funding rounds, reaching unicorn status in November 2020 after its latest £25m equity investment round, bringing it to a £805m ($1b+) post-money valuation. The delivery service secured funding from funders such as the Business Growth Fund, MMC Ventures, as well as Unilever Ventures, who specialise in beauty and wellness consumer brands.

Gousto also made it on 10 high-growth lists, including ranking first on Alantra Food and Beverages Fast 50 in 2021. As they gain more market share and public recognition, it seems like fundraising must be coming its way to support its ambitious plans.

2

Ogury aims to create more impactful ads using data on the behaviour of smartphone and tablet users across multiple apps, brands and websites. Its vision is centred around personalised data for a better user experience. The rise in content consumption in recent years—which has only accelerated during the pandemic—no doubt has had an impact on the success of the business.

The adtech scaleup has received £69m in equity funding across five rounds since its launch in 2014. Its latest round of funding of $50m (£38m) took place in December 2019, bringing it to a £163m post-money valuation. Ogury confirmed its intention to expand internationally with this latest fundraising, after seeing a gap in the market for GDPR compliant technology, triggered by increasing concerns for privacy and data protection in the APAC region.

Its success in expanding overseas was recognised by the 2020 Fast Track International Track 200 high-growth list, which ranks mid-market private companies with the fastest-growing international sales over the most recent two accounting years. Ogury has featured on a further 10 high-growth lists since its inception.

International expansion is clearly a priority for Ogury, which of course requires considerable capital—we predict this will take the form of a megadeal in the near future.

3

Featurespace combines insights from data and computer science to develop artificial intelligence software that detects fraudulent behaviour. It achieves this by profiling customer activity and using machine learning to predict future individual behaviour. Its applications range from financial security, to anti-money laundering, to game fraud.

The AI company is a Cambridge University spinout, and attended the Future Fifty accelerator in 2018, a programme specifically focused on developing late stage technology businesses. Featurespace has so far been featured on no less than 15 high-growth lists, including being one of the recipients of the 2018 Queen’s Awards for Innovation.

Featurespace has secured a total of £83.5m equity investment across eight funding rounds–this happened roughly every 12 months since 2016, so it seems very likely that a new funding round is coming its way in 2021.

4

Build a Rocket Boy (no, not the Elbow album) develops AAA games. Founded by Grand Theft Auto lead developer Leslie Benzies in 2016, the company has grown at quite a pace. In 2017, Build a Rocket Boy opened an office in Budapest, away from its headquarters in Edinburgh and reached over 400 employees by 2020.

Having secured their series B funding in November 2020, the game developer raised £32.7m in equity funding co-led by Galaxy Interactive, together with existing investor NetEase. This round enabled Build a Rocket Boy to reach over £100m valuations and totalled their funding to £50m across four rounds.

The company’s success, despite the recent disruption caused by the pandemic, was evident in our research with the Telegraph back in 2020, where Build a Rocket Boy’s inclusion within the top 100 tech firms highlighted their positioning amongst the best and brightest in Britain’s startup scene.

The Scotland-based company is gaining interest due to the upcoming release of the game EVERYWHERE which is currently being worked on in their Edinburgh, Budapest and Los Angeles offices. New product launches are often accompanied by funding rounds, and we predict Build a Rocket Boy’s will be quite a successful one.

5

Oxford Photovoltaics, also known as Oxford PV, is a pioneer in the solar cell sector, generating more affordable clean energy whilst providing increasingly attractive solutions to tackling climate change. Established in 2010 by University of Oxford’s professor Henry Snaith and Kevin Arthur, the spin out has the vision to power the transition to an all-electric, greener, world.

The socially conscious Oxford PV’s growth comes at no surprise, growing from strength to strength since their inception, raising a total of £108m across 12 fundraising rounds, with the most recent round worth £34m in 2019 to enhance their transition into manufacturing and bring products to market.

Not only has Oxford PV experienced success in the funding department but the clean energy spinout has hit several of our growth triggers, evidencing their successful track record and optimistic future ahead. We can expect Oxford PV’s next move to be the complete installation of a new manufacturing line in their Brandenburg office, suggesting a potential need for fundraising.

6

Co-founded by Dr Mark Kotter and Florian Schuster, bit.bio (formerly Elpis Biomed) is a human synthetic biology company with ambitious targets including the aim to make new organs from cells within a decade.

bit.bio, much like Featurespace and Oxford PV is an academic spinout. Regarded as a market leader, bit.bio converges technology and biology to produce consistent batches of human cells.

bit.bio’s contributions to the regenerative medicine industry helped it secure two grants worth £280k and four rounds of equity fundraising totalling £35.9m. Funding has come from a multitude of stakeholders including Richard Klausner, former director of the National Cancer Institute and founder of Lyell Immunopharma, Juno and Grail.

bit.bio’s obvious focus on meeting its research goals in a sustainable manner makes it a key target for investors and a likely contestant for the next megadeal.

Industry-leading analysis on the UK’s biggest equity investments—and it’s completely free…