UK Startups That

Failed in 2021

27 April 2022

Share

The business world is full of stories of startup failures, from ill-fated fintech ventures to mismanaged medtechs and misguided entrepreneurs (Silicon Valley’s Theranos probably rings a bell). In fact, it’s believed that 9 out of 10 startups end up failing—a stat which both startup founders and venture capital investors will know painfully well.

But why is it that so many small businesses collapse within their first year? Here, we explore the key reasons why startups fail, and how failure rates for Beauhurst-tracked companies compare to the wider startup ecosystem. We also take a closer look at some of the biggest startup failures of 2021.

Why do startups fail?

Lack of product-market fit is one of the most common reasons behind failed startups, with many new businesses spending years designing and developing the perfect product, only to discover nobody wants or needs it. There are a broad range of factors, however, that impact the likelihood of startup success.

Other common causes of business failure include lack of funds or interest from VCs, as well as pricey legal challenges. And with fewer resources under their belt than established companies, many early-stage startups have also been less able to withstand the shock of the COVID-19 pandemic.

How many companies fail each year?

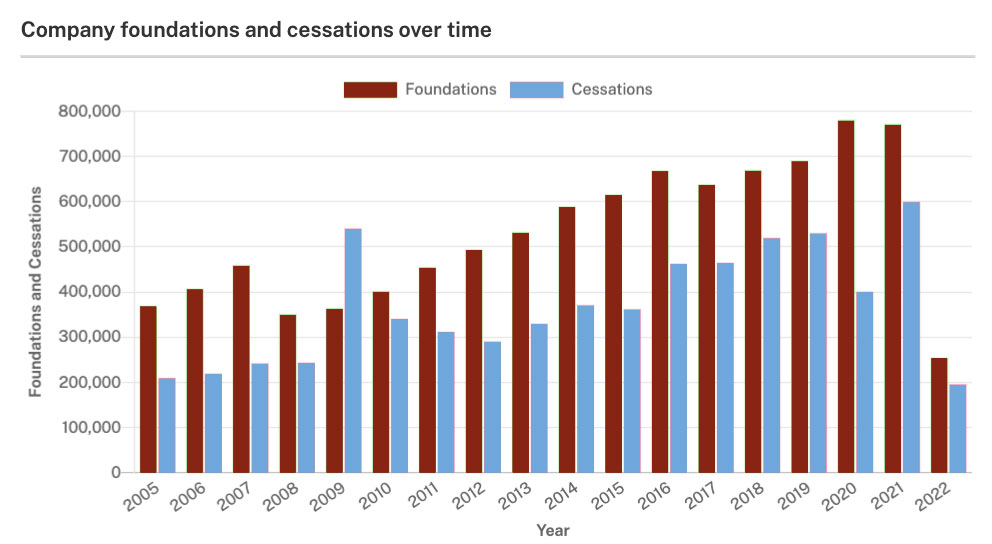

As with the number of startup success stories, the number of startup failures changes from year to year, with huge fluctuations depending on macroeconomic factors. The graph below shows the total volume of company foundations and cessations in the UK since 2005 (using data from Companies House).

The 2008 financial crisis clearly had a huge impact on the economy, with more companies failing in 2009 than being founded, unlike any other year. Yet the most recent macroeconomic crisis, driven by the COVID-19 pandemic, has had a much smaller impact on company foundations and cessations in the UK.

With the help of Rishi Sunak’s CBILS loan initiative, Coronavirus Job Retention Scheme (aka furlough) and other COVID support schemes for businesses, there were just 401k company cessations in 2020—compared with 530k in 2019. We also saw a record number of company foundations in 2020, at 780k, perhaps due to a rise in entrepreneurship during the pandemic.

Through 2021, there were 771k company foundations and 599k cessations, as 11% of the UK business population shut down last year. For companies that have hit one of our high-growth tracking triggers, however, the odds are far better—amongst the most ambitious businesses in the UK, just 4% transitioned to the “Dead” or “Zombie” stages of evolution last year.

Companies categorised as Dead have either announced they’re ceasing all activities or have parent companies that have formally dissolved. Whereas, Zombie companies are those that have been neglected for a prolonged period or are in a troubled financial state—we highlight these businesses which look in distress, so that you can find them before they fail.

Overall, 668 high-growth UK companies went under in 2021. We’ve chosen to spotlight a handful of these businesses, exploring how they came to be and the challenges their founders faced in building a successful startup. Failure is often a part of future success, and there are lessons to be learnt from each of their journeys. We hope to see many of the entrepreneurs behind these companies pursuing new ventures soon (several have already started), as so-called phoenix founders.

14 of the biggest startup failures of 2021

Farmdrop

Farmdrop was founded by former stockbroker Ben Pugh in 2012. Based in London, the online grocery delivery service brought food to customers sourced directly from local farmers and fishermen. By cutting middlemen from the supply chain, producers were able to receive a higher proportion of their produce’s retail price.

By the end of 2020, Farmdrop had raised over £37m in equity fundraisings, across 10 rounds. This included a £10m deal in 2018, led by VC funds Impact Ventures UK and Belltown Ventures. The company was also named in Mishcon The Leap in 2015, which tracks 100 of Britain’s most exciting high-growth businesses, and included in SyndicateRoom’s Top 100 list in 2018.

But despite its early success and a growing customer base supported by more households using home deliveries throughout the pandemic, supply chain issues meant the business model struggled to translate this growth into profit. Rising fuel prices, driver shortages and an increase in the cost of animal feed meant Farmdrop had a pre-tax loss of £10m in 2021, with a loss of £11m the previous year.

In December 2021, Farmdrop announced that it would cease trading, after failing to secure enough money to manage its increasing business costs.

Ralph & Russo

Luxury clothing brand Ralph & Russo was founded in London in 2006. By 2021, the company had achieved 20% scaleup status, and secured more than £50m in equity fundraisings with Tennor Holding and angel investors. It was founded by Australian entrepreneurs Tamara Ralph (the brand’s Creative Director) and Michael Russo (CEO).

Ralph & Russo was forced to close its storefronts several times during the pandemic, in line with national restrictions, but continued to offer online ordering and delivery services. In March 2021, however, the company announced that it had entered administration, in order to restructure the business and find enough money to continue operating in the future.

In July 2021, Ralph & Russo was acquired out of administration by Retail Ecommerce Ventures, joining the firm’s existing portfolio of e-commerce ventures. Its website claims that Retail Ecommerce “is restoring the brand and will elevate it to new heights”.

Greensill

Greensill Capital was founded by Lex Greensill in 2011. The fintech company offered supply chain financing, lending money directly to suppliers which could later be paid off by buyers. This minimised the time suppliers would need to wait for invoices to be paid, improving their cash flow, while allowing buyers to extend their payment terms if required.

Having already secured £189m in equity funding from General Atlantic, in 2019, Greensill was included on Business Cloud’s 100 Fintech Disrupters list of the UK’s most exciting fintechs. That same year, it raised two further rounds of equity investment from SoftBank Vision Fund, worth £1.13m in total. It later acquired three other ventures: FreeUp, Earnd and Omni.

In March 2021, Credit Suisse froze $10b held by Greensill, as part of their insurance covering defaults lapsed. Later that month, after attempting to find a solution, including selling part of the business, Greensill filed for insolvency after it was unable to repay a loan due to lack of funding.

Meanwhile, former Prime Minister David Cameron was an advisor to Greensill, resulting in an inquiry last year into alleged lobbying of members of the UK Government. The inquiry found that Cameron broke no rules, but had shown “a significant lack of judgement”.

DJS

Founded in 2013, DJS (UK) was a software-as-a-service (SaaS) company. It owned and operated short-term lender PiggyBank and lead management system Leadtree Global, among other fintech services. Based in Bournemouth, DJS (UK) secured a £15.0k equity deal in 2016.

In 2019, it was named on Fast Track’s Profit Track 100, which ranks private companies with the fastest-growing profits over the previous three years. That same year, however, PiggyBank was forced to cease trading—in July 2019—following concerns raised by the FCA about its affordability checks, and the collapse of several other payday lenders.

DJS (UK) went into administration in December 2019, with the firm eventually being dissolved in September 2021. Its founder, Dan Ware, remains Co-Founder and CEO of Big Golden Pineapple. A holding group for professional services businesses, it is now the parent company of Leadtree, alongside several other ventures, including Wheelie Good Finance and Pineapple Recruitment.

EventsTag

EventsTag designed a range of tools to encourage fans to share content to social media at events. Prior to 2021, the London-based tech startup had raised £2.15m in equity investment, across five funding rounds. These included three deals with private equity and venture capital firm Mercia. It had also attended the Wayra London accelerator, for businesses in the internet of things (IoT), 5G, data democratisation or customer experience sectors.

In 2018, EventsTag acquired event management software startup Excelerated Applications. The company later secured a £35.8k Innovate UK grant, in June 2020, to develop an online visitor experience with navigable 3D displays. It was intended for brands that were sponsoring or hosting virtual events amidst COVID-19 social distancing restrictions.

Despite its proactive response to the pandemic, in January 2021, EventsTag went into liquidation. It was later acquired by Inurface Media, a digital signage provider. Following the acquisition, EventsTag merged with its co-founders’ second brand (We Are Interact) to form Xi, retaining its original team members and in-house digital experience tech platform.

Together, founders Daniel Strang and Ollie Harridge have gone on to co-found HomeWerk, an automated team building platform. Strang is also CEO and Co-Founder at high-growth fitness startup Coopah, which develops a mobile app for personalised running training.

Friska

Bristol-based Friska operated a chain of “feel good food” restaurants across the UK. Founded in 2009, the company had secured two equity and debt fundraisings, amounting to £4.25m.

With the arrival of COVID-19 and the ensuing government measures, Friska was forced to temporarily close its physical premises in April 2020. It reopened at various times throughout the year, began offering takeaway options, and took part in the Eat Out To Help Out scheme. But, like most of the leisure and entertainment industry last year, it faced severe and ultimately crippling challenges as a result of the pandemic.

In November 2020, the company entered into a voluntary arrangement (CVA), which saw its Manchester and Birmingham locations shut down. Friska was later acquired, in July 2021, enabling its co-founders Ed Brown and Griff Holland to retain two of their Bristol sites under a new name. According to Brown’s LinkedIn, the decision was made “to help ensure the survival of the brand, safeguard as many jobs as possible and return some value to our creditors”.

Building on their experience of entrepreneurship so far, the pair now run Vela OS, a new project offering a full stack, cloud-based system for the hospitality sector. It seeks to help businesses to manage their suppliers, employees, compliance, and more.

Bulb

Founded in 2014, energy supplier Bulb aimed to provide simpler and cheaper energy to its customers through the automation of back office operations, all of which could be managed through a mobile app. The green energy company produced 100% renewable electricity and 100% carbon offset gas.

Bulb’s entrepreneur co-founders, Hayden Wood and Amit Gudka, initially funded the business through savings and personal contacts, growing it to over 20k customers within the first year. In total, the company secured £65.3m in equity fundraisings, across six rounds, with the likes of JamJar Investments and Clearly Social Angels. Its latest raise, in June 2018, saw the company reach a post-money valuation of £411m.

As part of its rapid early-stage growth, Bulb attended Tech Nation’s Upscale and Future Fifty accelerator programmes. By late 2021, the company’s user base had grown to approximately 1.7m, and it had featured on numerous high-growth lists, including Lazard’s T100 European Venture Growth Index and the FT 1000.

But, in September 2021, financial problems (brought on by a sharp increase in natural gas prices in the UK) meant Bulb sought a bailout. In November, investors failed to provide further funding. While other UK energy suppliers that collapsed had their users transferred to larger firms, Bulb’s substantial customer base meant it was placed into special administration. This means it’s instead being run by the UK Government via energy regulator Ofgem.

Co-founder Gudka has since stepped down from day-to-day activities at Bulb to focus on his new cleantech startup, renewable energy infrastructure firm Field, which he founded in January 2021. Field’s current focus is on developing battery storage for clean energy.

Igloo Energy

Bulb wasn’t alone in its struggle. Amidst the ongoing energy crisis, Igloo Energy was one of several small gas and electricity suppliers that went bust last year. The Southampton-based energy company was founded in 2016. Its business model focused on helping customers to reduce their energy consumption, cutting costs and emissions through smart meter data and connected home technologies.

By the end of 2020, Igloo had secured four rounds of equity funding, worth a combined £24.4m, alongside a £82.1k grant from Innovate UK. The grant had been awarded to help the company develop a prototype for a self-learning data platform to support its operations.

In 2019, it was named on the Startups 100 list of the UK’s most impressive early-stage businesses. Just two years later, however, Igloo Energy ceased trading, in September 2021. Ofgem has appointed E.ON Next as the new supplier for Igloo’s customers, Meanwhile, Igloo Works (the company’s heat pump installation arm) has continued operating.

Football Index

Founded in 2015, Football Index developed a betting system that allowed users to gamble by buying imaginary shares in football players which could result in payouts based on player performances. In total, the business raised £7.76m in equity fundraisings. Three out of five of its funding rounds were facilitated by crowdfunding platform Seedrs. And in 2020, Football Index was named in Fast Track’s Tech Track 100, which ranks the UK’s fastest-growing tech companies.

In March 2021, trading on the Football Index platform was suspended as a change in rules reduced the dividend payouts from player shares, leading to a crash in its market. The valuation of user portfolios sharply fell and, shortly after, its parent company BetIndex entered administration. Both the UK Gambling Commision and Jersey Gambling Commission then suspended Football Index’s licence.

According to his LinkedIn, Football Index CEO and Co-Founder Adam Cole was also previously a NED at high-growth SaaS company Natterbox.

Wooha Brewing

Based in Moray, in the Scottish Highlands, Wooha Brewing was a producer of natural, vegan-friendly ales and lagers. Founded in 2014, the fast-growth beer company went on to secure £1.38m in equity investment during its lifetime, across four funding rounds (two of which were raised via crowdfunding platform Crowdcube).

Wooha’s latest equity fundraising was completed in February 2020, with the intention of building out its Sales team, funding promotional activity, and supporting the company’s international growth. But the best-laid plans do often go awry, and that was certainly the case when the pandemic hit…

Despite partnering with Wetherspoons, Ocado, and Amazon Prime, and securing trade deals across numerous international markets, in March 2021, Wooha entered administration. The company cited cash flow problems as the reason behind this decision, arising from the combined challenges of Brexit and COVID-19, as bars up and down the country shut up shop.

Wooha was eventually acquired by North Coast Brewing in June, which hopes to recommence operations in the near future. Meanwhile, Wooha’s founder, Heather McDonald, is currently an Executive Manager at Highland BlindCraft, a social enterprise in Inverness that employs people with disabilities to make beds and mattresses.

The Collective

The Collective provided co-living spaces, combining private accommodation with shared amenities and co-working spaces, paid for with a single monthly bill. The company was founded in 2010 and attended the Mayor’s International Business Programme accelerator, which provides support to London-based businesses looking to expand internationally.

With two co-living spaces in London, The Collective expanded into the US in 2019, opening their third communal living hub in New York. A loan investment of £140m from Deutsche Bank and GCP Asset Backed Income Fund followed a year later, with the intention of helping the company continue to expand globally. Meanwhile, a further four sites were under construction in the UK in 2021, while a Brooklyn development was due to open in early 2022.

Despite heavy investment and expansion plans, The Collective instead entered administration in September 2021. Reduced occupancy as a result of the pandemic severely affected the company’s product-market fit and meant it lacked the money to repay loans. The Collective failed to raise further capital or undertake a sale. FTI Consulting were appointed administrators, but confirmed that the two London co-living spaces will not shut down during the process.

Senzer

London-based Senzer developed respiratory devices, designed to safely and effectively deliver cannabinoid pharmaceuticals to patients. In March 2020, it secured a £2.39m unannounced equity deal, at a post-money valuation of £17.2m. This followed on from a £840k Innovate UK grant in 2019, awarded to help Senzer develop its respiratory delivery system for treating side effects of chemotherapy.

In February 2021, Senzer announced that it had entered administration, eventually ceasing operations in July. What caused this sudden closure? The medtech startup struggled to secure backing for its proposed IPO on the Alternative Investment Market (AIM), amidst mounting pressure from creditors and the challenge of gaining regulatory approval for its products proving especially difficult.

Great British Prawns

Headquartered in Edinburgh, aquaculture company Great British Prawns was a wholesale supplier to restaurants across the UK. It was founded in 2010 and specialised in producing tropical prawns at its farm near Stirling, using responsible farming techniques.

Between 2015 and 2020, Great British Prawns secured £5.48m in equity fundraisings, across four rounds—the latest of which was secured in January 2020. But by May 2021, the company had become yet another victim of the hospitality shutdown during the COVID-19 pandemic. With the majority of its employees already furloughed under the Government’s Job Retention Scheme, Great British Prawns entered administration.

The company’s co-founder, Dougie Allen, remains an active proponent of sustainable aquaculture, currently Co-Founder and Director at Rastech. Headquartered at the Scottish Oceans Institute in St Andrews, the firm is developing innovative solutions in land-based aquaculture through academic and industry partnerships. Fellow co-founder James McEuen is currently a NED at high-growth company Sigma Sports, Director at Bradshaw Taylor (backing numerous outdoor and lifestyle brands), and Founder at Aquahydra Technologies.

GOTO Energy

Founded in 2018, GOTO Energy provided environmentally-friendly energy tariffs to the UK market. Still relatively new to the green energy scene, the Dover-based startup raised a £3m equity funding round in February 2019 and, by 2021, was supplying roughly 22k households with gas and electricity.

It was announced in October 2021, however, that GOTO Energy had fallen into administration and ceased trading. It became the twelfth energy supplier to go under in the UK since the start of September. Ofgem appointed Shell Energy as the new supplier for GOTO’s customers.

More leads, more clients, less churn.

Get access to unrivalled data on all the companies and funds you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo today to see the key features of the Beauhurst platform, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client profile.