COVID Business Support: Did the Government Get It Right?

Category: Uncategorized

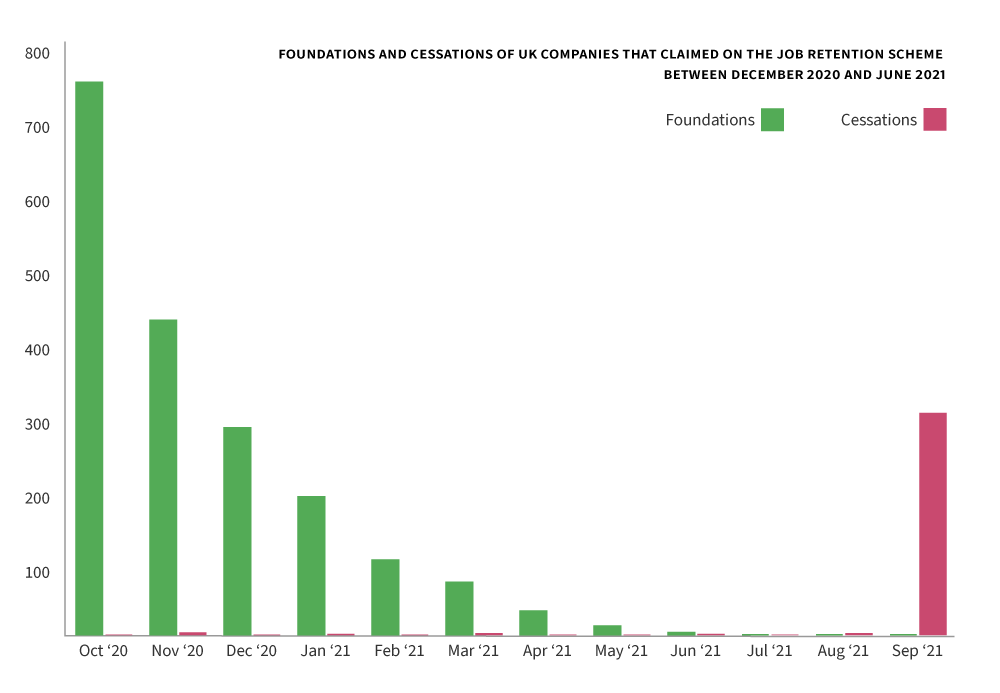

With the UK Government’s Coronavirus Job Retention Scheme drawing to a close at the end of September, and normality creeping back into society, we’re reflecting on the effectiveness of government measures taken to stabilise businesses during the pandemic.

When announcing the initial economic measures back in March 2020, Chancellor Rishi Sunak pointed to two aims: protecting jobs (to avoid large spikes in unemployment) and supporting businesses (to reduce the extent to which they’re impacted). We’ll keep these factors in mind whilst judging the effectiveness of UK Government measures.

The most notable project undertaken to achieve these aims was the Job Retention Scheme, also known as the furlough scheme. The programme saw 80% of an employee’s salary funded by the Government if they were unable to work through the pandemic, up to a limit of £2.5k a month.

Meanwhile, the Government also implemented several economic stimulus measures to support the UK’s businesses through COVID-19. These included a Coronavirus Business Interruption Loan Scheme (CBILS) and the BounceBack Scheme, both introduced to help small businesses, and the Future Fund, providing government-backed convertible loans to companies that had previously raised equity finance (so long as these investments were matched by private investment).

Overall Trends in Company Foundations and Cessations

If the aim of these projects was to avoid a crashing economy, of the type observed following the 2008 financial crisis, our data showcases signs of success.

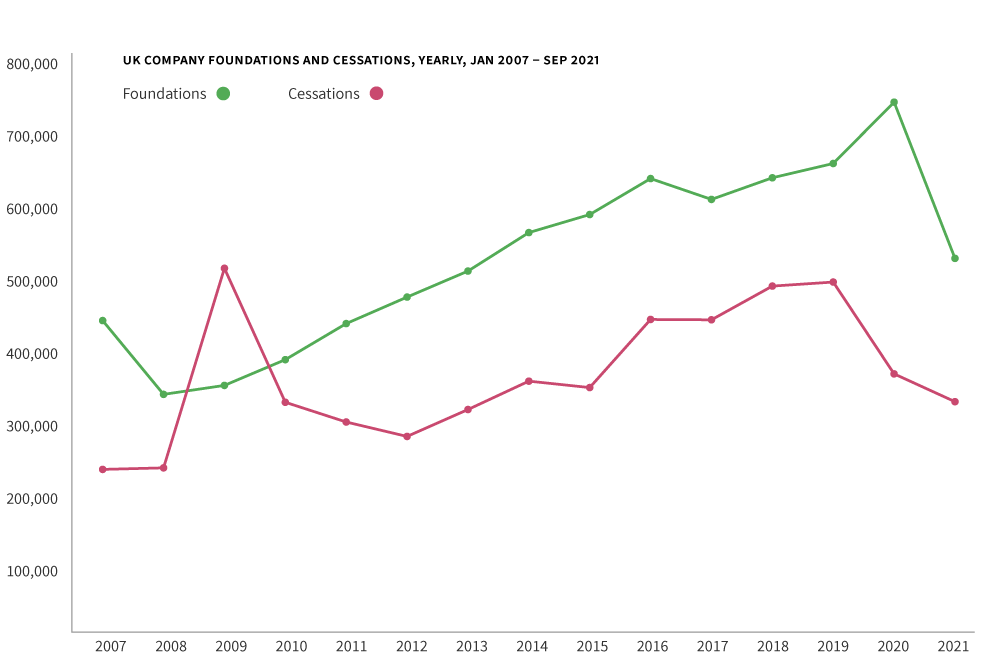

Between 2008 and 2009, the number of companies incorporated increased by merely 3.7%. In this same time frame, the number of businesses that ceased all operations jumped by over 120%, with almost 53k companies shutting down. You can see a clear difference when comparing this activity with the same data between 2019 and 2020.

Over 780k new companies were formed in 2020—13% more than the previous year. This growth, as shown in the graph above, follows the general trend of increasing business creations over the last decade. Between 2019 and 2020, we also saw an overall decline in the number of cessations, with 26% fewer companies closing down.

These figures indicate that government measures encouraged the continued growth of business foundations. But even more impressive is that these schemes not only prevented the number of company cessations going through the roof, they also drastically reduced them. This is a marked improvement on the trends seen in 2008.

Of course, there are some key differences between the Government’s reaction to the 2008 financial crisis and the 2020 pandemic. Although a range of measures were taken to support the economy following the 2008 recession, in response to COVID-19, the Government intervened quicker, and with the most extensive peacetime spending seen in the UK private economy.

In 2008, affected companies were not offered anything like the £10k grants made available to half a million small businesses when the pandemic struck. Instead, the Government introduced VAT cuts to support consumer spending and provided greater bank bailouts to keep lenders, such as the Royal Bank of Scotland and Lloyds, afloat.

Whilst assessing the outcome of the financial crisis and the pandemic might seem premature, the different approaches taken by each government may have contributed to the trends we’ve seen in the data.

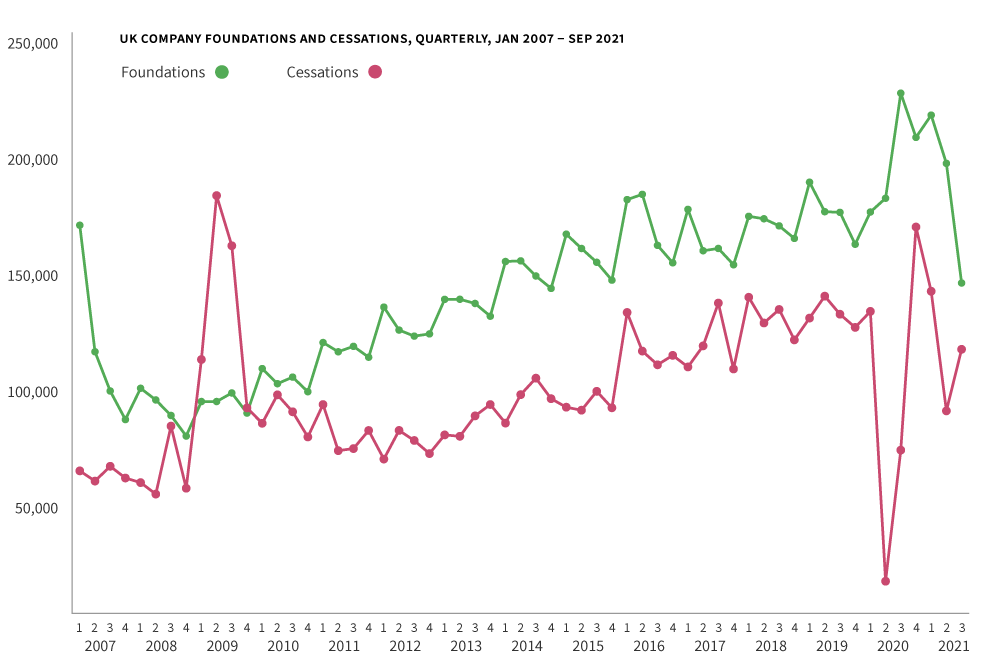

Looking at quarterly figures, company cessations dropped by 89% in Q3 2020, before rebounding in Q2 2021. The dramatic drop in cases of insolvency followed a broader global trend at the time, where countries benefiting from unprecedented financial support and payment holidays saw their number of business cessations decrease considerably.

The repayments for the Bounce Back scheme and CBILS were due 12 months after the initial loan, meaning that the first cohort of companies to receive the support began repaying in May. The fact that cessations have remained low until September indicates that these debt mechanisms did indeed provide meaningful support.

Measuring the effectiveness of the Job Retention Scheme

The Job Retention Scheme, also known as the furlough scheme, was one of the most well-known measures taken by the Government to support UK businesses. The programme is currently in the process of scaling down, with the Government reducing their contribution to employee salaries from 80% to 70% in August, and then to 60% in September.

Recent research published by the Office for National Statistics indicates that the scheme prevented a repeat of the large spike in unemployment seen following the 2008 crash (when the unemployment rate reached a high of 7.9%). In contrast, since the start of the pandemic, the level of unemployment has never surpassed 5.2%.

Measuring the effectiveness of the Future Fund

The Government’s Future Fund launched in May 2020, with the intention of providing support for innovative businesses. The programme offered companies the opportunity to secure government-backed convertible loan notes (CLNs), alongside third-party investment.

To be eligible, companies had to have raised at least £250k of equity investment in the last five years, and the loans had to be (at least) matched in value by equity investment from private investors. Controversially, companies using the fund must repay the loan with a ‘redemption premium’, amounting to 100% of the principal of the bridge funding.

Although the British Business Bank has regularly published aggregate data on where the Future Fund money was allocated, it has been criticised for failing to provide in-depth figures, such as the names of individual investee companies. As a result, we only have a fraction of the data needed to effectively judge the programme’s success.

We’re able to spot businesses that have Future Fund backing if:

1) The company announced its involvement in the scheme to the press

2) Its CLN has converted to equity, as indicated in Companies House filings

So far, we’ve been able to identify 195 such companies—out of a total 1,190 Future Fund recipients. These findings coordinate with a recent publication by the British Business Bank, listing 158 companies whose convertible loans have converted into equity shares.

The intention of the Future Fund was to help high-growth companies to continue growing, and was specifically carved out for those businesses that were not eligible for debt mechanisms. Given that we still only have access to partial data on Future Fund-backed companies, and signs of startup success usually take a couple of years to materialise, we can’t yet measure the effectiveness of this scheme. However, it is positive to see that, so far, only two such companies have fallen into the ‘zombie’ stage of evolution, indicating that they have been neglected for a prolonged period of time or are in a troubled financial situation. The rest remain active.

Summary

UK companies experienced less turbulence in the aftermath of COVID-19 than in 2008. The extent to which government measures helped mitigate the impact of the pandemic is unclear but Beauhurst data suggests that most businesses using the Job Retention Scheme and Future Fund have been successful in weathering the COVID storm. Whether this was down to government policy or to structural factors prevalent among the high-growth population is difficult to ascertain.

Related content

Future Fund Data: What We Know So Far…

With the help of the Future Fund, high-growth UK companies secured a record number of investments in 2020, at 2,928 equity deals. But what do

Analysing the Future Fund: Where Did Our £800m Go?

Figures released last week by the British Business Bank show that 745 companies have received £770.8m worth of convertible loans from the Future Fund scheme

Our quick take on the Future Fund

The Government’s announcement of support for ambitious, innovative companies this morning is a step in the right direction. However, based on our analysis, and from