Analysing the Future Fund: Where Did Our £800m Go?

Category: Uncategorized

Figures released last week by the British Business Bank show that 745 companies have received £770.8m worth of convertible loans from the Future Fund scheme since it launched in May. The published statistics also describe the regions where the companies are headquartered and the gender and ethnic breakdown of senior management teams.

As a quick reminder, the Future Fund allows eligible companies to secure a loan between £125k and £5m via a convertible loan agreement (CLA) with the UK government. The scheme requires at least equal match funding from private investors such as venture capital funds. The interest rate of the loan is negotiable between the lead investor and other investors but must be at least 8%. Repayment is due at exit, maturity (36 months), or on default of the company.

While these are welcome data points, they do not provide a robust view of how nearly £800m of taxpayer money is being used to support private enterprises via the loan scheme. As Henry Whorwood, Beauhurst’s Head of Research & Consultancy, said in June: “The taxpayer has a right to know where their money is going.”

It would be useful to know the size, stage and sectors of the 745 companies. This would help in assessing whether the money is flowing to companies that are likely to be facing financial difficulties due to the pandemic. Knowing the identity of the private investors that have matched the Future Fund’s contributions would help make clearer which interests are being served by the state aid.

While these data points do not seem forthcoming, we can use Beauhurst data to approximate the composition of the Future Fund’s portfolio and shed some light on transactions where convertible loans may have been provided.

The statistics below were generated from a dataset of 778 qualifying fundraisings completed between 20 May and 20 October 2020 by 754 companies. As per the Government’s criteria, these transactions involved private UK companies that had raised at least £250,000 in equity investment in the five years before the launch of the fund, were incorporated prior to 31 December 2019 and were raising £125,000 or more.

Sectors

Technology and IP-based businesses dominate the proxy cohort, with 72.4% of the companies having some activity in this top-level sector. This is followed by Business and Professional Services with 47.5% of the cohort having some activity in the area and then Industrials with 21.5%.

The top four subsectors within Technology and IP-based businesses make for an interesting study as they are all sectors where the impact of coronavirus is likely to be slight or even positive. They are Software-as-a-Service (19.1%), Internet Platform (13.8%), Mobile apps (13.0%), and Pharmaceuticals (4.1%). The top 10 subsectors by number of companies are shown in the ranking below; some companies will be active in several sectors.

The fact that Technology and IP-based businesses, Business and Professional Services, and Industrials emerge as the likely beneficiaries of the Future Fund is no surprise. These three also top the sectors by number of companies raising equity over the last five years. Companies with activity in these areas respectively make up 53.5%, 43.7% and 23.0% of all equity-raising companies during the period. Given that one of the eligibility criteria for the fund is raising £250,000 of equity investment in the five years prior to 19 April 2020, these sectors were always likely to be overrepresented in the Future Fund.

Only 9.7% of the proxy cohort are in Leisure and Entertainment, a sector that accounts for 12.3% of companies that have raised equity since 2015. While other schemes were put in place to address the difficulties that businesses in this sector face, it is striking to see how few of these firms are likely to have accessed the Future Fund.

Investor ranking

Equity crowdfunding platform Seedrs facilitated public participation in 65 funding rounds while Crowdcube was involved in 49 funding rounds. While it is admirable that companies have managed to successfully raise funds from the public during the pandemic, this finding does raise a question around whether taxpayers have received the best value for money. Companies that raise money via equity crowdfunding will not receive the same level of scrutiny as those that raise money from institutional investors. As a result, companies using these platforms can achieve higher valuations than institutional investors would stomach.

Taking into account the £5m cap, taxpayers may have funded as much as £132.5m worth of loans to companies that raised money through equity crowdfunding platforms. This would equate to 17.2% of the £770.8m lent through the Future Fund.

The top investors by number of deals can be seen in the ranking below. After the concentration of equity crowdfunding deals at the top, deal numbers drop away sharply with the Scottish Investment Bank and super angel co-investment fund Access EIS tied for third place on 13 transactions. The appearance of Access EIS does suggest that some non-Future Fund investment activity has been captured in the proxy cohort. As its name suggests, the fund is seeking to utilise the Enterprise Investment Scheme (EIS) which is incompatible with the Future Fund.

Company stage and size

The proxy cohort suggests that the Future Fund is living up to its aims of focusing on companies that are pre-revenue or pre-profit. Of the 778 fundraisings, 222 (28.5%) were by companies that were seed stage at the time of the deal and 406 (52.2%) were by companies that were venture stage. For those not familiar with Beahurst’s cross-sectoral stages of evolution, companies at seed stage and venture stage are younger, smaller businesses that are less likely to have the financial stability of growth and established businesses.

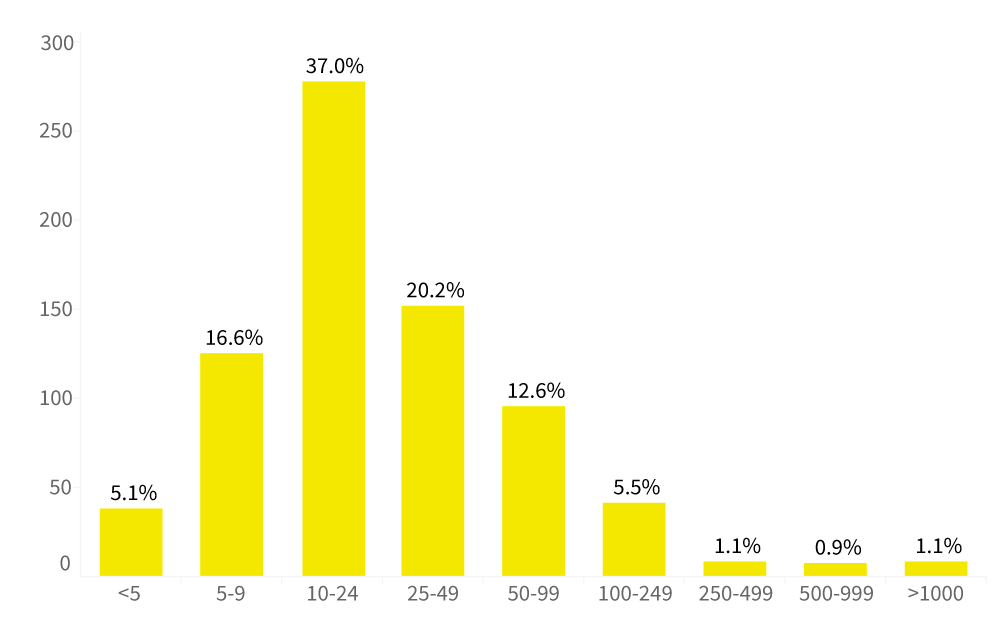

Future fund proxy cohort by employee count

Breaking down the companies by number of employees also suggests that loans went to smaller businesses. Of the proxy fund companies, 78.9% have fewer than 50 employees.

Summary

We cannot be certain of the actual companies that have been supported by the Future Fund but the proxy cohort created using Beauhurst’s data suggests that they are largely technology startups. While it is positive to see companies managing to raise equity finance during the pandemic, the high number of equity crowdfunding deals present in the sample does raise some questions about whether the Future Fund has provided value for money. Companies that raise money via equity crowdfunding receive less scrutiny than those that raise money from institutional investors and may be able to achieve higher valuations.

Beauhurst’s analyst-updated Covid-19 tags show that the pandemic is having a low or even positive impact on 87.8% of the companies in the proxy cohort. Only 10.7% are experiencing a moderate impact and thankfully only 1.5% are severely affected. While the proxy cohort suggests that companies backed by the Future Fund seem to be of the size, sector and health we would expect, only time and further disclosures by the British Business Bank will tell the full story.

Would you like more insight into what the Future Fund might look like? Or would you like to discuss the methodology used for this analysis? Email Dan Robinson for further details.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.