What’s Causing a Rise in Seed-Stage Valuations?

Category: Uncategorized

We recently released a report with SFC Capital (Seeding to Succeed) examining a decline in the number of seed rounds raised by high-growth UK businesses, specifically a decline in the number of initial deals. These first deals are a vital step for companies undertaking a growth journey and a long term decline in these deals could spell trouble for the UK’s high-growth ecosystem.

The report found that investment in seed-stage companies has significantly dropped since the pandemic struck in March 2020, both by number of deals closed and total amount raised. Those who are interested in tracing the factors behind the decline can read the report as well as Beauhurst’s H1 2021 market update, which shows some signs of a recovery in deal numbers.

Interested in the latest trends in seed fundings?

Download the free report

This article explores another significant phenomenon occurring at the seed stage: valuations of seed-stage companies have broadly been on the rise for the last 10 years.

For clarity, Beauhurst assigns a company a stage of evolution, based on features such as company size, technology readiness, and market traction. A seed-stage company will usually be a young company, between one and three years old, with an uncertain product-market fit or perhaps awaiting regulatory approval depending on its sector. This Company Growth Life Cycles article discusses the stages of evolution in more detail.

Does the increase in valuations at the seed stage mean that valuations have surpassed what might be a realistic future view of these companies’ potential? In other words, is there a market bubble for equity in seed-stage startups? This article outlines the rise in seed-stage company valuations and explores some of the factors that likely underlie it. These include the changing behaviour of venture capital firms, the unprecedented economic stimulus undertaken during the pandemic, and the notion that companies may be creating value faster than ever before.

Given the changes that have occurred in the private funding landscape over the last couple years, it seems unlikely that the rise in valuations is indicative of a bubble. The factors discussed below show that, while the market for seed-stage equity may be exuberant, it does not yet seem irrational.

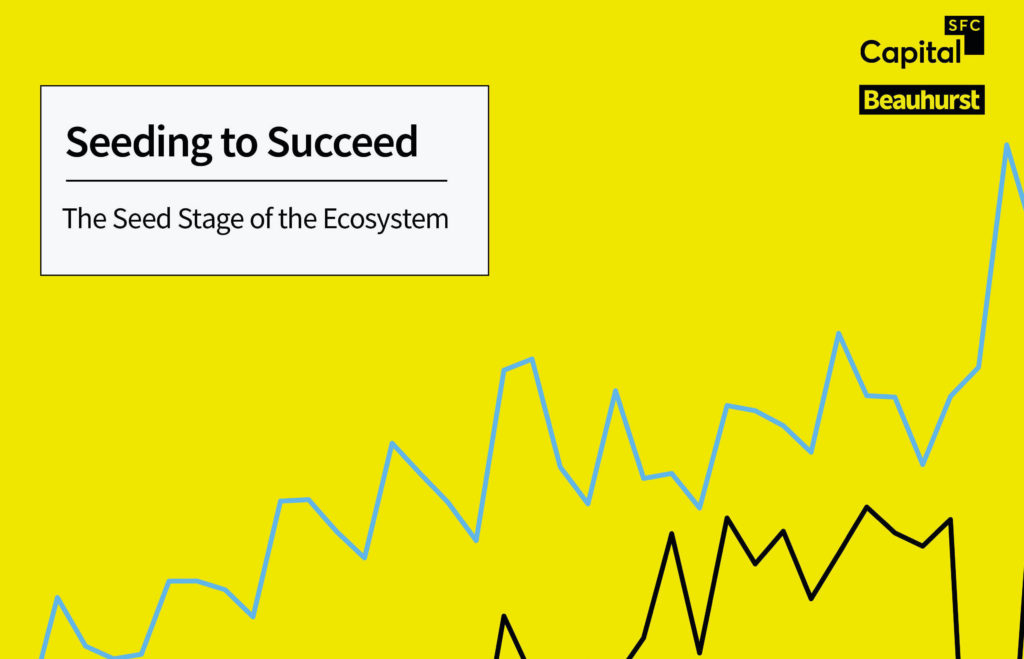

A 10-year increase in seed-stage company valuations

Using data from the Beauhurst platform, we’ve found that the median pre-money valuation of seed rounds raised by UK-based companies has been increasing for the last 10 years. As shown in the chart below, the value of companies raising first rounds over the decade has more than doubled. This trend is even more pronounced for seed-stage companies raising additional deals. For these businesses, the median valuation rose from £1m in 2011 to £2.5m in 2021.

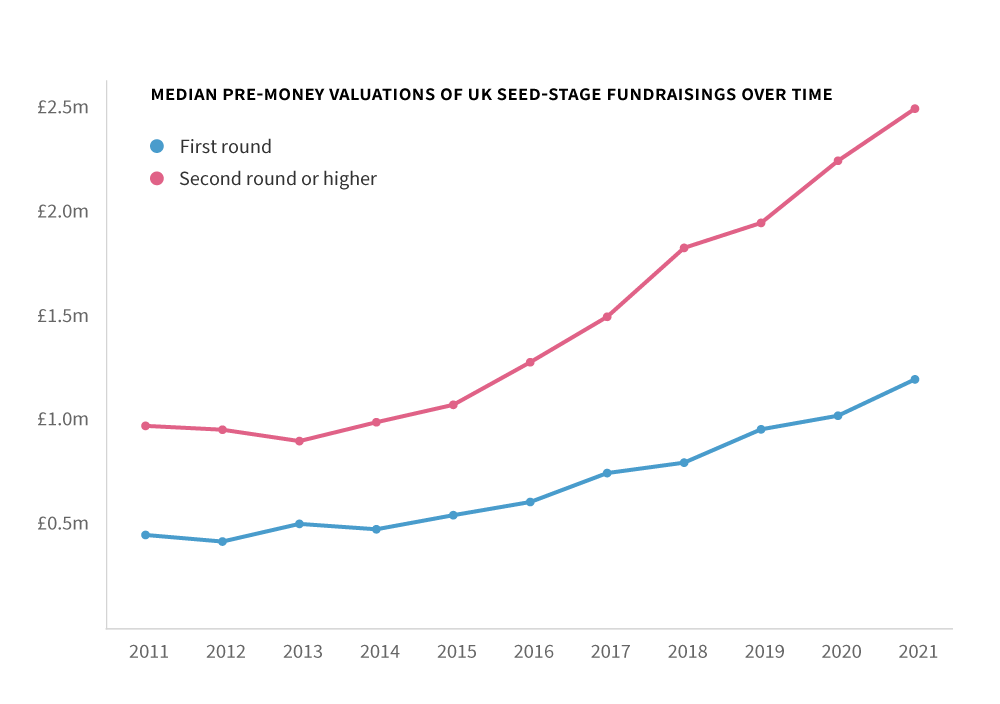

This data, alongside that in our Seeding to Succeed report, shows that the number of first-time seed-stage deals were on an upwards trajectory until 2018, together with the median valuation of those companies. This trend changes after 2018, when there are fewer first-time deals happening at the seed stage.

This may be due to changes to the Seed Enterprise Investment Scheme (SEIS) which occurred that year. SEIS provides tax breaks to individual investors that back early-stage companies. The changes to the scheme meant that companies needed to have committed capital prior to applying for approval under the scheme, reducing the number of companies using the scheme to raise seed investment. A reduction in the number ‘investible’ companies may be partially responsible for the increase in median valuations (particularly at the second round and beyond) after 2018. Further factors are explored below.

Venture capital funds are raising more cash than ever before

In 2015, the average fund raised £149m, while in 2020, the equivalent figure is £361m. Investors having access to greater reserves will naturally translate into higher valuations for the businesses these funds invest in, due to competitive forces. VCs will compete on price for the best quality deals, thus driving up company valuations. The flood of money into private equity and venture capital firms reflects an increased appetite for risk in pursuit of returns.

Another aspect of larger fund sizes and the link to valuations is the increased familiarity of VCs with making larger investments. Dan Robinson, one of our Research & Consultancy Associates here at Beauhurst, notes in an article on valuation increases across the ecosystem: “…as investors raise larger funds, it becomes more challenging from an administrative and behavioural standpoint to write smaller cheques. Even when investing in smaller companies than usual, a fund manager or VC may find it easier to agree to higher valuations and cut familiar-sized cheques.”

This trend can, in turn, be traced back to an increased appetite for risk, which we’ll discuss in more detail in the next section.

Economic stimulus

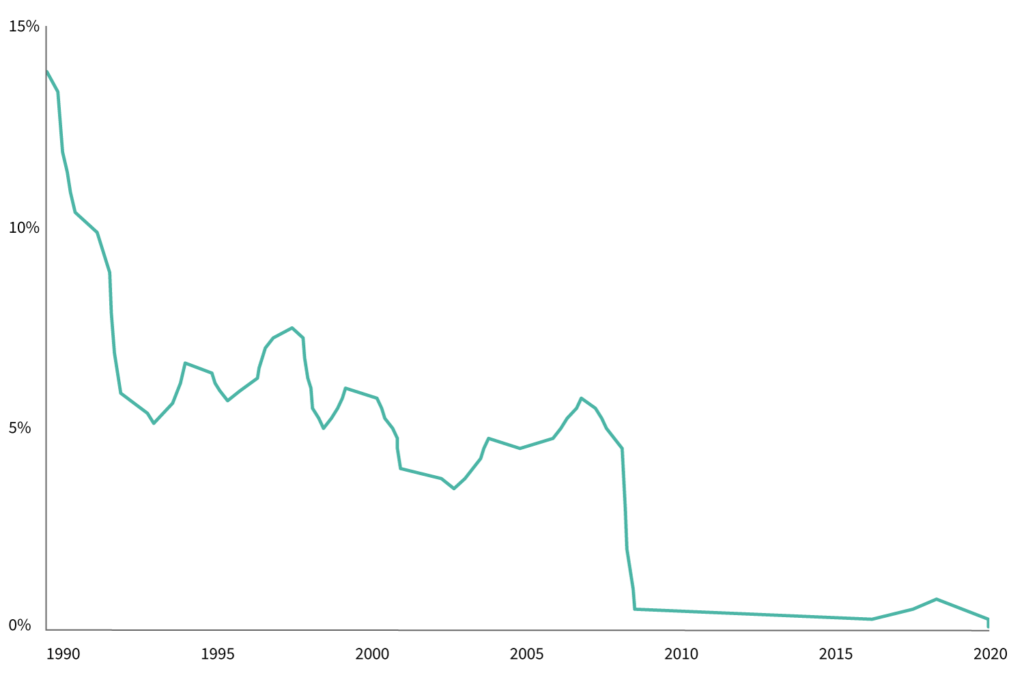

Another contributing factor to increasing startup valuations is a consistent fall in interest rates. Lower interest rates make it cheaper for people to borrow, and in turn encourages riskier investments. If we think of interest rates as a risk premium, then having lower rates of interest across the board could cover the risk associated with a particular transaction. On a macro level, this would drive investment away from ‘safe’ assets, such as government bonds, into riskier sectors, such as venture capital.

bank of england base rate over time

In fact, data gathered by Black Snow Capital shows that startup equity has the highest price sensitivity of all assets included in the analysis (ranging from long-term government bonds to real-estate and public companies). In other words, small changes to monetary policy are likely to have a huge impact on startup equity. It would make sense, therefore, that an expansionary monetary policy would encourage funds to invest more capital in riskier seed-stage companies, thus causing a ‘bubble’ in their valuations.

High valuations imported from American VCs

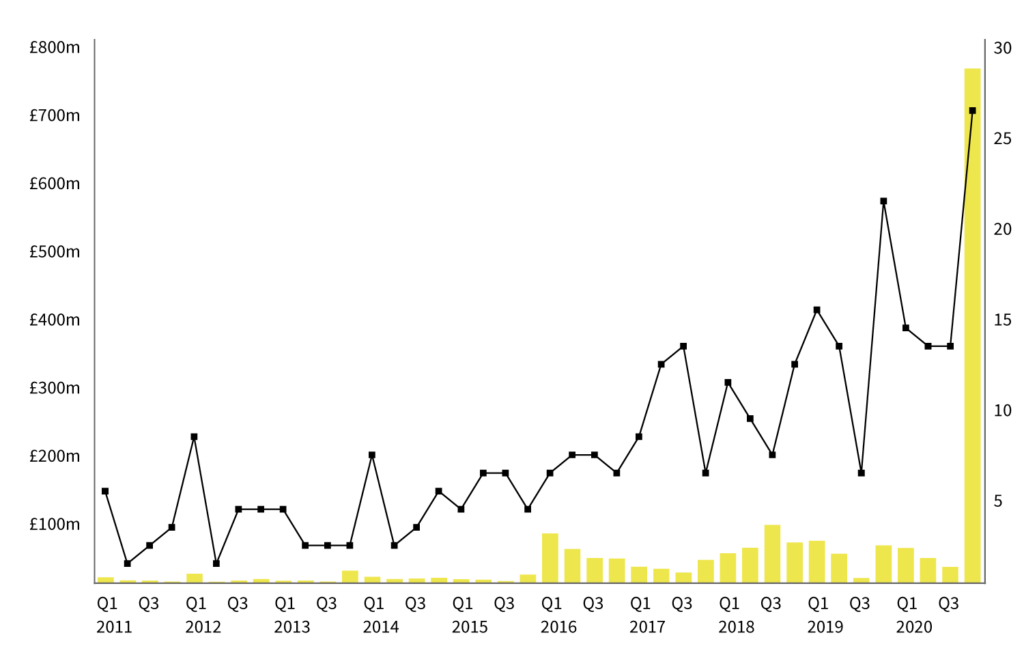

Not only are domestic VC funds becoming more cash-rich, but we’ve also observed increased investment in seed-stage businesses from across the pond. Traditionally, VCs based in the United States have had large pools of capital to draw on, and are thus able to fund larger rounds (for instance, the likes of Tiger Global, the American fund currently managing $50b in private equity).

As we can see, US investment into seed-stage businesses in the UK has increased significantly over the past decade, from a mere £7.28m in 2011 to £760m in 2020. Pressure from these new entrants could have encouraged incumbent UK VCs to follow suit and up their bids for the most promising seed-stage ventures.

volume and value of us investment into seed-stage companies in the uk over time

Seed-stage companies are building more value

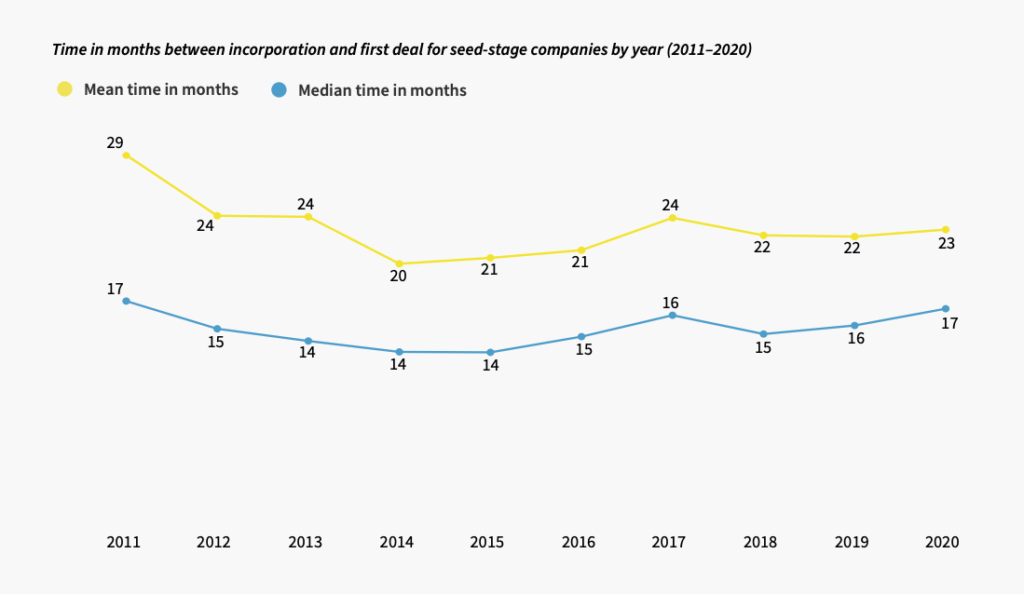

A simple explanation for this might be that companies are taking a longer time to raise their first round of seed funding, pushing the valuations higher because they have genuinely built more value into the business before they secure equity. In other words, seed-stage valuations accurately reflect the higher value of a business, as opposed to an inflation bubble.

But our data does not support this. As shown in our Seeding to Succeed report, the average time between incorporation and first deal at the seed stage has remained remarkably constant year-on-year.

Another factor worth noting, however, is that recent technological progress means businesses are now able to build more value in a shorter period of time. A company can achieve far more in 15 months in 2021 than it could in 2011. Among other factors, the rise of AWS and other software platforms means that companies no longer need to build proprietary software from scratch, helping them accelerate their operations. There are also more organisations specialising in providing startup advice, such as sector-specific accelerator programmes.

Given that companies are now able to develop a lot more in the same length of time compared to 10 years ago, it may well be that their higher valuations reflect an inherent higher worth of seed-stage businesses.

So, is there a seed-stage valuation bubble?

A bubble seems unlikely, as the rise in seed-stage valuations can be explained by the factors we’ve discussed. The unprecedented economic stimulus undertaken during the pandemic likely accelerated existing interest in the private funding landscape. Trends in venture capital fund sizes also made this change more feasible, but it does seem that seed-stage companies are indeed building value faster than ever due to technological progress.

The pandemic has also revealed an enormous appetite for tech, making it likely that valuations will continue to rise for years to come. Whilst striking, this trend is unlikely to be an irrational bubble, but based on concrete evidence as to why seed-stage companies are more valuable than ever before.

Download our free insights on seed-stage fundraising activity in the UK