Equity Investment Market Update | Q3 2022

We analyse the latest data on UK equity investments, to spot emerging trends in the high-growth ecosystem.

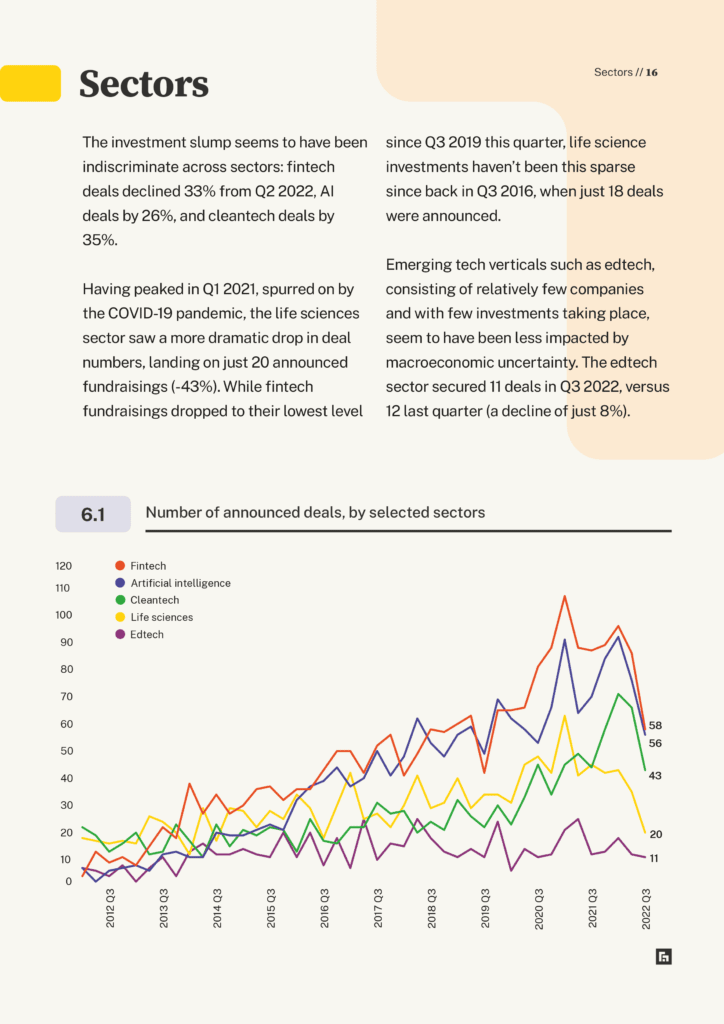

Macroeconomic and political headwinds are whipping themselves into a storm: rising interest rates; a partial recession; bond markets defanging growth-oriented policies; and hefty inflation are being felt in every area of the economy. And the UK’s startups and scaleups are no exception—as our latest data makes clear.

In some ways, this is to be expected. COVID-19 accelerated new investment (levered with cheap debt) into consumer-focused, software-enabled growth plays. Recession threatens their user growth, and rising interest rates—causing some equity investors to exit the market—threaten their runway.

But early-stage investing is meant to involve heavy losses, particularly in the Silicon Valley model. The UK’s failure rate has always been slightly lower, but losses are still part of the game.

Some investment over the past 24 months has been frothy—it couldn’t last. But some of this asset class (more classic venture capital) is meant to be countercyclical. Investing in an early-stage, high-risk technology requires a time horizon that can defy macro uncertainties.

So venture investors need to be optimists: the current climate requires an adjustment of investment theses, but not permanent cessation. The success of the innovation economy cannot be measured in pounds alone: good ideas can win out, bad ideas will go bust.

What did we find out about the UK equity market this time around?

- Investment activity declined during the quarter, with £2.76b invested into the UK’s private companies, across 518 rounds

- Deal volume and amount raised decreased at every stage of evolution, alongside a significant drop in first-time fundraisings

- Around one in two deals went to companies headquartered in London, accounting for 57% of all pounds deployed

- Megadeals hit their lowest levels in two years, with just eight investments worth £50m+

- Crowdfunding fared better than other investment types, with deal volume dropping just 7%, compared to 32% for venture capital and private equity funds

Download the report for more insights.

About the authors

Discover, track and understand the UK’s high-growth ecosystem.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo today to see all of the key features, as well as the depth and breadth of data available on the Beauhurst platform.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.