The Artificial Intelligence Top 100 UK | 2025

John McCrea, updated: 24 April 2025

Since OpenAI’s ChatGPT publicly launched in late 2022, artificial intelligence and large language models have become ubiquitous. Small businesses are now able to scale up faster, and the world’s leading tech companies, including the likes of Google and Microsoft, have since developed their own tools.

But it’s not just Big Tech getting in on the action — the UK is home to a fast-growing population of startups and scaleups, developing their own proprietary AI technology and new applications for machine learning algorithms and data science.

Spanning almost every high-growth industry, from cybersecurity and healthcare automation to chatbots and self-driving cars, there are endless ways in which AI models are being used to help consumers and businesses.

We’ve ranked the top 100 artificial intelligence (AI) companies in the UK, by the total amount of equity raised.

Take a tour

The UK — particularly the golden triangle of London, Oxford, and Cambridge — is a popular place for artificial intelligence startups. According to our data, there are currently 2,361 AI companies across the UK that have hit one or more of our high-growth signals—all indicators of ambitious growth plans and future startup success.

Since we originally posted this article in May 2022, the UK AI market has boomed with £8.48b in equity investment swelling to £18.1b as of January 2025. Meanwhile, the average pre-money valuation of the UK’s AI companies sits at £16.6m, with an average stake taken of 15.6%.

This makes artificial intelligence one of the best-funded industries in the UK, surpassing fintech and behind only the software-as-a-service and mobile application industries.

In this annual ranking, we profile the UK’s AI startups and scaleups that have secured the most investment so far. Read on to find out who they are, how much each company has raised, and how they may innovate in 2025.

Methodology

To be included in this list of AI companies, companies must be:

- Headquartered in the UK

- Operating in the ‘Artificial Intelligence’ Beauhurst industry classification

- Listed as ‘Active’ on Companies House

We’ve then ranked these companies by their total equity raised.

And if you’re a Beauhurst subscriber, you can try this search for yourself.

All data for the analysis was taken from the Beauhurst platform, and is accurate as of 06 January 2025.

All the data for the top 100 list was taken from the Beauhurst platform, and is accurate as of 23 April 2025.

Download the top 100 AI companies list.

Top 10 Artificial Intelligence companies in the UK

10.

Exscientia

Total amount raised: £299m

Established: 2012

Location: Tayside

Scotland’s only listing in our top 10 of AI companies is a giant of the biotech space, having successfully floated with £299m raised. Exscientia uses artificial intelligence to design millions of potential small molecule drugs. It then uses this data to predict their potency and effects, providing indications of which molecules are most likely to make successful drugs.

Before the University of Dundee spinout exited, it had raised £300m in equity across seven rounds, and received three grants worth £5.40m — the first from Horizon 2020 as part of the vaccine development push for COVID-19, with two subsequent grants coming from the Bill and Melinda Gates Foundation.

09.

Multiverse

Total amount raised: £318m

Established: 2016

Location: London

Multiverse has developed a software platform that delivers training and upskilling content to subscribers — including the Multiverse AI Academy — with the aim of closing the skill gap within businesses. The company also facilitates the matching of employers with apprentices.

As of January 2025, the company has raised £318m in equity, acquiring two companies along the way in Eduflow and Searchlight. Participants in Multiverse’s raises have included UK-based Index Ventures and StepStone Group, along with a host of US venture capital firms such as GV (Google Ventures) and Lightspeed Venture Partners.

08.

Lighthouse

Total amount raised: £378m

Established: 2017

Location: London

Lighthouse (formerly OTA Insight) is a commercial platform for the travel and hospitality industry, providing advanced revenue management solutions to over 70,000 hotels across 185 countries. The company specialises in transforming complex data into actionable insights, enabling hotels to optimise pricing, promotions, and distribution strategies.

Based in Southwark, this travel and hospitality company has now raised a total of £378m through seven funding rounds. The company has featured on three high-growth lists including the FT1000 and the Fast Track tech 100.

07.

Thought Machine

Total amount raised: £397m

Established: 2017

Location: London

Thought Machine is a London-based fintech company founded in 2014 by Paul Taylor, a former Google engineer. The company specialises in developing cloud-native core banking and payments platforms designed to help banks modernise their infrastructure and deliver innovative financial products. This includes integration with AI tools.

This fintech company attended the Mayor’s International Business Programme, and has now featured on nine high-growth lists. Most recently, it featured on the FT1000 and the BusinessCloud FinTech 50 both in 2024.

10.

Total amount raised: £185m

Total equity rounds: 5

Established: 2014

Location: Oxford

9. Callsign

Total amount raised: £215m

Total equity rounds: 5

Established: 2010

Location: City of London

8. Lendable

Total amount raised: £216m

Total equity rounds: 7

Established: 2014

Location: Hackney

06.

Quantexa

Total amount raised: £421m

Established: 2016

Location: London

Quantexa is a cybersecurity firm that develops AI technology to secure organisations’ data and flag illegal activity. It works closely with industries that handle large datasets (such as banking, e-commerce, and the public sector) to create analytical models that uncover data risk, reveal opportunities, and enhance decision making.

The company is backed by AlbionVC, Dawn Capital, HSBC Enterprise Fund, and Accenture, among others. In its latest funding round, Quantexa raised £137m in investment. This took the company’s total fundraisings to £421m.

Quantexa has attended both the Microsoft ScaleUp accelerator and Tech Nation’s Future Fifty accelerator. It has also appeared on 14 high-growth lists, including The Telegraph’s Tech Hot 100, Fast Track’s Tech Track 100, InsurTech 100, and more recently, the 2024 editions of the Lazard T100 European Venture Growth Index and JP Morgan Top 200 Women-Powered Businesses.

05.

Isomorphic Labs

Total amount raised: £464m

Established: 2021

Location: London

Isomorphic Labs is creating an AI-first platform designed to accelerate the drug discovery process. By integrating cutting-edge machine learning techniques, the company seeks to identify promising drug candidates across various disease areas more efficiently than traditional methods. The approach involves modeling cellular processes to predict molecular interactions with high accuracy, thereby reducing the reliance on time-consuming wet lab experiments.

The company, which spun out from Google, has been through just one funding round, but raised a huge £464m. The funding came from Alphabet, Google Ventures and Thrive Capital. The investment round was designed to fund the company’s AI research and development.

7. Huma

Total amount raised: £236m

Total equity rounds: 10

Established: 2011

Location: Westminster

6. Patsnap

Total amount raised: £251m

Total equity rounds: 4

Established: 2007

Location: Southwark

5. Quantexa

Total amount raised: £286m

Total equity rounds: 6

Established: 2016

Location: Lambeth

04.

Cera

Total amount raised: £479m

Established: 2015

Location: Essex

Cera administers homecare, telehealth consultations, and prescription services, managed through a mobile app. This enables users to book appointments with nurses on demand. The app, which uses data analytics and machine learning, is designed to improve healthcare services and health outcomes for its users.

To date, the company has secured £479m through eight rounds of fundraising and in August 2022, it raised £81.3m to increase its capacity to help more patients. Participants in this round included 8090 Partners, Evolve Healthcare Partners, Guinness Ventures, and Jane Street, amongst others. The company has attended DigitalHealth.London Accelerator, PwC Scale Programmes, and Govstart.

Since then the company has secured a further £133m through a combined equity and loan funding round.

03.

Graphcore

Total amount raised: £527m

Established: 2016

Location: Bristol

Graphcore operates in the semiconductor processing chip industry, developing and manufacturing chips made specifically to accelerate artificial intelligence and machine learning tasks. Graphcore’s chips use Intelligence Process Unit (IPU) technology, housing 1,472 separate IPU-Cores, capable of executing 8,832 separate parallel computing threads.

The City of London-based AI startup has a total of eight funding rounds under its belt, which saw it raise over half a billion pounds and reach unicorn status after just four years of trading.

Since then, Graphcore faced some challenges in the market and recently exited following an acquisition by SoftBank for £462m. It remains trading under the Graphcore name and is partnered with large tech companies such as Microsoft and Dell Technologies. The company, which has offices in London, Cambridge, Oslo, Beijing, Seoul, and across the US, takes the third spot on our list.

02.

OneTrust

Total amount raised: £699m

Established: 2001

Location: London

OneTrust is a leading software company specialising in privacy, security, and governance, risk, and compliance (GRC) solutions. Founded in 2016 by Kabir Barday, OneTrust provides a comprehensive platform designed to help businesses manage complex regulatory requirements across various sectors and jurisdictions — including the responsible development of AI products.

The company raised a total of £699m, and acquired four companies, before moving abroad to the US. It has also featured on four high-growth lists, including the RegTech 100, the Deloitte Fast 50, and the ProcureTech100.

01.

Wayve

Total amount raised: £1.01b

Established: 2017

Location: London

Wayve burst onto the scene in February 2024, following a huge £822m raise from backers Nvidia, Softbank Group, M12, and Eclipse Ventures, achieving a pre-money valuation of £1.40b and a post-money valuation of £2.22b.

The company — which develops software for self-driving cars using artificial intelligence and machine learning technology — became a unicorn overnight and is now one of the most influential UK players in the AI and self-driving automotive spaces.

Wayve has also attracted three grants totalling £3.36m, awarded by InnovateUK and the Centre for Connected and Autonomous Vehicles (CCAV).

4. Gousto

Total amount raised: £321m

Total equity rounds: 14

Established: 2012

Location: Shepherds Bush

3. Cera

Total amount raised: £366m

Total equity rounds: 9

Established: 2015

Location: Islington

2. Thought Machine

Total amount raised: £392m

Total equity rounds: 8

Established: 2011

Location: Islington

1. Graphcore

Total amount raised: £528m

Total equity rounds: 9

Established: 2016

Location: City of Bristol

The future of artificial intelligence companies in the UK

As use cases for artificial intelligence products expand by the week, and the UK continues to foster a welcoming environment for tech startups, the next few years presents an exciting opportunity for the UK economy.

AI giants Google, DeepMind, and OpenAI already have strong presences in London, and with the automotive industry pouring money into research and development for new technologies, the investment in Wayve presents confidence in the UK artificial intelligence industry.

With a strong foundation in academic research and a healthy ecosystem of AI startups, the UK is well-positioned to become a world leader in AI research.

UK-based AI companies are expected to play a pivotal role in shaping the future of industries such as healthcare, finance, manufacturing, and cybersecurity, as exemplified by the companies in this list. The integration of AI technologies into these sectors has the potential to drive unprecedented efficiencies, enhance decision-making processes, and make a significant contribution to economic growth.

The UK government’s commitment to fostering innovation through initiatives like the Turing Artificial Intelligence Fellowships, alongside dedicated funding for AI research, underscores the national focus on becoming a global leader in artificial intelligence.

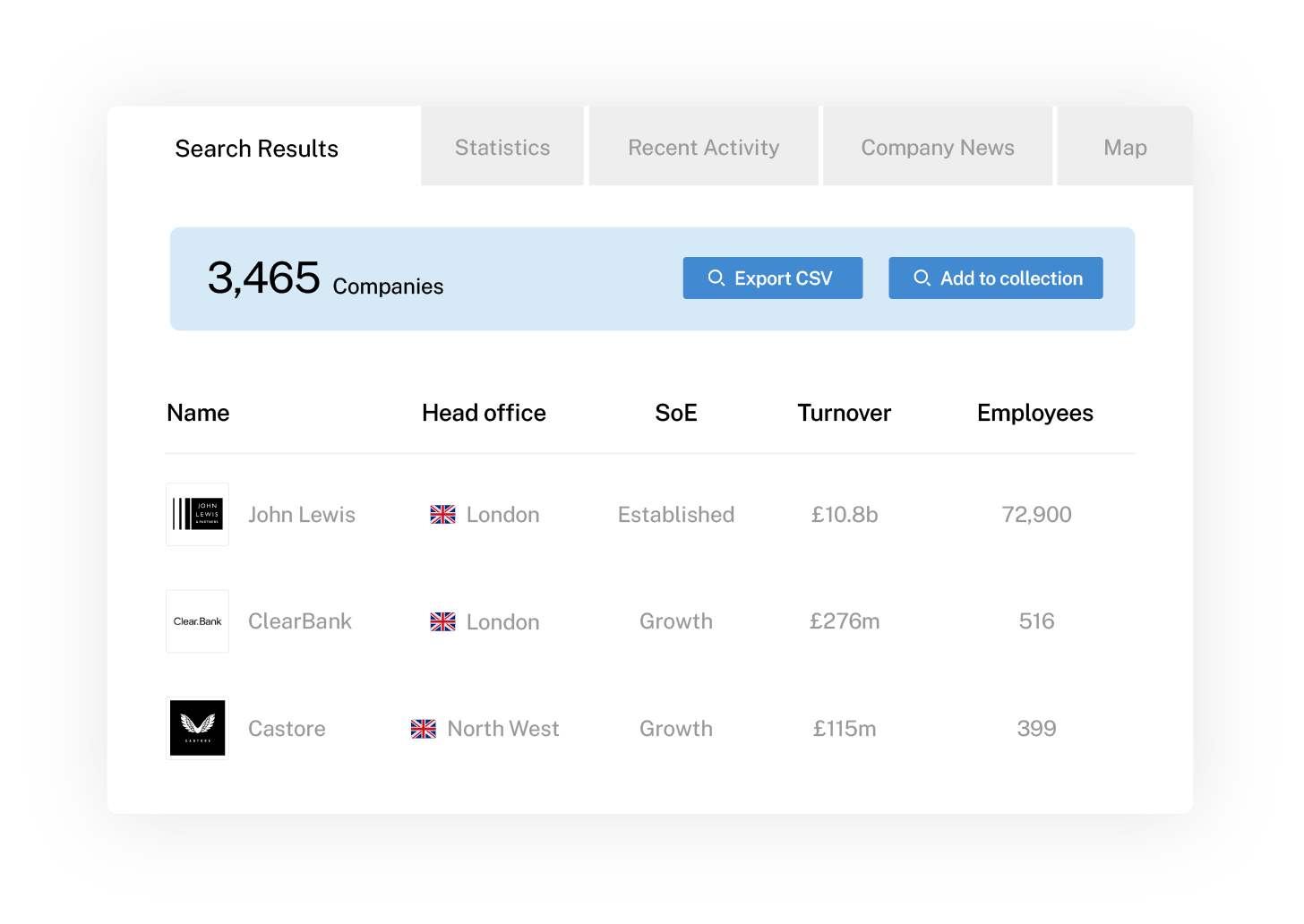

If you want to find out more about AI companies in the UK, Beauhurst is here to help. Our platform enables you to be among the first to find the next generation of industry-leading businesses — as soon as they show growth potential.

With our data, you can analyse market trends, download charts, and export the information you need to make finding the next hot companies effortless. With our up-to-the-minute data and industry-leading insights, we make finding new companies simple.

To see the platform in action, simply book a tour of the platform using the form below or, if you’re short on time, try one of our online platform demos.

Recommended for you

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy