Investment into UK Cleantech Companies in 2021

Category: Uncategorized

Equity investment into greentech or cleantech companies found renewed energy last year. Globally, H1 2021 saw record levels (£48b+) of investment into clean technology—but what about in the UK, the world’s third largest market for cleantech investment from VCs, behind the US and China?

In our piece on the UK’s top green energy companies, we took a closer look at businesses developing clean energy technology, like hydrogen fuel cell manufacturer Bramble Energy, and reducing CO2 emissions through improved energy efficiency, like battery storage startup Moixa. Here, we explore wider cleantech funding in the UK’s high-growth ecosystem, in a piece originally published in our annual report on equity investment in the UK private market, The Deal.

From the biggest cleantech deals of 2021 to some of the innovative technologies being developed, read on to learn more about one of the fastest-growing sectors in the country.

How did cleantech investment fare in 2021?

In 2021, the UK witnessed the highs and lows of the COP26 UN Climate Change Conference in Glasgow, on top of a country-wide energy crisis, and a spate of public protests calling on the Government to take stronger action against climate change. And as politicians increasingly turn their attention to green technology and its place in the global climate agenda, so too have investors. We’re seeing very positive signs of progress in the UK cleantech market, as both the number and value of announced equity deals secured by cleantech companies continues to grow. This upward trajectory has been particularly strong since 2018.

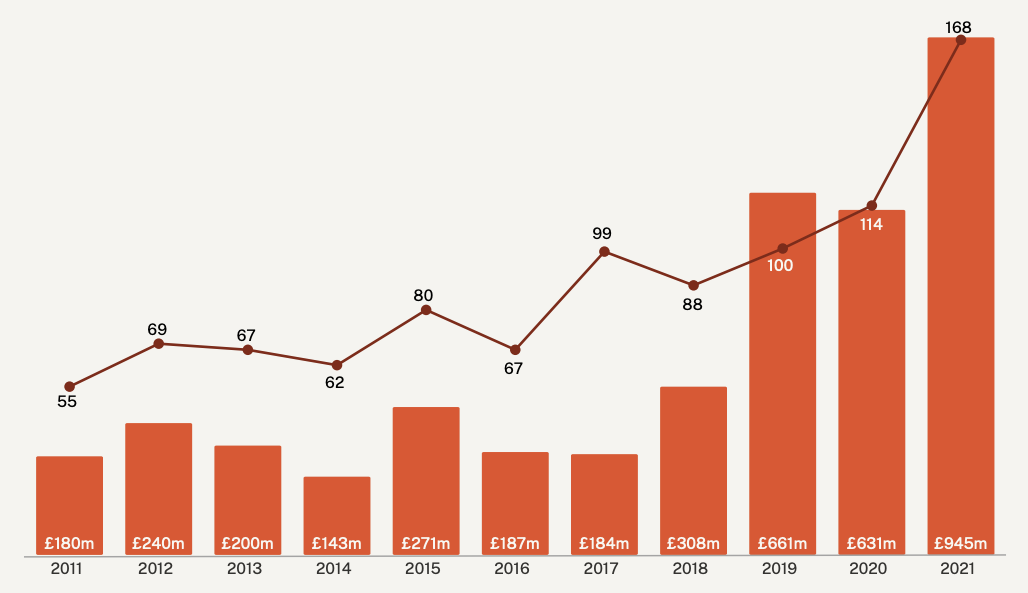

Whilst amount raised in the cleantech sector dropped off slightly in 2020—in line with wider trends amidst the COVID-19 pandemic—it has massively rebounded since. Between 2020 and 2021, we saw an impressive 50% increase in pounds deployed to UK cleantech companies, landing on £945m raised throughout the year. Meanwhile, the number of cleantech deals being announced grew from 114 to 168, marking a rise of 47%. On both counts, Q4 2021 was the best quarter on record for cleantech investment in the UK—an impressive £455m was secured by companies in the sector, across 47 equity rounds.

Number of deals and amount invested into UK cleantech (2011-2021)

Which UK regions are securing cleantech investment?

With investors participating in more deals and putting more money behind climate change solutions than ever before, where in the UK is this funding going?

One of the biggest startup success stories of 2021 was Britishvolt, the Northumberland-based cleantech firm that designs and manufactures sustainable lithium-ion batteries, primarily for use in electric vehicles (EVs). Founded by Swedish entrepreneur Orral Nadjari and incorporated on the final day of 2019, Britishvolt surpassed the billion-dollar valuation mark in August 2021. In doing so, it joined EV company Arrival and renewable energy firm OVO in the herd of UK cleantech unicorns, at less than two years old.

Seven clean technology companies announced equity deals worth over £25m in 2021. And, unlike the broader UK equity market, the sector’s largest rounds were not overwhelmingly London-centric. Headquartered in Bristol, electric aviation firm Vertical Aerospace raised £149m in October, before listing on the NYSE via a SPAC merger in December. Meanwhile, Essex-based Tevva Motors secured £42.5m in November, to accelerate production of its extended range electric vehicles (EREVs) for customers by the end of 2022.

Scotland is also proving an emerging hub for green innovation, currently home to 11% of the UK’s high-growth cleantech companies. According to The Scottish National Investment Bank, “Scotland has long held an international reputation for expertise in the energy market, which means it is well-positioned to develop innovative technologies in the cleantech space.”

The Bank was set up in November 2020 to address long-term challenges facing the region, including supporting its transition to net zero by 2045. The Bank tells us that, “given the increasing focus on developing solutions to tackle climate change, and Scotland’s potential role within that, cleantech is clearly an area where we see huge potential”. It sees the energy transition “as a clear economic opportunity for Scotland, both in terms of the domestic market and export potential for the nation’s SMEs.”

Indeed, two of the biggest deals in cleantech last year went to businesses based in the region: Edinburgh-based urban farming venture Intelligent Growth Solutions (£42.2m) and Glasgow-based vegan protein producer ENOUGH (£35.9m).

The biggest cleantech deals of 2021

1. £150m | Flexion Energy

2. £149m | Vertical Aerospace

3. £124m | Plastic Energy

4. £42.5m | Tevva Motors

5. £42.2m | Intelligent Growth Solutions

Top investors into cleantech companies

Most of these big ticket cleantech deals saw participation from foreign investors, primarily US and French firms. But while foreign investors may have deployed the most capital to cleantech companies in 2021, the sector’s top funders by number of deals were all UK-based. These include SFC Capital, Turquoise International, The Scottish National Investment Bank, Scottish Enterprise, and Edinburgh-based Par Equity.

It was crowdfunding platforms, however, that took the crown as cleantech’s most active investor last year, with 23 announced equity deals facilitated by Crowdcube and 18 by Seedrs. According to Crowdcube’s Q4 2021 shareholder update, “as the climate change conversation got louder through 2021, particularly around COP26 in November, we saw increasing demand for cleantech and sustainability investments” from the crowd. Alongside climate change protests and strikes, the public is now proactively coming together to finance the next generation of green technologies themselves.

The prevalence of crowdfunding, early-stage investors and government funds in cleantech funding is unsurprising given the relative immaturity of the sector—35% of deals in 2021 went to companies operating at the seed stage, and 48% to those at the venture stage, with just 17% reserved for later-stage firms. Perhaps less expected, however, is the lack of purpose-driven funds in the ranks of top investors.

Indeed, what used to be a niche sector in the UK, that predominantly attracted impact investors, is now attracting more mainstream funds. Cleantech is quickly becoming a priority for regional firms, as well as those operating in the energy, utilities and infrastructure space, following the crowd in future-proofing their investments.

The Scottish National Investment Bank “expects cleantech investment to continue to grow this year, as more institutional and private investors see the opportunity in financing what will likely be cornerstones of how business operates in the future.” The Bank also notes “seeing a build in momentum behind impact-related reporting and disclosure which we anticipate leading to more investors looking at how they proactively manage their exposure to impact-type risks.”

Natasha Jones, Early-Stage Investor at Octopus Ventures, tells us: “Over the next 30 years, every business, within every industry, will need to transition to net zero carbon emissions. Best estimates put the level of investment needed to achieve this at $5-7 trillion. This astonishing target will simply not happen without entrepreneurs—and the investors who back them—mobilising technology in innovative ways. The VC community is waking up to this huge opportunity.”

Want to read more on emerging sectors in the UK private market?

Download our free report.

Emerging verticals within the cleantech industry

According to Jones, “with growing pressure from consumers, governments and regulators, all types of businesses are seeking ways to reduce their emissions. In the UK, for example, 45% of the FTSE 100 have made some sort of net zero pledge. However, research also shows that only 16% have a strategy to realistically meet their commitments. Carbon accounting software providers are seen as the wedge to engage businesses in their climate impact, incentivise green behaviour and investment, and provide meaningful pathways for companies to achieve net zero.”

Carbon accounting, that is the quantifying and tracking of greenhouse gas emissions, will no doubt be central to global decarbonisation efforts in 2022. So it’s no surprise that we’re seeing a growing number of high-growth UK companies operating in this space.

One such company is Pledge, which builds carbon tracking tools for businesses seeking to measure, reduce and offset carbon emissions across their supply chains. Founded in March 2021 and based in London, the seed-stage startup secured its first fundraising in October, worth £3.27m, to roll out its B2B carbon tracking software. Similar ventures that raised funding in 2021 include carbon accounting platform Emitwise and carbon removal subscription firm Lowercarbon, plus Pawprint which develops a carbon tracking app focused on employee engagement.

Companies like these are mostly directing their tech towards business customers, addressing organisational sustainability goals, such as ESG targets, the cost of carbon, and stakeholder engagement. But we’re also starting to see more cleantech innovations targeted at the individual, such as within the EV market, with EV charging now carved out as an industry vertical of its own.

For instance, both char.gy and Forev are developing charging points for electric vehicles—char.gy raised £6.4m from the government-backed Charging Infrastructure Investment Fund in June 2021, whilst Forev secured £2m from The Scottish National Investment Bank in July. Then there’s Bonnet, whose app enables drivers to find electric charging points. Bonnet secured £950k in funding from APX, Ascension and Imperial College Innovations Fund in August, to expand its operations, charge point offering and network partnerships.

Another area of cleantech capturing investor interest is agritech, in which technology is being developed to make farming more efficient and sustainable. Elemental is one example, having developed tech to convert food waste into fertiliser and food ingredients, with the aim of reducing waste in the farming industry and developing a sustainable circular model. The company secured two deals with Crowdcube last year, in March and July, totalling £1.41m.

Likewise, crowd-backed Zero Carbon Food raised £5.63m via two equity rounds of its own, to further develop its controlled environment farms. These carbon-neutral sites use redundant underground spaces to produce plants with LED lights and hydroponics (i.e. no soil required). The company is also tapping into several innovation grants, awarded to support its vertical farming research and development.

A word on the COP26 climate conference

In November last year, COP26 brought together leaders, delegates and media from around the world, culminating in the signing of the Glasgow Climate Pact by 197 countries. But alongside a number of shortcomings, including the watering down of emissions-cutting pledges from some of the largest industrial nations, commentators also noted the distinct lack of startups at the conference.

COP26 saw tens of thousands of participants gather to share ideas and propose solutions to the climate crisis. Outside of negotiations taking place in the Blue Zone, to which only accredited politicians, NGOs and activists had access, public exhibitions and talks were held in the Green Zone by organisations fortunate enough to secure a spot—including cleantech startups.

But one wonders, without a seat at the table (or a spot to stand in the VIP zone), how are cleantech companies going to help fight the climate emergency? The lack of VC presence and conversation around impact investing at COP26 was equally alarming. Despite increased government and VC investment in cleantech in recent years, and all the green technologies being developed, more collaboration is still needed to help limit global warming to 1.5 degrees.

As a nation, we have the technology required to accelerate change. The more funding our cleantech startups can secure, the more likely they’ll be to scale, attract new talent and investors, displace environmentally unfriendly incumbents, and be called on to advise on future political decisions.

The future of UK cleantech

In his annual letter to CEOs this year, BlackRock’s Larry Fink made clear that “the tectonic shift towards sustainable investing is still accelerating…The next 1,000 unicorns won’t be search engines or social media companies, they’ll be sustainable, scalable innovators—startups that help the world decarbonize and make the energy transition affordable for all consumers.”

So, whilst more work is needed to ensure cleantech entrepreneurs get the backing and influence they need to make a difference, we have high hopes for 2022. Whether it’s vertical farming or EREVs that become the next big thing, we’re optimistic it will be another stellar year for UK cleantech investment and innovation.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.