The regions challenging London’s investment pull

Category: Uncategorized

As outlined earlier this year in the Deal, London takes the lion’s share of equity investment in the UK. In fact, 2017 was the first year in which more than half of all deals involved London firms, underlying the increasing dominance the capital has over the rest of the country.

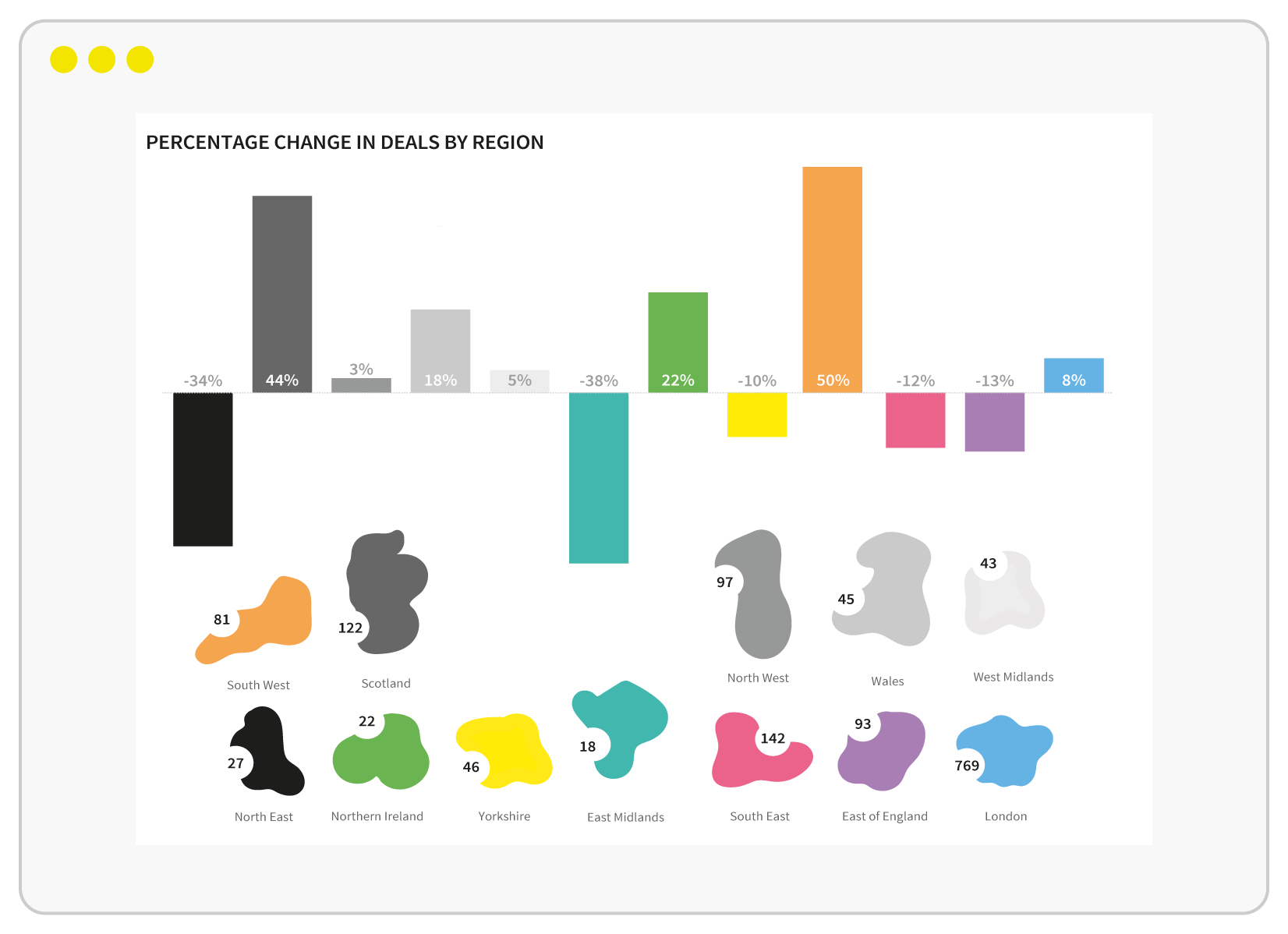

So despite a falling share of deals, how is the rest of the country faring? The number of deals in the North East and the East Midlands fell by 34% and 38% respectively last year, in contrast to an 8% rise in London. However, there is more promising news from Scotland, which enjoyed a 44% increase. It is a similar story in the South West, where investments rose by 50%, the UK’s largest percentage improvement on the previous year.

What are the stories behind these statistics? We’ve taken a closer look at some of the companies who received investment in these regions, and the investors willing to take a chance outside of London.

The best of South-West

With a combined £61.2million secured in two deals across 2017, Graphcore is a Bristol-based machine learning company in a period of powerful growth. The first of their two investments last year arrived in July in the shape of £23.1 million from Atomico. They were then backed by Sequoia Capital in November to the tune of £38.1 million.

TrueSpeed are another South-West based company, providing broadband and phone via fibre-optic links to houses and companies. They secured an impressive £75 million equity investment from Aviva last July, making it the largest single investment to come into the region in the past twelve months.

Also one to keep an eye on from the South-West, again based in Bristol, is Artificial Intelligence company FiveAI. They provide software for safe and cost-effective urban mobility through Machine Learning and AI-based solutions. Having secured a further £14 million of equity from Amadeus Capital in September 2017, FiveAI have become a well-established name among Artificial Intelligence companies.

Initiatives such as Bristol and Bath’s Engine Shed are driving innovation in the South-West. With a strong ethos based on sustainability, Engine Shed comprises several components – all there for the purpose of creating a strong regional economy and driving local company growth. Such components include the Bristol Angel Hub, offering a focal point for the early-stage investment community in the area, and the Oracle Startup Cloud Accelerator, setup to develop partnerships with local startups and to encourage co-development between early stage businesses.

What is most interesting about the South-West is the way in which the region is attracting investment. It seems as though there is a collective recognition of the need for innovation, dynamism and collaborative co-development schemes which not only benefit individual businesses, but the area as a whole. Given this, it is unsurprising that they achieved a 50% increase in investment last year and indicates an exciting period of growth is imminent.

BrewDog bats for Scotland

When looking at Scottish investment, it is difficult to ignore the powerhouse that is BrewDog. They secured a further £100million equity from TSG Consumer Partners in April 2017, taking their total funds raised to a hefty £142 million. With this coming in as their tenth investment, BrewDog are showing no signs of slowing down. They are currently dominating the crowded and highly competitive UK craft beer industry as well as making inroads into the American market. Having completed the acquisition of The Draft House just over a week ago, BrewDog are clearly a company at the very top of their game.

The securing of the £100million from TSG Consumer Partners is significant, not least because TSG are an American private equity firm and the investment coincides with BrewDog’s expansion into the US. This investment has helped them build a brewery in Ohio and is a telling indicator about how the future value of BrewDog is viewed amongst US investors.

This is even more impressive given the fact that BrewDog have already raised £41.1 million via crowdfunding alone. Their hugely successful and record-breaking crowdfund ‘Equity for Punks’ is aiming to raise a further £50 million through the recent launch of their fifth crowdfunding round. If they achieve that, BrewDog will become the largest crowdfunded business of all time.

But there is more to Scotland’s investment pull than just BrewDog’s success. NuCana, a pharmaceutical company that has developed a new form of chemotherapy to fight cancer, announced a £75 million IPO on the NASDAQ Stock Exchange last September. This made it one of the UK’s most successful pharmaceutical companies.

Exscientia, a company that uses artificial intelligence to develop and test small molecule pharmaceutical drugs, looks as though it could reach similar heights. Just last September they announced a £13.2 million equity investment from Evotec and look set to be at the forefront of pharmaceutical innovation for the foreseeable future.

A challenge to London investment?

London still attracts the most investment in the UK by far. For regions such as the North East, the widening gulf between themselves and the capital is worrying. Yet it is a promising sign that there are companies outside of London that are flourishing and are providing healthy competition to London for attracting investment. With 769 investment deals made in London over 2017, compared to Scotland’s 122 and the South West’s 81, there remains a clear front-runner. But the percentage increases made in these two regions is an indication that more investors are starting to look outside of the capital for promising companies. If this trend continues, it would not only be of tremendous benefit to those regions themselves, but to the healthy growth of the UK economy as a whole.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.