Proptech UK: The Leading Lights

Category: Uncategorized

Another year has passed with no sign of the housing crisis abating. Recent reports state that the average age for first-time buyers in London has reached 36. This is a long time to rent, and this has helped result in the first instance of a generation being poorer than the preceding generation since 1900. Can Proptech companies provide the answer? The UK is nurturing a generation of disruptive businesses who develop new software products designed to disrupt the property sector, and have received a significant rise in funding.

Property Tech In The UK

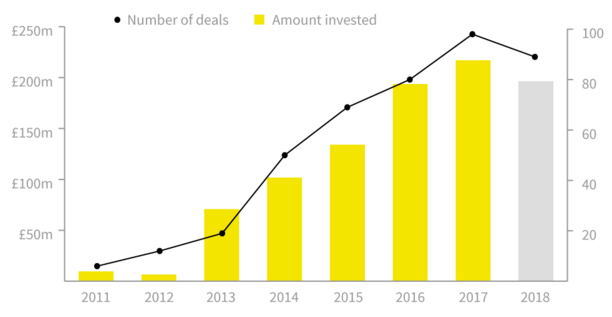

After a record-breaking year of funding in 2017, we have seen a return to normal levels in 2018.

UK PropTech companies can be split into three broad subsectors: property investment platforms, web-based estate agents/property-listing sites, and web-based platforms designed to disrupt how people purchase or own homes.

The original UK PropTech company, Zoopla, has become something of a household name, achieving a billion dollar valuation when they IPO’d in June 2014. Essentially a property listing platform, they were taken private earlier this year by American PE firm Silver Lake for £2.2b. Through this deal early investor DGMT (the Daily Mail’s parent company) made £640m.

More recently, P2P property lending platform LendInvest has become the UK’s leading PropTech startup. Their platform acts as a two-way street for property lenders and borrowers. An investor will put their money into LendInvest, who will then package this finance out into loans for property developers or buyers. The investor takes the interest, minus a small fee which is taken by LendInvest. Through the platform investors can manage their investments according to their specific requirements.

Recently valued at over £150m, turnover in their 2018 financial accounts exceeded £30m, and operating profits jumped to nearly £2m. In 2017 they featured on the Sunday Times Fast Track.

Though much younger, a new company called British Pearl is looking to challenge LendInvest’s position in this subsector. Through their platform, investors can either purchase shares in certain properties, or put money into property loans, from which they can receive a secured rate of interest. In July this year, British Pearl raised £7m in equity from Lord Stanley Fink, at a £14m pre-money valuation.

Other young UK PropTech companies have sprung up as direct challengers to Zoopla, offering a property listing platform. These include Yopa and Purplebricks (which IPO’d on AIM in 2015). Slightly more focussed, others such as Nested operate online estate agents, hoping to provide a better service to property owners than the usual chains.

Disrupting the mortgage market

Of particular interest to those struggling to get onto the housing ladder is a very young startup called Wayhome. Incorporated in early 2016, Wayhome allows prospective homeowners to purchase a property with just 5% of the deposit. Wayhome, or rather their investor partners, purchase the rest of the property. Homeowners then pay rent dependent on the value of the property that Wayhome still owns. For instance, if Wayhome owns 90% of the property, the occupier pays 90% of the market rent.

Other innovative companies, though not quite as ambitious as Unmortgage, are looking to completely digitise the overly bureaucratic mortgage process, with sleek, high-UX web-based software. These include MortgageGym and Molo Finance.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.