Equity investment market update: Q1 2019

Category: Uncategorized

The latest data on equity investment trends in the UK. We’ve analysed every publicly-announced equity fundraising in Q1 2019, to spot emerging trends and patterns in the market.

See our yearly edition, The Deal, for in-depth analysis and features on key market trends.

Key findings

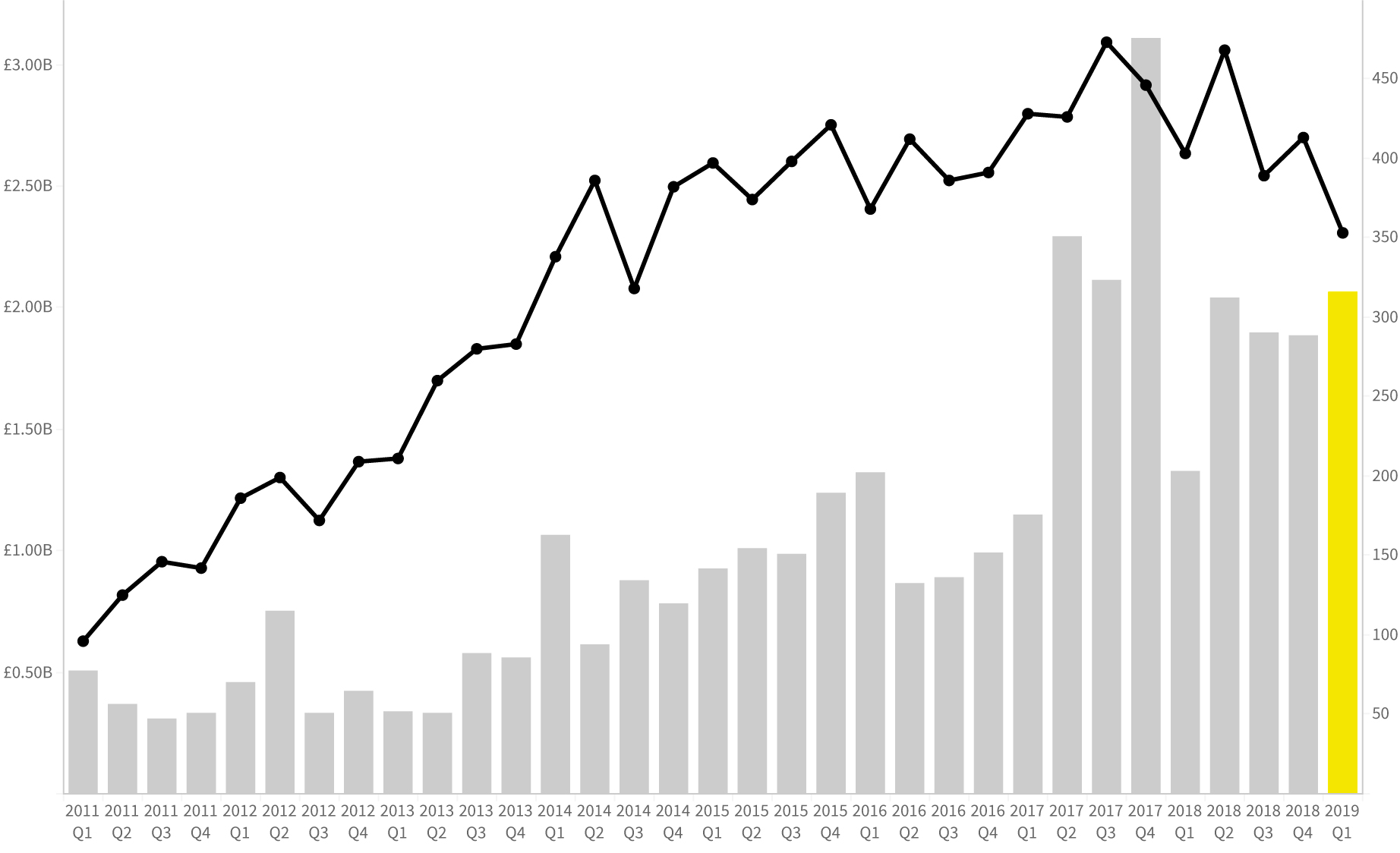

Number of deals

Amount invested

Difference from Q4 2018

Difference from q4 2018

- Deal numbers fell by 17% from the previous quarter, making this the lowest quarter for deals since Q3 2014.

- The amount invested rose 10% from Q4 2018. While amounts have been high since 2017, this is the first time Q1 has seen such a high amount.

- Only 25% of deals were below £500k. This is the lowest share ever, compared with a high of 51% in Q2 2014.

- The quarter saw a record median deal size of £1.5m, up from a low of £0.48m in Q2 2014.

- No sector saw a record number of deals, although FinTech set a record amount invested of £948m.

deal numbers and amount invested

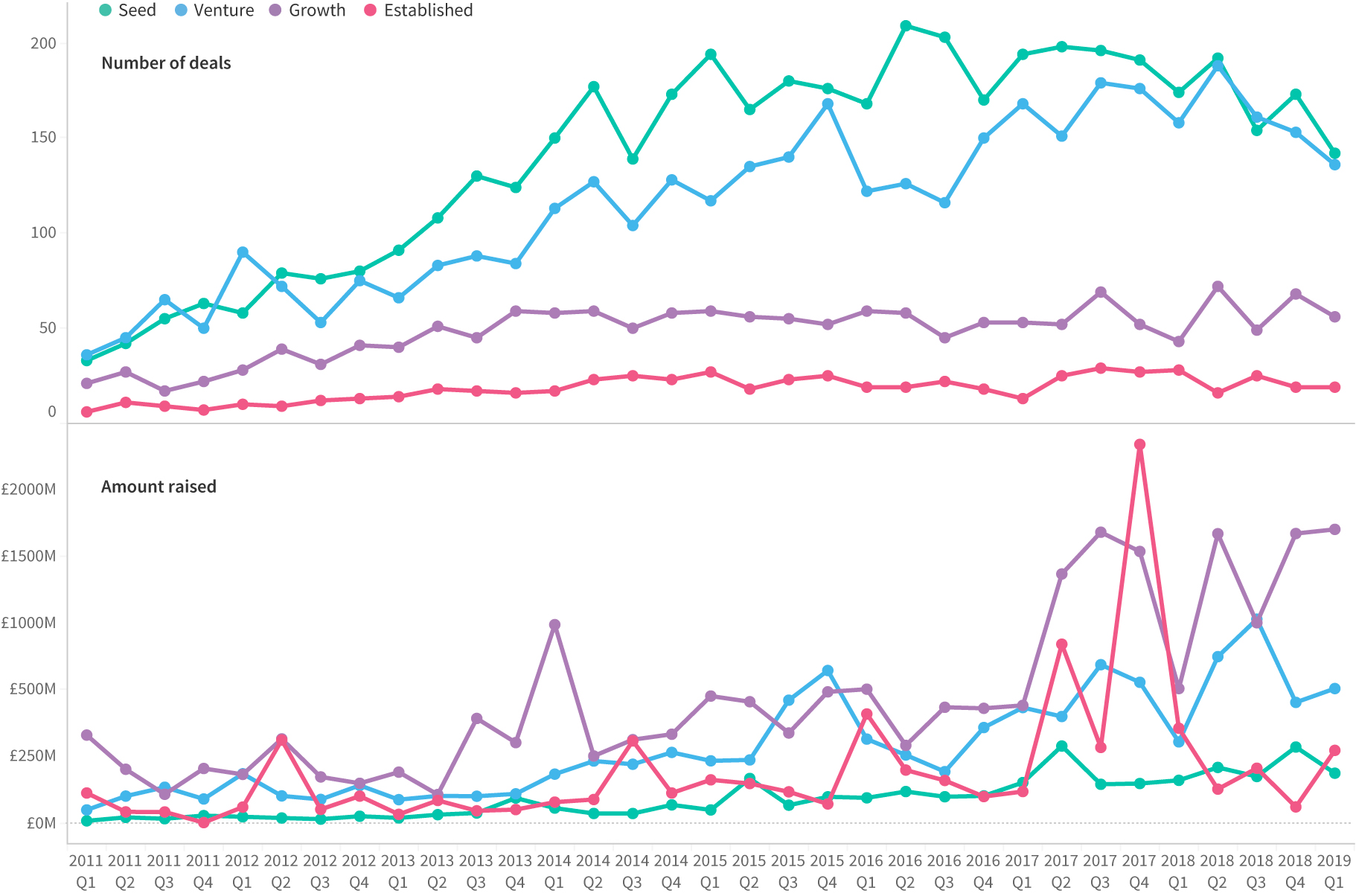

Investment stages

Deal numbers fell at the seed, venture and growth stages, and remained level at the established stage. The amount invested at the growth stage remained high, with the other stages of evolution staying in line with historical figures.

deal numbers and amount invested by company stage

The seed-stage numbers are a cause for concern: there were only 142 announced seed deals this quarter (compared to the record of 209 in Q2/16). Since late 2017 the number of seed deals has been converging with the number of venture deals. This will be storing up a problem for the future: if the earliest-stage business don’t get funded now, there’ll be fewer growth deals to be done in the future.

Henry Whorwood Tweet

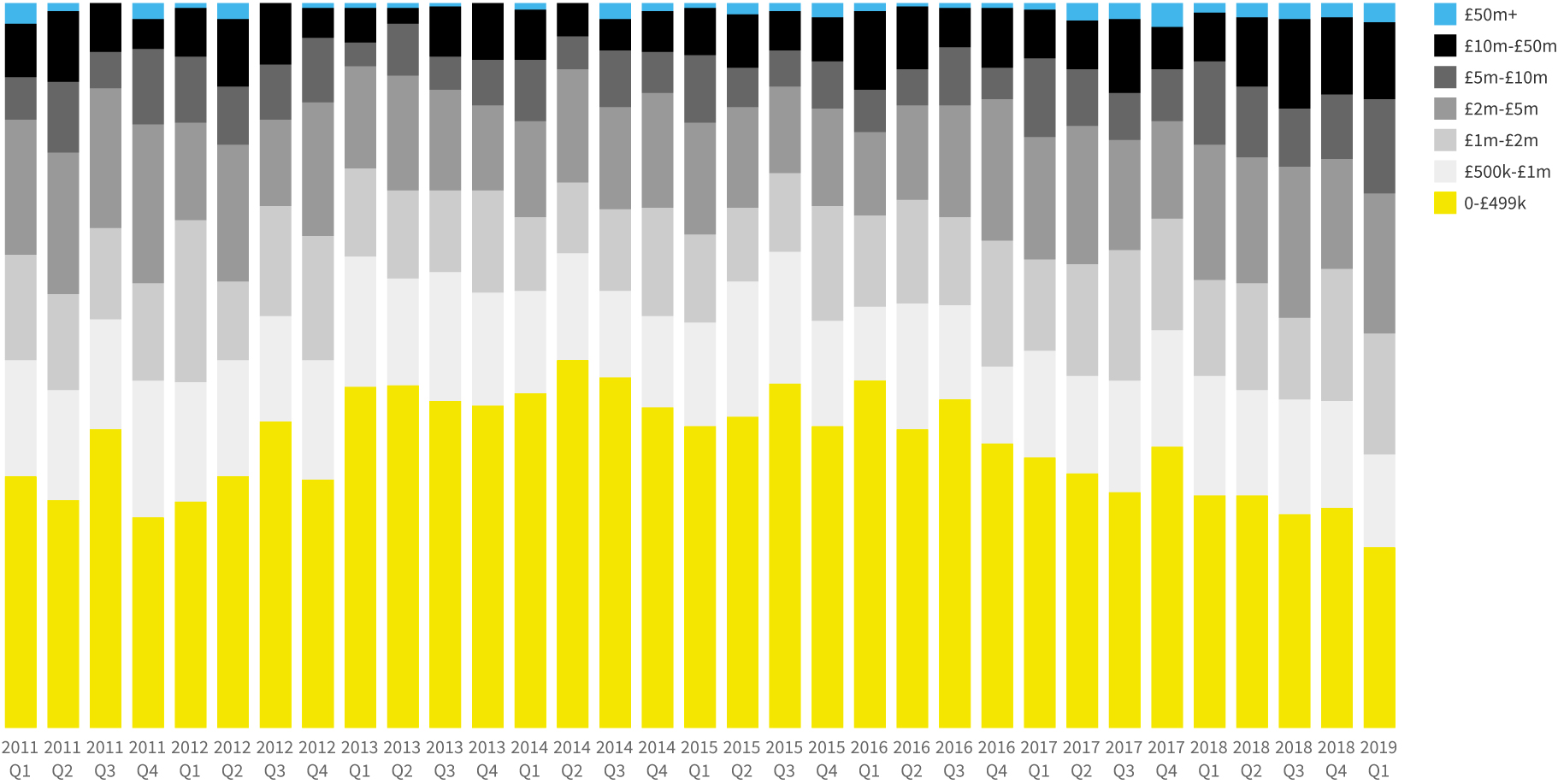

Investment sizes

We’ve been pointing out the trend for increasing deal sizes for a while now, and this course has continued into Q1 2019. For the first time, only 25% of deals fell below £500k. This is the lowest ever proportion of deals of this size, compared with a high of 51% in Q2 2014. This fall in smaller deal numbers has coincided with an increase in the number of megadeals (deals worth £50m+), of which there were 8 this quarter.

Indeed, deal sizes have been growing; this quarter saw a record median deal size of £1.5m, up from a low of £0.48m in Q2 2014.

deal sizes, percent share per quarter

Deals under £500k represent a lower proportion of the activity in the market than ever before. The decline in seed deals is one part of this. Increasing average investment sizes is another. But this may also be the area of the market most sensitive to Brexit. Deals under £500k typically involve individuals rather than institutions, and people can more easily adjust their investing practices to reflect their sentiment about the market.

Henry Whorwood Tweet

Sector focus

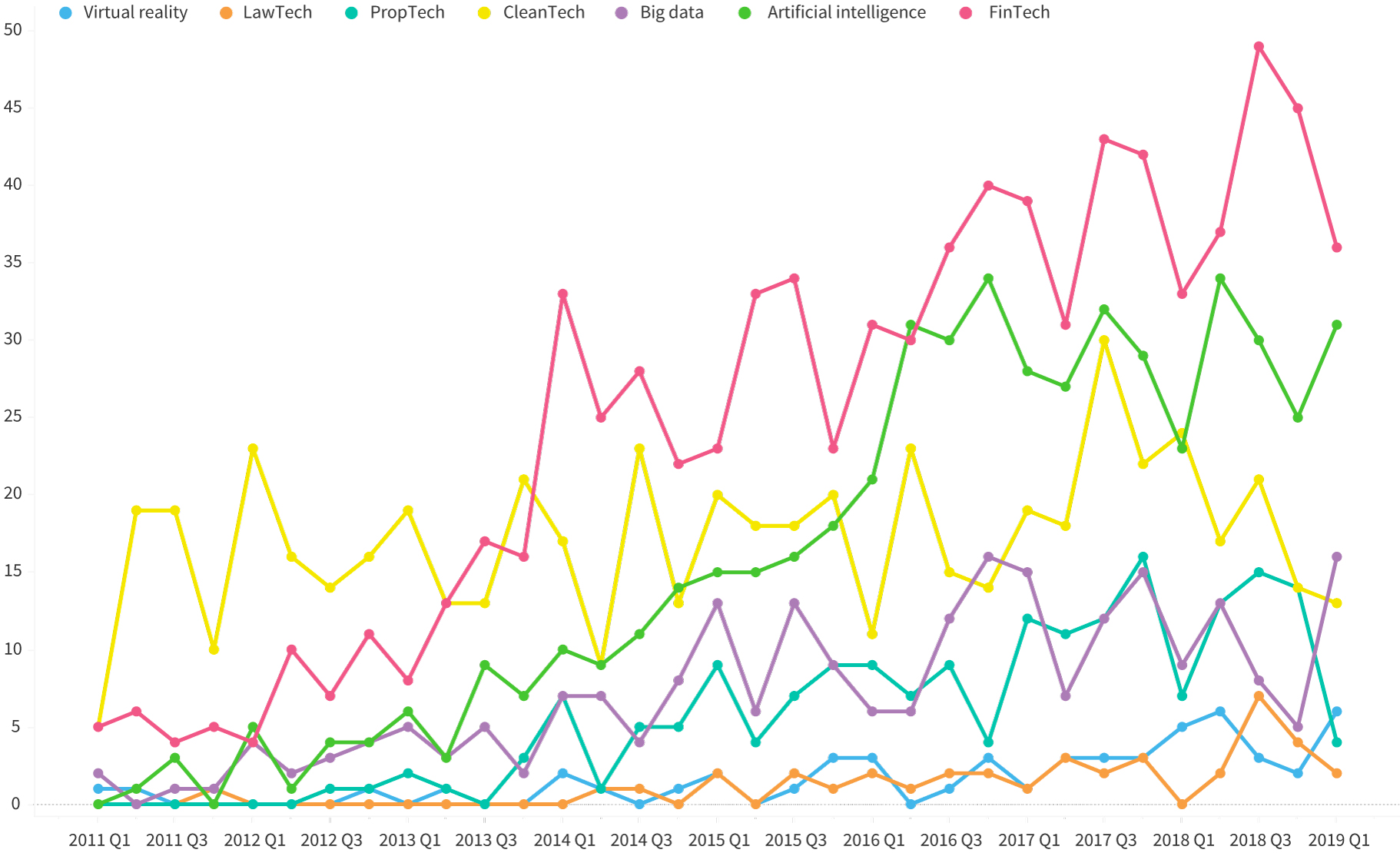

The quarter was a poor one for deal numbers across the board, with no sector recording a record number of investments. Of course, at a quarterly level such fluctuations are normal and we wouldn’t consider this a warning sign for any of the UK’s leading sectors just yet. Indeed, Fintech saw the highest ever amount invested, with £948m going into the sector.

Big data companies also had a strong quarter, with deal numbers reaching levels last seen in Q4 2016, and £88m invested into the sector.

number of deals, selected sectors

Have you seen our full year report?

The Deal is our free, detailed analysis of every equity fundraising in 2018. We look at the stories behind the deals, and examine which companies, investors and sectors are making waves.