A beginner’s guide: scaleups in the UK

Category: Uncategorized

We’ve just released The Scaleup Index, our analysis of the UK’s fastest-growing companies, in association with The ScaleUp Institute and Smith & Williamson.

Below, we give an overview of these unique companies, and explain their value to the UK economy – plus take a look at what it is that’s powering their growth.

What makes a company a scaleup?

Whilst individual scaleups differ from each other in many ways, some things are common to all of them. In order to be a scaleup, a firm must:

- Have average, annualised growth of 20% or more over three years

- Have at least 10 employees at the start of the observation

Growth can be measured by turnover or by headcount.

In the words of Irene Graham, CEO of the ScaleUp Institute – our partners on this research – these companies are vital to the strength of the UK economy.

And as Stephen Welton of BGF put it, scaleups and companies which aspire to that status have the most potential to make a “disproportionately large impact on innovation, productivity, employment, and ultimately growth of the whole economy.”

We’re pleased, then, to have put together this new and comprehensive research.

What are ‘invisible’ scaleups?

An important feature of the companies studied is that they invariably have at least two of the following:

- Turnover of 10.2m or more

- Assets exceeding £5.1m

- 50+ employees

These are the criteria that determine whether or not a company is obliged to file full accounts with Companies House.

So some firms that meet the definition above will be scaleups, but are ‘invisible’.

Current policy recommendations may soon change this, and we await progress eagerly. Until then, our report looks only at visible scaleups.

What does a typical scaleup look like?

Many high-growth companies operate in the tech space – but not these. The majority of scaleups operate in property, distribution, and manufacturing. Again defying the popular conception of high-growth firms as cutting-edge consumer products (think challenger banks, mobile apps, food delivery firms), 35% of scaleups sell services to other businesses.

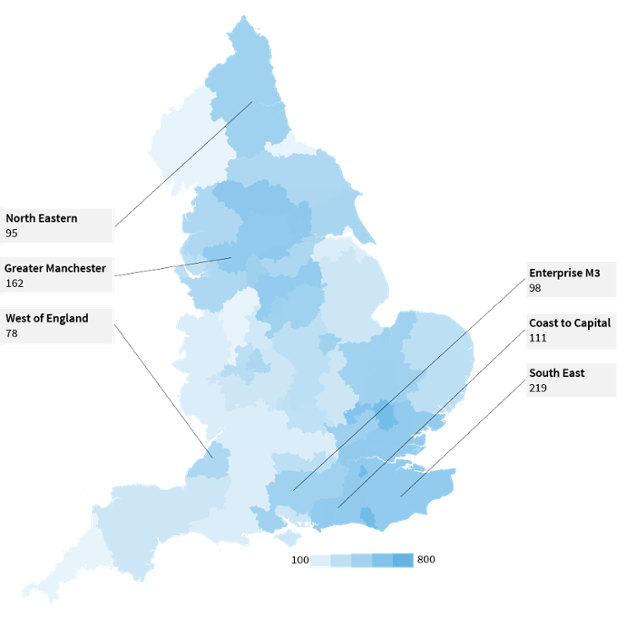

Scaleups are also less concentrated in London than you might expect – though 21% of scaleups nonetheless reside there. But the North West perfoms well, hosting 10%, and the West Midlands boast 8%. The firms appear to cluster around Local Enterprise Partnerships (LEPs) too: Greater Manchester alone has 162, and Leeds City Region is not far behind on 144:

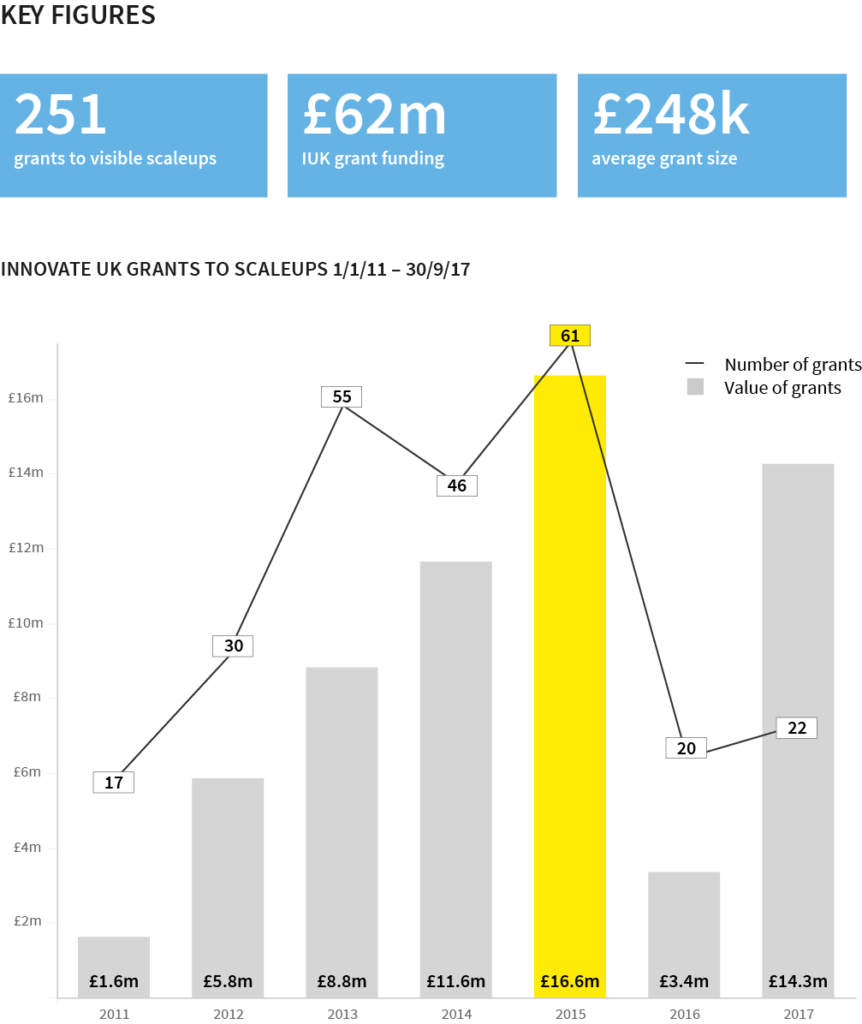

Data suggests these firms are less than half as likely as startups (that is, non-scaleups that have met another of Beauhurst’s triggers for high-growth) to receive grants: 14% of all startups receive a grant of some kind, compared to just 5.3% of scaleups. This is likely related to the disparity in tech focus between the two – many grant categories awarded by governmental bodies are restricted to technology firms.

15.9% of scaleups have received equity investment, with 2017 already proving a record year for the amount of cash into these companies – £1.5bn has gone in so far, over 44 deals. Visible scaleups are by their nature later-stage than startups, making them less risky as investments than very young firms, so it’s perhaps unsurprising that the average deal amount this year (£34.4m) is significantly higher than the average received by other high-growth companies (£1.27m).

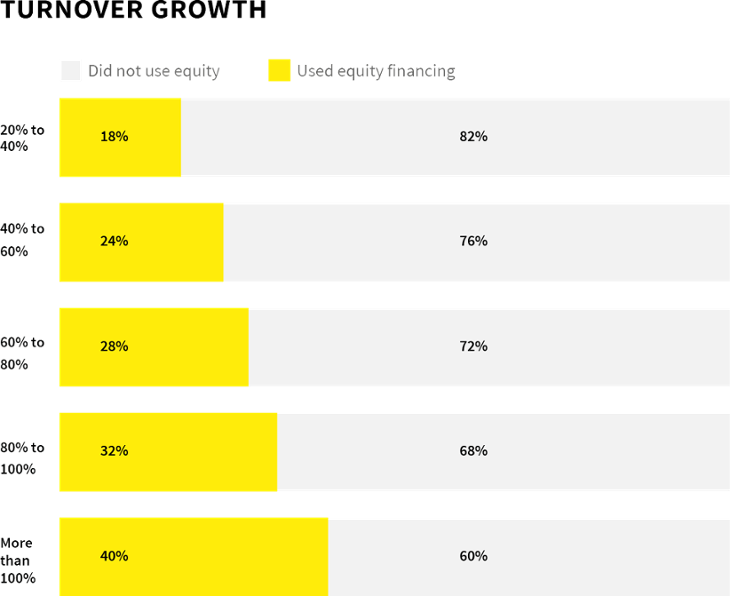

Despite the relative infrequency of equity investment into scaleups, this investment is correlated strongly with an increase in turnover growth. Indeed, the more investment a scaleup receivs, the more likely it is to be growing its turnover by 100%+ per year.

Another distinguishing factor between scaleups and startups is that scaleups are typically older than 20 years. Only 7% are younger than 5, although a quarter are aged between 5 and 10.

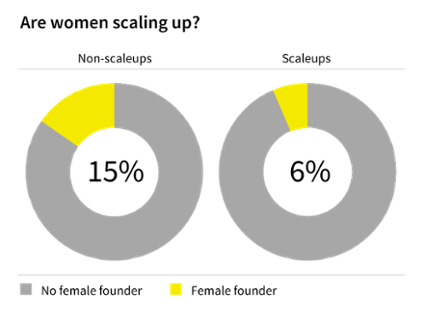

When it comes to senior staff, non-scaleups have the edge on gender equality.

Our analysis of 2016 (available here) found that 6% of scaleups have a female founder. When looking back since 2011, however, this figure dropped to 4%.

This is arguably a positive sign: it suggests that firms that have only recently become scaleups are more likely to have female leadership.