Investment into the UK’s Spinout Companies 2021

For the second year running, we’ve collaborated with Parkwalk to analyse equity investments made into UK spinouts to spot emerging trends and patterns in the market.

Introduction

Academic spinouts are a key element of the innovation ecosystem. By commercialising the intellectual property created in the UK’s universities, they facilitate the application of these technologies in the world.

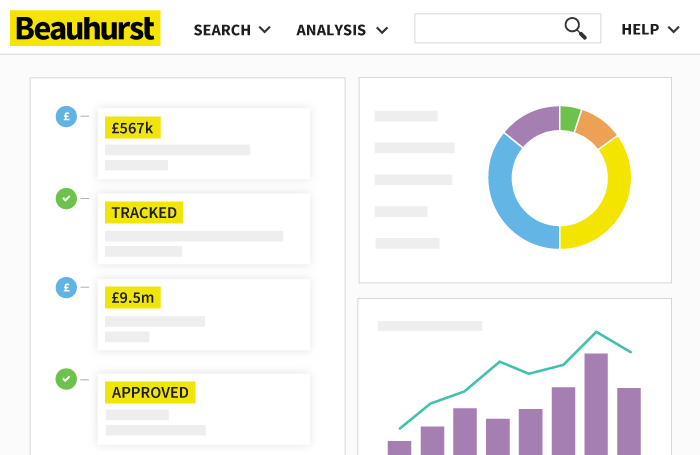

Beauhurst tracks all the UK’s spinout companies that have been incorporated since 2011, and will also track those that are older but have shown other signs of growth ambition (e.g. have raised equity or have attended an accelerator). We collaborate with all the UK’s universities to ensure we have comprehensive coverage of the spinout population at any time.

This report focuses in on one area of the activity of these spinout companies: equity investment. We detail the equity investment activity into spinout companies, as well as the source and destination of these investments. Beauhurst captures both announced and unannounced fundraisings by checking through Companies House records as well as across the web. We employ a fusion of artificial intelligence and human data experts to ensure the accuracy of this data.

Key findings from 2021

- Last year saw a record 371 equity investments made into UK academic spinouts with the £1.35b total invested just falling shy of the 2018 record (£1.36b)

- The number of first-time spinouts deals in 2020 was 54; the lowest number of first-time deals since 2011

- The report includes a breakdown of the largest investments into UK spinouts in 2020, including the £84m deal completed by Oxford Nanopore Technologies last October

- The top investors by number of deals in 2020 were Scottish Enterprise, Parkwalk and Mercia Asset Management

- The top academic institutions by number of deals secured by their spinouts in 2020 were the University of Cambridge, the University of Oxford and Imperial College London

- Funds headquartered in the United States are the most prolific foreign investors into UK spinouts, accounting for 222 deals over the last 10 years

About the authors

henry whorwood

Henry leads Beauhurst’s research and consultancy, and is an expert on equity finance and high-growth business. He has worked on briefs for clients including Barclays, Syndicate Room, Innovate UK, Smith & Williamson and the British Business Bank. Henry regularly gives presentations on finance and market trends at events around the country. Henry studied Classics at the University of Oxford.

Daniel robinson

Daniel conducts data manipulation, visualisation and analysis as part of the Research and Consultancy team. He has a background in business analysis and commercial copywriting in Australia and the United Kingdom. He previously worked at The Sunday Times Fast Track, Oxford University Press, and advertising network MullenLowe Group.

Ava scott

Ava is an expert data cruncher and business analyst in the Research & Consultancy team. She provides research and insights for multiple clients, including the Royal Academy of Engineering, Syndicate Room and Penningtons Manches. She holds a BA in Human Sciences from the University of Oxford, and is currently studying for a PhD in Cognitive Neuroscience at University College London.

Explore the data for yourself

Book a 30 minute demo to see all of the key features as well as the depth and breadth of data on the Beauhurst platform.