Upcoming IPOs 2020: will these companies IPO this year?

Category: Uncategorized

Trends in the UK’s high-growth IPO market

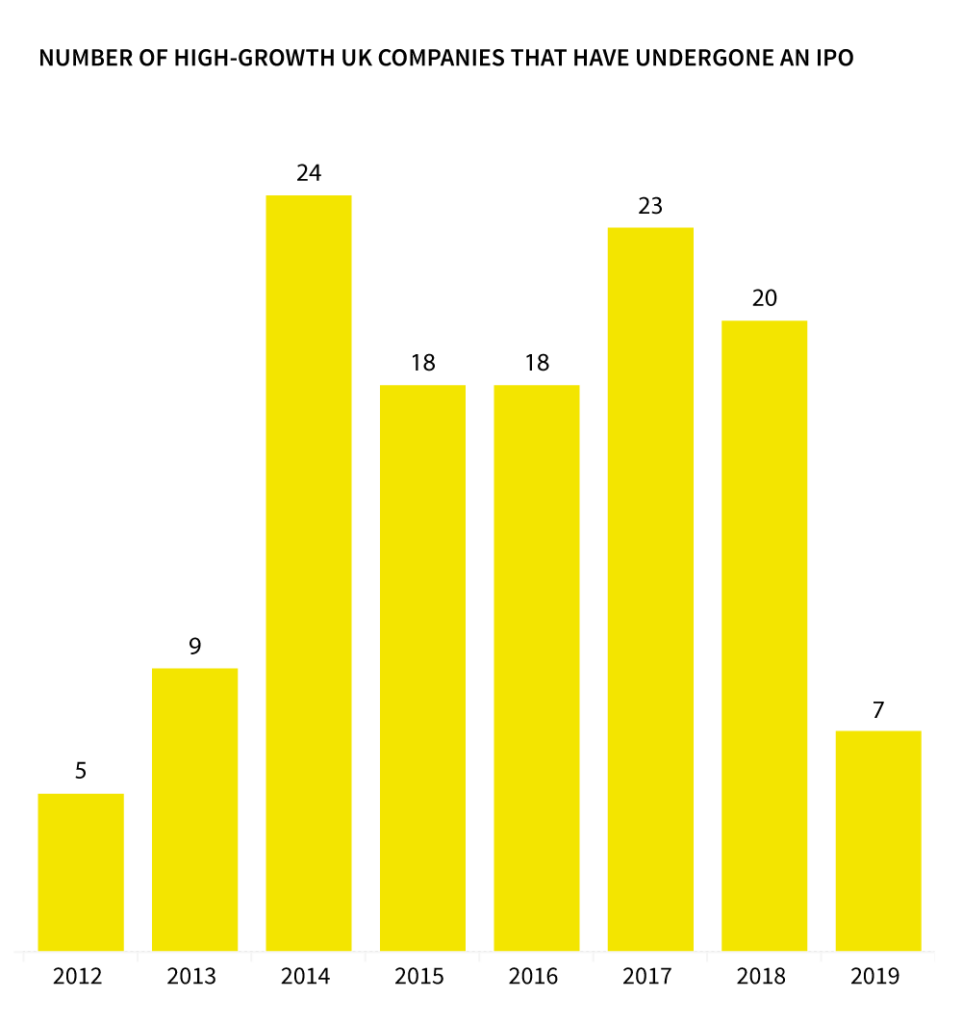

The Initial Public Offering (IPO) market has changed dramatically in the past two decades. What was once the obvious route for a fast-growing startup to raise large sums of money and allow investors and employees to sell their shares has now declined in popularity. 2019 was an especially quiet year, with just 7 Beauhurst tracked companies (the most ambitious businesses in the UK) listing on a stock exchange, the lowest number since 2012. In this post, we take a retrospective view of the market as well as a look at some of the UK’s upcoming IPOs.

Why is the IPO market slowing?

One of the most significant factors is that there is now more cash available in the private market than ever before, with 2019 seeing more equity invested than any year prior (look out for our annual equity report, The Deal, for more information on this in the coming weeks). And much of this capital is being deployed in very large instalments, allowing later stage startups to stay private for longer.

For example, last year, rumours circulated over a possible IPO for Deliveroo. But the food-delivery giant opted instead to raise a $575m equity round, postponing a listing on a stock exchange, with plans to go live in 2020. Of course, some of this capital may well help fund the IPO process.

It’s also important to note the bad press that IPOs have had over the past few years. Talk of a ‘valuation bubble’, particularly within the tech market, may have prompted strategic leaders of high-growth companies to err on the side of caution when it comes to braving the public market. Indeed, these rumours are, in some cases, coming into fruition. American co-working space provider WeWork faced such a large backlash against its valuation and the way it was operating when it announced plans to IPO that its biggest investors, Chinese megafund SoftBank, pulled support for the listing.

Subscribe to our weekly newsletter for

free analysis of the UK’s high-growth space.

Why might a company want to stay private?

Private companies enjoy fewer regulations than those that are publicly listed. They are also held accountable by fewer stakeholders. Some companies aren’t focussed on an exit event at all, and are dedicated to fulfilling their mission as a private company. For example, in a recent interview, the team at OakNorth claimed they weren’t interested in listing publicly.

For those that do want to go public, macroeconomic factors can have a massive impact on exactly when they choose to apply for a listing, and economic uncertainty may mean they choose to delay to a later date. It’s unclear exactly how much of an effect uncertainty over Brexit has had on the UK’s IPO market, but if Johnson can deliver on his promise of exiting by January 31st then confidence in the market is likely to increase, resulting in a higher number of IPOs than in 2019.

Which companies are choosing to go public?

In order to anticipate which companies may choose to go public in the near future, we’ve taken a look at the shared characteristics of those that have recently listed. It’s interesting to note that we’ve seen some fairly dramatic changes in the kinds of companies that have listed over the past seven years. For example, between 2013 and 2015, the most common growth characteristic of a company that successfully IPOd was that it had reached the OECD’s definition of a scaleup company:

All enterprises with average annualised growth greater than 10% or 20% per annum, over a three year period, with at least 10 employees at the start of the observation.

From 2016 onwards, the most common method of growth for these companies is equity funding. Since 2012, the median pre-money valuation before listings has increased rather dramatically from £3.24m to a high of £34m in 2017. In 2019 this figure stood at £25m.

We’ve taken a number of factors into account, including the age, sectors, stage of evolution, funds raised, latest valuation, and public mentions of plans to IPO to build a list of companies that we consider ones to watch.

Deliveroo

Head office location: City of London

Current stage of evolution: Growth

Areas of operation: Services on demand

Total funding received: £1.15b*

The fundraising announced in May 2019 and led by Amazon has been paused for investigation by the Competition and Markets Authority (CMA).

The UK’s best-funded startup company, Deliveroo is a food delivery service which is branching out with its own delivery-only restaurants. The growth-stage company was first registered in 2012 and has significantly shaped the UK’s gig-economy since. The company has raised £1.15b of equity over nine funding rounds, although the latest investment announced in May 2019 and worth a staggering $575m is still under investigation by the Competition and Markets Authority (CMA), due to Amazon’s involvement.

Led by co-founder and CEO Will Shu, the company has a fairly large list of investors on its cap table, including Accel, Eight Roads Ventures, Index Ventures and JamJar Investments amongst many others. In an interview in May 2018, Shu said that “an exit event is not even remotely on my radar”. But just a few months later, The Telegraph claimed the company was preparing for an IPO in the very near future. It has been rumoured that the $575m raised last year will give Deliveroo the runway to undergo an exit event, with unnamed sources penciling an IPO in for 2020.

Atom Bank

Head office location: Durham

Current stage of evolution: Growth

Areas of operation: Fintech

Total funding received: £482m

Atom operates a digital-only banking service, with all its services provided through its app. The Durham-based fintech has opted to diverge away from providing current accounts (a popular route for challenger banks), instead offering savings accounts, mortgages and business loans to its customers. Ranking second on our recent list of top funded fintech startups in the UK, Atom has raised a breathtaking £482m over 12 funding rounds. The latest round of £50m was completed in July 2019, with the purpose of funding product development and making new hires. Soon after, in August 2019, Atom was awarded a £10m grant from the Capability and Innovation Fund (CIF) for the same purpose.

Atom is backed by a number of investors, including British Business Bank, venture capital fund Anthemis, angel network Conviction Investment Partners and Spanish bank BBVA. In July 2019, CEO Mark Mullen squashed rumours that Spanish investor BBVA would acquire the challenger bank. The FT reported that “Atom was working to prepare for an eventual IPO rather than being swallowed up.” That sounds like there’s still some work to be done before venturing into the public markets, but that the company is amping up for a listing within the next few years.

Brewdog

Head office location: Aberdeen

Current stage of evolution: Established

Areas of operation: Food and drinks processors

Total funding received: £284m

Brewdog is one of the UK’s most famous startup success stories, and Scotland’s only active unicorn company. Co-founded in 2006 by James Watt and Martin Dickie, BrewDog claims to be the catalyst of the craft beer revolution. The companys’ growth journey so far has been nothing short of impressive, with £284m raised over 11 funding rounds, including four crowdfunding rounds via Crowdcube. This capital has enabled the company to open a chain of craft beer bars, expand to the US and Australian market, pull off a series of shock marketing stunts, and pass a new beer measure law in Parliament.

Brewdog has also secured £2.38m worth of grants, achieved 20% scaleup status and been featured on 26 high-growth lists. In 2014, the company attended ELITE accelerator, sponsored by the London Stock Exchange.

Brewdog’s turnover has grown from £2.7m in 2014 to a massive £47.5m in 2018, and it is now categorised in the established stage of evolution. The company has been discussing an IPO for several years, and is on track to take the plunge into the public markets this year.

ComplyAdvantage

Head office location: Westminster

Current stage of evolution: Growth

Areas of operation: Fintech, AI, Big data

Total funding received: £38.3m

ComplyAdvantage provides an online database that details information on individuals and organisations associated with financial crime, such as money laundering and financing terrorism. The company’s machine learning algorithm helps businesses quickly identify risks amongst their client base, improving their process for complying with relevant financial crime regulations.

The company was founded and continues to be led by Cambridge graduate and serial entrepreneur Charles Delingpole, of MarketInvoice fame. In March of last year, Charles confirmed to BusinessCloud that the company was on track to double their staff to over 300 by the end of 2019, and that the ultimate goal is an IPO.

So far, ComplyAdvantage has reached 20% scaleup status and secured four funding rounds totalling £38.3m, placing it 42nd in our recent ranking of the UK’s top fintech startups. Investors in their earliest rounds remain undisclosed, but recent backers include two of the UK’s leading venture capital funds – Balderton Capital and Index Ventures. It seems unlikely the company will exit imminently, given that Index Ventures first invested in January 2019, but this is certainly one to keep an eye on.

Kymab

Head office location: South Cambridgeshire

Current stage of evolution: Growth

Areas of operation: Pharmaceuticals

Total funding received: £209m

Based in Cambridgeshire, Kymab is discovering and developing human monoclonal antibody therapeutics with an initial focus on malaria and HIV. Led by CEO Simon Sturge, the pharmaceutical company has raised a massive £209m over seven funding rounds. Investors include LifeArc, Malin Corporation and Wellcome Trust, along with Woodford Investment Management. In 2017 Kymab received a $9m grant from the Bill and Melinda Gates Foundation to accelerate the development of novel vaccines.

Back in May 2019, Business Weekly announced that the Kymab team were considering an IPO on Nasdaq, following the submission of a ‘confidential draft registration statement’. They subsequently made a post stating that “the initial public offering is expected to commence after the SEC completes its review process, subject to market and other conditions.”

Xmos

Head office location: Bristol

Current stage of evolution: Growth

Areas of operation: Chips and processors

Total funding received: £59m

Spunout of the University of Bristol and operating within the hub of silicon chip companies in the South West, Xmos designs and retails fabless semiconductors. Xmos was first registered in 2005, and has since raised £59m over seven funding rounds. Its latest round, back in September 2019, saw £15.5m invested in equity and loan finance with the purpose of job creation and further research and development. The company has also secured three grants totalling £2.74m and reached 20% scaleup status.

Another accolade to add to a long list is the success of Xmos’ spinout company, Graphcore. One of the UK’s 16 active unicorn companies, Graphcore has developed a processor optimised for machine-learning tasks, and technology to accelerate machine learning applications both in servers and in the cloud. Graphcore was most recently valued at £932m (December 2018).

Rumours have been circulating of an IPO event for Xmos for the past decade, but the company is yet to comment on these. Xmos is backed by a number of investors who pride themselves on having a long-term, global view, including Amadeus Capital, Robert Bosch Venture Capital and Draper Esprit. It remains to be seen just how long-term this investment cycle will be.

iwoca

Head office location: Camden

Current stage of evolution: Growth

Areas of operation: Fintech, AltFi

Total funding received: £216m

Camden-based iwoca provides small businesses with short term loans which have fixed interest rates, starting from 2%. The loans are quick and easy to apply for, unlike the lengthy process of applying for a small business loan through a traditional bank.

£14.8m of equity funding has been pumped into the AltFi company, and a further £201m of capital has been provided in a mix of equity and loan funding. They’ve used this capital to grow rapidly since their first round of £10k in 2012, having achieved 20% scaleup status and increased their headcount to over 300, with offices in London and Frankfurt. Their operating profit was most recently declared to be £9.9m, a pretty significant sum in an environment which often values growth over profits – clearly, the team at iwoca has successfully balanced both.

In 2015, iwoca joined Tech Nation’s prestigious Future Fifty programme, a late-stage accelerator programme which has supported over 140 high-profile companies, including fellow fintechs Monzo, Revolut and Starling Bank. The exit rate of the accelerator currently stands at a healthy 23%.

OrganOx

Head office location: Oxford

Current stage of evolution: Venture

Areas of operation: Medical instruments

Total funding received: £29m

OrganOx is a medical instruments company that aims to improve the outcome of organ transplants and increase the number of transplants that can take place. It does this by preserving human organs in a functional state through transport. Their fully-automated metra device delivers donor livers with blood flow, oxygen and nutrients at a normal body temperature.

OrganOx is a spinout from the University of Oxford, co-founded by Professors Constantin Coussios and Peter Friend. Now led by CEO Craig Marshall, the company has raised nine rounds of equity funding totalling £29m. The latest round of £4.62m was completed in December 2019, with a pre-money valuation of £52.3m. VC fund Oxford Technology first invested in OrganOx back in 2008, and other backers include The Royal Society Enterprise Fund, Technikos, and Oxford University’s The University Challenge Fund (UCSF). Backers of the last six rounds remain undisclosed, but the company’s cap table reveals a number of angel investors and venture funds, from China-based GT Healthcare to Poland-based Kan Investments. It’s likely that this cohort of investors will be pushing for some kind of liquidation event in the near future.

Get a free tour of the platform.