UK fintech data: an overview of startups and their investment

| Beauhurst

Category: Uncategorized

With the UK fintech sector seeing more investment than ever before, and continuing to fuel growth, we’ve taken a closer look at the UK fintech landscape.

So what is fintech?

Put simply, it’s companies using technology to disrupt and support banking and financial services.

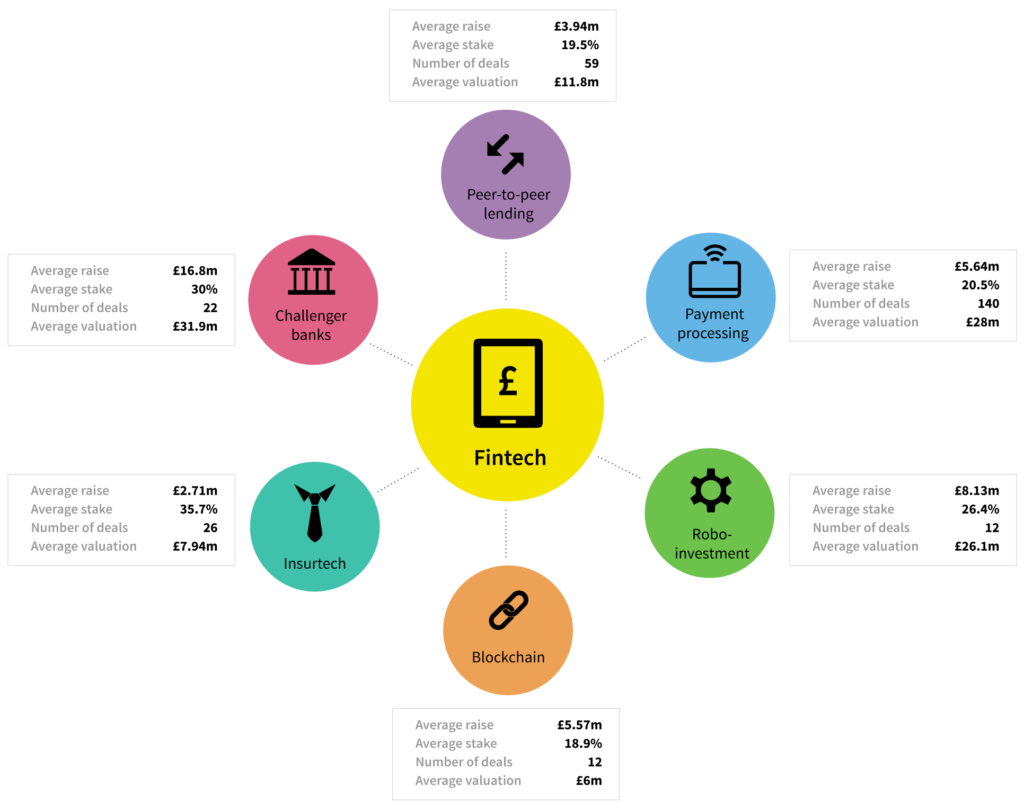

We’ve analysed the main sub-sectors that make up this exciting vertical.

Challenger banks

Challenger banks are fintech companies that both provide the services you’d expect of a retail bank, and aim to disrupt the current dominance of traditional retail banks. Many challenger banks offer services for small firms as well as individuals, and provide a range of traditional services (mortgages, saving, moving money) alongside more innovative features (spending breakdowns, instant transfers, simple cross-border payments).

From big names like Atom and Monzo through to relative unknowns (at the moment!) like Folio and Loot, challenger banks are one of the most exciting types of company to watch within UK fintech – just take a look at their growth over time. We’ve profiled some of the key players in the past: take a look at Atom, Tandem (twice), and Revolut, and you can find a more general overview of the sector here.

Payment processing

Payment processing platforms largely fall under SaaS as a category, and the sector has proved lucrative in recent years: high-profile successes like that of PaymentSense, which provides credit and debit card machines to SMEs, take the average valuation of companies in the space to £14.7m.

Other payment processing software companies include Azimo, which allows individuals to send money internationally via an app; Currencycloud, which operates on a similar basis but is aimed at companies working internationally; Yoyo Wallet, whose app operates payment processing alongside consumer loyalty rewards, and GoCardless, whom we profiled in September.

Blockchain

We explained what blockchain is here, and it has ramifications for everything from regtech to ecommerce. Partly due to the increasingly mainstream use of cryptocurrencies like Bitcoin and Ethereum, and partly due to the evolution of smart contracts outside the sphere of finance, we think blockchain companies are only going to grow in the near future: take a look at the first graph above to see how investors’ appetites have increased over time.

PSP

Peer-to-peer lending allows ordinary investors to make a return by lending cash, usually via an online platform, to other individuals or businesses.

Increasingly popular but increasingly controversial, peer-to-peer finance is currently coming under fire for inadequately scrutinising borrowers and delivering diminishing returns to investors. Nonetheless, its recent popularity inspired the government to create an Innovative Finance ISA last year. Only 2,000 of these accounts have been opened in the time since, partly due to the struggle of many P2P lending platforms to pass regulatory hurdles imposed by the Financial Conduct Authority.

Insurtech

Insurtech seeks to disrupt one of the most traditional industries in finance, and can cover the provision of services to both individuals and insurance companies themselves.

Several insurtech companies have already made headway with equity fundraising: Zuto compares car insurance providers; QuanTemplate develops software for insurers that analyses their data; RightIndem assists individuals with insurance claims after accidents, and Digital Fineprint provides insurers with social data to assist with matching policies to users. Equally, certain funds like Eos Venture Partners are keen to invest in the space. Should these gambits prove successful, we’re likely to see further innovation in coming years.

Roboinvestment

Commentators frequently express concern about how automation will affect the labour market over the coming century. Only rarely, however, do they mention the recent rise of businesses who are trying to automate the investment industry.

Roboinvestment refers to investments that are managed by “robo-advisors“, or rather, automated investment managers. Investment decisions are governed primarily by algorithms, usually with minimal human interference. This cuts out the steep broking fees, allowing roboinvestment firms to pitch themselves as an accessible alternative to the incumbents.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.