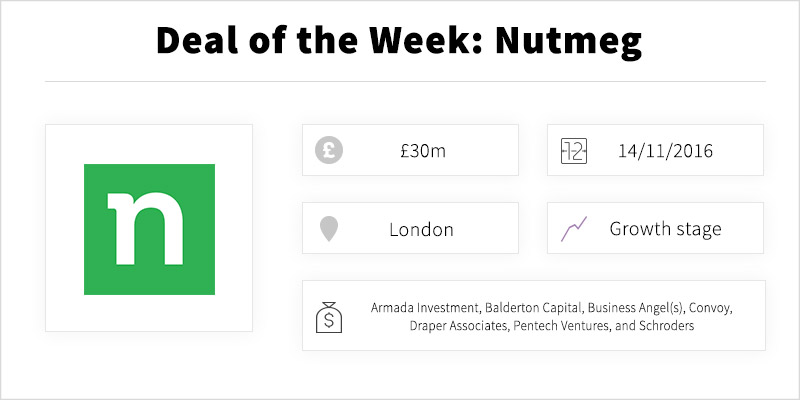

Nutmeg spices up UK fintech with £30m equity investment

Category: Uncategorized

For a comprehensive overview of UK fintech investment data, take a look at our guide.

What do they do?

Nutmeg is an online investment management firm specialising in investments, ISAs and pensions. It advertises its services as “no-nonsense investing”, and offers low fees, globally diversified portfolios, and expert strategy designed to pay off in the long term. The high-growth company seeks particularly to attract those new to investing, with an unusually low barrier to entry: only £500 is required as an initial gambit.

What have they raised?

Nutmeg has raised £30m this week, taking its total amount raised to £54m over seven equity fundraisings. This comes in the wake of its having named Martin Stead its new CEO over the summer. Indeed, Nutmeg claims the funding round is the largest into British fintech since June’s Brexit vote.

This is not strictly true: fintech scaleup iwoca, which provides short term loans for eBay and Amazon retailers, announced in early October that it had received £46m from investors including Prime Ventures and Shawbrook Business Credit. Beauhurst has verified £20.6m of this deal*.

The online investment management firm’s largest previous fundraising was announced as $32m from Armada Investment, Schroders, business angel(s) and Balderton Capital in June 2014. Beauhurst’s own estimate placed the value of that fundraising as considerably lower, however, at £5.34m.* A huge 47.4% stake was taken in exchange for this funding.

Behind the money

Pentech Ventures, Armada Investment, Balderton Capital and Schroders have all now invested twice in Nutmeg. Draper Associates and Convoy have both made their first foray into the business, and various business angels have participated for the second time (although it is not known whether any individual angel has invested twice).

This suggests Nutmeg has pulled off quite something in attracting such a cohort. Indeed, whilst it will be a few weeks before a valuation can be given with confidence, Nutmeg’s book value as of 2015 was £9.35m. This investment, Nutmeg’s largest ever, will only add to that figure.