IPO Watchlist 2022: 15 High-Growth Companies Likely To List

Category: Uncategorized

What is an IPO?

An initial public offering, or IPO, is when a company lists on a stock exchange, allowing individual investors or firms to buy the company’s shares on the public market, and providing an exit event for founders, employees and private investors.

Why do companies IPO?

IPOs have traditionally been the end game for startups and scaleups companies, with founders, early employees, and existing investors able to make huge sums of money, depending on their shareholdings and the value of the business at the IPO. This is often incredibly attractive for senior leadership, especially given that entrepreneurs have likely foregone a market-rate salary and the stability of a regular 9–5 job for several years.

IPOs also offer the opportunity for companies to generate more growth capital from public investors, and in the past have been necessary for companies to achieve significant success. But over the last decade, IPO activity in the UK has stagnated, with companies now able to raise more cash from venture capitalists and other private investors than ever before.

Trends in the UK's high-growth IPO market

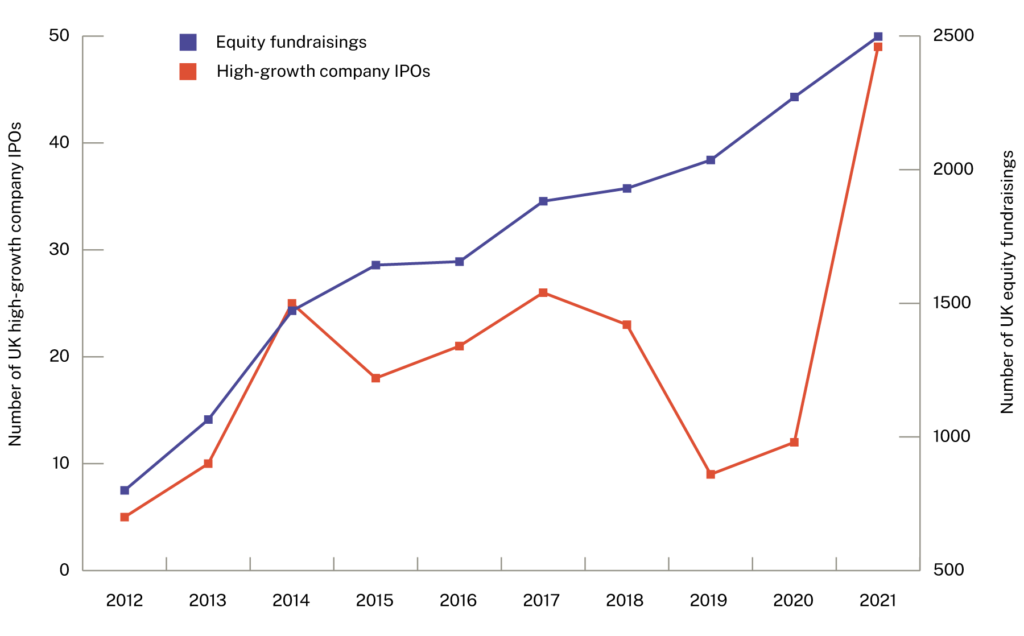

In 2019, just nine high-growth UK companies listed on a stock exchange (either in the UK or abroad), compared to 25 in 2014, despite there being over 40% more high-growth companies in 2019 than in 2014.

This trough continued in 2020, with the dual storm of Brexit and the Covid-19 pandemic in full swing, when just 12 high-growth UK companies listed on a stock exchange.

UK high-growth company IPO and Equity investment activity over time

Last year, however, IPO activity reached a record high, with 49 high-growth companies in the UK making their public market debut. These included Deliveroo, Exscientia, Oxford Nanopore Technologies, Pension Bee, and Parsley Box. The last high-growth IPO of 2021 was CT Automotive’s listing on the Alternative Investment Market (AIM) on December 23rd, which valued the company at £7.49b. More than 85% of high-growth companies that IPO’d in 2021 listed on a UK stock exchange, up from 65% in 2018.

Stock market performance in the past year has been driven by unprecedented economic stimulus around the world, along with increased popularity of retail investing. Together, these factors have made the public markets more attractive to companies for listing.

But it wasn’t all sunshine and rainbows, as many companies did not achieve the dazzling valuations that they’d hoped for, including Deliveroo, which was labelled the “worst IPO in London’s history” after a 26% drop in share price on its first day of trading.

According to Linda Main, Head of KPMG’s UK Capital Markets Advisory Group: “One key focus point during 2021 was the aftermarket performance of IPOs. Our analysis shows post-IPO performance widely diverged by company with 39% of large listings recording share price drops, compared to only 13% of equivalent companies in 2019 (the most recent comparable year). Generally, where share price performance has disappointed, it can be attributed to company-specific factors. Therefore, companies looking to IPO should not be put off.”

So what do we foresee happening in 2022? Despite record activity in 2021, many companies that planned to float have decided to wait for a more favourable market, whilst others are considering a float for the first time.

Either way, there’s an incredibly strong pipeline of companies looking to IPO. And with the policy changes recommended in Lord Hill’s UK Listing Review due to come into effect in 2022, an increasing number of these may be taking place on home soil (on the London Stock Exchange, NEX Exchange and Alternative Investment Market), rather than being lured over the pond (to the New York Stock Exchange and NASDAQ).

Here, we’ve profiled 15 companies we suspect might IPO in the next 12 months, whether on a UK stock exchange or abroad, based on their current growth trajectories and rumours in the press.

15 Upcoming IPOs

Lyst

Lyst is a social shopping site that aims to help users find fashion items from various brands. The company attracted over 150m users in 2020 and achieved a turnover of £23m from commissions on sales completed via the app.

According to Vogue, Co-Founder and CEO Chris Morton “wants to do for fashion what Spotify and Netflix have done for music and movies: create a highly personalised, frequently visited, ubiquitous app, to both search for what you know you want and to discover items you didn’t know you needed.”

The scaleup company, which is now in its Growth stage of evolution, attended the Future Fifty accelerator in 2013, and has raised a total of £121m of investment from various investors. These include 14W, Accel Partners, Balderton Capital, C4 Ventures, Fidelity International, Giano Capital, Molten Ventures, and Novator Partners.

The latest of these rounds closed in May 2021, at $85m (£60.2m), and was labelled by the company as a pre-IPO round. Techcrunch reported that the time and location of the IPO is still to be confirmed, but that it would likely take place between one and three years after the funding round, so it could be on the cards for 2022.

Recycling Technologies

Spun out from the University of Warwick in 2011, Recycling Technologies has developed a process that can convert mixed plastic waste into heat and electricity. Its modular technology can be installed at existing waste sites to help divert plastic waste away from landfill, incineration and leaking into the environment.

The cleantech company has featured on multiple high-growth lists, including the Top 100 – Britain’s Fastest Growing Businesses (2019), and The IP100 (2019). To date, it has raised £24.3m in investment, across 14 funding rounds, with participation from Crowdcube, EcoMachines Ventures, Minerva Business Angel Network, Mirova, Neste, and SyndicateRoom.

Recycling Technologies first planned to list on the AIM in December 2021, with a plan to raise £40m at a £111m market cap. But it chose to postpone the IPO after receiving “interest from a broad range of investors in the IPO marketing process, including investors that are more strategic in nature that require additional time to make a final investment decision, as well as significant blue-chip funds.” The Swindon-based company now intends to list in “early Q1 2022”.

Zopa

London-based fintech Zopa operates a peer-to-peer lending site. The company was accelerated by Tech Nation’s Future Fifty programme in 2013, and has since gone on to raise £516m, across 13 funding rounds. Investors include Arrowgrass Capital Partners, Augmentum Fintech, Balderton Capital, Benchmark Capital, Bessemer Venture Partners, Chimera Investment, Corigin Ventures, Forward Partners, Northzone Ventures, and Softbank Vision Fund.

In October 2021, the company raised a £220m funding round at a reported valuation of £750m, securing its place in the UK’s unicorn herd. At the same time, it announced plans to list in London as early as Q4 2022. Zopa CEO Jaidev Janardan told the FT that “we think we are ready [to list], but one thing I would like to have is a track record of profitability before going public.”

Zepz

Formerly known as WorldRemit, Zepz develops an online platform enabling migrants and expats to send remittances to family and friends abroad. The fintech company was one of the first female-founded businesses to join the UK unicorn herd, and has raised £528m, across 10 funding rounds. Investors include Accel Partners, Farallon Capital Management, LeapFrog Ventures, Technology Crossover Ventures (TCV), and TriplePoint.

Zepz’s latest round, which took place in August 2021, closed at $292m (£214m) and valued the company at well over £3b. At the time, Bloomberg News reported that the business was considering an initial public offering as soon as 2022.

Now employing over 1.5k people in 15 offices around the globe, Zepz reported 4.5m monthly customer transactions in 2020, worth a combined $10b, and Companies House filings show a reported turnover of £120m in 2020, down from £122m in 2019.

Onfido

Onfido develops software designed to verify a customer’s identity by assessing the legitimacy of their government ID and facial recognition technology. The digital security company, which draws on artificial intelligence technology, has attended both the Future Fifty accelerator (2017) and the Mayor’s International Business Programme (2016).

To date, it has secured £175m of funding from Augmentum Fintech, Brightbridge Ventures, Crane Ventures, M12 (formerly Microsoft Ventures), Salesforce Ventures, SoftBank Capital, and Talis Capital, among others.

Rumours have been swirling that Onfido is seeking to list across the pond, after growing quickly in the US. In June 2021, The Telegraph reported that it “has begun switching from British accounting rules to US standards in preparation for a ”potential US IPO in the near future”, according to job listings.”

The company also recently hired two new American executives, Faisal Chughtai and Nello Franco, to prepare for its next stage of growth. Mike Tuchen, Onfido CEO, has emphasised the pair’s experience with IPOs and public companies, stating that “Faisal brings 20+ years’ experience as a CFO, GM and Investment Banker for Internet and software companies, growing businesses at scale, and deep experience with IPO, financing and M&A strategies. Nello, joining as CCO, has advised Vista’s $70B enterprise portfolio companies, and transformed public companies into customer-first organisations.” Hiring this kind of experience might suggest that the company is seeking to go public very soon.

Atom

Atom develops a digital-only retail banking service. The Northumberland-based challenger bank was founded in 2014 as the UK’s first app-based bank. It has since grown to over 400 employees with more than half a billion pounds of investment raised, across 13 funding rounds. It is backed by a long roster of investors, including Anthemis Group, BBVA, British Business Bank, Conviction Investment Partners (CIP), Marathon Asset Management, Middleton Enterprises, Polar Capital, and Toscafund, among others.

In an announcement in February 2021, off the back of a £40m funding round, CEO and co-founder Mark Mullen said that “the team retains an IPO as our objective and we’ll take the business there when we and the markets are ready. After the year that’s just gone I’m not going to claim perfect foresight, but we’re looking at the financial year 2022/23 as our IPO target.”

Another statement released in August 2021 noted that Atom had “achieved a monthly operating profit for the first time in the company’s history and we’re determined to accelerate further and faster both this year and next as we continue our journey towards sustainable profitability and IPO.”

Fruugo

Fruugo retails a variety of consumer goods online. The e-commerce marketplace is located in South Lakeland, and has featured on both the Northern Tech 100 (2021) and the FT 1000 (2021). Out of all the companies on this list, Fruugo has raised the lowest amount of investment, at £760k.

In August, Sky News reported that Fruugo was seeking an initial public offering in the near future and, one month later, the company published its intention to float on the AIM, with the intention of listing in October 2021. But October—and the rest of 2021—came and went, and so 2022 looks like it could be the year the company goes public.

Fruugo co-founder Dominic Allonby has said that the planned IPO “will enable the Group to invest further in its technology, including developing the user experience and onboarding process, to continue to achieve its significant growth potential from adding new retailers to the platform.”

Giggling Squid

Founded in Brighton in 2002, by husband and wife duo Pranee and Andy, Giggling Squid now operates a chain of 40 Thai restaurants from its headquarters in Guildford. The company is now in its Growth stage of evolution, with £6.4m of equity finance under its belt.

Back in 2018, amidst the tumult of Brexit negotiations and economic uncertainty, Giggling Squid CEO and Co-Founder Andy Laurillard announced that the company was gearing up for its next stage of growth, and said that “an IPO would give us access to capital to support our growth plans,” but that “it’s the wrong time to start thinking about it […] maybe in a year’s time.”

Four years later and the company has weathered both Brexit and the pandemic, remaining profitable through both. The company’s most recent financial statement, from April 2021, reported a turnover of £33.9m and an operating profit of £2.53m.

In October 2021, Laurillard told The Times that an IPO still wasn’t on the cards just yet, but that they would review this in 2022 along with all the other financing options open to them, noting that “we’re now a much larger, better-capitalised business, so we’re a different proposition.” So, whilst it’s not a sure fire bet for 2022, it’s one to keep an eye on.

The Cheeky Panda

The Cheeky Panda produces sustainable toilet paper from waste bamboo, aiming to reduce deforestation and chemical use in the manufacturing process. Founded by Julie Chen and Chris Forbes in 2016, the company has raised £14.5m to date, across eight funding rounds, with backing from Northern & Shell Ventures, and crowdfunding platform Seedrs.

The Cheeky Panda has grown from strength to strength since being founded in 2016, with products now selling across Europe, the US, and Asia, at retailers such as Waitrose, Boots and Superdrug. The green company has published revenue forecasts of £20m+ in 2022 and £50m by the end of 2023. It even has its sights set on a vertically integrated supply chain, with plans to operate bamboo farms around the world.

The company hopes to be the first crowdfunded business to list on a stock exchange, and could go public in 2022. According to a report in The Grocer in July 2021, “The company is working with KPMG on an IPO strategy and is running a dual-track process, which includes plans to either float on AIM next year or raise money in a private placing followed by a much bigger flotation on London’s main market in 2023 or 2024.”

South West Brands

South West Brands operates a group of consumer CBD brands, such as Botanic Lab which produces CBD-infused soft drinks. The female-led business is based in Islington, and has raised £2.63m to date, across eight funding rounds. The company has launched two consumer brands in the past six months: LoveMeMeMe, a vegan healthcare brand with CBD ingredients, and FEWE, a menstrual cycle care brand.

The company announced plans to IPO back in June 2021, and has since raised a £300k round from existing investor SEED Innovations and other, undisclosed backers. The fundraising was a mix of equity and loan investment, with SEED Innovations contributing £150k in convertible loan notes (CLN). The announcement of this investment stated that “Consideration of, and progress towards, a possible listing on the London Stock Exchange remains, however this is delayed from the original Summer 2021 timetable.”

NEOM

NEOM produces a range of organic scented products such as perfumes, candles and body products. Founded in 2004 and based in London, the female-led company is now in its Growth stage of evolution. To date, it has raised £2.12m of investment, across four funding rounds, and is backed by Piper Private Equity. |

Back in September 2021, The Times reported that NEOM had hired Rothschild “to advise on a possible listing that could value it at up to £100 million.”

EG Group

EG Group operates multiple petrol and service stations in various international locations, and operates a range of third party retail brands within its stations, including KFC, Subway and Carrefour. The Established-stage company is based in Blackburn, and has featured on multiple editions of the Top Track 100.

Incorporated in 2001, EG Group has now secured £320m of loan finance from Handelsbanken, Lloyds Bank Commercial Finance, and Lloyds Bank Corporate Asset Finance. The company’s latest available financials (from 2019) reported a turnover of £2.22b and an operating profit of £81.2m.

Back in 2019, Bloomberg reported that the company was considering an IPO at a valuation of £10b. Run by brothers Mohsin and Zubair Issa, the firm may have got cold feet, but since then has gone on somewhat of an acquisition spree, buying businesses across Europe, the US and Australia. This includes the acquisition of healthy fast-food chain Leon in April 2021, and a majority stake in supermarket chain Asda, previously owned by Walmart, for £6.8b.

In September 2021, Bloomberg again reported rumours that the company was eyeing an acquisition or IPO, with a spokesperson from the company telling The Grocer that “EG Group regularly works with its advisers to explore a wide range of options to create value in its portfolio”. So could 2022 be the year? Watch this space…

Omnio

Omnio develops software for banks and other businesses, providing financial and payment services. Rather than disrupting incumbent firms like many other fintechs, Omnio’s banking-as-a-service platform aims to empower banks and large corporations to innovate and advance their digital banking offerings.

The company is based in Westminster, and has raised £38.6m to date, across two rounds. The latest of these closed in March 2021, and was labelled as a “Pre-IPO Convertible Bond” round. At the same time, Omnio announced that it was “aiming for a listing in the foreseeable future.”

In December 2021, Omnio CEO Adrian Cannon told TechBlast about the company’s M&A ambitions, and plans to IPO “probably late next year or middle of the year after”. So that puts them on course for a 2022 or 2023 listing, which could be in London, New York, or even Sweden.

OnBuy.com

OnBuy.com operates an online marketplace which sells new and refurbished items from leading brands, including Apple, Sony and Calvin Klein. Based in Bournemouth, the e-commerce company has raised £49.4m, across seven funding rounds, including participation from Bring Ventures, Fuel Ventures, Seedrs, and Wealth Club.

The most recent of these investments took place in the summer of 2021 and, according to BusinessCloud, is intended to fund “further meteoric growth for OnBuy, with sights firmly set on reaching unicorn status in the coming years.”

In December 2021, the company announced that it was offering employees £1m in company shares, following impressive year-on-year growth, off the back of a successful Black Friday sale. OnBuy.com is rumoured to be eyeing an IPO in the next two years.

Britishvolt

One of the latest additions to the UK’s cohort of unicorn companies, Britishvolt designs and manufactures lithium-ion batteries for use in electric vehicles. With plans to build the country’s first giga-factory, Britishvolt has raised £61.9m, from investors including Carbon Transition, Cathexis Venture II, Glencore, NG Bailey, and other, undisclosed investors.

Based in Northumberland, Britishvolt has been vocal about its plans to go public and, whilst the firm remains in an early stage (with no turnover generated in 2021, as batteries remain in the prototype stage), the company has managed to grab the attention of investors across the world, with several US Special Purpose Acquisition Companies (SPACs) reportedly showing interest.

Still, Chairman Peter Rolton recently told the Guardian that changes to UK listing rules means that London is now the most attractive location for a Britishvolt IPO: “You know what, we’re a British company and our preference would be the London Stock Exchange […] It’s the right home for us.”

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.