How to use Charges and Mortgage Data

There’s so much data out there, it’s hard to know what’s relevant for making good decisions — and charges and mortgage data might not be something you’d ever considered.

What is charges and mortgage data?

When someone lends money to a company, a charge is a document specifying the assets the lender may claim if the borrower defaults on their debt. From these we can therefore tell when a company has taken out a secured loan. The most common type of charge is a mortgage, where a business (or individual) will put up their house as collateral for the loan.

With this data you can identify companies which have received debt, when the company has received debt, whether it’s been paid off, who they received it from, and what assets they used as collateral.

What is the difference between charges data and mortgage data?

Charges and mortgage data both refer to legal and financial aspects of property ownership. But they are different things. Here’s a breakdown:

Charges

A charge is any secured debt over any asset(s).

Mortgage Data

A mortgage is a sub-type of charge over property or land, where the debt being secured is used to acquire that property or land.

A mortgage refers to a specific type of charge against a property, whereas a charge is a more general term that refers to any secured debt (including mortgages) – i.e. all mortgages are charges, not all charges are necessarily mortgages.

Ready to upgrade your approach?

Discover how BeauhurstAdvise can help you help your clients.

What can charges and mortgage data be used for?

Charge data can be crucial for both property buyers and financial institutions to work out the financial health of a company and the risk associated with lending against it, as well as seeing if a company may be open to your services.

Let’s imagine two companies:

- JSM Logistics is a growing freight and haulage company, recently active on Companies House

- Sallyport Commercial Finance specialises in invoice financing for smaller businesses

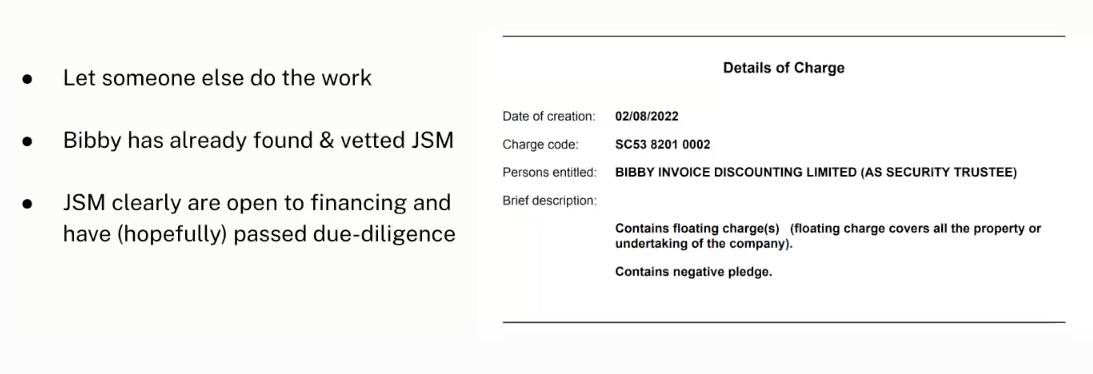

Sallyport would see potential in JSM Logistics due to their growth and industry presence. But, on the surface JSM might not look that interesting to Sallyport. Why? Because there’s a high quantity of other companies just like JSM. How can Sallyport find the right companies for them? They can let someone else do it for them.

With charge details, you can see previous invoice financing. For example, Bibby Invoice Discounting Limited may have already identified JSM as a suitable candidate for invoice financing, and this will be recorded.

So, now Sallyport can come in and offer invoice financing knowing JSM will be open to it, saving them from sifting through hundreds of filings.

Additionally, Sallyport could also identify companies which its competitors have lent to in the past, providing an opportunity either to target them with better terms or improved service, or to qualify them out and avoid wasting time competing with them.

How to find charges and mortgage data

Land Registry

You can search through the government’s land registry to find UK charges and mortgage data. The HM Land Registry is the main authority responsible for recording land and property ownership in England and Wales.

You can search the HM Land Registry’s online portal to access property records, including details of any mortgages, charges, or other encumbrances on a property. But you’ll need to know what you’re looking for in advance.

Companies House

If the property is owned by a company, you can search the Companies House database. Companies House maintains records of company information, including charges registered against a company’s assets, such as property.

How to get the most out of Companies House data

Discover how to navigate Companies House to find what you’re really looking for.

Local authority searches

Local authorities (better known as your local council) also maintain records related to property ownership and charges within their jurisdictions. You can request a local authority search through the relevant local council or authority. This search may reveal information about planning permissions, building regulations, and any legal charges affecting the property.

You’ll need to find your local council and submit your request through their website — and they ask for several documents before doing the search. Here’s the Brighton and Hove local authority search as an example of what you might need.

When accessing charges and mortgage data in the UK, it’s essential to ensure that you’re using reputable sources and verifying the accuracy of the information obtained — there are plenty of phishing or scam websites out there that may give you false information. And you should be prepared to incur fees for certain services, for example the HM Land Registry only allows you to access some information if you pay a fee.

All of these options are time-consuming and resource heavy. We have a better solution…

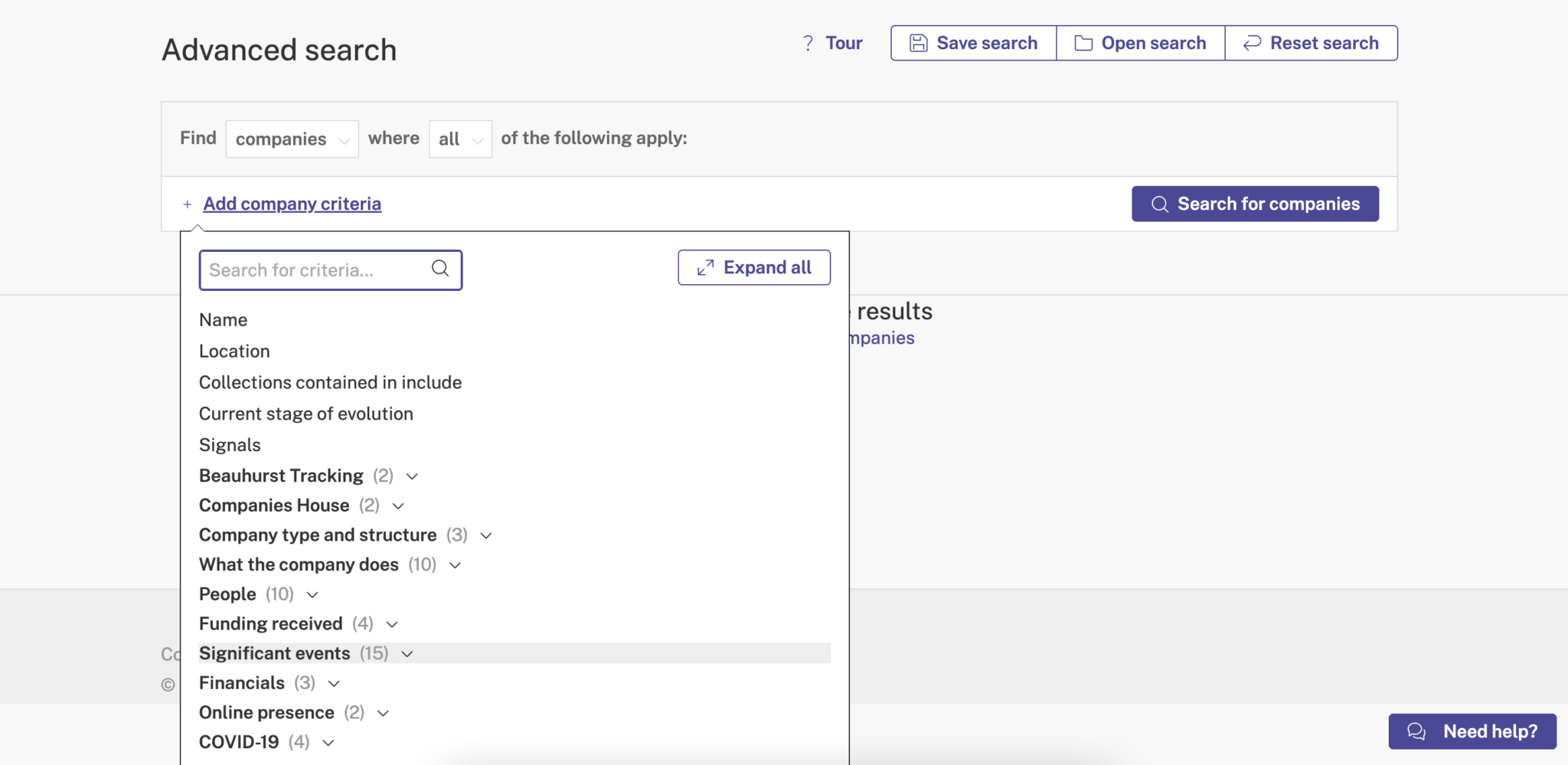

How to find charges and mortgage data with Beauhurst

The Beauhurst platform has all the information you need when it comes to charges and mortgage data — and it couldn’t be easier to access.

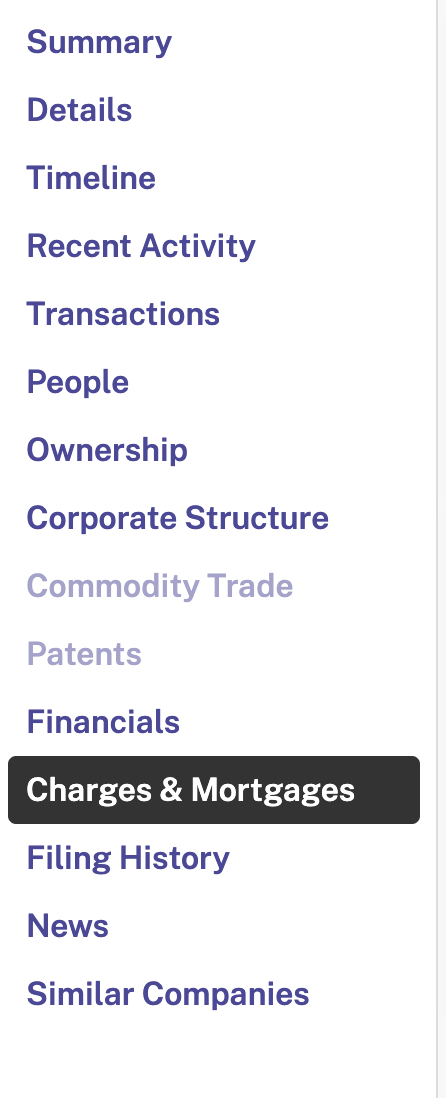

On our platform, you’ll find our charges and mortgage data under Significant events.

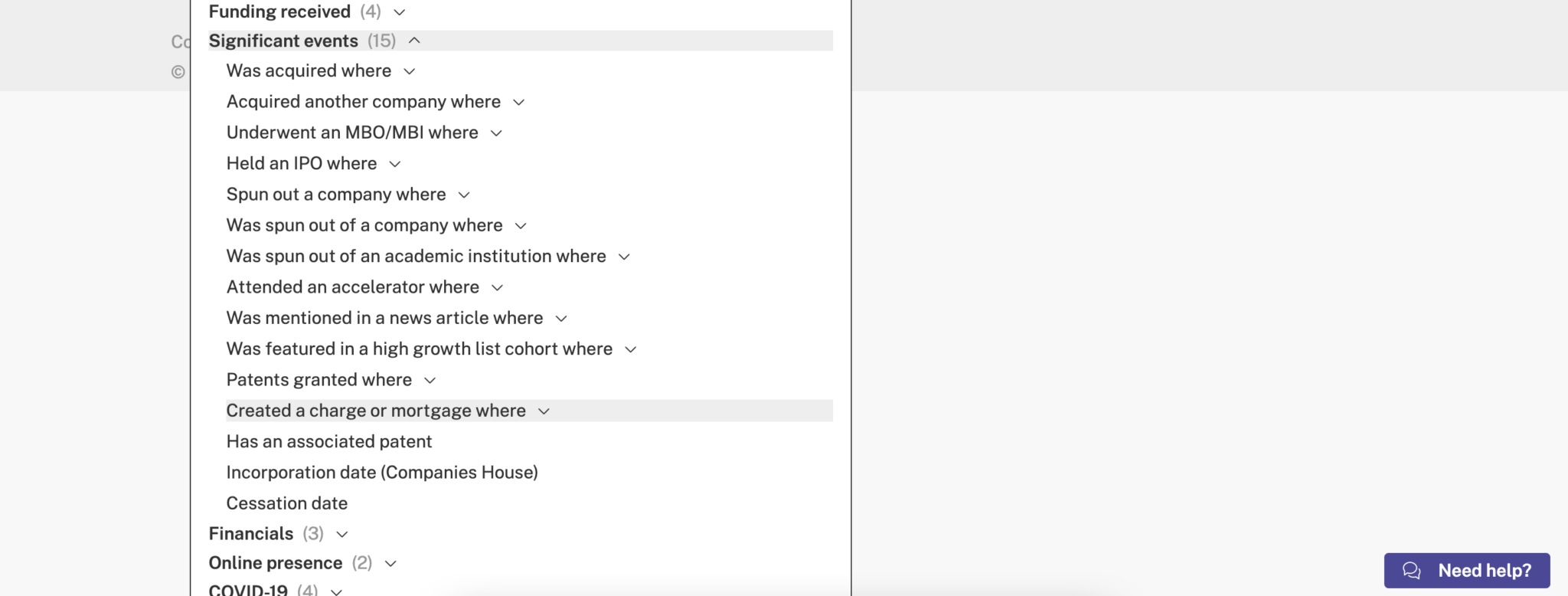

From here, you’ll see Created a charge or mortgage where.

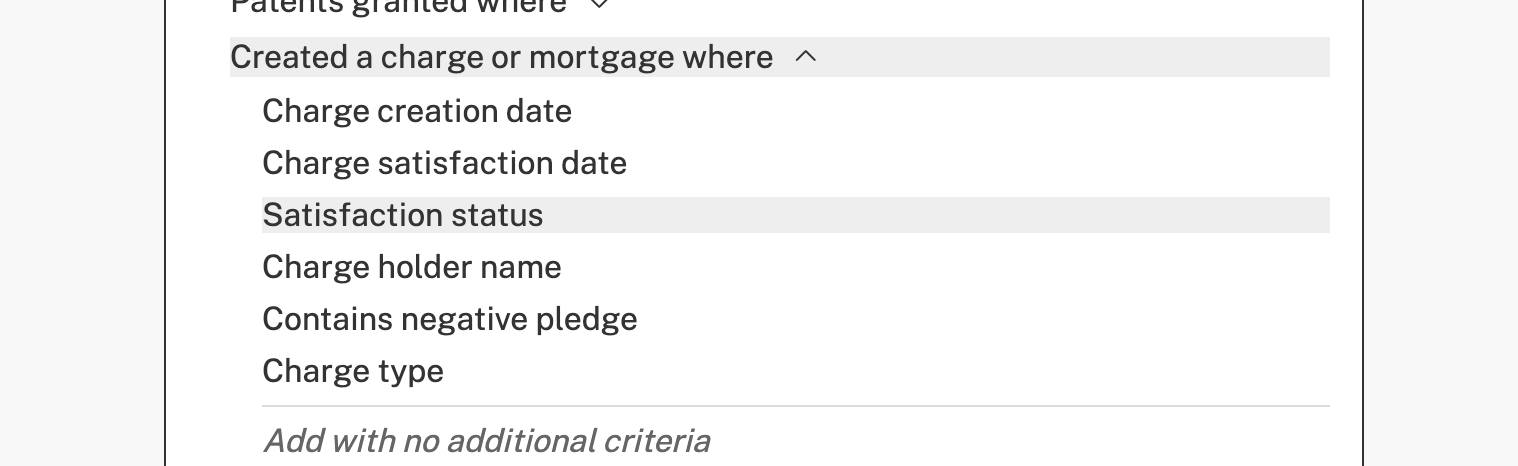

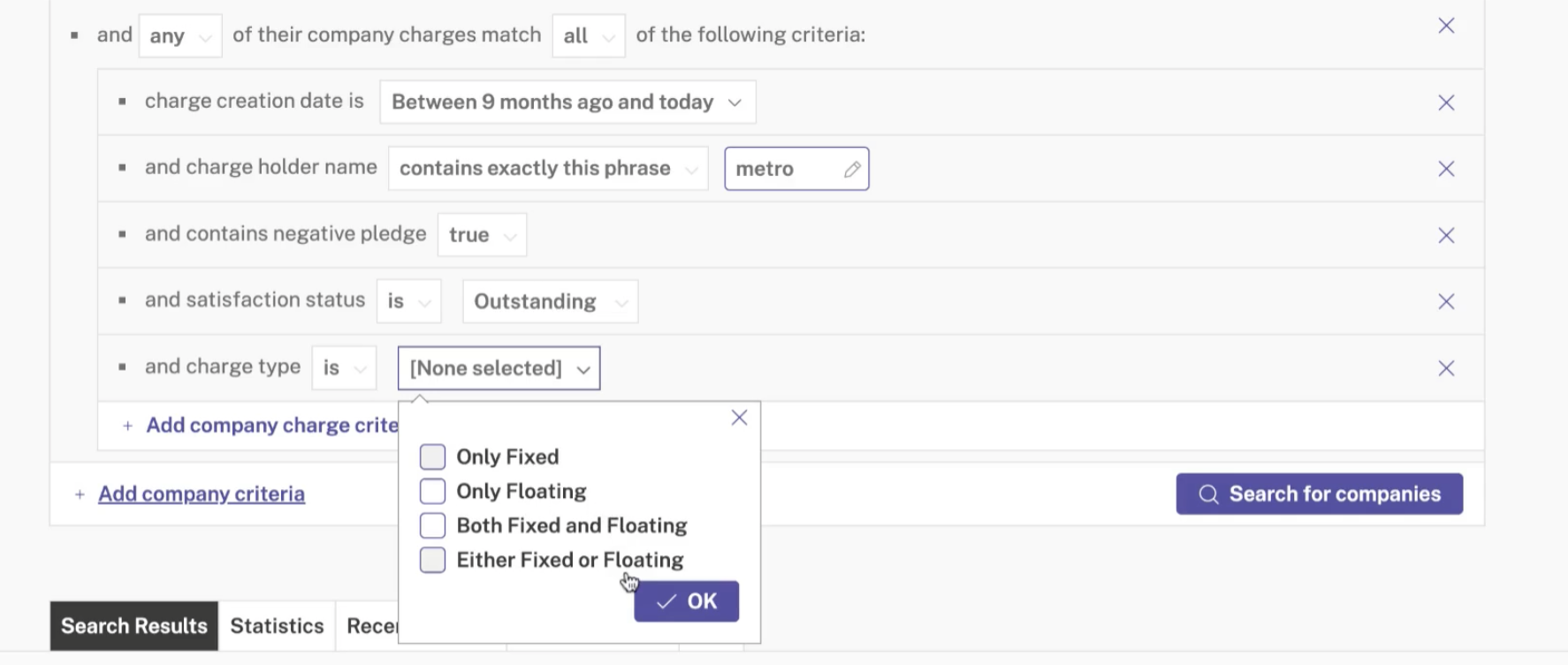

This will give you several options to narrow down your search:

- When the charge was created

- The status of the charge

- The name holder of the charge

- Whether or not it contains a negative pledge

From here you can add all the information you need to find exactly what you’re looking for.

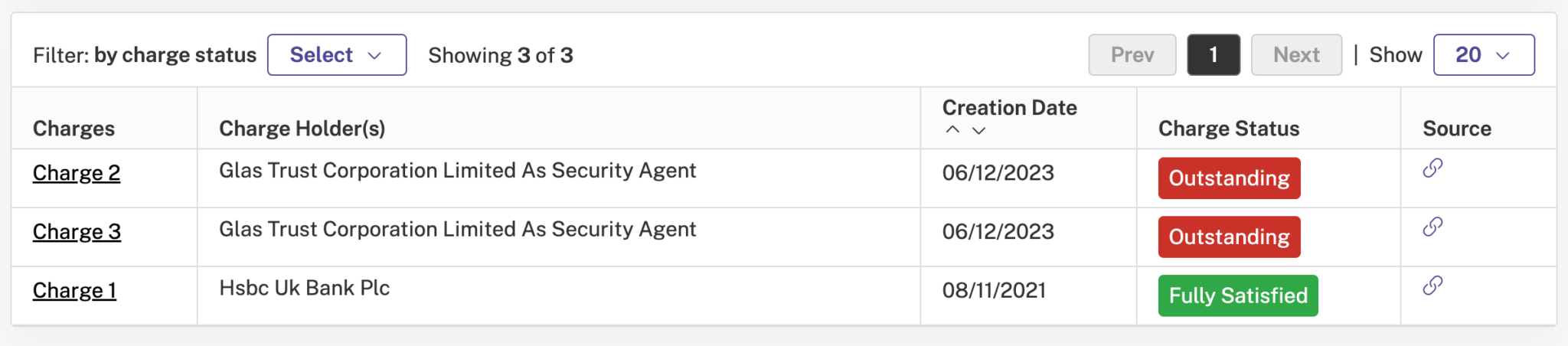

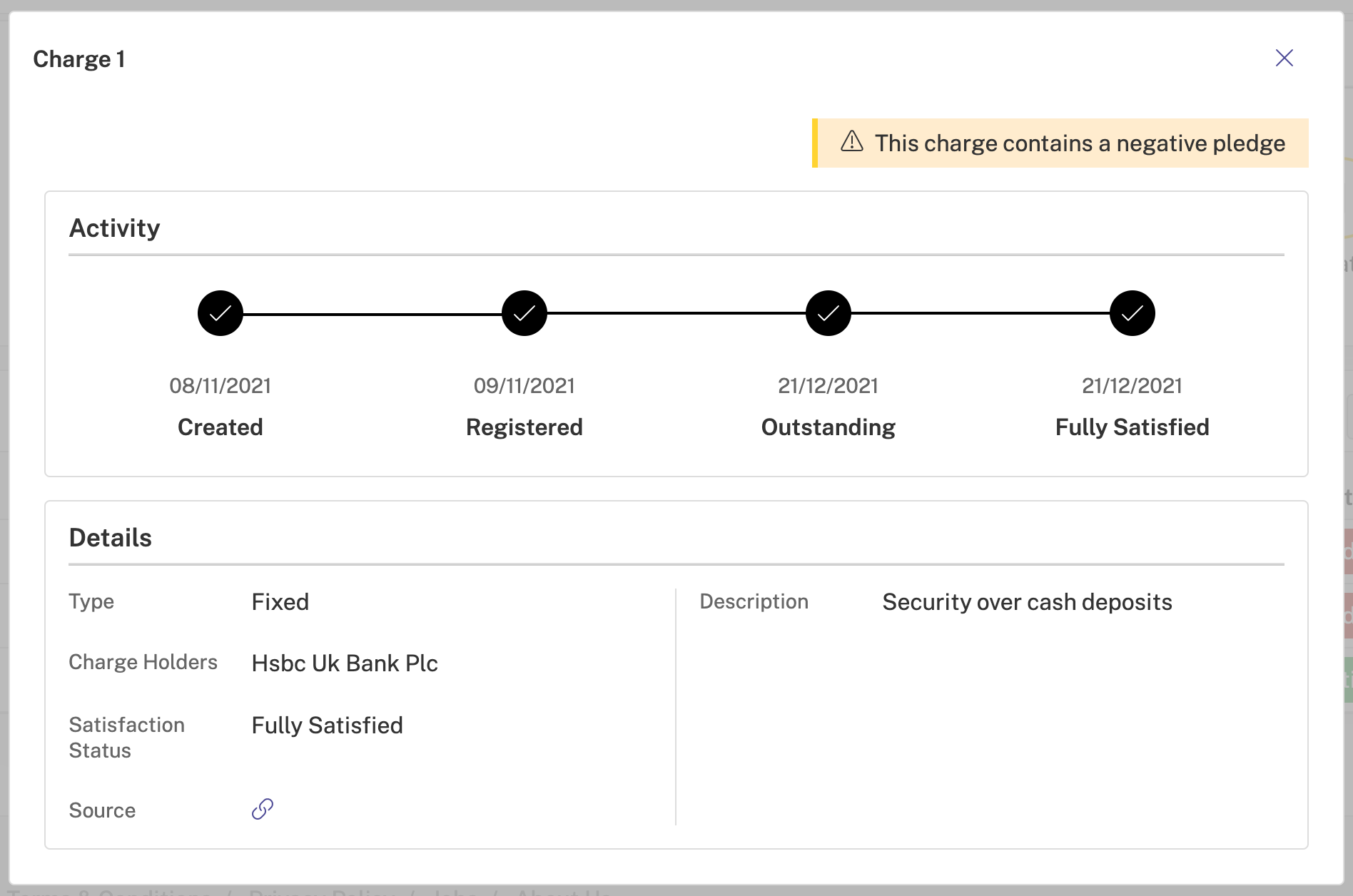

And from here you can see very detailed information on those charges, including the lender and whether or not the charge is satisfied or outstanding.

- Identify relevant companies quickly

- Monitor your competitors

- Streamline your pipeline

- And all at scale

Discover our data.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.