How To Find Expanding Companies (Plus 4 That Grew During Lockdown)

Category: Uncategorized

Now the PM’s roadmap out of lockdown is under way, and Rishi Sunak is urging firms to reopen their workplaces to help kickstart the economic recovery, many of us could soon be returning to the office. But many startups have scaled whilst working remotely, and so outgrown their existing offices (or will be looking to hire even more people soon). This is especially true for sectors that have been positively impacted by COVID, such as fintech or digital security. The Chancellor’s back-to-work message presents a good opportunity, therefore, for commercial real estate and recruitment agencies whose pipelines dried up during lockdown.

But as a co-working or office space provider, fit out company, or recruiter, how can you capitalise on this situation in such a saturated market? For those currently relying on word of mouth, or Linkedin updates and Google Alerts, we have a tool that enables you to find new prospects quickly and easily, and before your competitors do…

At Beauhurst, we collect data on 30,000+ high-growth companies in the UK, from the smallest startup to market-leading businesses with hundreds of employees. Our platform helps thousands of professionals do their jobs better. With powerful search and detailed profiles, Beauhurst equips you with all the information you need to discover fast-growing businesses that could be your future clients.

Here’s five signs that indicate a company is expanding and may need your services, plus how our data can help you find and verify them.

5 signs a company is expanding

1. Growing employee numbers

A clear signal that a company is expanding and in need of a new office is if they’ve hired more people during lockdown and hence outgrown their existing space. This could also be a sign to recruiters that a company’s looking to bring on even more people soon.

The Beauhurst platform tracks the number of employees of every high-growth business in the UK, so that you can see which startups have grown in headcount. Plus, it has information on key decision makers, including founders, C-suite executives, and directors, so you can quickly spot any gaps in a company’s senior leadership team and know exactly who to reach out to.

2. New funding (or a lack thereof)

A recent fundraising means that a company has new capital to deploy and typically means it’s looking to expand its operations. Meanwhile, for companies in sectors doing well during COVID, a recent lull in fundraising activity (6-12 months) may indicate that a sizeable new funding round is in the works. This is a useful way of identifying future opportunities, businesses that may soon be looking to expand. And proactively building relationships with these leads now means you’ll be ahead of your competitors once a fundraising is announced.

Beauhurst tracks all equity fundraisings into high-growth UK companies, including both announced and unannounced funding rounds. Unannounced deals (investments not disclosed to the public) typically make up around 70% of all UK fundraisings, which explains why we’ve developed a top-level process to detect them. With the Beauhurst platform, you can also see and search across the reason for funding, where it’s been announced, for instance job creation or R&D.

3. Advance in growth stage

Here at Beauhurst, we use detailed ‘stages of evolution’ to classify where tracked companies are at in their development. We go beyond ‘Series A’, ‘Series B’, and so on (measured simply by number of funding rounds completed), instead drawing on over 40 different criteria to determine which category a business falls into: Seed, Venture, Growth, or Established.

Moving between growth stages is a good indication that a company is expanding their operations. This is especially true when a business first moves from Seed to Venture stage, as this means it’s recently gained significant traction, and has secured fundraising and a valuation both in the millions. Any company doing so during COVID is likely to be taking the next step in their growth soon, and moving to a larger office space once lockdown is over.

4. Improving financial performance

An improvement in financial performance during the pandemic would suggest that a business is growing. And an increase in gross profit, in particular, is a good indication that a company has adequate capital to spend on a new workspace. The Beauhurst platform provides a comprehensive record of tracked businesses’ latest financials, including full company accounts, credit ratings and limits, and auditors, so you can see how they’re performing.

5. Recent accelerator attendance

Accelerated companies usually grow at pace and, on average, raise 44% more money than their peers. Upon graduating from an accelerator, many companies are also on the lookout for offices, either for the first time (having previously been accommodated by the programme) or for new space that better fits their changing requirements. The UK’s top accelerator programmes consistently produce some of the country’s most promising young businesses, so we track their entire graduating cohorts.

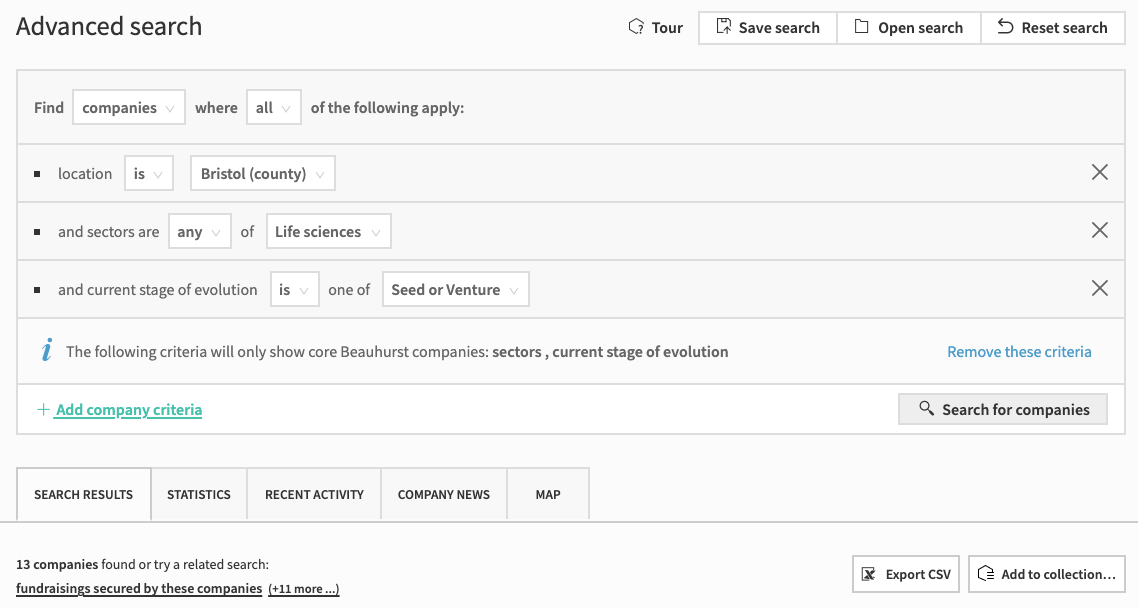

Finding these companies on the Beauhurst platform

These signs that a company is expanding are easy to spot using the Beauhurst platform. First, you can build a custom list of companies relevant to you and your target industry, by searching across hundreds of datapoints, including location, sector, and stage of evolution.

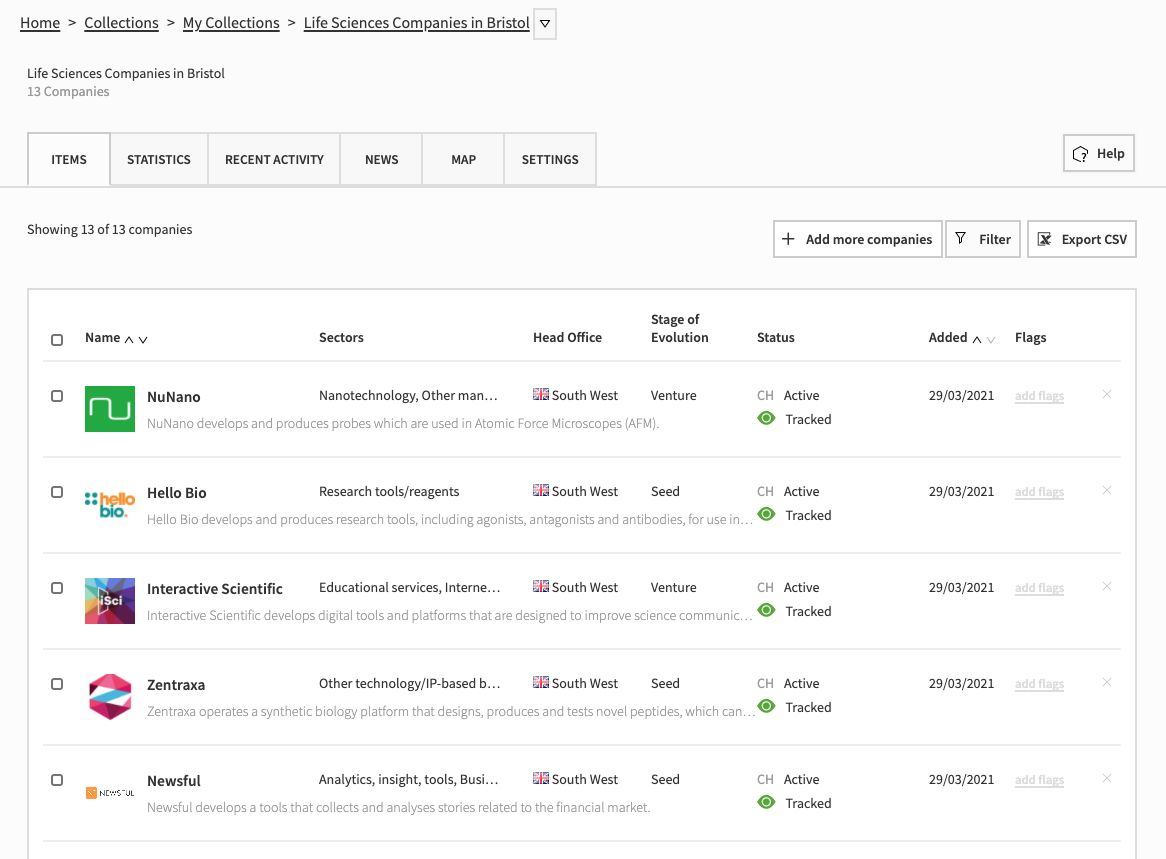

Then, you can easily keep track of these companies by adding your results to a Collection, which can be set to automatically update as we discover new businesses that meet your search criteria. This means you can quickly see which of the companies you’re interested in have grown their employee numbers, for instance, or raised a new funding round.

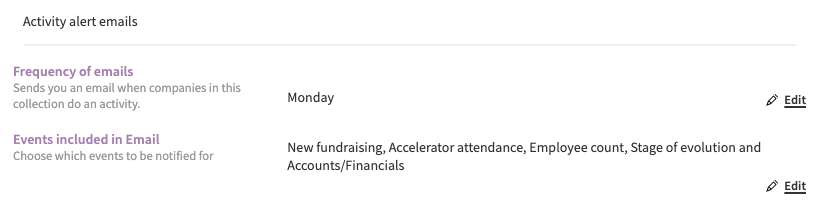

You can even receive alerts, sent straight to your inbox, when new data is added about the companies in your Collection. These alerts can act as a prompt to get in touch with businesses as soon as they meet your chosen criteria, using the verified contact details provided.

As a Beauhurst subscriber, you’ll also have access to a dedicated Account Manager and Client Services Executive who will serve as points of contact for all your questions, requests, and platform training. If you’d like to find out more and explore the platform for yourself, simply book a demo and one of our Associates will be in touch.

4 Startups That Expanded During Lockdown

We’ve selected a handful of the companies tracked on our platform, all of which operate in sectors that have seen rapid growth during the pandemic. According to our data, each of these ambitious businesses is seeing a potentially positive impact from COVID-19, has increased headcount during the pandemic, and is currently creating new job opportunities. On top of this, they have also all been successful in raising equity funding during the latest lockdown. These are the types of businesses likely to be hiring and looking for new office space soon, and are just a small subset of all the fast-growing companies you can find on our platform.

Trade Ledger

Trade Ledger provides software to financial institutions in the SME and mid-market lending sector. The company’s lending-as-a-service (LaaS) platform supports commercial lending products for asset finance, inventory finance, and invoice finance. Its technology transforms new structured data sources from the supply chain into actionable insights and tasks.

Founded in 2016, Trade Ledger has offices in both Sydney and London, and has secured £15.8m in equity fundraisings to date, across four funding rounds. In February this year, the company secured a £13.5m funding round, led by Point72, with involvement also from Hambro Perks and Foundation Capital. Trade Ledger has stated it will use its latest investment to hire more people for its sales, marketing, and customer delivery teams.

Blockchain.com

Blockchain.com has developed a range of tools, including a blockchain wallet, crypto trading exchange, and live data explorer, providing users with a simple and secure way to buy, sell, and hold cryptocurrency. To date, Blockchain.com has secured £356m of equity investment, across four funding rounds.

Between March 2019 and March 2021, the company attended Tech Nation’s two-year Future Fifty accelerator programme for leading late-stage tech businesses. It raised an £86.5m equity round in February this year, with involvement from multiple funds (including follow-on investor Google Ventures). The company then secured a further £218m equity fundraising on 24 March to help accelerate its growth, through acquisitions in particular.

Cutover

Cutover has developed a work orchestration and observability platform, primarily for financial institutions. Its software enables teams to plan, carry out and analyse complex work faster and more efficiently. Cutover was founded in 2012, and now has offices in both London and New York City, having raised £55.5m in equity investment, across eight funding rounds.

Just before COVID arrived on the scene, in November 2019, the company secured a £13.2m fundraising, followed by a further £13.5m round in June last year. At this point, Cutover’s stage of evolution was moved up from venture to growth on our platform. The company was then listed on the Deloitte Fast 50 high-growth list in November 2020. On 25 March, Cutover secured a further equity fundraising (and its largest to date)—this latest investment, worth £25.6m, will be used to bring the business into new markets, further develop its product, and expand its customer service capabilities.

PPC Protect

PPC Protect has developed real-time, autonomous software for pay-per-click (PPC) advertising, aimed at protecting businesses from click fraud. Since being founded in 2016, the company has so far raised £2.12m in equity investment, across two funding rounds.

It attended Tech Nation’s Cyber accelerator between April and September 2020, and went on to secure a £2m equity investment in January this year, in a round led by Fuel Ventures. The company will use its latest investment to ramp up its product and expand internationally, having seen an increase in fraudulent activity and the number of businesses relying on digital ad spend during the pandemic.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.