How to Find a Company’s Shareholders

Whether you’re conducting M&A due diligence, targeting high-value investors for fundraising opportunities, or refining your B2B sales strategy, knowing who owns — or has a stake in — a company, is vital.

Shareholder information helps you uncover key decision-makers, reveals financial backers, and enables you to assess strategic alignment. However, getting hold of that data is often easier said than done.

Traditional methods of researching company ownership can be time-consuming and frustrating. Public databases like Companies House, while useful, might not have everything you need. And shareholder data is often buried in PDF filings, difficult to interpret, or simply outdated.

Fortunately, there is a better way — in this article, we’ll explore how you can easily access and understand company shareholder data.

Why a company's shareholders matters

There’s a number of reasons why company shareholder data can be useful for you and your company.

Due diligence and risk checks

Whether you’re thinking about a partnership, acquisition, or buy out, it’s smart to know who’s actually behind the business. Shareholder info can flag risks, show who really calls the shots, and help you make more informed decisions.

Smarter investment decisions

If you’re looking to invest, it helps to see who’s already on board. Are there respected investors involved? Has the company raised before? These kinds of insights can reveal a lot about a company’s credibility and future potential, or help you spot any Risk Signals.

Better-targeted sales and outreach

Trying to win over high-growth businesses? Knowing who their backers are can give you an edge. Shareholders often influence the direction of the company (and the budget), so they can be just as important as the leadership team — especially when it comes to closing deals.

Staying ahead of the competition

Keeping an eye on who’s investing in your competitors can help you spot trends early, understand where the money’s going, and find opportunities before others do.

The traditional way to find shareholders

There are ways to find information on a company’s shareholders manually — but they’re not exactly quick or easy.

Companies House is usually the first stop. Whilst it’s a great free resource, it has some limitations. Shareholder details are often buried in old PDF filings, which means a lot of scrolling, downloading, and deciphering. Even after this, the data might only reflect the founding shareholders, with no clear picture of who actually owns what today.

You can also try piecing things together using other databases and online sources, but accuracy can be hit or miss. Many platforms don’t show the full picture, especially when it comes to beneficial owners, who hold shares through nominee structures or offshore entities. It’s also very difficult to understand the changes to a company’s shareholders over time. So even after hours of searching, you might still have a significant knowledge gap.

All of this adds up to a serious drain on time and resources. If you’re juggling multiple companies or need quick insights for fast-moving deals, manual research just doesn’t cut it. It’s tedious, slow, and often incomplete which can be frustrating when you’re trying to make confident, well-informed decisions.

Take a tour

How Beauhurst streamlines shareholder identification: a step-by-step guide

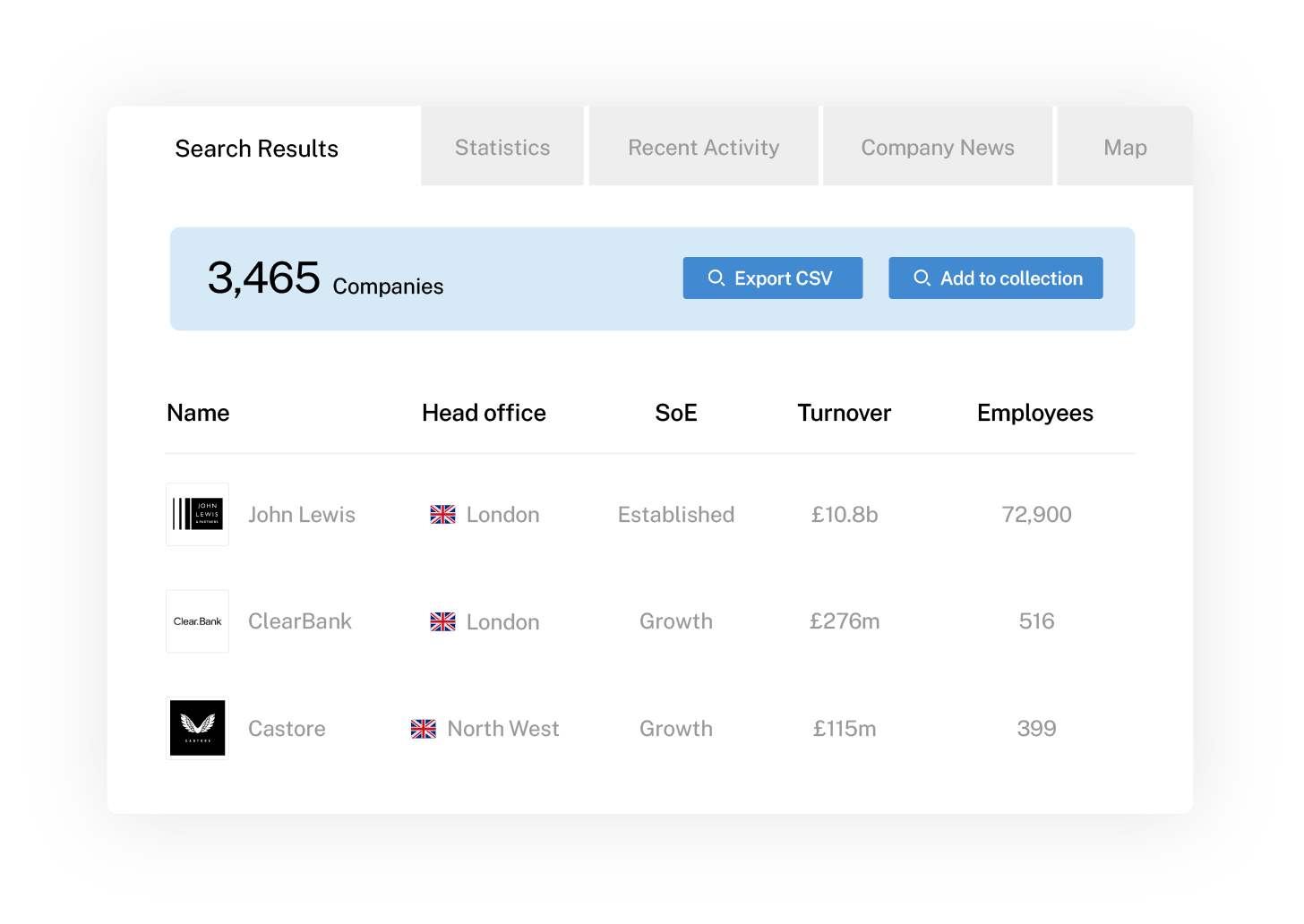

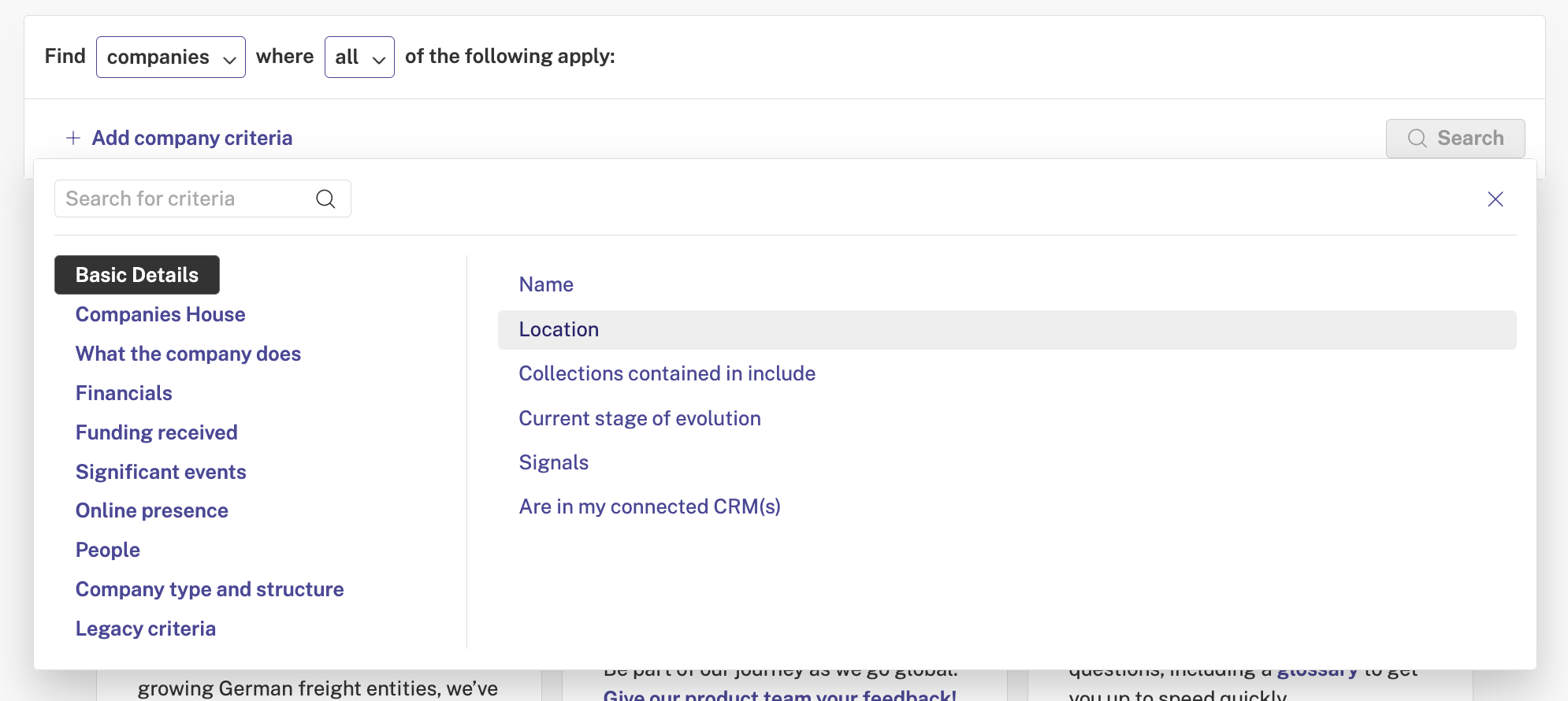

Step 1: Using Beauhurst's advanced search and filtering

- Location

- Industries and buzzwords

- Investment stage

- Events such as fundraisings

- And much, much more

This makes it much easier to narrow down what you’re looking for, rather than using a database like Companies House where you have to directly search for a company.

Knowing what kind of company to target is crucial for setting up your search. Not sure what you’re looking for? We have a number of resources to help you pinpoint your company searches. Check out our video on how to find your ideal customer profile below.

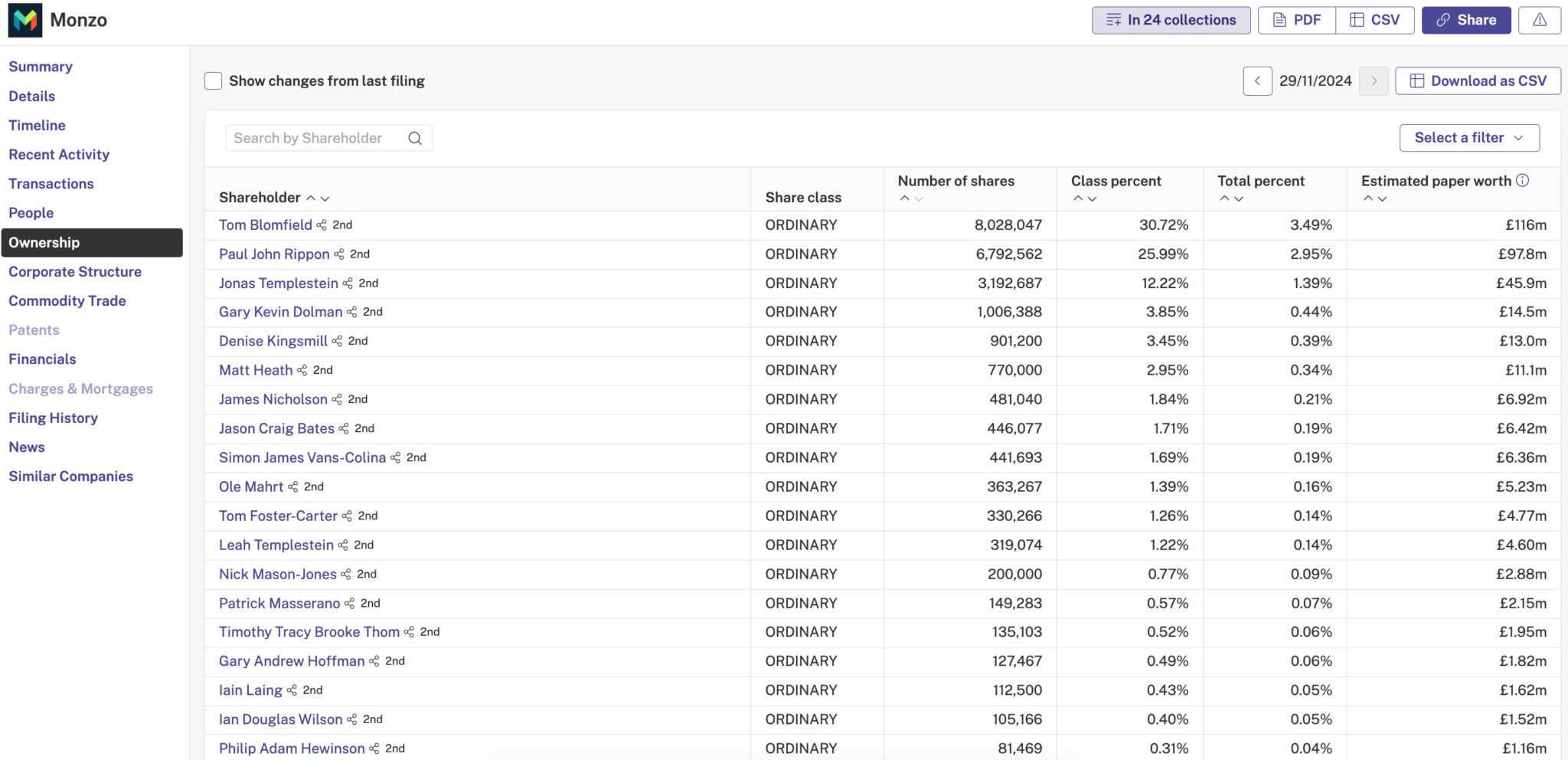

Step 2: Exploring a company’s shareholders

Once you’ve clicked into a company profile, you’ll find everything you need under the ‘Ownership’ tab. From here, you can see everything about the company’s shareholders from individuals to companies, alongside their number of shares, the total percent owned and the person or company’s estimated paper worth.

This gives you a very clear picture of a company’s shareholders and how it’s divided.

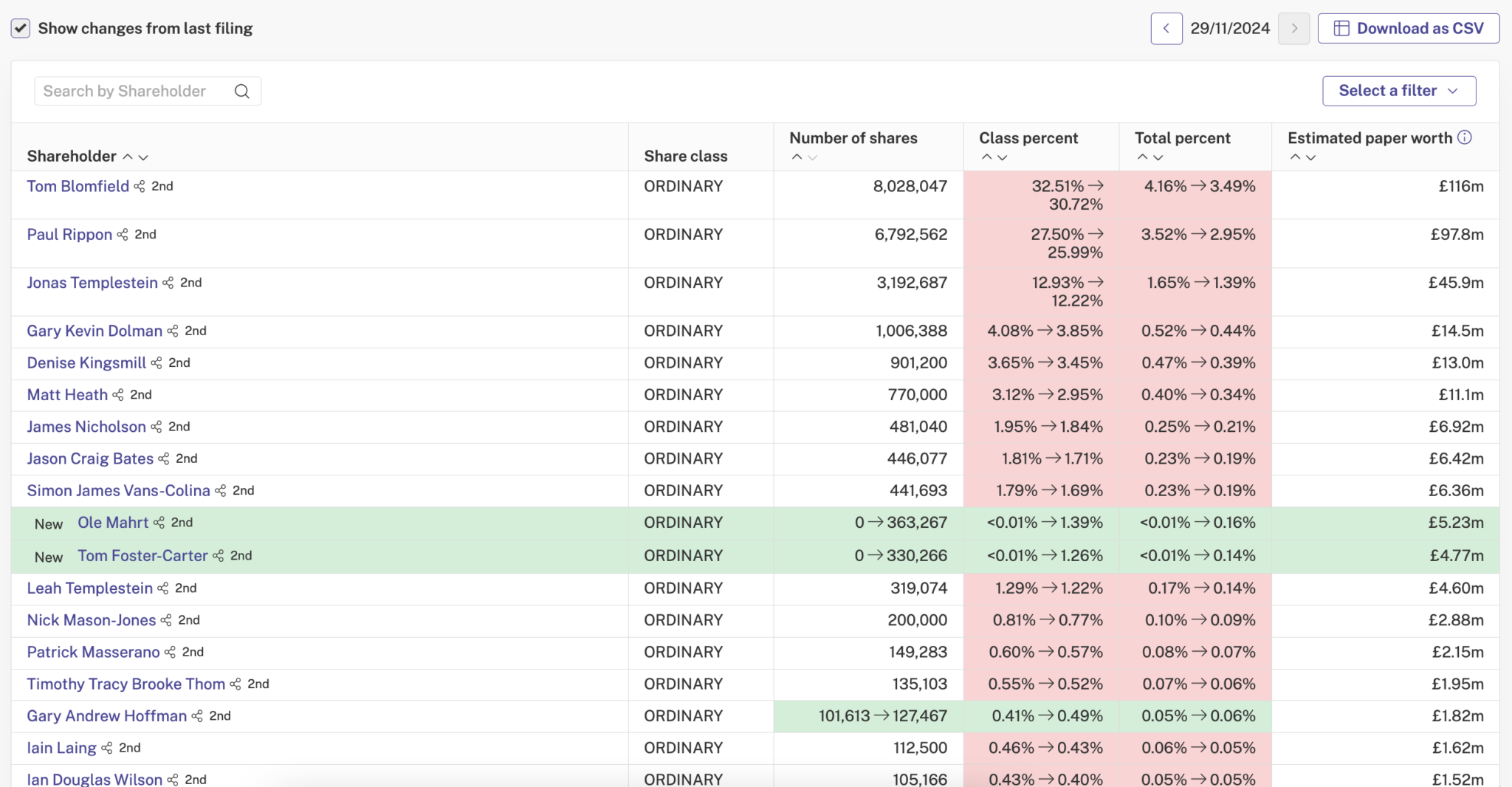

Step 3: Verifying data accuracy and timeliness

We know how important it is to work with reliable data, especially when making high-stakes decisions.

Beauhurst combines automated tracking with a dedicated team of expert researchers to validate and update shareholder information regularly. We monitor filings, news, press releases, and other trusted sources to make sure our data reflects the most current picture available.

You can easily understand the changes to a company’s shareholders over time by ticking the ‘Show changes from last filing’ box. This highlights new shareholders and changes in ownership of existing ones, so you can see what changed and when. Scroll back through historic filings to explore even further.

Step 4: Finding contact information and insights

Identifying a key shareholder is one thing but getting in touch is another.

Beauhurst provides contact information for both individuals and companies, where available, helping you reach out directly to the people who matter. So whether you’re looking to pitch an investment opportunity, start a conversation, or explore a partnership, we make it easier to connect.

Plus, you’ll see contextual insights like role history, past involvement in other companies, and more so you can tailor your messaging and approach in a way that resonates.

See how you can access Beauhurst’s shareholder information, and find contact details on key decision-makers in the video below.

Step 5: Understanding shareholder motivation through investment history

A name and stake percentage only tell part of the story. Knowing why someone has invested (and for how long) completes the picture.

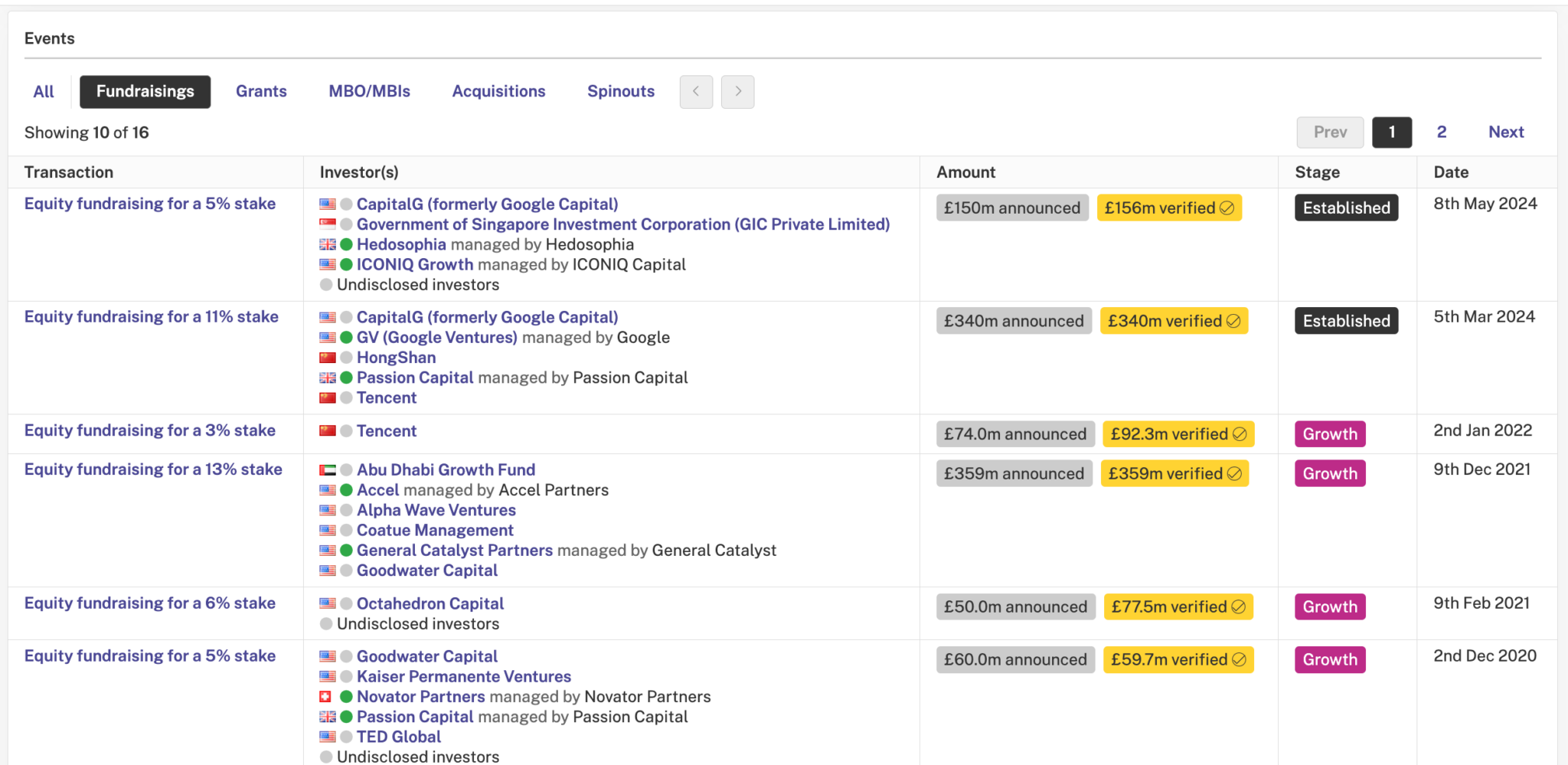

On each company profile, Beauhurst also shows detailed funding rounds, including who invested, when, and how much. Clicking into each of these fundraising events, you can see even more data including the purpose of the investment.

This gives you a sense of shareholder timelines, motivations, and likely exit horizons. Is this a long-term backer? A recent investor looking for quick growth? Someone preparing for a sale?

Want to know more on how to analyse Beauhurst data? Get in touch with one of our team and we’ll be happy to help.

Step 6: Discover even more with Beauhurst's corporate structure visualisation tools

When companies have complex ownership structures, it can be hard to follow the trail. Beauhurst makes this simple and visual.

Our ‘Corporate Structure’ tab provides an interactive corporate tree that maps out a company’s ownership hierarchy. This includes parent companies, subsidiaries, and affiliated entities, both within the UK and internationally. Each entity in the structure is accompanied by key details such as its jurisdiction, Companies House ID, and company type.

This visualisation allows you to quickly identify the ultimate parent company and understand the relationships between different entities. You can also easily spot any offshore entities or complex ownership layers that might pose regulatory or reputational risks.

And what’s more, the entire corporate structure can be downloaded as a PDF so you can share it with colleagues or include in reports.

You can also find the ‘Person with Significant Control’ over the company easily, by clicking onto the ‘People’ tab and scrolling down. On this tab, you’ll also find all current key people, current and former directors, and any reported gender pay gap data.

How to Check a Company’s Corporate Structure

Learn how to check a company’s corporate structure, why it could be integral to your business and how to share that information with clients.

Unlock the power of shareholder insights with Beauhurst

Finding out who owns a company shouldn’t be a guessing game, or a never-ending scroll through outdated PDFs. Whether you’re assessing risk, targeting new leads, or making high-stakes investment decisions, having access to accurate and up-to-date shareholder data is essential.

Our BeauhurstInvest platform makes the entire process faster, easier, and more reliable. From discovering shareholders to visualising complex ownership structures and contacting key decision-makers, everything you need is right at your fingertips.

If you’re tired of patchy, unreliable public data and time-consuming manual research, it’s time to try a better way.

Discover how BeauhurstInvest can transform your approach to shareholder research — book a demo or explore the platform today.

FAQs

The terms shareholders and members are often used interchangeably, but they have distinct meanings depending on the type of company in question.

Shareholders are individuals or entities that own shares in a company limited by shares that include most private and public companies. As shareholders, they effectively own a portion of the business, usually have voting rights, and may receive dividends or share in the company’s profits. Their roles and rights are outlined in the company’s articles of association and any shareholder agreements in place.

Members, on the other hand, is a broader legal term referring to the owners of a company. In companies limited by shares, members and shareholders are typically the same. However, in companies limited by guarantee — such as charities, clubs, or other nonprofits — members don’t hold shares. Instead, they agree to contribute a nominal amount if the company winds up. These members may still have voting rights and a say in how the organisation is run, even though they don’t benefit financially from it.

So, while all shareholders are members, not all members are necessarily shareholders. It all depends on the company’s legal structure.

In the UK, shareholder information is typically updated annually or when significant changes occur, depending on the source of the data and the company’s legal obligations.

For most companies, updates to shareholder information are filed through Companies House, the UK’s official register. Companies are required to submit a confirmation statement (previously called the annual return) at least once a year, which includes details of shareholders at that point in time. However, Companies House doesn’t require companies to report changes in shareholdings as they happen — only once a year or if there’s a major restructuring like an allotment of new shares or a significant change in control.

In short, yes, though in the UK not completely. There are ways shareholder identities can be obscured, which can make things tricky if you’re relying on public records alone.

In the UK, private companies must disclose their shareholders to Companies House, and this information is generally public. However, the level of transparency depends on how the shares are held.

One common method used to obscure true ownership is through nominee accounts. In this setup, the shares are legally held in the name of a nominee (like a law firm or investment broker), but the beneficial owner — the person who actually controls or benefits from the shares — is hidden from public view. While this is perfectly legal, it can make it harder to identify who’s really behind a company unless you dig deeper.

Offshore structures can also be used to add further layers of complexity. In some cases, the true beneficial owner may be hidden behind several companies registered in jurisdictions with weaker disclosure rules.

Discover our data.

Get access to unrivalled data on the companies you need to know about, so you can approach the right leads, at the right time.

Schedule a conversation today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

We’ll work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy