How to Conduct a Company Financial Health Check

Conducting a company financial health check is essential for understanding a business’s stability, growth potential, and overall viability. Whether you’re an investor, partner, or business owner, regularly assessing a company’s financial health allows you to identify potential risks, evaluate opportunities, and make informed decisions.

Why are company health checks important?

Company health checks are crucial for a number of reasons.

Firstly, performing one on your own business provides a comprehensive assessment of your company’s financial stability, operational efficiency, and overall business performance.

Checks like these can help identify potential issues early, allowing you to address them before they become a major problem. They also offer insights into areas of strength, which can help C-level executives make strategic decisions to enhance profitability and growth.

Equally, company health checks are important when doing due diligence on external parties, such as investment or lending targets, or potential business partners. This is because they provide critical insights into the financial and operational health of a company. These assessments help external stakeholders make informed decisions regarding their involvement with the company.

Which industries should be performing company health checks?

Wealth management: managing high-value clients’ portfolios

In the wealth management industry, company health checks are vital for managing high-value clients’ portfolios. These checks ensure that the companies who are looking for investment are financially stable and capable of delivering a consistent ROI.

By regularly evaluating the financial health and performance of portfolio companies, wealth managers can make informed decisions to protect and grow their clients’ investments.

Private equity and venture capital: investing in high-growth companies

Private equity and venture capital firms routinely perform company health checks when investing in high-growth companies.

These assessments are essential for understanding the financial stability, growth potential, and risk profile of target companies. Health checks help these firms identify the best opportunities, mitigate investment risks, and develop strategies to maximise returns on their investments.

How to do Lead Scoring at your Company

Corporate law: legal due diligence in mergers and acquisitions

In corporate law, company health checks are a key component of legal due diligence during mergers and acquisitions (M&A). Lawyers conduct these checks to ensure that the target company is in good financial and operational standing, free of hidden liabilities, and compliant with all relevant laws and regulations.

Step-by-step guide to conducting a company health check

Step 1: Reviewing financial statements

Begin by reviewing the company’s financial statements, which are the cornerstone of understanding its financial health.

To do this, you can look at:

- Balance sheet: Assess the company’s assets, liabilities, and equity to gauge its financial stability and liquidity. Pay attention to key metrics such as current ratio and quick ratio to understand the company’s short-term financial health.

- Income statement: Analyse the company’s revenues, expenses, and profits over a specific period. This statement helps you understand the profitability of the company and its ability to generate income.

- Cash flow statement: Evaluate the company’s cash inflows and outflows from operating, investing, and financing activities. This statement is a key method of assessing the liquidity and cash management efficiency of the company — and can help you analyse cash flow.

Step 2: Analysing cash flow

- Cash flow statement: Examine the different sections of the cash flow statement — especially operating, investing, and financing activities. Determine how well the company generates cash from its core business operations.

- Identifying constraints: Identify any constraints in cash flow, such as delayed receivables or high capital expenditures, that could impact the company’s liquidity.

- Optimise cash flow: Explore opportunities to optimise cash flow, such as improving collection processes, renegotiating payment terms with suppliers, or reducing unnecessary expenses.

Step 3: Assessing profitability

- Gross profit margin: Calculate the gross profit margin by subtracting the cost of goods sold (COGS) from total revenue and dividing by total revenue. This metric can indicate how efficiently the company is producing its goods or services.

- Operating profit margin: Evaluate the operating profit margin by considering operating income as a percentage of total revenue. This margin reveals the company’s efficiency in managing its operating expenses.

- Net profit margin: Assess the net profit margin by dividing net income by total revenue. This margin reflects the overall profitability of the company after all expenses, taxes, and interest have been deducted.

Step 4: Evaluating debt levels

- Debt-to-equity ratio: Calculate the debt-to-equity ratio to understand the proportion of debt relative to equity. A high ratio might indicate that the company is heavily reliant on debt, which could pose risks if not managed properly.

- Managing debt: Review the company’s debt repayment schedules and interest obligations. Consider strategies to manage debt, such as refinancing, restructuring, or reducing debt levels to improve financial flexibility.

- Equity strategies: Explore equity strategies to balance the company’s capital structure. This may include issuing new equity, retaining earnings, or optimising dividend policies.

Step 5: Reviewing budget and forecasting

- Actual vs. budget analysis: Compare actual financial performance with the budgeted figures. Analyse any significant variances to understand the reasons behind them.

- Adjustments for variances: Make necessary adjustments to the budget or future forecasts based on the analysis. This may involve revising revenue targets, adjusting expense allocations, or re-evaluating investment plans.

Step 6: Identifying market position and competitiveness

- Analyse market trends: Study current market trends and industry developments to gauge how they may impact the company’s operations and growth potential.

- Industry performance: Evaluate the performance of the industry in which the company operates. Identify any opportunities or threats that could influence the company’s market position.

- Competitors: Analyse the company’s competitors to understand their strengths, weaknesses, and strategies. This can help in identifying areas where the company can improve or differentiate itself.

Step 7: Conducting due diligence

- Company background: Gather detailed information about the company’s history, business model, and key milestones.

- Management: Assess the experience and qualifications of the company’s management team. Strong leadership is crucial for navigating challenges and driving growth.

- Ownership: Understand the ownership structure of the company, including key shareholders and their influence on decision-making.

- Legal compliance: Ensure that the company is in compliance with all relevant laws and regulations. This includes reviewing contracts, licences, and any ongoing or potential legal issues.

Step 8: Evaluating risk factors

- Identifying risks: Identify potential risks that could impact the company, such as market volatility, regulatory changes, operational disruptions, or financial constraints.

- Mitigating risks: Develop strategies to mitigate identified risks. This may include diversifying revenue streams, enhancing operational efficiencies, or investing in risk management tools.

- Using Beauhurst’s tools: Leverage tools like Beauhurst to gain insights into potential risks, such as market shifts or competitor activities, and to track changes in the company’s risk profile over time.

To conclude, these steps can be a long and arduous process but there is an easier way. With Beauhurst you can find everything you need to easily and efficiently perform a company health check.

How Beauhurst Fits Into A Sales Workflow

How to conduct a financial health check using Beauhurst

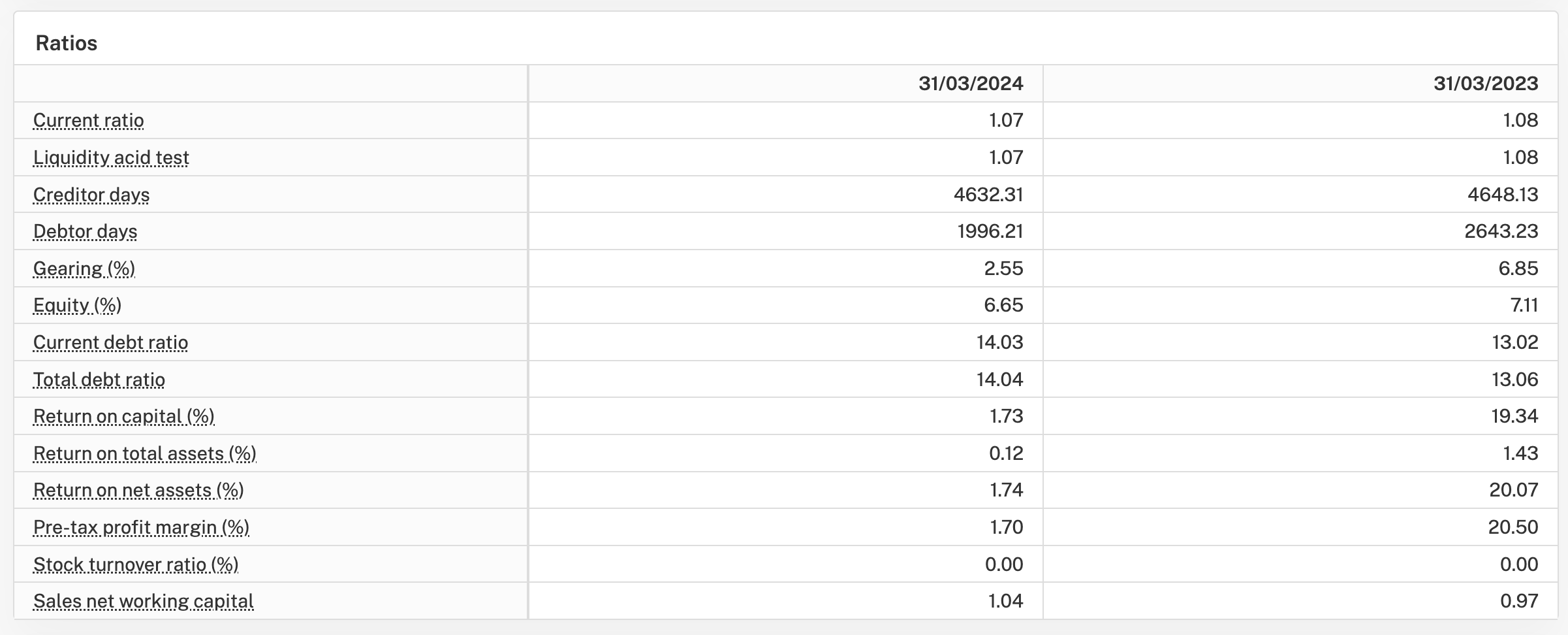

You can access the financial statements for every single UK company with Beauhurst. From the financials section on a company profile, you’ll have access to all the filings you need to perform a thorough company health check.

You’ll have access to a company’s:

- Balance sheets

- Turnover and profit information

- Capital and reserve

- Cash flow

- Even its ratios, so you don’t need to work them out yourself

- And more

What’s more — you can also download PDF tear sheets on your target companies, or simply share the company page with another Beauhurst user for instant collaboration.

See how you can use Beauhurst to perform a company health check in our video below.

Customising the platform

If you already know the name of the company you want to look at, you can use our quick search feature. Just type in the name of the company in the search bar at the top of the page.

But if you don’t have a specific company in mind and to start market mapping, the first thing you’ll need to do is know how to run an advanced search so that you can find the right kind of companies.

From the advanced search, you can add industry-specific criteria to narrow down your search.

You can set up your search to include:

- Location: where do you want to find companies? In your localised area or in a more expansive area?

- Industry: here you can select which industry or buzzword you want to target

- Financials: if you already know what kind of financial state you want a company to be in, you can narrow that down here — this includes turnover and assets

There is a lot more you can add to this to hone down your search and to make sure you have the right information to see if a company is in any financial trouble.

You can find a demo of the advanced search here.

Check out our YouTube Channel

Leveraging Beauhurst for continuous monitoring

Setting up alerts for real-time updates

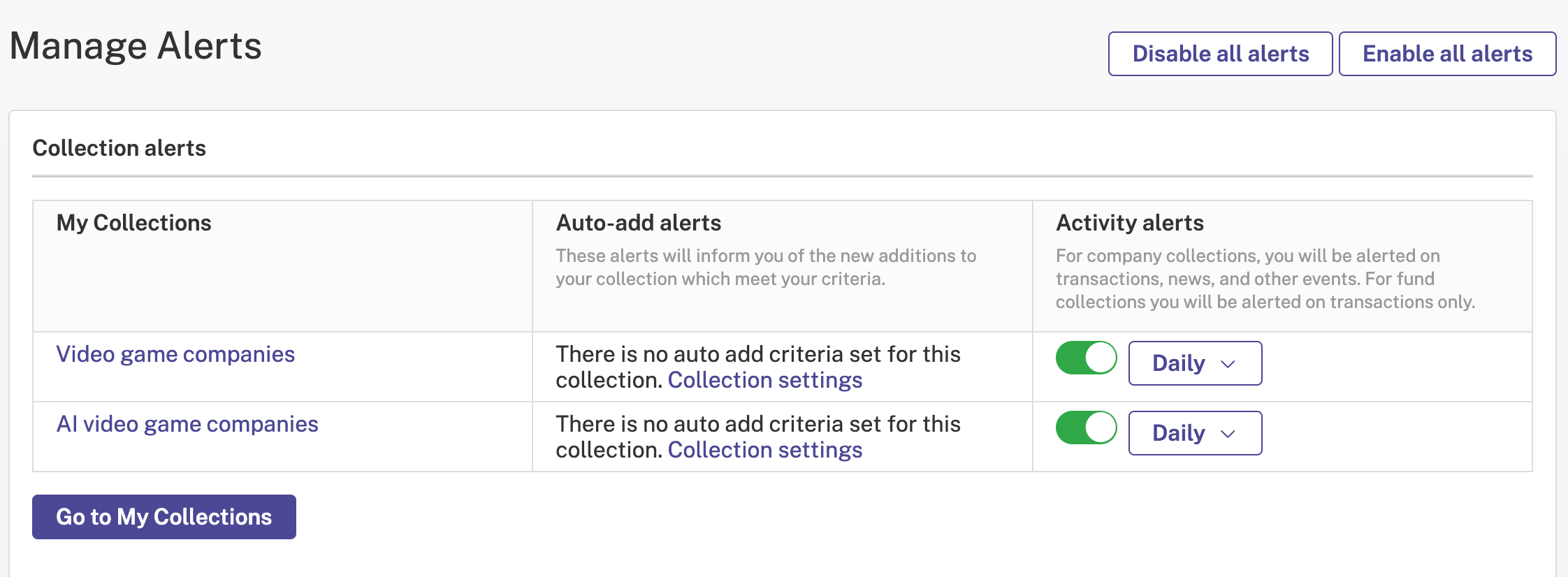

Once you’ve selected a company you want to track and added them to a Collection, you can set up alerts on that company to let you know if they go through any changes that could cause concern or show signs of improvement.

From the My Collections section, click on ‘Manage Alerts’ to customise your company alerts.

Integrating Beauhurst data with existing workflows

You can also plug Beauhurst data into your existing CRM.

We offer integrations with HubSpot and Salesforce, allowing you to get real-time company data from Beauhurst directly into your CRM. This means you can see a company’s financials, size, industry, and more, without leaving your CRM.

This integration allows for real-time updates, improved data accuracy, and better decision-making, ensuring that you maximise the potential of your Beauhurst data without disrupting your established workflows.

See how JP Jenkins uses Beauhurst to build a pipeline, fast.

Access informed decision-making with Beauhurst

Once you’ve familiarised yourself with the eight steps outlined in this article, you can use Beauhurst to quickly and easily check a company’s financial stability.

By leveraging Beauhurst’s comprehensive data on financials, funding rounds, and key growth signals, you’ll be able to assess the financial health of a business with just a few clicks — enabling you to identify potential risks, uncover growth opportunities, and make informed decisions.

Want to know more? Book a demo with one of our experts, and they can talk you through all the elements of the platform.

Discover our data.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of the Beauhurst platform, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.