Foreign Direct Investment in the UK | 2020

Category: Uncategorized

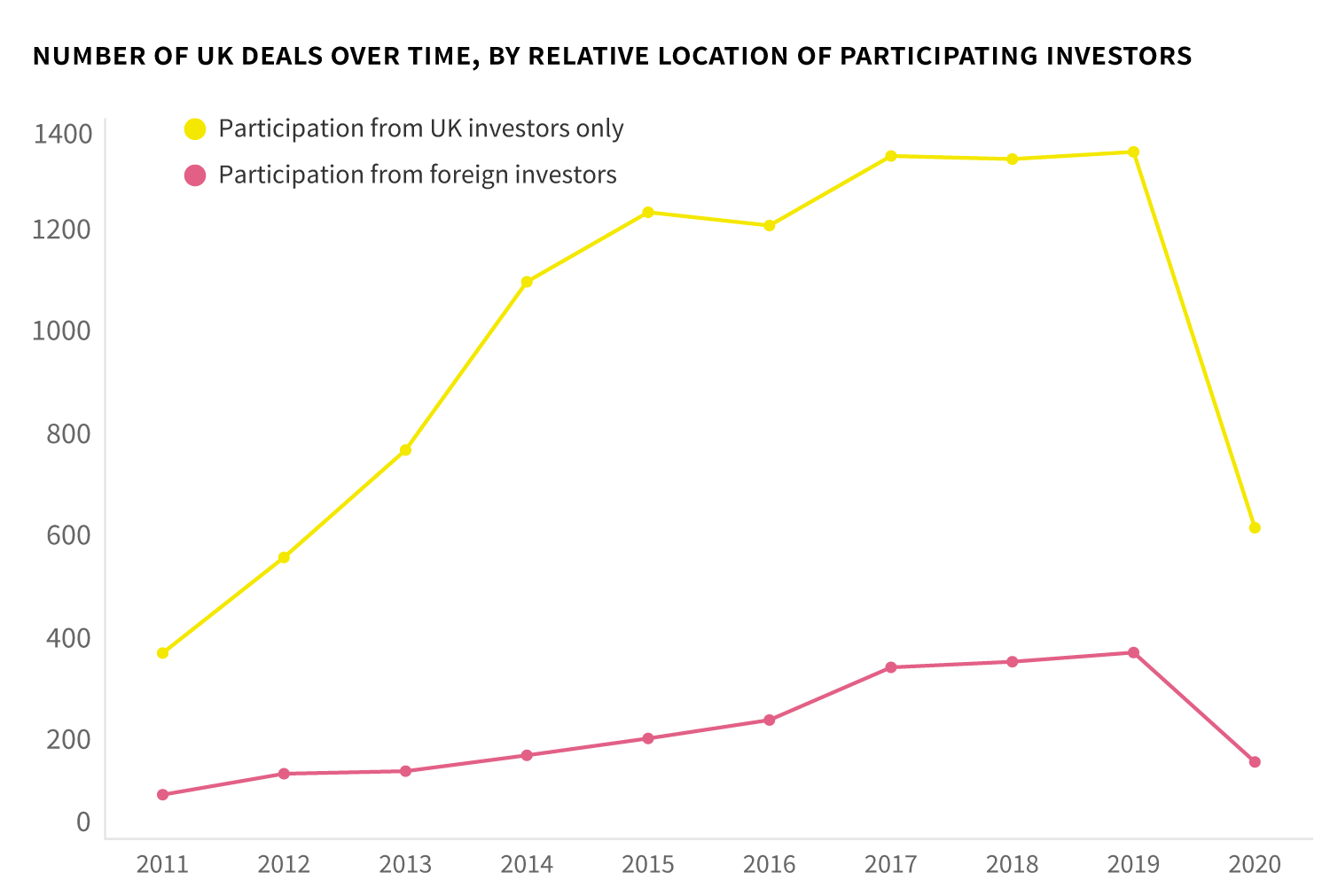

Foreign direct investment in the UK has been steadily increasing since our records began in 2011. This is testament to the strength of our high-growth ecosystem, which has helped to develop world class startups with pioneering technologies. And even in the midst of the coronavirus pandemic, international interest in UK companies has prevailed.

In this post, we look at recent trends in foreign investment into the UK, and how these have been impacted by COVID-19. Want to see which funds are the most active investors in the UK? Download our free PDF to see the ranking.

Foreign Direct Investment in the UK – Deal Numbers

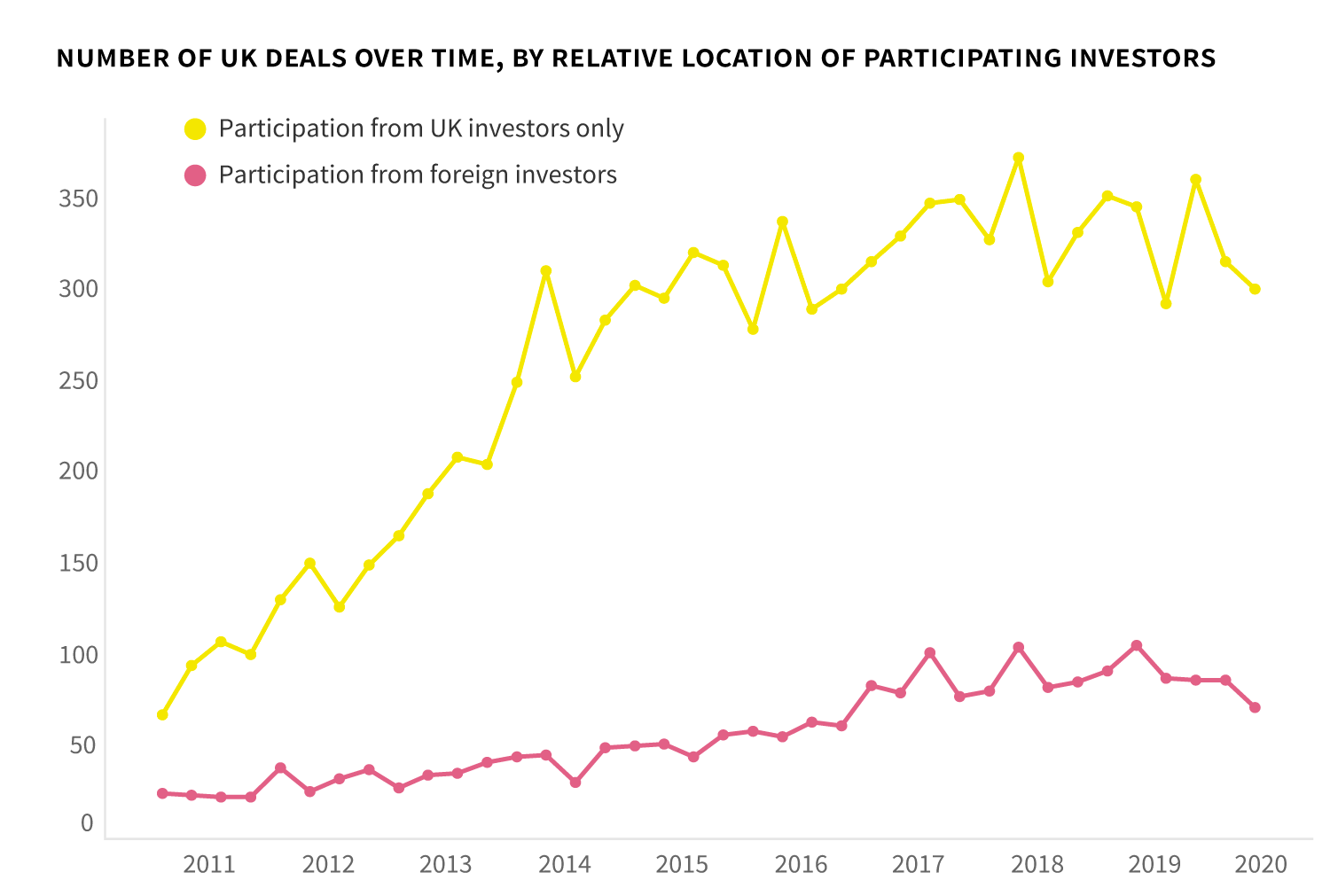

And despite the rising concern around COVID-19 and the implementation of global lockdown measures in Q1 2020, foreign deal numbers remained on par with the previous quarter; 87 deals were closed in both Q4 2019 and Q1 2020. This plateau can be explained by the closing of late-stage deals, which were set in motion well before the pandemic.

It’s likely that early stage deal activity did drop off in Q1, but this only became apparent in Q2 because funding rounds (especially those that involve investors from abroad) usually take a couple of months to finalise. Indeed, we’ve seen a 17% decline in deals in Q2 compared to Q1 2020.

Whilst this drop is fairly steep, it’s not the first time we’ve seen such a decline in a single quarter — foreign deal numbers declined 33% between Q2 and Q3 2014. The true test will be in the recovery from this dip and the aftermath of coronavirus.

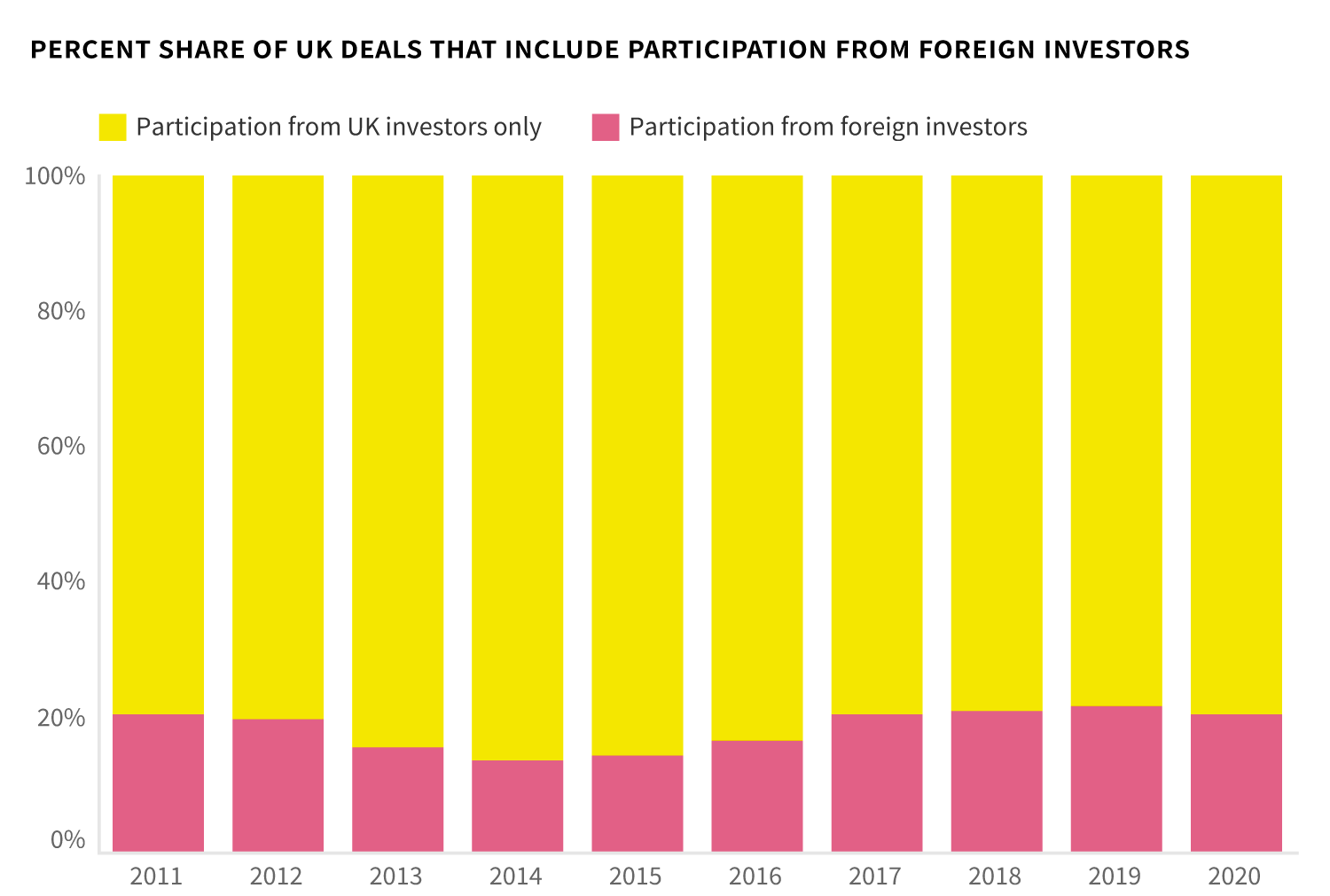

The proportion of deals made with participation from a foreign investor also peaked in 2019, when 22% of all UK funding rounds attracted investors from abroad, up from a low of 14% in 2014. That figure currently stands at 20% in 2020.

Foreign Direct Investment in the UK - Deal sizes

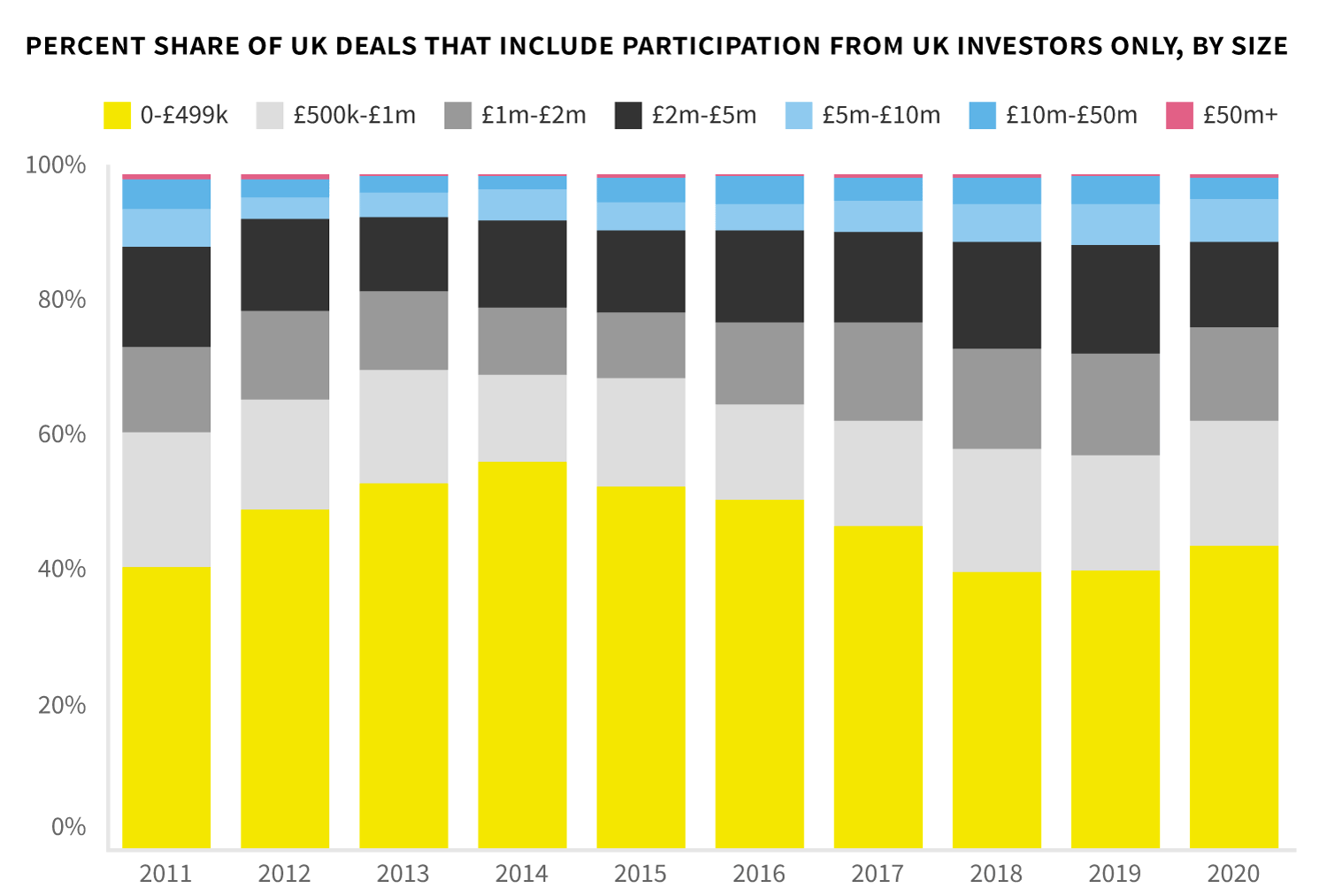

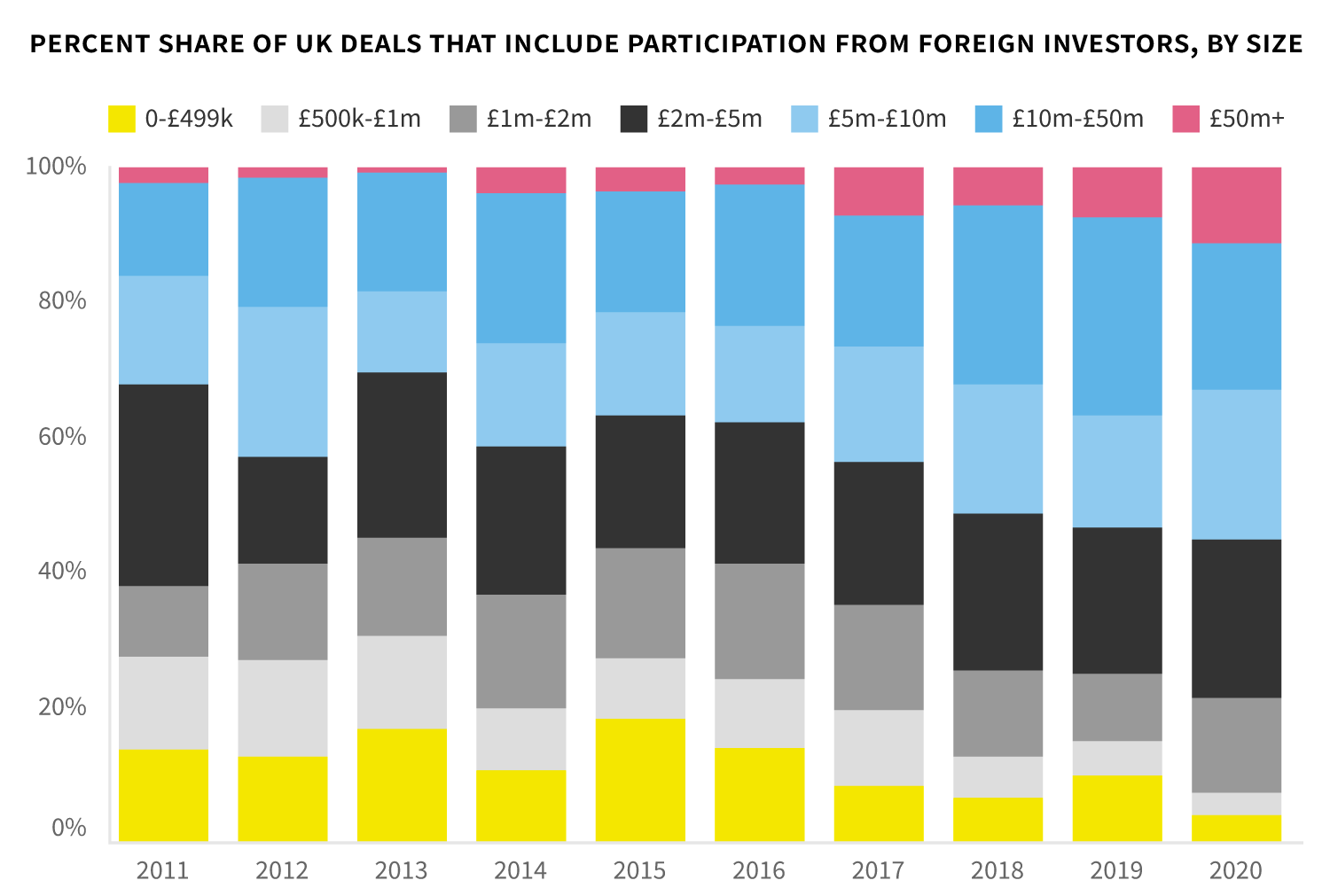

Foreign investors contribute a disproportionate amount of funding to the United Kingdom, tending to invest in later stage companies with higher ticket prices. This trend is clearly visible over time, with just 7% of foreign deals in 2020 worth less than £1m — a record low.

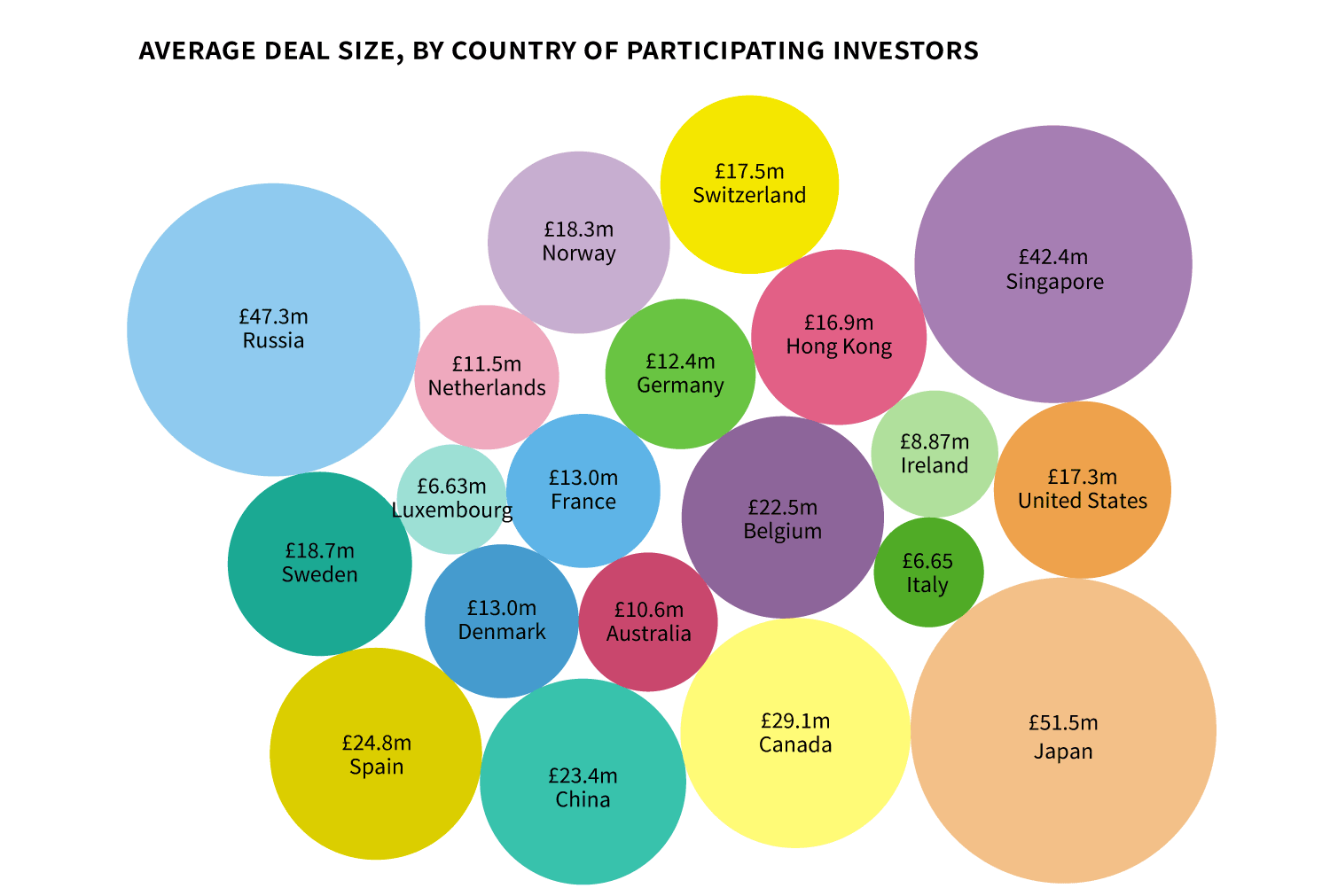

The average size of deals that include foreign money is just over £14.3m, whilst deals that are made purely by UK investors are worth an average of £2.03m. But this average changes depending on the country of origin, with Japanese and Russian funds most likely to invest in the largest rounds.

Which countries are most actively investing in the UK?

Since 2011, funds based in the United States have consistently been the most active foreign investors into the UK — and by quite a long way. In the first half of 2020, US investors participated in 84 funding rounds into UK companies, taking the total number of deals with US involvement to 1,113 since 2011.

German investors are the second most active, having participated in 16 deals in H1 2020, and a total of 232 since 2011. That’s just 20% of the number of deals completed by US investors.

Download the free PDF for free data on the UK’s top foreign investors.

Which continents are most actively investing in the UK?

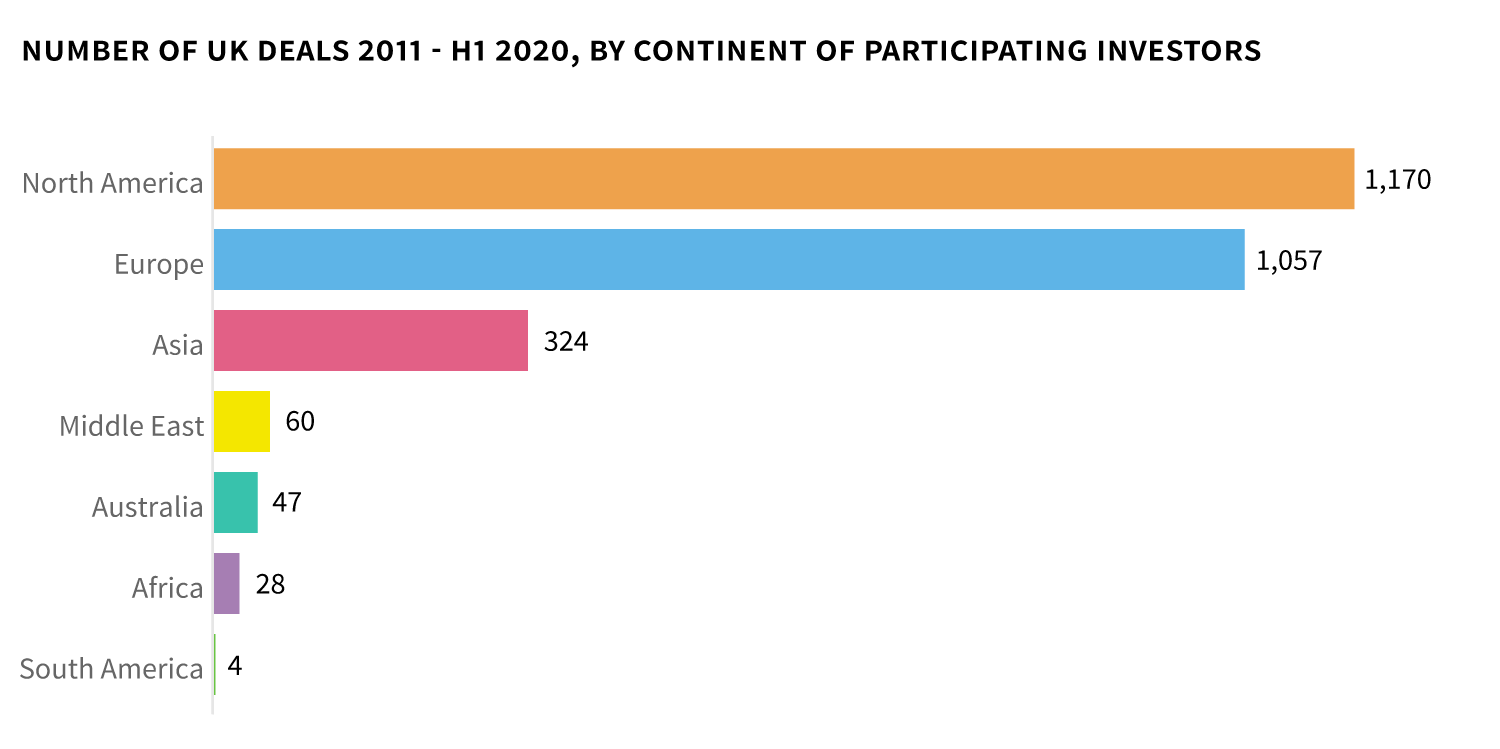

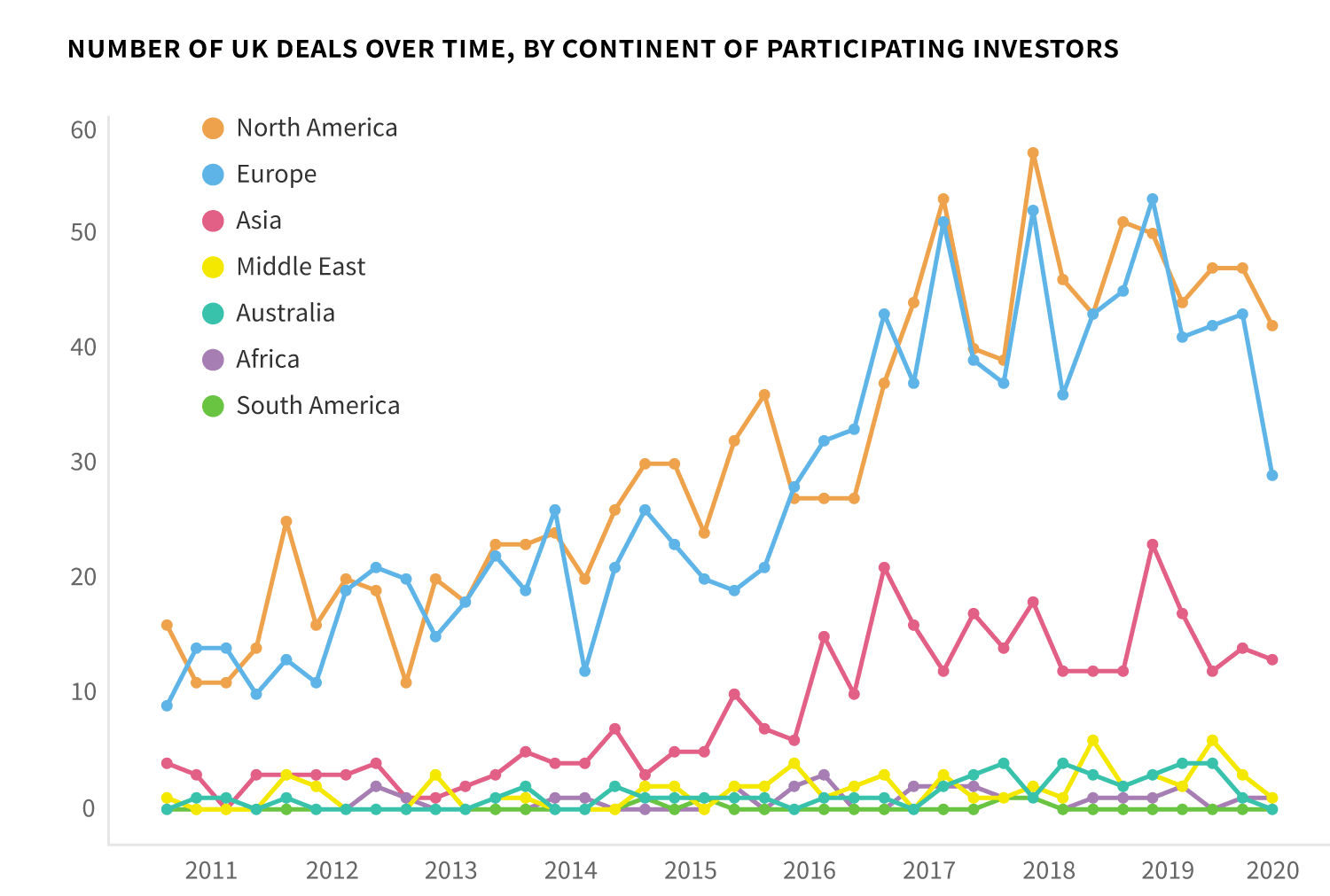

On a continent-level, North America still nabs the top spot, with 1,170 deals completed since 2011. Europe follows closely behind at 1,057.

But it looks like this gap might be about to widen. Deals that included participation from European investors dropped by a third from Q1 to Q2 2020, landing on 29 deals. This is the lowest number of European investments since Q2 2016. We’re keen to see if the figures recover over the remainder of the year.

So, what does the future look like for foreign investment flows in the UK?

There are some fairly well-established trends in foreign direct investment into UK companies, with mostly American and European investors fighting to fund the larger, later stage deals.

We’re excited to see how these trends change in the future, especially as trade deals are finalised and global lockdown measures are relaxed. Will North American investors pull far ahead of those in Europe, or will funds in other parts of the world become more interested in what the UK’s high-growth ecosystem has to offer?

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.