The 6 Fastest Growing Sectors in the UK 2021

Category: Uncategorized

The impact of COVID-19 on UK businesses has varied greatly between sectors, in no small part due to the government’s indecisive response to the pandemic. Whilst the entertainment, leisure and services industries are in deep-water, much of the tech industry has leapt forward. Startups operating in deeptech, cybersecurity, and areas of emerging tech performed well during the tumult of 2020.

In this post, we examine the fastest-growing industries through 2020, by comparing announced equity fundraisings made in 2019 with those made last year. Six key startup industries have emerged, each showing substantial and rapid growth since 2019 and a record year in 2020, in terms of both the number of deals completed and the amount invested.

Digital Security

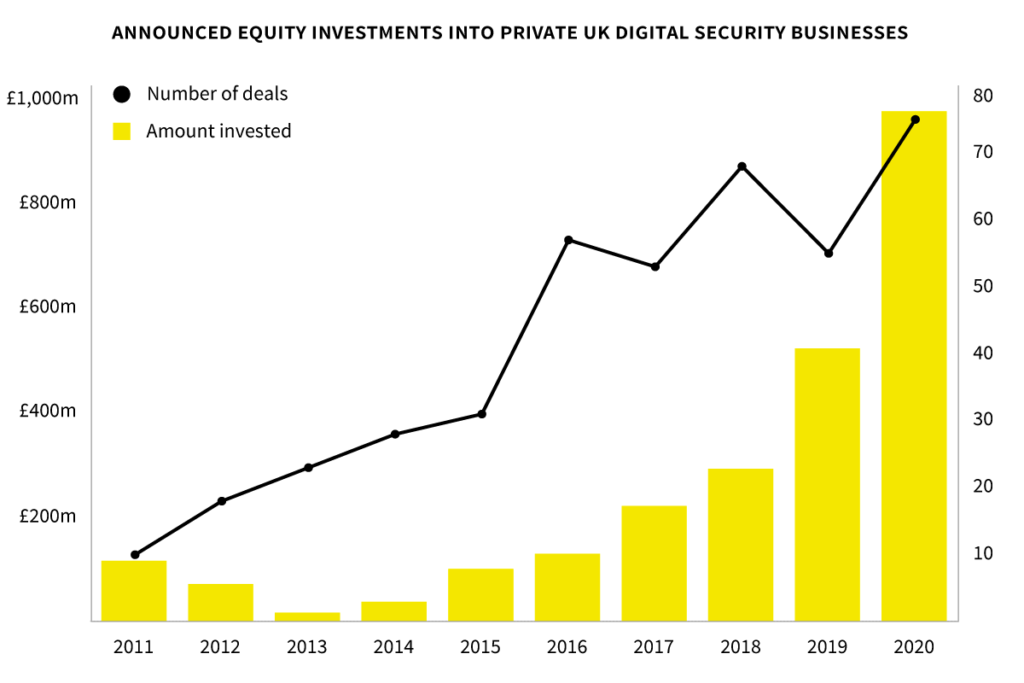

The protector of the technology industry, competition is clearly hotting up in the digital security market. Three of the UK’s 23 active unicorns operate in the space, and a large volume of deals have gone ahead during coronavirus. And that stands to reason, as the pandemic has accelerated digitisation, forcing many companies to immediately review their security systems. Investors can see that there is a clear appetite for innovative solutions in this area, and are willing to bet on its future success.

Digital security companies secured a total of £522m across 55 announced rounds in 2019. Throughout 2020, £976m was deployed over 75 rounds, marking a 87% increase in value and 36% increase in deals completed.

Of all digital security companies in the UK, OneTrust secured the biggest raise last year with a $300m round (£224m) in December, at a reported valuation of $5.1b. This is an incredible valuation, but especially in the context of its $2.7b valuation reported just ten months earlier, as part of a $210m (£162m) deal. Could this be realistic? Only time will tell, but general partner at investor Technology Crossover Ventures (TCV), Tim McAdam, certainly believes so:

“There are hundreds of regulatory initiatives in the works emanating from all major countries. OneTrust has emerged as the runaway SaaS leader in the trust and privacy arena. OneTrust CEO Kabir Barday and his team have built the only truly global privacy platform allowing companies at any stage or size to own their privacy initiatives and remain compliant.”

OneTrusts’ privacy management software helps over 6,000 firms to comply with global privacy laws and better address risks. The company has continued to grow its team during the pandemic, with over 70 positions still open.

One of the latest additions to the UK’s unicorn cohort, Snyk also secured two impressive rounds in 2020, totalling $350m (£269m). The Hackney-based company develops tools that alert users and help fix security vulnerabilities in their open-source coding.

Snyk kicked off 2020 with a £115m round, with contributions made by a number of American funds. These included Amity Ventures, BoldStart, Coatue Management, Salesforce, Striped Group, Tiger Global Management and Trend Forward Capital. Nine months later, Snyk bagged another $200m from undisclosed investors (although we reckon many participants were follow-on funders).

Want to see indepth articles on the hottest sectors of 2020? Download our free report today.

Insurtech

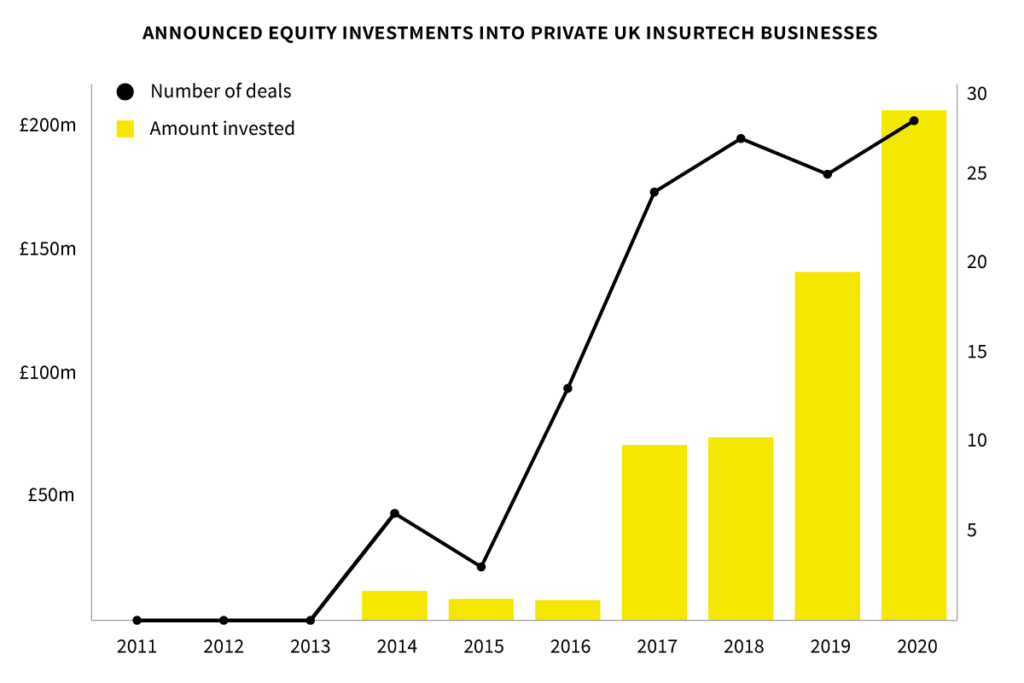

Insurtech companies are exploring avenues that large incumbent firms might have less incentive to pursue. These include ultra-customised policies, social insurance, and using new streams of data to dynamically price premiums. Insurtechs can provide products and services to consumers, or develop tech to streamline or overhaul processes for existing insurance firms.

The insurtech industry has seen rapid growth in the past five years. Just £8.68m was deployed across three announced equity rounds in 2015, compared to £207m across 28 rounds in 2020. Between 2019 and 2020, the amount invested grew 47%, while the number of rounds completed rose 12%, surpassing the previous record of 27 deals in 2018.

A third of the rounds completed in 2020 took place in January, before COVID had arrived in the UK. But the largest of these rounds took place in May, well into the initial national lockdown. This £78.4m round was raised by pet insurer Bought By Many, a company we recently listed as one of the hottest tech startups in the country.

Launched in 2012 and based in Camden, Bought By Many offers bespoke pet insurance via online form-free claims. Its funding round was led by FTV Capital, with participation from existing investors CommerzVentures, Munich Re Ventures, and Octopus Ventures. The investment is being used to fund the company’s expansion across the UK and abroad, following its launch in Sweden.

The nature of insurtech companies, and the highly regulated market in which they operate, means many will need to build partnerships with underwriters and more established firms in order to trade. While investors continue to deploy capital to the sector, the success of individual companies through the pandemic will also depend on these corporate partnerships.

Analysts at KPMG have warned that “while carriers are committed to the innovative projects and insurtech partners they’re already involved with, they are less likely to take risks on new, unknown insurtech companies.”

In addition, they said: “New products and companies will likely struggle to find funding in this environment. Investors will be looking for insurtech opportunities with proven business models, solid customers, and good growth prospects.”

Indeed, just 2 of the 28 insurtech rounds secured in 2020 were first-time raises; one by Marinsight, which provides data analysis solutions for the marine insurance sector, and the other by Whitespace, which allows users to create, process, negotiate and bind insurance contracts entirely digitally.

Cryptocurrencies

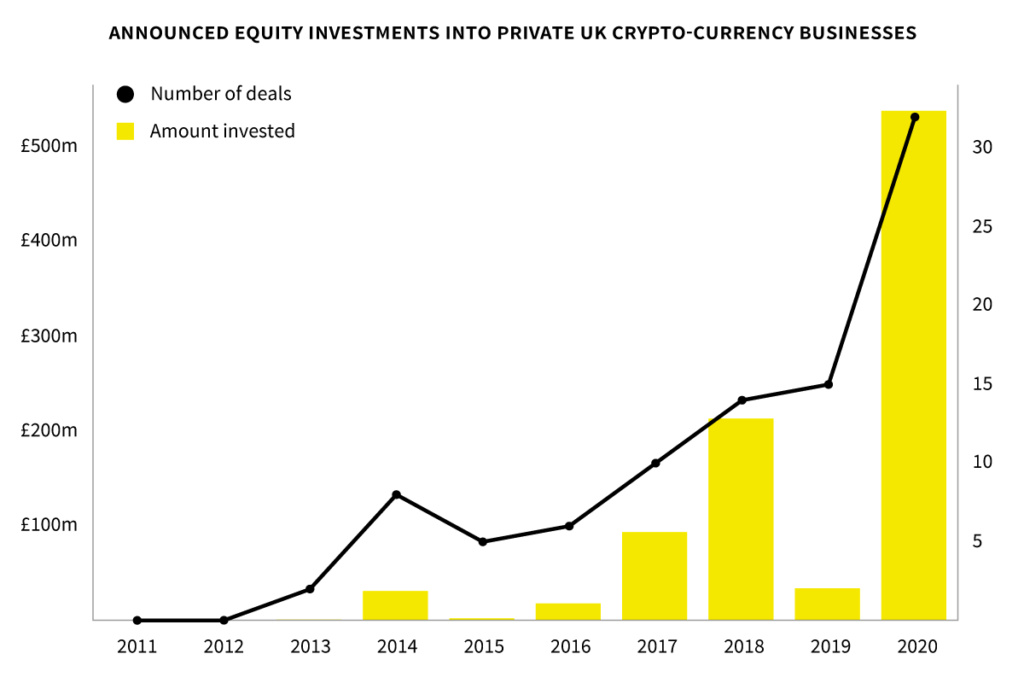

Cryptocurrencies have gained something of a reputation for facilitating nefarious and anonymous activity, but many companies are trying to move them into the mainstream—and they seem to be doing a pretty good job of it.

The sector experienced 1,533% growth in deal value and 113% increase in deal numbers between 2019 and 2020. £539m was invested across 32 deals in 2020. The most prolific investors in the sector were crowdfunding platforms Seedrs and Crowdcube, which facilitated nine and three rounds last year, respectively.

The biggest name in this market? Challenger bank Revolut. Although not its core focus, Revolut offers a way for users to buy, hold and trade cryptocurrencies, including Bitcoin, Ether and Stellar. Revolut raised two funding rounds in 2020, one in February for $500m (£383m), and one in July for $80m (£62.4m). Capital will be used to fund expansion into the United States, advance research and development, and accelerate business operations. The most recent round was completed at a valuation of £3.98b pre-money.

Aside from this fast-growing financial giant, there are plenty of other crypto startups entering the market. Edinburgh-based Zumo, for instance, which raised £1.61m via Seedrs in September 2020, develops a non-custodial wallet and payments platform that is designed to enable the spending of cryptocurrency in everyday situations.

Meanwhile, Coinfirm is developing a risk and compliance platform for blockchain-based transactions. Its aim is to combat money-laundering and the financing of terrorism as well as helping clients meet other regulatory requirements regarding cryptocurrencies. Based in London, the company raised more than €6m over two rounds in 2020. The first for €4.48m (£3.83m) in January, and the second for €2m (£1.81m) in July.

Quantum

Using the principles of quantum mechanics, quantum computing makes computation faster and less energy-intensive. The sector is nascent, but applications are already extensive, and businesses are jumping at the chance to be at the forefront of this new technology.

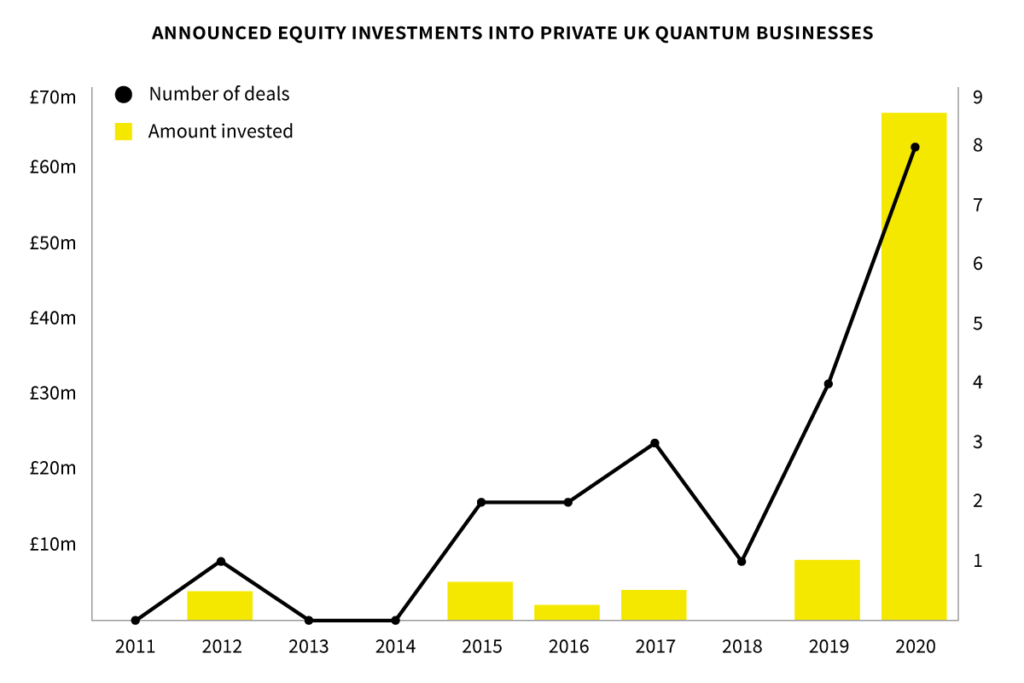

There have been 21 announced equity deals into UK quantum companies since 2011, and £90.2m deployed across the sector. 2020 saw the most activity to date, with 8 deals completed (double those in 2019) at a total of £67.4m—more than seven times the £8m invested in 2019.

Much of this activity was driven by Cambridge Quantum Computing (CQC), founded in 2014 by Ilyas Khan (CEO), Takis Psarogiannakopolous (CTO) and Henrik Dreyer. Now in its growth stage of evolution, the company builds tools for the commercialisation of quantum technology, such as its quantum development platform “t|ket>”, and offers access to a wide variety of corporate and government clients.

CQC now employs over 60 scientists and operates across the US, Europe, and Japan. To date, the team has raised £53m in equity finance, including a £411k raise in February 2020 and a £33.6m round closed on 9th December. Investors include IBM, Serendipity Capital, Honeywell Ventures, and Touchstone Gold, among others.

Other key players in the sector include M Squared, which combines quantum with photonic technology, and Quantum Motion Technologies, which is developing and commercialising a silicon-based quantum computer. Meanwhile, Oxford Quantum Circuits has produced the UK’s first commercially available quantum computer. Each of these companies has attracted investor attention, and millions of pounds in capital over the past year.

And private investors aren’t the only ones betting on this industry. In June 2020, the Government pledged £70m to help develop quantum technologies, and ensure the UK is a world-leader in the sector. This investment is part of its £1b Quantum Technologies Challenge, led by UKRI, which has involved over 80 companies across the UK, along with almost 30 research organisations. This latest funding will help with projects like the diagnosis of cancerous tumours during surgery.

Fintech

It should come as no surprise that the UK’s best performing startup sector continued at an incredible growth rate through 2020. The nature of COVID and the risks involved with exchanging cash has put a greater emphasis on contactless payments, and the alternative forms of payments available through fintech.

The squeeze on working capital has also forced many businesses, big and small, to take a closer look at their finances and find more convenient and insightful ways of managing cash flows. For B2B fintechs, demand for lending has skyrocketed, and some (including Starling Bank and Tide) helped roll out the Government’s Bounce Back Loan Scheme.

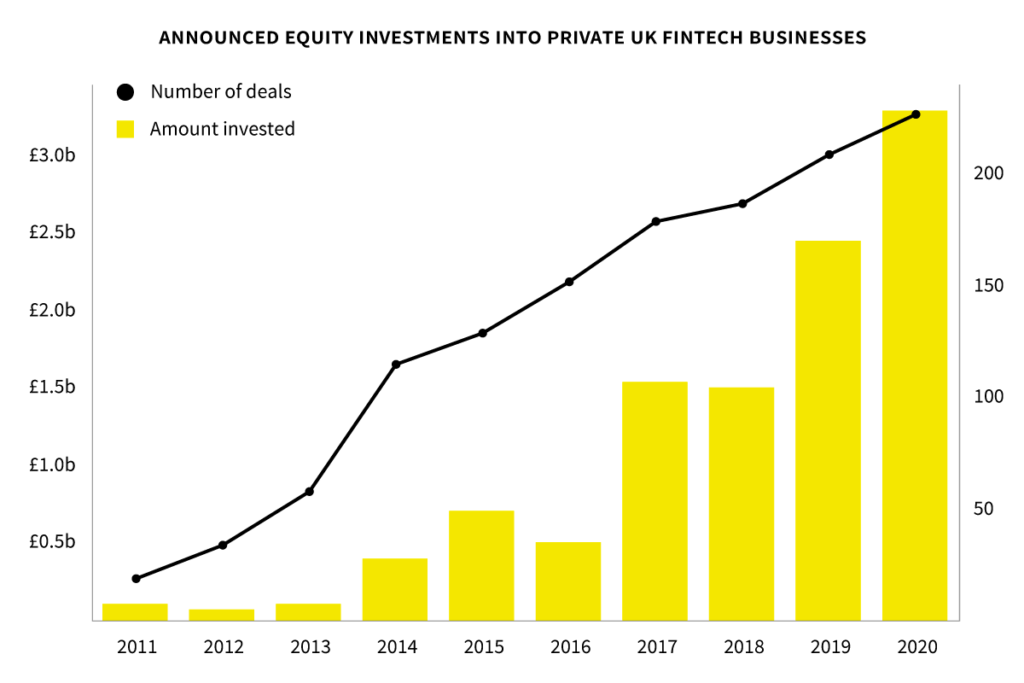

And there’s no doubt that fintech will be sticking around for the long term, well beyond coronavirus. Thus, current uncertainty has made little dent in investor confidence in the sector. Between 2019 and 2020, deal numbers increased 9%, from 209 to 227, whilst the amount invested increased 35%, from £2.44b to £3.29b.

This growth was largely driven by more established firms raising eye-watering amounts: that $500m (£383m) deal by Revolut in February, a £266m round by digital mortgage lender Molo Finance in October, and a $319m (£248m) round by international transfer service TransferWise in July.

Together, growth and established stage businesses announced 66 deals over the course of 2020, totalling £2.5b. But the bulk of active, private high-growth fintechs remains in the seed (45%) and venture (34%) stages of evolution.

We’re keen to see how the fintech landscape changes, and how younger companies develop, as the more established, first generation of UK fintechs mature, and potentially exit the private market.

Challenger Banks

Now a staple in every millennial’s financial arsenal, challenger banks provide more efficient, personal and flexible banking services than those offered by established firms such as HSBC, RBS, and Santander.

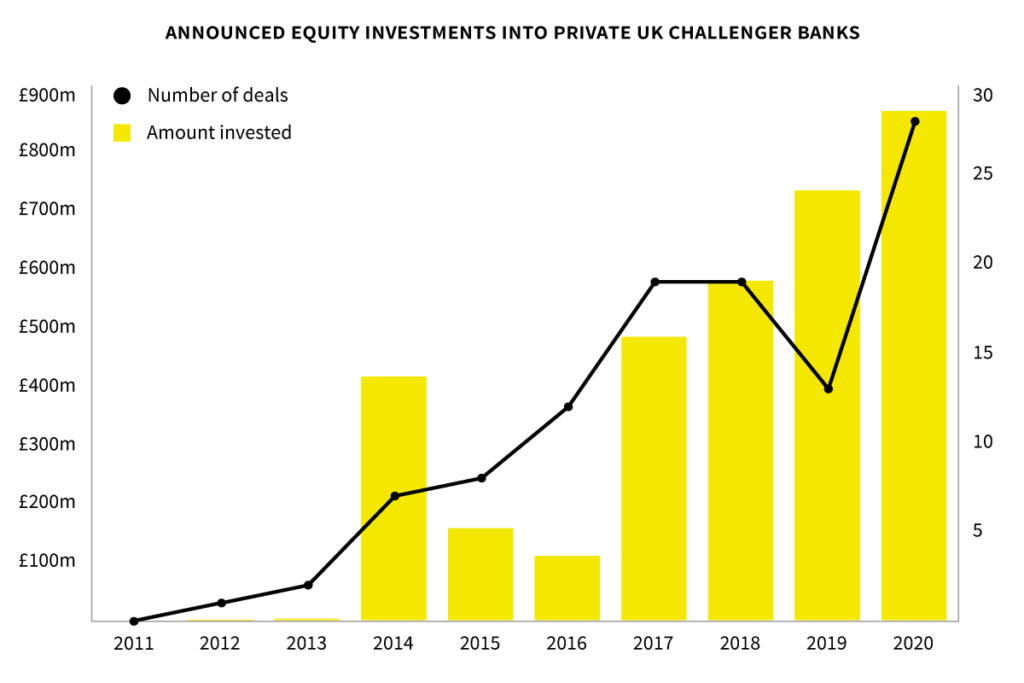

This subset of fintech has seen astonishing growth over the last decade. And after a drop in deal numbers in 2019—which ended with just 13 investments completed—2020 rebounded. The amount invested into these companies in announced rounds totalled £869m last year—a 19% increase from 2019—whilst the number of deals completed grew 115% to 28.

You’ll be familiar with the household names at the forefront of this burgeoning industry, one that is proving to be increasingly disruptive to incumbents. Revolut (yes, there it is again) aims to become the “Amazon of banking”, and has raised £690m to date, £445m of which was secured in 2020.

Starling Bank has been voted Best British Bank for three years now, and has raised £263m in equity finance, £100m of which was secured in 2020.

Meanwhile, rival bank Monzo is building a bank that its users can actively help shape. Monzo has raised £444m to date, £120m of which was raised in 2020. Notably, the first of the company’s two announced funding rounds in 2020 was a significant down round, closing at a valuation 40% lower than the company’s previous raise. Monzo also reported 120 redundancies, saw Tom Blomfield step down from his position as UK CEO, and hit headlines when Starling Bank’s CEO, Anne Boden, published a tell-all account of her personal dealings with Blomfield, former-CTOat Starling.

And Monzo wasn’t the only neobank to suffer during the pandemic. Revolut lost several senior execs through the year, and reportedly cut over 100 jobs. The year was far from smooth for the sector, but businesses showed resilience, and growth persisted.

And it’s not just the big dogs securing funds. There are several newer entrants making moves, and focussing on sustainable growth rates rather than the ‘growth at all costs’ mantra associated with the sector. We recently profiled these new businesses, and took a closer look at how the big three have grown.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.