Deliveroo launches new innovation fund

Category: Uncategorized

In a perhaps unexpected turn of events, Deliveroo has just launched a new £5m innovation fund. Whilst this sounds like some sort of venture capital initiative, in reality the objective of the fund is slightly less straightforward, with three broad aims: investing in existing restaurants, developing new brands to operate from delivery-only “Deliveroo Editions“, and working with up-and-coming chefs to support their business through delivery-only options. Increasingly, it looks as though Deliveroo is moving towards setting up its own restaurant brands.

This announcement may come as a surprise, as it means Deliveroo has entered the corporate venturing scene at a very young age (just 6 years old), and well before an IPO date has been announced. Interestingly, CEO Will Shu worked as an investment banker for Morgan Stanley before becoming an entrepreneur — it will be interesting to see whether he plays a key role.

It also shows a departure from Deliveroo’s original asset-light commercial model. When it started up, the company didn’t operate any food production infrastructure, instead focussing heavily on tech. However, last year they began expanding a network of so-called “dark kitchens”. These are delivery-only outlets that are not open to the general public. By the end of this year, they will operate 130 of these kitchens internationally, which will operate alongside any new brands the company sets up.

These increasing efforts to diversify indicate the company is feeling the pressure to innovate in an already crowded food delivery market.

One chief competitor is Just Eat, who launched a joint accelerator and corporate venture team (Just Eat Ventures) in 2016. Two days after Deliveroo announced its innovation fund, Just Eat announced the launch of its own “Business Booster” programme, which will aim to nurture independent restaurant businesses. This shows just how hotly contested the space is becoming.

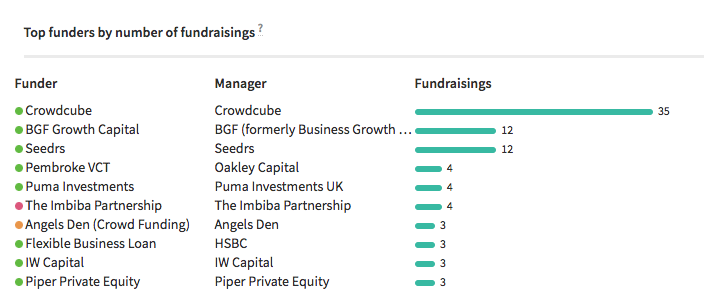

In terms of more traditional funding competition, Deliveroo’s new fund will be up against several others in the race to find the next Franco Manca. Crowdfunders predictably play an active role in funding new restaurants – larger VCs will be wary of entering the crowded eat-out market. However, BGF Growth Capital, Pembroke and Puma Investments are all active in this area. Pembroke are a big name, and were instrumental in bringing American burger chain Five Guys across the Atlantic, in a commonly touted private equity success story. More recently they backed Chilango, whose sales increased dramatically 2016-2017. It will be interesting to see how Deliveroo’s new fund fares, and what impact it will have on Britain’s restaurant investment scene.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.