Cryptocurrencies & Decentralised Finance: Is Stability in Sight?

Category: Uncategorized

Cryptocurrencies and blockchain technology are increasingly working their way into the mainstream. The news that El Salvador will start accepting Bitcoin as legal tender, and the recent IPO of crypto exchange and wallet Coinbase, are just two developments that go to show cryptocurrencies are here to stay, despite controversy over their associations with scams and money laundering. Here, we explore the latest developments in crypto markets, and take a look at the high-growth companies working to stabilise these notoriously volatile currencies.

If you need a reminder on how blockchains and cryptocurrencies work, check out our previous blog on what makes blockchain secure.

Crypto is not just Bitcoin

Whilst Bitcoin, the first ever blockchain and digital currency (BTC), is probably the most well-known, it is by no means the only one out there. Dogecoin, another blockchain and associated token, has also been in the news as of late. Inspired by the popular shiba inu dog meme, Dogecoin was initially created in 2013 as a reaction to the somewhat wild speculation in crypto markets at the time, and has since continually fluctuated in popularity and price, often in correlation with Tesla and SpaceX CEO Elon Musk’s notorious tweets.

The second biggest blockchain by market cap, after Bitcoin, is Ethereum. Whilst Bitcoin and Dogecoin are primarily used as a store of value, Ethereum enables much more than simply transferring coins between addresses. Ethereum’s ‘smart contracts’ allow logic-based decisions and transactions to occur on the blockchain. Instead of simply ‘do X’, Ethereum smart contracts enable ‘if X happens, then do Y; if not, do Z’. This means that complex applications can be built on the Ethereum blockchain.

DeFi the disruptor

Ethereum was created in 2015, and has since seen an explosion of applications and protocols being run on it. One of the most fertile areas of innovation is ‘Decentralised Finance’ (or DeFi). DeFi aims to replace traditional financial institutions and central banks with decentralised alternatives, run entirely automatically on the blockchain. For example, users can lend and borrow money, earn interest, take out insurance, trade in futures and derivatives, and buy put or call options, all on the Ethereum blockchain, without relying on any third parties to carry out these transactions on their behalf.

One of the core reasons for the growth of innovation in this area is ‘composability’. Decentralised applications (DApps) are all open source and public, allowing DApps to be built on top of each other, taking the functionality of one application and adding to or improving it with another.

DeFi tokens and applications

Ethereum also allows for a variety of coins and tokens. Its native token is Ether (ETH) but, like Bitcoin, its price is highly volatile. To overcome this volatility, and allow people to use DeFi in a more stable, predictable way, ‘stablecoins’ have been created (so-called because their value is relatively stable over time).

The three most popular stablecoins are Tether (USDT), USDC, and DAI. To achieve stability, their value is pegged to a traditional currency, normally the US Dollar (so, for example, 1 DAI = 1 USD). These types of tokens mean that DeFi DApps can be used in a way more akin to traditional finance, like depositing money in a savings account and earning stable interest. The difference that DeFi makes is that you don’t have to trust a middleman, such as a bank, to hold your money for you.

Another type of token made possible by Ethereum is the NFT (non-fungible token). Tokens which represent currency are fungible; this means they can be interchanged—one pound coin is worth the same as any other pound coin. NFTs, however, are unique, and so can represent almost anything else. For example, an NFT could represent ownership of a real-world asset, such as a plot of land or an invoice, or a purely digital asset, such as a work of digital art. Running this on a blockchain means that ownership of the NFT is demonstrably yours—it can’t be forged or seized by a third party.

This opens up a whole host of further DeFi applications. You could tokenize ownership of a house into 1,000 NFTs and then sell them; the owner of one of these NFTs would own 1/1000th of the house, and could also claim 1/1000th of the income it generates through renting it out.

Fast-growing crypto startups

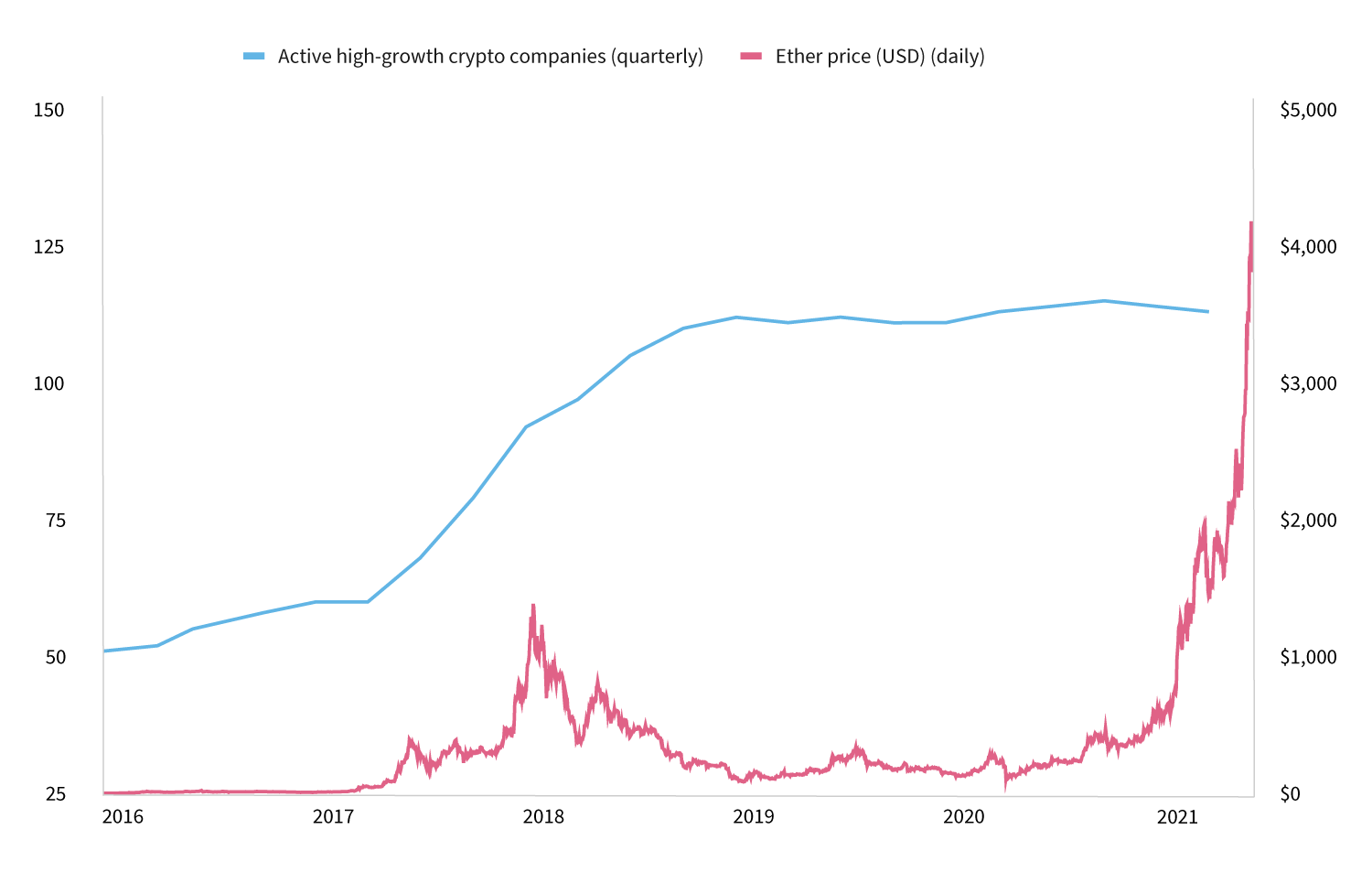

With so much attention being given to this space, it’s unsurprising that the number of cryptocurrency companies in the UK has increased drastically in the last three to four years, especially in 2017 and 2018. This coincided with the peak and subsequent decline of the price of Ether and Bitcoin in the same period. 2021 has seen an even bigger increase in the price of Ether; perhaps a promising signal of a further increase in the number of crypto companies to come.

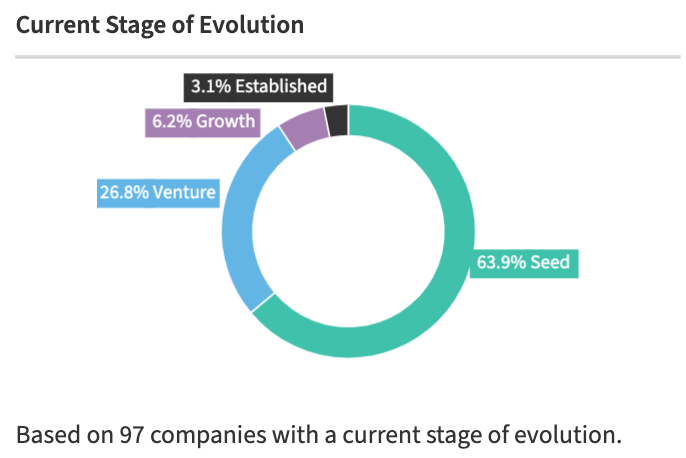

Whilst the majority of DeFi companies and applications are based in the US, there are also plenty of UK startups innovating in this space. Of the 97 active cryptocurrency companies that have met at least one of our eight high-growth tracking triggers, almost two thirds are still at the Seed stage of evolution, reflecting the relative youth of the sector.

Currently at Venture stage, DeFi company Argent has raised over £12m in equity investment to develop a user-friendly ‘wallet’ application. A wallet is a place to store and transact with crypto tokens, similar to a bank account in traditional finance. Wallets can be centralised (like the Coinbase website), meaning the company holds your tokens on your behalf, or decentralised, like Argent. Decentralised wallets have the advantage of users fully owning and holding their tokens; third parties, including the wallet provider, have no way of seizing or otherwise controlling a user’s digital assets.

Argent’s mobile app aims to make using DeFi applications as simple and accessible as possible. Users can buy Ethereum-based tokens such as ETH, Tether, and DAI, and interact with a wide variety of DeFi applications to invest, lend, or trade their tokens, all from within the app.

Based in Edinburgh, Zumo also operates a crypto wallet. Recently grown from Seed to Venture stage, Zumo allows users to buy and store Bitcoin and Ethereum-based tokens, plus send them to other users around the world and spend them in everyday situations using a debit card connected to their wallet.

At the Growth stage, Blockchain.com is one of the more mature UK cryptocurrency companies. It operates a wallet application for both Bitcoin and Ethereum, as well as an ‘Explorer’ to allow users to see the historical prices of different tokens, the transactions taking place on these blockchains, and other stats such as the number of active users and number of transactions over time. Founded in 2014, it’s so far raised a huge £356m in equity investment over four funding rounds, and attended the Tech Nation Future Fifty accelerator in 2019.

Blockchain.com also operates a token exchange, allowing users to buy and trade in a wide variety of Bitcoin and DeFi tokens. Like wallets, exchanges can be centralised (like Blockchain.com, Coinbase, and Binance) or decentralised (such as Uniswap). Decentralised exchanges (DEXs) can take longer to execute trades but, when using a centralised exchange, the user relies on a third party to execute the transaction and secure crypto assets on their behalf (and is hence charged a fee), and these transactions aren’t recorded on the blockchain. With DEXs, users transact with each other directly on-chain, with no middleman and zero or very low fees.

With so many different tokens available, and new ones being created all the time, it’s important that exchanges have sufficient liquidity for them, to allow users to buy and sell tokens at stable and predictable prices. This is where market makers come in; market makers can help new projects get their tokens listed on exchanges and ensure that there’s enough token liquidity to facilitate high levels of trading and efficient markets. Wintermute, based in Manchester, does exactly this. Founded in 2017, the company has raised over £17m in funding to create an algorithmic market maker protocol for a wide range of digital assets.

Is the future decentralised?

Since the start of 2021, the price of Bitcoin and Ether has skyrocketed, and interest in the crypto space has increased with it. Based on the rise in the number of UK cryptocurrency startups in 2017 and 2018, during the last crypto boom, we’ll likely see another big increase over the coming year, bringing with it even more innovation and new applications for blockchain and DeFi. Whether this technology will become fully mainstream (or even replace traditional financial services and institutions in the long term) is anyone’s guess. But for now, strong interest and investment into the increasing varieties of cryptocurrency companies looks set to continue.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.