The Biggest Investments of Q4 2020 (So Far)

Category: Uncategorized

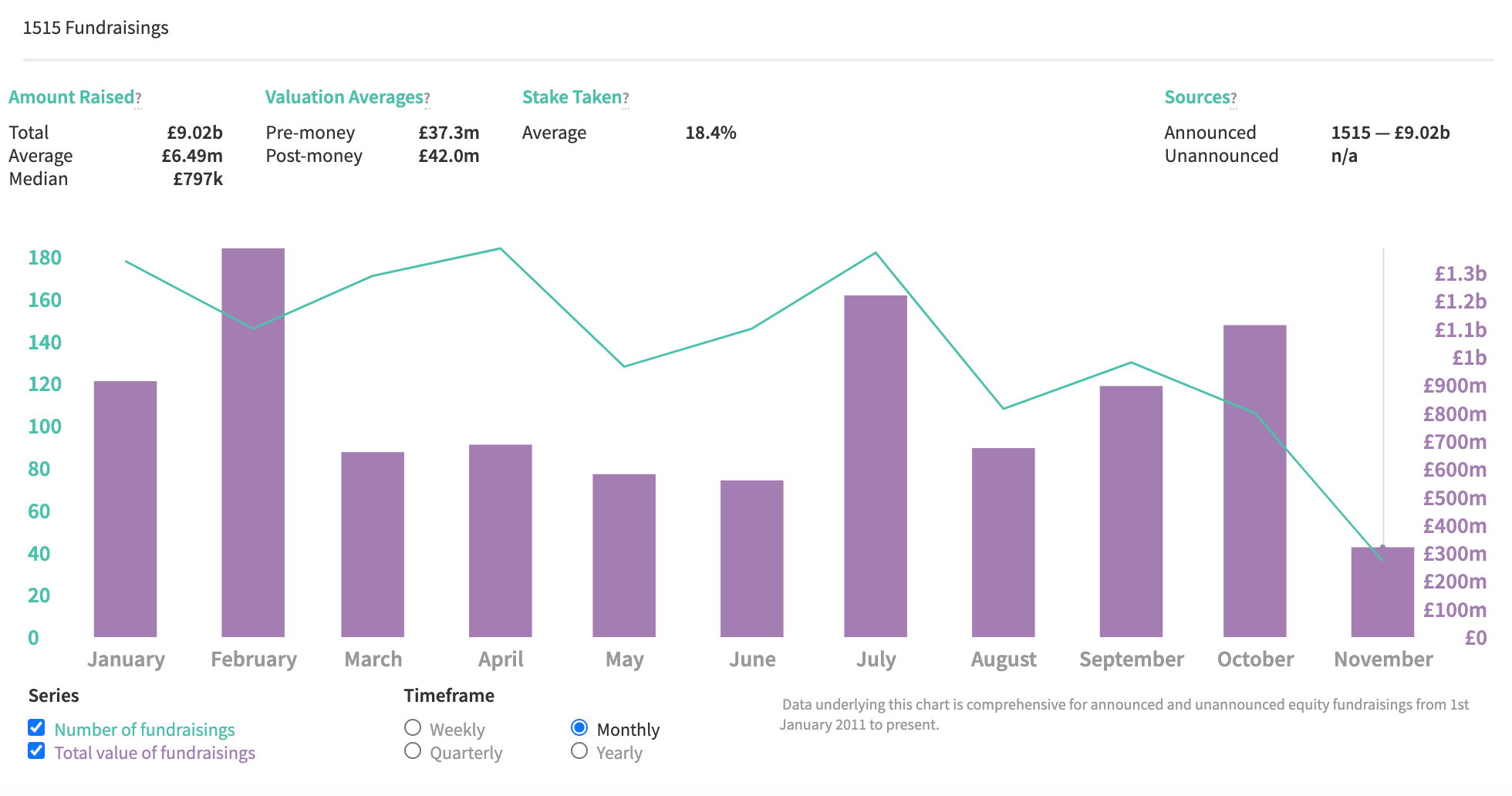

Since the start of 2020, £9.02b has been invested into high-growth, private UK companies across 1,515 deals. £1.4b of this has been in Q4, across 148 deals to date.

Whilst the number of deals completed each quarter has been trending downwards, the average size has been rising. As of November 10th, the average deals size stands at £11.3m in Q4, compared to a figure of £6.49m across 2020 to date.

So, which companies have secured the largest of these rounds, and which investors have backed them? We’ve ranked the most valuable UK investments that have been announced so far.

The 12 largest UK fundraisings in Q4 2020 (so far)

1. Molo Finance

Founded: 2016

Headquartered: Westminster

Amount raised in last round: £266m

The largest fundraising of Q4 so far, by a margin of £26m, was Molo Finance’s £266m raise. Molo Finance is a relatively young fintech startup, founded at the end of 2016 and operating out of Westminster. The company is a digital mortgage lender—the first of its kind— that is disrupting the largely-traditional mortgage industry.

Molo’s £266m investment came from Andenes Investment, GPS Ventures, Macquarie Capital, Patron Capital, and Yabeo. This investment dwarfs the £14m Molo had raised in its prior rounds—overall, the company has now raised £280m across four rounds. Molo raised the investment, which was a mixture of loan and equity capital, in October. The capital was invested for the purpose of R&D, to invest in the company’s technology, and to fund future company growth.

The deal was advised by Specfin Capital and was secured on the back of exceeding demand for the company’s services throughout COVID-19. This surge of digital mortgage applications was potentially linked to suspension of purchase taxes on homes costing up to £500,000, back in July. Just in August and September alone, Molo’s pipeline of buy-to-let mortgage transactions totalled over £500m.

Carolyn Porretta, a managing director at Macquarie Group and non-executive board director of Molo, added: “The UK mortgage market is currently undergoing an enormous transformation to digitalise”, and Macquarie Group invested because Molo is “at the forefront of this technology”.

2. Cazoo

Founded: 2018

Headquartered: Camden

Amount raised in last round: £240m

In October, Camden-based Cazoo raised an equity investment of £240m. The investment came in return for a 12.8% stake in the company, returning a pre-money valuation of £1.64b (a 156% increase on its previous round’s valuation). The company operates an online marketplace allowing users to buy used cars and have them delivered in 72 hours.

The round drew on a long list of investors, including: Blackrock, D1 Capital Partners, DMG Ventures, Durable Capital Partners, Fidelity Management & Research Company, General Catalyst Partners, L Catterton Europe, Mubadala Capital, Novator Partners, and The Spruce House Partnership. Many of these are follow-on investors from Cazoo’s $116m raise back in March.

The company has seen sharp growth over the past few months. It acquired used car retailers Imperial Car in April, providing the company with a national network of infrastructure, distribution, and car inventory. Cazoo also just opened its sixth customer centre in Bishop Auckland this month. The business now has branches across the UK in Manchester, London, Bristol, Cardiff, and Birmingham.

Cazoo became a UK unicorn on the back of this most recent investment, taking only two years to reach a $1b valuation.

3. Hopin

Founded: 2019

Headquartered: Islington

Amount raised in last round: $125m (£94.9m)

Islington-based Hopin provides online networking events, with clients using the platform to create and host online functions with people across the globe. Hopin differs from other video platforms, such as Zoom, insofar as: it does not have an attendee cap, offers post-event analytics, and it has features such as sponsor branding and “multistage” event streaming.

The company raised a £94.9m equity fundraising on the 10th November from Accel, Coatue Management, DFJ Growth, Institutional Ventures Partners (IVP), Northzone Ventures, Salesforce Ventures, Seedcamp, and Tiger Global Management. The purpose of this investment is to make new hires, expand, and develop its platform further.

Hopin has raised £132m across four rounds altogether, and this latest valuation made them the UK’s most recent and youngest unicorn, taking the accolade from Cazoo.

COVID-19 proved a boon for the company’s business model. As physical events became impossible overnight, Hopin’s platform made online events accessible, financially viable, and even environmentally sound. The number of users surged from 16,000 in March to 175,000 in June, and today boasts over 3.5 million users.

Clients include Adobe, Forbes, and TechCrunch. Hopin intends to double investment into product and ramp up hiring in the coming months, expecting to reach 800 staff members in 2021.

4. Arrival

Founded: 2015

Headquartered: Hammersmith and Fulham

Amount raised in last round: $118m (£90.6m)

Arrival designs and manufactures electric vehicles, designed to cost the same or less than petrol and diesel equivalents. The company works specifically on lightweight commercial vehicles, and this year began work on a new electrical bus designed for socially-distanced travel.

Founded in 2015, and headquartered in Hammersmith and Fulham, Arrival has already reached 20% scaleup status, along with raising £396m in fundraising across five rounds. The company has received £7.07m in grants, too.

Arrival raised this equity investment at growth stage for a 9.8% stake, giving the company a £321m pre-money valuation. The purpose of the investment is for increasing its vehicle production capacity, including the launch of a new factory in the US.

The entire investment came from BlackRoc, a high-value investor that tends to invest in non-UK businesses. BlackRoc has made exceptions, though, for companies such as Arrival, Funding Circle, The Hut Group and the aforementioned Cazoo.

Arrival has now recruited over 1,200 employees on its mission to accelerate zero-emission transportation, with offices across North America, Germany, Israel, Russia and the Netherlands.

5. Oxford Nanopore Technologies

Founded: 2015

Headquartered: Oxford

Amount raised in last round: £84.4m

Oxford Nanopore Technologies develops a range of portable DNA and RNA sequencing devices, that are also capable of characterising epigenetic modifications. In simpler words, its technology allows analysis of our cells, no matter how short or long the sequence, providing real-time information. The company was spun out from the University of Oxford, and is another private UK unicorn.

Oxford Nanopore secured fourth-largest round this quarter: an £84.4m investment for a 4.8% stake. The round included participation from International Holdings Company and RPMI Railpen, for the purpose of R&D, funding innovation, and the development of the company’s manufacturing operations.

RPMI Railpen is in charge of investing the railway’s pension schemes’ assets. IHC is a UAE-based fund that focuses on high-growth, tech-driven companies across the world.

So far, Oxford Nanopore has raised £655m over 15 funding rounds. The company appeared on Deloitte’s Fast 50 in 2019, among a host of other high-growth lists. In 2020, the company has been fulfilling orders for over 500,00 LamPORE COVID-19 tests. Oxford Nanopore is nearing 500 employees, and now has offices in the USA, China, and Japan. Plus, its DNA sequencing technology is now used by scientists in over 100 countries.

6. Congenica

Founded: 2012

Headquartered: Cambridge

Amount raised in last round: £39.0m

Cambridge-based Congenica is a genomic analytics company that has developed technology to provide molecular diagnoses of genetic diseases, thus enabling physicians to better tailor treatments. It focuses particularly on the analysis of rare diseases and inherited cancer. Congenica was spunout of the Wellcome Trust Sanger Institute in 2012, and attended the NHS Innovation Accelerator in 2017.

The company raised a £39.0m round of equity investment this month from IDO Investments, Legal & General Capital, Puhua Capital, Tencent, and Xeraya Capital. Additionally, three follow-on investors joined this round: Cambridge Innovation Capital, Downing, and Parkwalk Opportunities.

The investment was raised in exchange for a 42.5% stake, valuing the company at £52.4m pre-money. Congenica has raised £65.8m in total across seven rounds.

Clients include hospitals, academic medical facilities, pharmaceutical companies, and diagnostic laboratories. Its network extends to over 18 countries, and with its latest fundraising sourced from investors around the world, the company is anticipated to expand its global footprint further. Indeed, the reasons for investment were listed as: accelerating international market expansion, and driving expansion of Congenica’s platform into somatic cancer and wellness, and developing partnerships with pharmaceutical companies

7. Envisics

Founded: 2016

Headquartered: Milton Keynes

Amount raised in last round: $50m (£38.8m)

Milton Keynes-based Envisics, founded in 2016, develops holographic technology and augmented reality HUDs (head-up displays) and implements them in vehicles. Its holographic display grants the driver real-time data on the windscreen, such as navigation and hazards information—enhancing the driving experience. The company synthesises many different fields of technology, such as computer vision, machine learning, and big data analytics.

The company raised its first-ever fundraising in October, a £38.8m equity investment from General Motors Ventures, Hyundai, SAIC Capital, and Van Tuyl Companies. You’ll notice that the investors are largely car manufacturers themselves, with many planning to deploy Envisics’ holographic tech in their next generation of cars.

Still in its growth stage of evolution, the company currently has just over 50 employees. Envisics plans to use its £38.8m investment for the development of its augmented reality technology, and prepare for market. Mass production of the vehicles isn’t forecast until 2023.

8. PrimaryBid

Founded: 2012

Headquartered: Westminster

Amount raised in last round: $50m (£38.8m)

Founded in 2012 and headquartered in Westminster, PrimaryBid has created a digital platform allowing private investors to purchase shares in listed companies. By connecting private investors with private companies digitally, Primarybid caters to the market of “retail” investors, rather than “professional” investors. According to the National Office of Statistics in 2018, 13.5% of UK shares belong to UK-resident retail investors.

The company received the sixth-largest investment of Q4 so far, totalling £38.3m from ABN AMRO, Draper Esprit, Fidelity International, LSE, and previous backers Pentech and Outward Ventures. The purpose of the investment is to make new hires, invest in its technology, grow partnerships and expand internationally. Overall, the company has raised £48.5m across seven rounds.

Public investment has risen in recent years—through platforms such as Seedrs and Crowdcube particularly—unlocking more capital, liquidity, and opportunities for investors and investees alike. Though, where Crowdcube and Seedrs crowdfund into private markets, Primaybid allows investors to invest in newly-issued public shares. The demand for public investment grew through COVID-19, as the number of institutional deals slowed and companies cast a wider net to find investment opportunities.

Vinoth Jayakumar, partner at Draper Esprit, said “our investment in PrimaryBid aligns with part of our wider investment thesis to democratise retail investors access to public markets, as well as modernise market infrastructure software.”

9. Rhino Products

Founded: 2003

Headquartered: Cheshire

Amount raised in last round: £36.0m

Rhino Products manufactures a range of accessories for commercial vehicles, including roof racks, ladders, and steps. The company was founded in 2003 and is headquartered in Ellesmere Port, Cheshire. This van accessory business has grown from a local supplier to an international company, with over 125 employees across sites in Cheshire, Flintshire, The Netherlands, Sweden, and Poland.

The company raised an equity investment of £36m from HSBC Commercial Banking and Lloyds Development Capital (LDC) to support the company’s international growth—the company’s first-ever funding round. HSBC and LDC are large-scale equity funds, investing around £11m and £17m per round respectively.

With its £36m investment, Rhino Products is looking to expand even further and “supercharge growth”, as CEO Steve Egerton says. The investment follows strong financial success recently, with revenues increasing by 60% in the last three years. The deal was advised by GCA Altium (Corporate Finance) and DWF (Legal).

10. Streetbees

Founded: 2014

Headquartered: Hackney

Amount raised in last round: $40m (£30.7m)

Streetbees develops software that facilitates the collection of a variety of data from people online. Users are paid small amounts in exchange for sharing aspects of their lives via media (photos, videos and text). Streetbees then uses advanced natural language processing to extract human analytics from the media that users share. Ultimately, Streetbees provides data to its clients to understand their customers—how they interact with brands, and how to understand new, emerging markets.

Over 3.5m users from 190 countries share moments of their life with Streetbees in real-time—that’s around 1million stories a month from users. One example of a pattern that Streetbee’s has picked up is: 1 in 4 people feel lonely when they drink tea. An insight like this can then be sold to brands to inform marketing. Equally, clients can commission Streetbees to carry out certain research and gain data from real people.

The company raised an equity investment from Atomico, Lakestar, LocalGlobe, and Octopus Ventures for $40m (£30.7m), making it the eighth-largest investment of Q4 so far. The purpose of this investment is to open new offices (in US, China, Germany and France), grow the Streetbees team, and launch new product solutions for media and financial services sectors. Founder Tucge Bulut also stated that the company is looking to increase data acquisition rates by 10x.

This Hackney-based, AI-driven SaaS startup was founded in 2014 and has now raised £51.1m across eight rounds. It was featured on the Deloitte Fast 50 ranking last year, and has grown by over 150% YoY through COVID-19. The company has even worked with the NHS to assess public opinion and mood during lockdown.

11. Well-Safe Solutions

Founded: 2017

Headquartered: Aberdeen

Amount raised in last round: £26m

Well-Safe Solutions operates a decommissioning service for spent oil and gas wells in the North Sea, employing new technologies to reduce the cost of decommissioning wells. The company was founded in 2017 and already employs over 80 staff. This Aberdeen-based oil and gas business has raised £95.8m across five rounds altogether.

This £26.0m fundraising was led by follow-on investor MW&L Capital Partners, for the purpose of purchasing assets and funding the next stage of company growth. MW&L Capital Partners is a private investment vehicle that deploys long-term capital across energy, financial, and shipping sectors. It was launched in 2018 by ex-Goldman Sachs partners Matthew Westerman and Julian Metherell, along with the head of Europe’s oldest shipping company, Peter Livanos

12. Cellcentric

Founded: 2003

Headquartered: Cambridge

Amount raised in last round: $33.0m (£25.1m)

Spun out of the University of Cambridge in 2003, Cellcentric develops cancer therapeutics. The Essex-based biotechnology company also has offices in Cambridge, Oxford, and Manchester. It has raised £74.8m in total across 13 rounds, alongside £2.45m in grants.

The company raised an equity investment of $33.0m (£25.1m), invested entirely by follow-on investor Morningside. Morningside is a Hong Kong-based family office investor that typically invests between $1 and $30m, and often invests in pharmaceutical and artificial intelligence companies. Morningside is committed to social responsibility, and has made announced investments into 25 high-growth private companies in the UK including F2G, Evonetix, and Immune Regulation

The purpose of the investment is to expand and develop Cellcentric’s clinical trials of the first-ever “p300/CBP inhibitor”. Essentially, the company has developed a novel drug, called CCS1477, to treat late-stage cancers and fight specific mutations (p300/CBP). Trials are active in ten hospitals across the UK, and are expected to reach the US and Europe in early 2021.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.