Which UK startups are US tech giants investing in?

Category: Uncategorized

The United States has a strong network of innovative startups, from Silicon Valley to New York City and The Research Triangle. With high-tech hubs scattered across the country and a constant supply of talent from world class universities, investors have a wide range of choice as to which businesses they put their money behind.

But increasingly, US funds are looking across the pond for new opportunities. Our recent report with Penningtons Manches looked at foreign direct investment into the UK’s ‘Golden Triangle’, and found that US investors are involved in 10% of investments into, and 40% of the total amount raised by, the UK’s private companies. This post will provide a deep dive into the investment activity of US tech giants, from Amazon to Pfizer, and their venturing arms.

Why is corporate venturing interesting?

Investments made by large organisations are not only a vote of confidence for the recipient company, but may also indicate the direction of corporate strategy; businesses may look to invest in innovative young companies operating in a similar space to their own, in order to facilitate the development of pioneering products and services.

These early stage investments may be the precursor to an acquisition of the smaller company, allowing the tech giant to incorporate and commercialise their intellectual property under their own brand. They may also have other simpler financial objectives, helping to support startups through to a lucrative exit event and substantial return on investment.

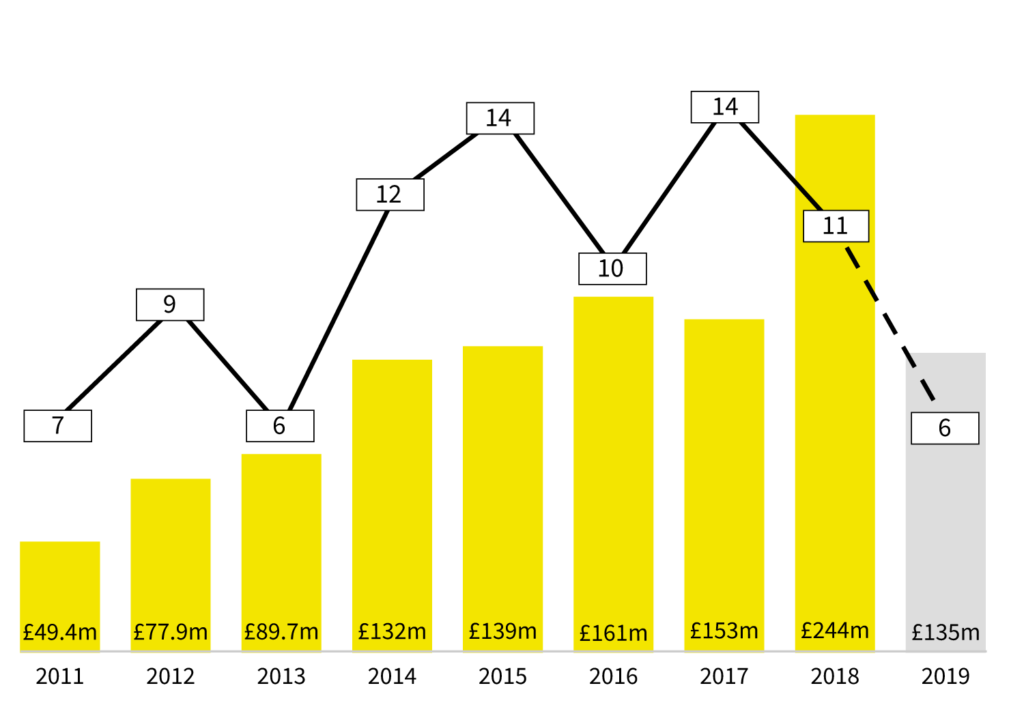

At the moment, US corporate investment represents a fairly small but growing portion of all UK equity investment, facilitating £244m of the £10.9b invested in 2018. Record numbers of equity investment have been made by these international companies in Q1 and Q2 of 2019 so far. So who are the biggest players and which companies are they interested in?

Number of deals and amount invested in UK companies by US corporates

GV (Google Ventures)

GV is one of three corporate venturing firms funded by Google’s corporate parent, Alphabet, and the only one to be active in the UK investment scene. The fund supports the development of commercial products, and has invested in 14 UK based companies at venture or growth stage– around 8% of their portfolio. They most recently participated in a $75m round into payment processing platform, GoCardless, to help the business expand internationally. This appears to be the first time GV have invested in the company, joining a host of other top funds, including Accel, Balderton Capital and Passion Capital.

GV have supported two UK companies that have exited the private market, both acquired in October 2018. The Bitcoin trading platform, Bitstamp, was acquired by Belgium-based investment company NXMH for an undisclosed sale price. Augmented Reality company, Blue Vision Labs, was acquired by the American ride-hailing-app, Lyft – another young company trying its hand at corporate venturing.

Intel Capital

Intel provides growth capital as well as expert advice and support with branding, expansion and customer engagement to companies in the seed, venture and growth stages. Intel has invested in over 230 companies since 2011, five of which are in the UK.

The most recent of these was a $12m round in online games publisher, Polystream. They also backed three funding rounds held by what3words, a location and mapping software company, in 2015, 2016 and 2018.

Three of their UK portfolio companies have reached an exit. Flexenable, which develops flexible hardware, such as phone screens and sensors, was acquired by RUSNANO Capital in 2015. Cellular hardware company, ip.access also exited in 2015, in an acquisition by Zouk Capital. Operating in an entirely different sector, accommodation onefinestay was acquired a year later by AccorHotels.

Pfizer Venture Investments

Pfizer is a New York-based pharmaceutical giant, with an annual budget of $50m for its venture fund. The focus of this fund is to “identify and invest in emerging companies that…have the potential to enhance Pfizer’s pipeline and shape the future of our industry.” With the UK’s world-class university and research units, it isn’t surprising that some of these pioneering pharmaceutical products can be found in British companies. The fund supports companies at all stages of growth and is focused on a range of healthcare-related areas, from therapeutics and diagnostics to drug discovery and healthcare IT.

Since 2011, the venturing arm has invested in over 35 companies, six of which are in the UK. Most recently (May 2019) they participated in a £14m round by the Cambridge University spinout, Storm Therapeutics, a company that aims to develop cancer treatments based on small molecules that affect sections of genetic code. Only one of their UK investments has since exited; Ziarco, which develops pharmaceutical products for inflammatory diseases and allergies, was acquired by Novartis in December 2016.

The Alexa Fund

Run by Amazon, the Alexa Fund invests at all stages of a company lifecycle in any location, providing hands-on development support and opportunities to showcase at its events, as well as equity investment. In the audio-technology arms race between Amazon, Apple and Google, partnership with and the development of innovative startups in the space will help elevate Amazon’s Alexa product and services. To this end, the fund has invested in two UK companies, Sensible Object, who have scope to integrate Alexa voice-technology into their digital board games, and Musaic, who develop HiFi systems for streaming music.

Qualcomm

Qualcomm have a few different funds for their corporate venturing function, one focussed on AI and another on Life Sciences, in addition to their main function which invests across various types of technology.

Qualcomm have over 120 portfolio companies, 12 of which are based in the UK. These include OpenSignal, a mobile connectivity database, Reach Robotics, robot gaming company, and Formula E, who organise and promotes the FIA electric car racing championship. Qualcomm has seen four of its portfolio companies through to acquisition, and one crash into administration. The corporate supported augmented reality startup, Blippar, from their very first round in January 2012, up until their last ditch funding round, in an attempt to stay afloat in September 2018, before going in to administration three months later.

How will the market develop?

It’s interesting to note that none of these corporate venturing arms have gone on to acquire their UK portfolio companies – in most cases it’s other foreign investors who have facilitated the exit events. Nevertheless, the Digital Competition Expert Panel have got their eye on this section of the market. In a recent report they highlighted the risks that acquisitions and mergers led by tech giants can pose for the flourishing tech scene in the UK; corporates hold such significant market share that they can stifle competition by preferentially supporting their own investment portfolio, or through oppressive pricing strategies.

Only time will tell if these corporate transactions will swallow up a more significant portion of the UK’s startup scene, but for now they seem to be helping to support and develop the market, something we can’t have too many complaints about in the midst of such macroeconomic uncertainty.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.