Ambitious startups shaping the AR and VR landscape

Category: Uncategorized

The rise of augmented reality (AR) and virtual reality (VR) technology has been well documented for a while now. We have seen major developments from tech powerhouses including Apple and Google, who have both made AR a clear focus for their latest (and future) phone models.

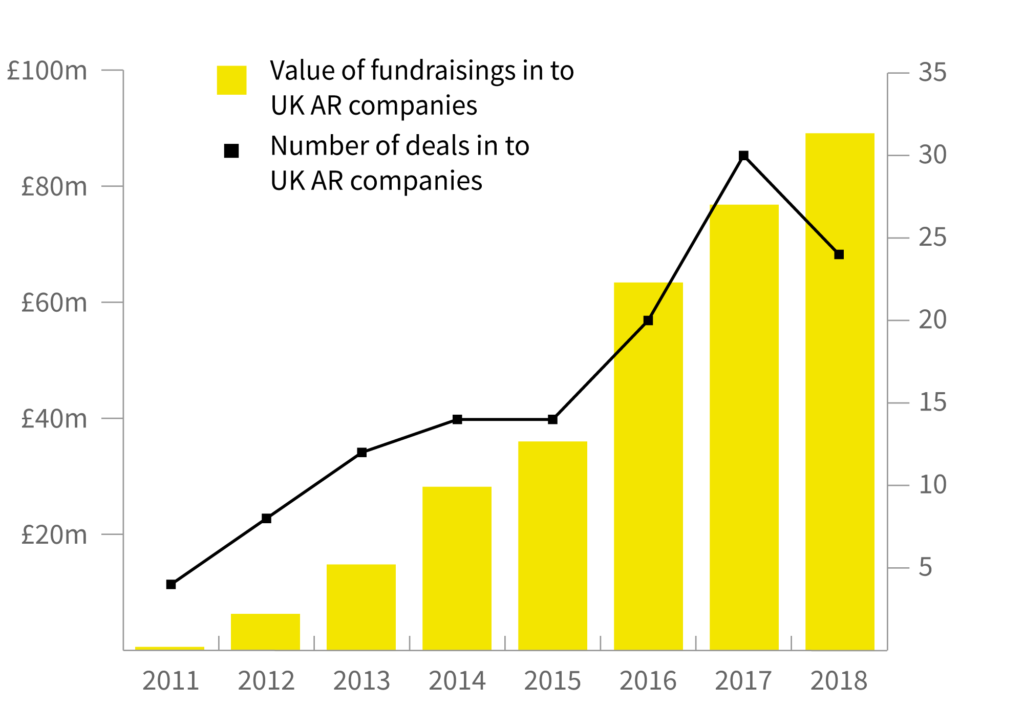

For the first time since 2011, the number of deals for augmented reality companies dropped, from 30 in 2017 to just 24 in 2018. However, total value of fundraisings for the year increased from £76.8m to £89.1m, showing an increase in average deal size.

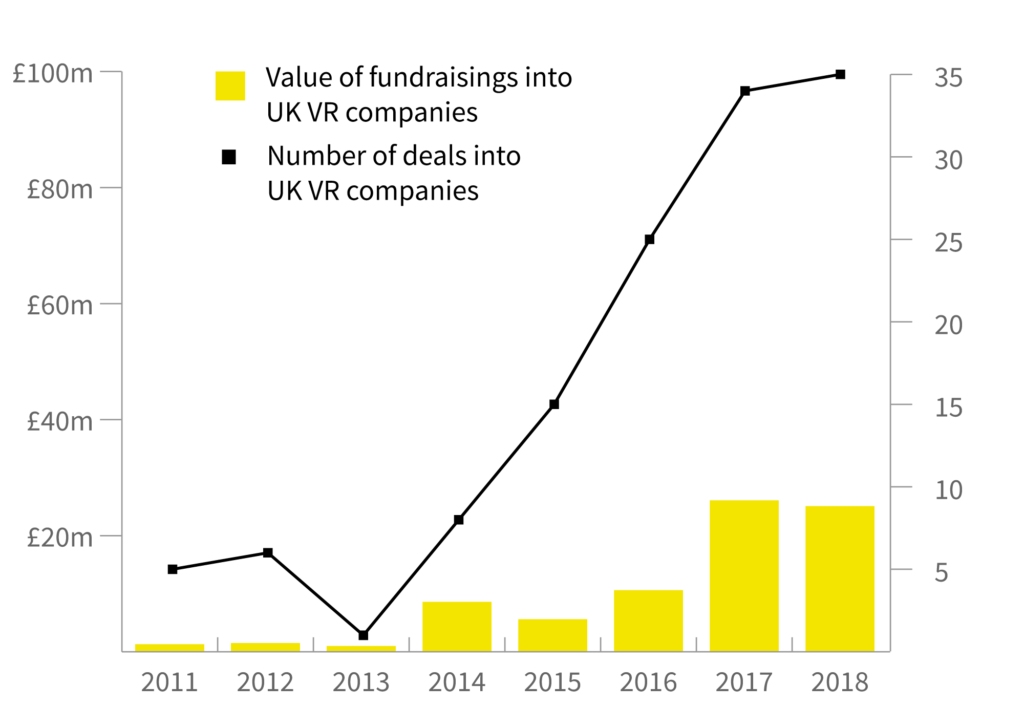

Virtual reality is also a growing industry, but is currently less developed. 66% of companies are in seed stage compared to just 55% in AR, and more deals but less money is going into the sector. There were 35 deals in 2018 totalling £25.1m, compared to 34 deals totalling £26.1m in 2017.

For those not familiar with the difference between the two, augmented reality layers computer-generated content onto real images, often through the use of a camera, while virtual reality creates an entirely computer-generated environment, often experienced through the use of headsets or goggles. Developments in both sectors have seen new uses for the technology, including health and well-being and more enterprise focussed uses such as adtech, rather than just gaming and entertainment. This post takes a look at some of the most interesting segments AR & VR companies are operating in in the UK, and some of the competition they face.

Wearables

WaveOptics was founded in 2012 and designs components for AR glasses and other wearables. Hoping that their ‘diffractive waveguides’ represent the next evolution in wearable AR technology, the growth stage company is aiming their technology at industrial, enterprise and consumer markets. The company has raised £33.2m in announced fundraisings since its inception, with £20.8m raised in December from a group of investors including Octopus Ventures and Robert Bosch Venture Capital.

The race is on to take AR wearables mainstream, but it’s been no easy task. Google’s pioneering foray into this market, Google Glass, was by all counts a failure; the product received widespread criticism and was later dropped. Last year a new enterprise edition of the product was released, and has received lukewarm reviews so far.

Intel also made a move with their Vaunt smart glasses, releasing a prototype in April 2018, but announced they were abandoning the project just two months later. Microsoft HoloLens has ventured in to the world of mixed reality, a combination of AR and VR in which physical and digital objects can interact. Having received positive reviews, the HoloLens is a big threat to other developers of AR wearables.

Social Networks

The biggest single raise by a VR company in 2018 was vTime’s £5.36m round in April. The company develops a VR social network app, where users can interact with friends in an immersive virtual world. vTime was founded in 2013 by video-game developer Martin Kenwright, and is based in Liverpool. Since its inception, it has secured two fundraisings totaling £8m.

vTime face competition from social media king, Facebook, who last year released a beta of ‘Facebook Spaces’, their own take on social VR. This follows on from their 2014 acquisition of Oculus Rift, one of the leading developers of VR headsets.

AdTech

The biggest single raise of the year in AR was from Blippar, who received $37m in September from a group of investors, including Candy Ventures and Qualcomm Ventures. Overall, the company raised a whopping £110m over the course of a six and a half year period, and faced financial collapse in December 2018, citing it as an ‘an incredibly sad, disappointing, and unfortunate outcome’. But just this week, reports surfaced that the company is making a comeback, after its IP was purchased by Candy Ventures.

The company was established in 2011 and after a pivot from a B2C to B2B model, they recently launched their Blippbuilder app, which allows marketers to create AR powered campaigns without needing any coding skills.

Also operating within AR and AdTech, Mirriad develops technology that digitally places brand imagery into TV and videos, meaning the ads cannot be skipped. Spunout from the University of Surrey in 2008, Mirriad have raised £32.1m over 12 rounds, along with £3.31m worth of grants. They floated on AIM in December 2017 for £25.4m and count Samsung, Ford and Virgin Media as clients.

Health and Well-being

Oxford VR, a spinout company from the University of Oxford, is developing mental health treatments that utilise VR technology. By creating immersive simulations of a variety of different scenarios, they claim they can help users to ‘practise more helpful ways of thinking and behaving’. For example, VR exposure therapy can provide the first step in confronting a fear of heights. The company raised the second biggest single fundraising of a UK VR company in 2018, with a £3.2m round in September at a £6.98m pre-money valuation.

Another spinout from the University of Oxford, OxSight have developed AR glasses called ‘SmartSpecs’, a system of devices to help people with severe visual impairment navigate independently. The system uses cameras and computer vision algorithms to detect and highlight objects in real-time, creating an interactive overlap over the wearer’s normal vision. The venture stage company has raised £3.4m over 2 funding rounds, and graduated from the Royal Academy of Engineering’s Enterprise Hub in 2015.