The UK’s Most Active Impact Investing Funds

Sarah Cheeseman, 10 August 2023

Over the last decade, impact investing has become an increasingly popular avenue of deploying capital in the UK. Yet just 1% of UK equity funds meet our definition of impact investors, despite evidence suggesting that purpose-led investment strategies are not just beneficial to the world, but also less likely to fail.

In this article, we explore the latest data on impact investing in the UK, and spotlight the most active impact funds in the high-growth ecosystem.

What is impact investing?

Impact investing is a strategy through which funds look to generate positive (and measurable) social or environmental impact, alongside a financial return.

How Beauhurst classifies impact funds

‘Positive impact’ means different things to different people, so establishing a precise definition of this type of investment is complex. For the purposes of this article, we’ve focused on intent: we only included funds that explicitly state that having a positive social or environmental impact is central to their investment decisions, and not just a byproduct of philosophy or sector restrictions.

We currently track 72 impact funds in the UK equity market that match this description, from specialised private equity and venture capital firms to angel networks.

For a list of investors generating a positive social impact by backing underrepresented founding teams (as opposed to companies whose products or services are impact-led), take a look at these 16 diversity-focused funds.

What are the main drivers for investing in impact funds?

There are a number of reasons why investors may take particular interest in impact funds, largely driven by a combination of financial, social and environmental motivations. These can include an alignment with their personal values, or choosing to work with companies that are addressing social and environmental challenges such as climate change, poverty, education or healthcare.

Some investors also recognise that these environmental and sociological issues present risks to businesses in the long-term, choosing instead to invest in companies that are actively managing these risks and promoting sustainable practices. Similarly, many impact-focused companies are forward-thinking and focus on sustainability, innovation, and social responsibility. These factors can contribute to their long-term profitability and potential for growth, making them attractive investments for the future.

How is impact measured and evaluated?

To determine whether the intended impact goals are being achieved, there are a number of common methods and frameworks that can be used. These include (but are not limited to):

Impact Metrics and Key Performance Indicators (KPIs)

These metrics can be quantitative (e.g. the number of people lifted out of poverty, carbon emissions reduced, clean energy generated) or qualitative (e.g. improvements in quality of life, community engagement, gender equality). Regularly tracking and analysing these metrics help assess the progress and impact of the investment.

The Impact Management Project (IMP)

IMP is a collaborative effort by over 700 organisations to arrive at shared fundamentals for measuring, managing and communicating impact. It has developed a standardised framework for impact measurement. It provides a set of five dimensions to assess an investment’s impact: what, who, how much, contribution and risk. The framework encourages investors to be clear about their impact goals and provides guidelines for data collection and reporting.

Social Return on Investment (SROI)

SROI is a methodology that quantifies both financial and social returns generated by an investment. It assigns monetary values to social outcomes, allowing investors to compare the social impact of different investments and determine the ratio of social value created per unit of investment.

United Nations Sustainable Development Goals (SDGs)

The SDGs are a set of 17 global goals adopted by the United Nations to address various social and environmental challenges. Impact investors often align their investment strategies with specific SDGs and track their progress towards contributing to these goals.

What is the average return on impact funds?

According to a report released by the Global Impact Investing Network (GIIN) in October 2022, 88% of impact investors reported that their investments met or exceeded their expectations. The median return on their investments was 6.4%, compared to non-impact funds at 7.4%.

The report also found that global impact investing has continued to show growth, topping $1tn in the US for the first time in 2021. Investment in impact funds is expected to grow exponentially over the next few years, driven largely by the United Nations’ Sustainable Development Goal to reach net-zero emissions by 2050. This means that huge amounts of money will need to be invested into environmental causes especially in a bid to create more positive impact.

While the report showed that the US and Canada accounted for around 50% of the impact investments around the world, European impact investors made up nearly a third of the market.

The UK’s impact investing market

The Global Impact Investing Network (GIIN) estimated in its 2020 Annual Impact Investor Survey that social impact investing had a global market size of around $715b, with particular progress being made in impact measurement and impact management. And research by EY and the Impact Investing Institute suggests that the UK market for impact investments reached £58b in AUM by the end of that year.

Based on the 72 active impact funds we’ve identified, plus those that are no longer active, we’ve analysed impact investment trends in the UK private sector. Similarly to GIIN’s research findings, we’ve seen a huge rise in the number of announced equity deals involving UK-based impact investment funds—from just 11 rounds (worth £188m) in 2011, to 209 rounds (worth £1.88b) in 2021. However, investments have started to decrease since 2021, and in 2023, we’ve seen 140 rounds, totalling £602m.

Fast-growing impact businesses that have secured the most equity funding so far, including Tandem who secured the most fundraising from these funds, at £362m. Tandem is creating an internet-based retail banking platform that emphasises eco-friendly finance, offering options like green fixed and instant access savings accounts.

Then there’s Neon—Neon is working on an application that offers virtual and digital payment processing solutions, in addition to providing loan services. This company secured the second highest amount of investment from these funds, £314m.

Impact investments are less likely to fail

At the onset of the COVID-19 pandemic, impact investment activity was hit harder than the wider UK equity market: in June 2020, we reported a 37% drop in deals announced by impact funds since the start of the year, compared to the same period in 2019. This decline was markedly worse than the 25% decline across all announced equity deals.

Once the initial shock of the pandemic subsided, however, impact investing rebounded. In fact, it may have been better placed to weather the storm—as funds typically apply more risk-averse investment strategies during times of crisis, and impact investments are increasingly being recognised as a safer bet. According to impact organisation ReGenerate, “the pandemic has strengthened the now overwhelming case that purpose-driven companies not only do good, but they are also more likely to be successful and sustainable.”

The dual objective of meeting financial goals and having a positive impact on the planet and its people is what sets impact investing apart from other forms of investment. Impact investing is sometimes mistaken for a charitable pursuit, but the potential for financial returns from these deals should not be understated.

In the UK, companies are considerably less likely to fail if they’re backed by an impact investor. In 2021, we found that just 11% of businesses that secured equity investment from an impact fund between 2011 and 2020 had since ceased trading or become inactive, versus 17% of those that received funding from conventional investors. At the other end of the scale, 23% of companies that received investment from impact funds had progressed to a later stage of evolution, compared to 18% for those raising funds from conventional investors.

Our methodology

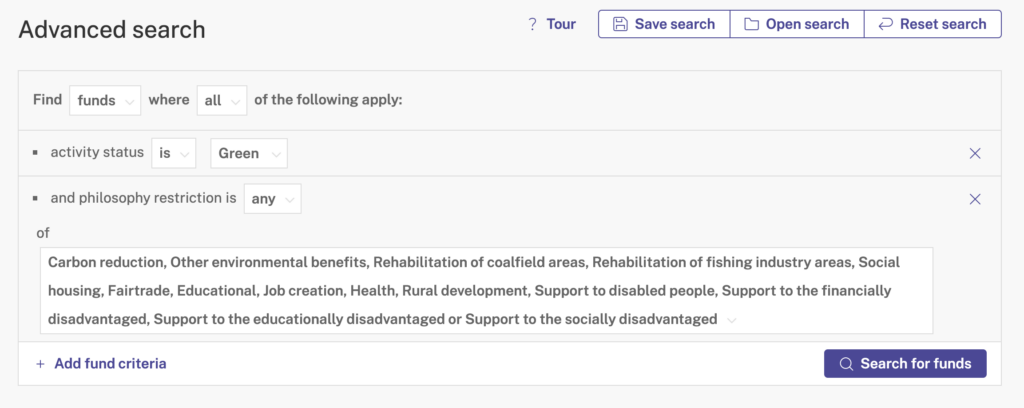

Finding active impact funds isn’t wholly straightforward so we’ve used a unique methodology to narrow down our search.

For this article, we’ve looked at all funds with a green activity status. And then added a philosophical restriction of:

- Carbon reduction

- Other environmental benefits

- Rehabilitation of coalfield areas

- Rehabilitation of fishing industry areas

- Social housing

- Fairtrade

- Educational

- Job creation

- Health

- Rural development

- Support to disabled people

- Support to the financially disadvantaged

- Support to the educationally disadvantaged

- Support to the socially disadvantaged

Most active impact funds in the UK

Impact investors in the UK are taking on all kinds of responsible investment opportunities. This includes urban farming startups and microfinance firms, to triple bottom line B Corps and social enterprises supporting the UN’s Sustainable Development Goals (SDGs). But which funds are the most active in the UK’s impact investment space?

Our data indicates that Ascension is the most active UK impact fund to date, having announced 222 equity deals with high-growth UK companies since 2012. They are followed by Omidyar Network with 74 equity deals to date, and Green Angel Syndicate with 50 investments.

In our previous summary, Nesta Impact Investments were at the top of our list, having raised a total of £237m with high-growth UK companies since 2011.

Ascension

Ascension is an early-stage venture capital firm that backs promising tech and impact entrepreneurs. They were voted Seed VC of the Year in 2022 and have been the most active investor in London over the past decade. The fund typically invests between £500k to £5m, largely focusing on software-as-a-service (SaaS) companies, such as blockchain technology company Blokur and CGI and VFX developers Gendo AI.

To date, they have participated in 222 fundraisings, totalling £298m.

Omidyar Network

Omidyar Network invests globally—including in the UK. This is a philanthropic investment firm, the fund given support market-based approaches with the potential for large-scale, catalytic impact. Its average investment is £12.9m, and over 74 fundraisings they’ve invested the most money over any other fund—£811m.

Green Angel Syndicate

Green Angel Syndicate represents the United Kingdom’s most expansive collective of specialised investors dedicated to combating climate change. The fund invests in projects to develop green technologies and solutions. And it typically invests between £150k and £1.5m. Its largest investment was given to QLM Technology, for £12.0m.

To date, they’ve invested in 38 companies, totalling £124m.

Summary

To summarise, the landscape of impact investing in the UK, although still a small fraction of the overall equity funds, is showing promising growth and potential.

The exploration of the most active impact investing funds within the high-growth ecosystem highlights a significant trend: investors are increasingly recognising that financial returns can coexist with positive social and environmental impacts. This synergy not only promotes a healthier economy but also fosters a more sustainable and equitable society.

Find active impact funds.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.