How To Value A Startup

Category: Uncategorized

At Beauhurst, we’ve a created a unique and comprehensive database of the UK’s high-growth private businesses. While many of these companies will go on to be worth many millions, it can be very difficult to value them early on in their growth. Using previous valuations and comparables, our platform helps finance professionals to value young companies. So how exactly do you value a startup?

Forward-looking valuations

Many metrics can be used. Sometimes, the valuation of a company will focus on how much profit the business currently generates. In this case the value could reach up to seven or eight multiples of how much profit they’re currently making per year. However, this becomes problematic for startups, the vast majority of which fail to generate profit during a significant part of their initial lifecycle. Furthermore, after many years of unprofitability, successful startups can then become very profitable indeed (Facebook took five years to turn a profit). Valuations with younger companies are very often extremely forward looking, with emphasis put on growth and revenue/profit potential rather than current status.

How does Beauhurst help?

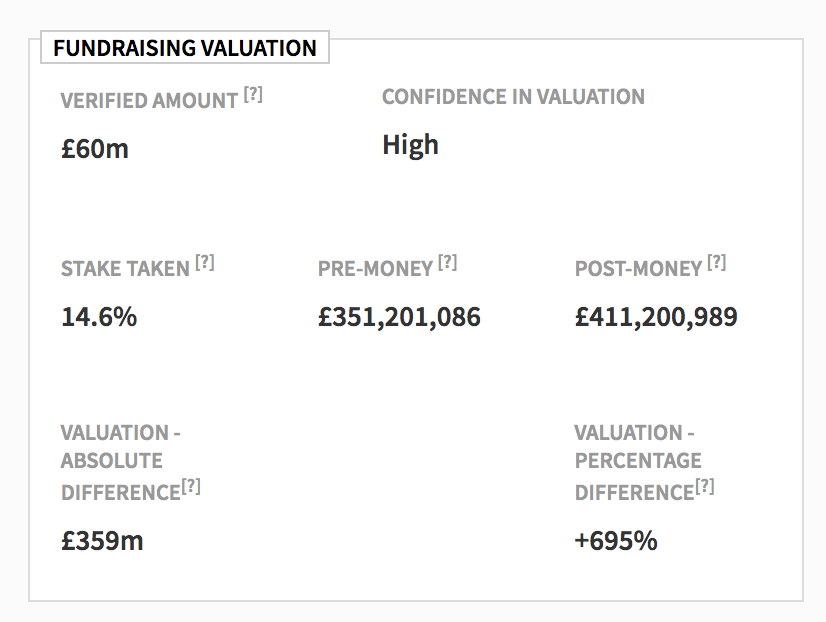

It’s possible to discover a startup’s valuation at the point of equity investment through company filings – even when not announced to the press. Companies are obliged to disclose whenever they issue a new round of shares, and at what price the new shares have been bought. This means a total share value can be calculated. Because this isn’t always as straightforward as it might seem, we even provide a confidence measure, showing where we think that figures might need to be taken with a pinch of salt, and where they should be reasonably reliable.

Whenever these rounds are disclosed on CH, we verify their validity against the company’s current size and performance. Our valuation data provides users with easy-to-access comparable deals across a particular sector, buzzword or stage of evolution, helping to inform new valuations whenever a new investment is made.

Being able to search over thousands of companies and their fundraisings means that advisors, funders (and indeed, business owners) can easily find equivalent past deals to their own upcoming fundraising, helping them to provide context to the market and, ultimately, help them arrive at a sensible valuation.

Case study: OVO Energy vs Bulb

At this point, it might be helpful to compare two competitors, one of which has recently received a valuation in their filings, compared with one which hasn’t. Bulb and OVO are two very similar companies, working to disrupt the UK’s retail energy market (i.e. the market through which property occupants purchase energy). This market has been described by various commentators, including the Government, as broken. OVO and Bulb have taken a tech-enabled approach, with a keen focus on customer service, to win a small but significant market share (5.4% between them).

As we reported last month, recent Companies House filings indicate Bulb has received a valuation of around £350m. This has grown quickly from their last valuation of around £50m last September, constituting a 700% increase in just under a year. The company was incorporated in late 2014, making it around four years old.

Bristol’s OVO Energy, meanwhile, is much more established, having supplied gas and electricity to customers since 2009. From 2014 to 2016, they more than doubled their turnover, from £317m to £717m. Operating profits jumped from -£30m to +£23.7m. In 2017 it made two acquisitions as it prepares for the increasing “distribution” of the energy market, and in 2018 they had enough spare resource to sponsor the Tour of Britain bike race.

OVO was valued at around £300m in April 2015. From their publicly available financial statements (which admittedly give a limited business picture), proven profitability, alongside their recent investments in broader energy infrastructure, you might think OVO would achieve a much higher valuation than Bulb.

The traditional profit multiplier method would yield a valuation of around £200m. Clearly that figure is too low. It also doesn’t take into consideration OVO’s past growth, having doubled their turnover and become profitable in the 12 months up to December 2016. Their customer acquisition is also still growing strongly. In the six months up to 30th June 2017, the company averaged a customer account of around 819,000, up from 676,000 at the end of 2016, an increase of around 21%.

This is impressive, but it doesn’t match the current customer acquisition rate of Bulb. Between May and August this year, the company’s customer base grew from 300,000 to 630,000. Whilst currently loss-making, this helps explain the company’s large valuation – investors are betting this rate will continue.

How to value a startup like OVO today, then? As you can see, it’s a tricky process, with an array of different factors to weigh in on. Will Bulb continue to take customers from the Big 6, or eat into OVO’s customer base? Will OVO continue to diversify into an integrated energy company? If so, what infrastructure will they develop/acquire? Will their healthy customer acquisition rate continue?

Judging by their growth since the last valuation, and comparing them with Bulb’s, you could reasonably expect OVO’s value to have doubled, to around £600m. Even that seems low, considering their profitability, and recent investments in broader energy infrastructure. £700m ($897m) seems, as a very rough ballpark figure, more suitable. This figure would take them close to the coveted “unicorn” figure of $1b.

Want to find out more about how Beauhurst helps advisors? Read some of our case studies, or check out how different industries are using our data to help them work with high-growth companies.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.