How to find companies that need funding and the funders that will back them

Category: Uncategorized

Our clients use our platform for many different functions, but one of the most popular is to find companies that need access to finance, and identify the funds and grant awards that would be appropriate for them.

This matching of companies to funding is largely carried out by Corporate Finance professionals, but can also be performed by local authorities and growth hubs that are encouraging inward investment in their areas. In this article, we’ll walk you through some of the search criteria you can use to identify companies in need of finance, and quickly match them with different funding options.

1. Companies that last raised funding 4 – 6 months ago

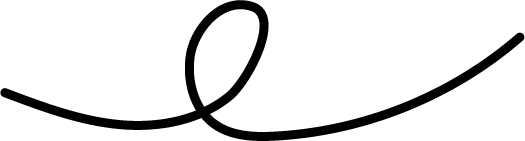

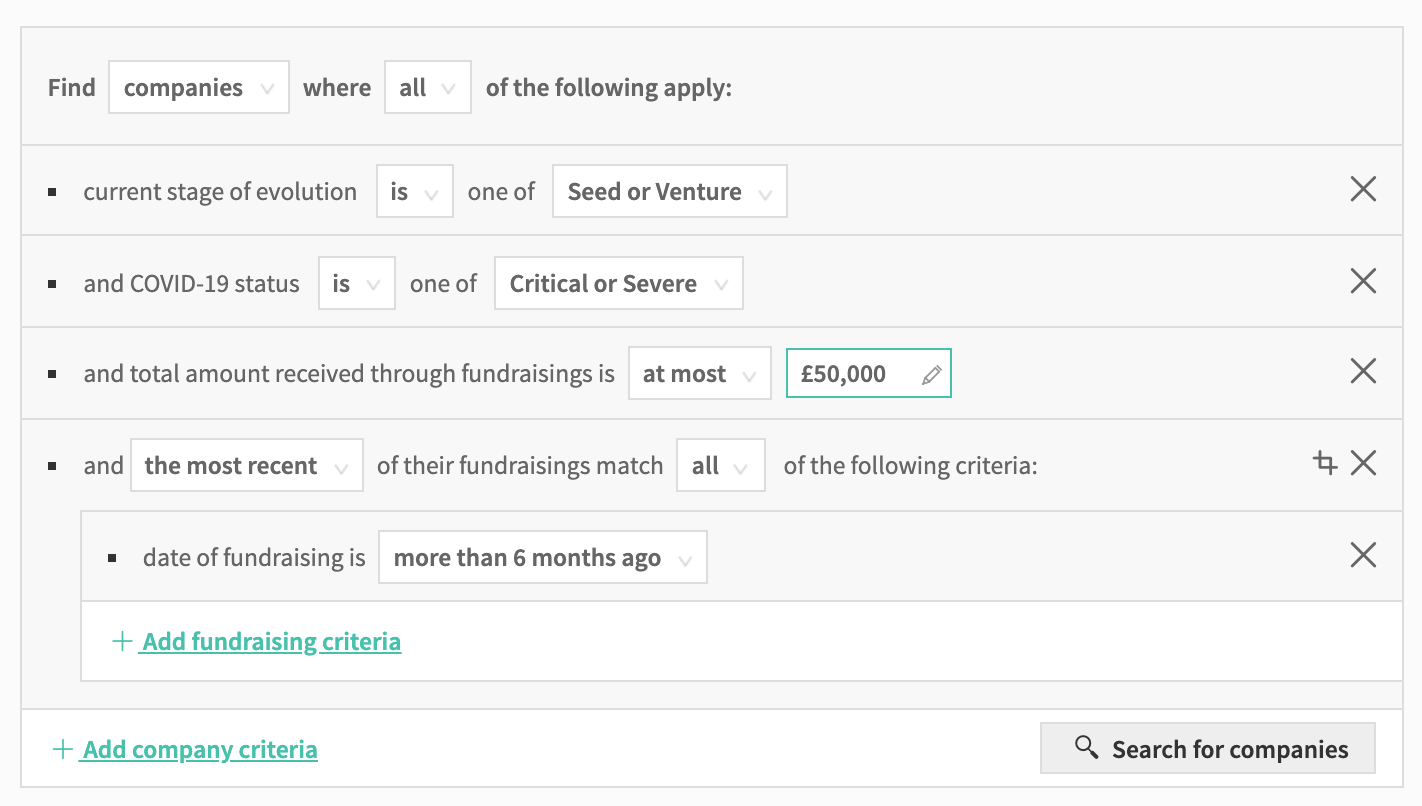

One of the ways to identify companies in need of finance is to search for those that last raised many months ago. With Beauhurst, you can search for companies whose latest round was completed before a certain date, or within a certain time frame.

Our data shows that the average time between fundraisings is between 13 to 15 months, with later stage companies lasting a little longer between rounds. These averages are also affected by the sector of operation. For example, equity-backed companies operating in the biomass and biofuel industry have an average of 16 months between funding rounds.

Companies will usually start working on a new funding round at least 6 months before they need the cash.

2. Companies that have recently raised a friends and family or angel round

Sometimes, founders of ambitious companies draw on their network of friends and family to fund the early-stages of growth, using a small amount of equity finance to develop a proof of concept or minimum viable product. But once they’ve got to that point, they’re likely to need the investment of venture capital funds (which have much larger pools of money as well as industry knowledge) in order to reach the next level.

Most companies won’t explicitly say when they’ve raised a friends and family round. But they’re fairly straightforward to identify using Beauhurst’s advanced tools to search over unannounced fundraisings.

These rounds are usually completed in the seed stage of a company’s evolution – very few founders will be lucky enough for their friends and family to be able to invest at the more competitive, later-stage rounds. The amount raised will be relatively small, usually around £25k, and there will only have been one or two rounds completed by the company in total.

3. Companies nearing the end of an accelerator programme

Accelerator programmes are a fantastic – and very popular – method of growth for fledgling ventures. We currently track 164 accelerator programmes across the UK, which provide their cohorts with a range of benefits including (but not limited to) mentoring, office space and access to networks.

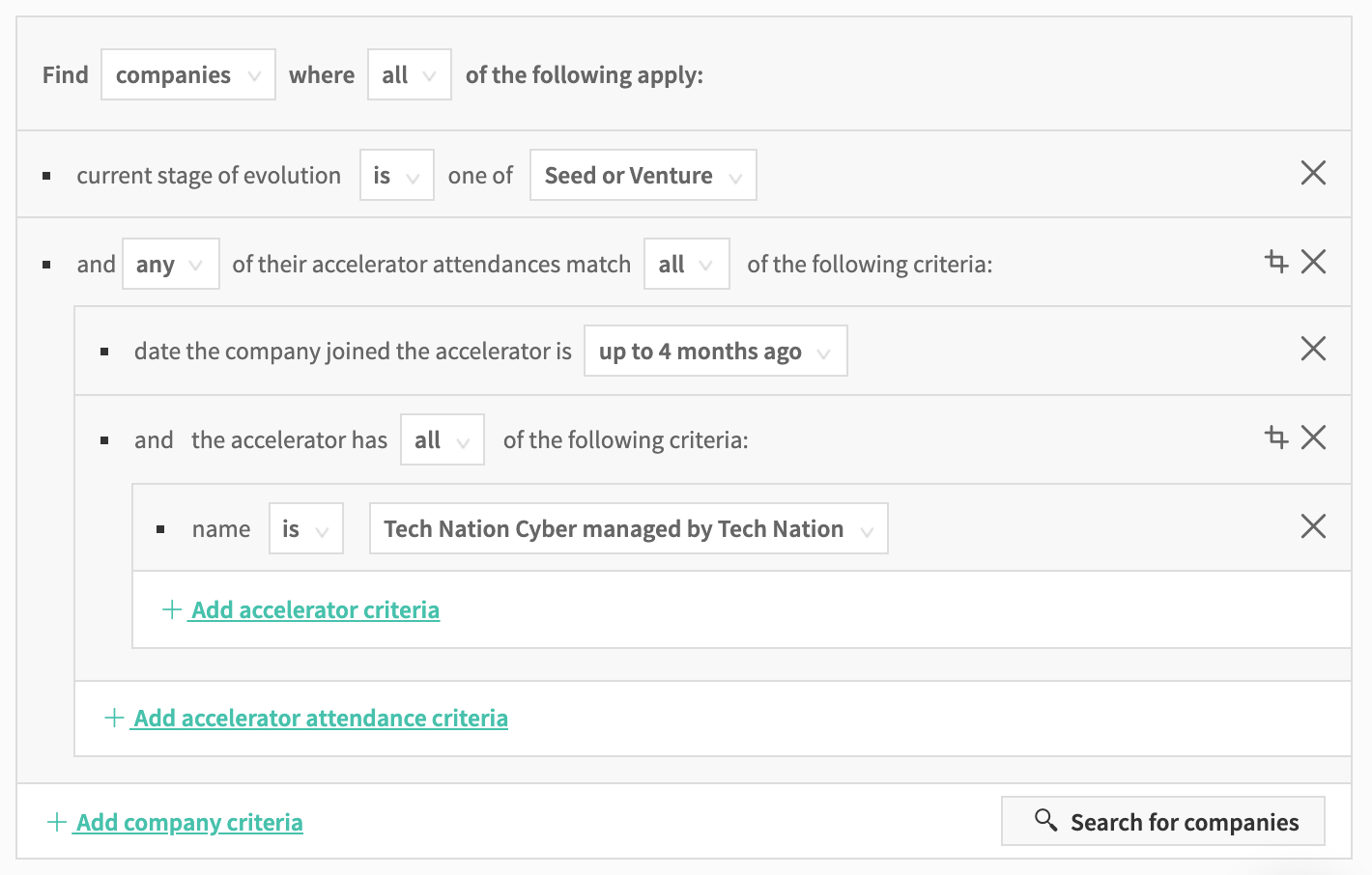

Most accelerators will end with a pitch day, where founders will have a couple of minutes to present their startup to investors. But founders won’t always find the right fund for them, and it’s always good to have options. Companies that are nearing the end of an accelerator programme are likely to be open to new funding opportunities, so it’s good to know who they are, and make sure that they know who you are too.

Most accelerator programmes run for either 3 or 6 months and will have a regional or sectoral focus. For a more granular search, specify which accelerator programmes you’re interested in.

4. Companies negatively impacted by COVID-19

Our data team have undertaken a massive project to map the impact of COVID-19, and the measures put in place to slow it, on every one of the high-growth companies tracked on the Beauhurst platform. We found that 16% of high-growth companies are critically or severely impacted, meaning that they’re suffering severe disruption or facing an existential threat to their ability to operate.

Although many of these companies won’t have been on the lookout for finance before the pandemic hit, the degree to which they’ve been affected may mean that they’re now in desperate need of funding.

Simply add the COVID-19 status on top of your other search criteria and select the categories you’re interested in. For an even more powerful search, combine this criteria with our previous suggestions to get a targeted list of companies that are very likely to be looking for new funding options.

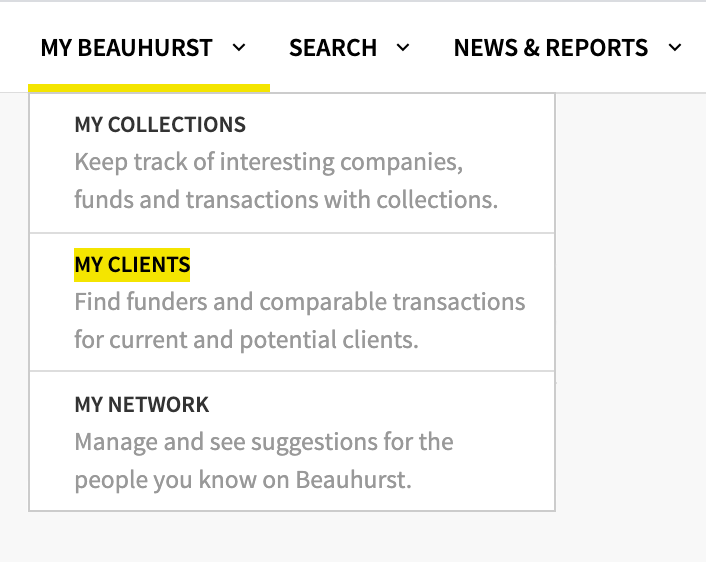

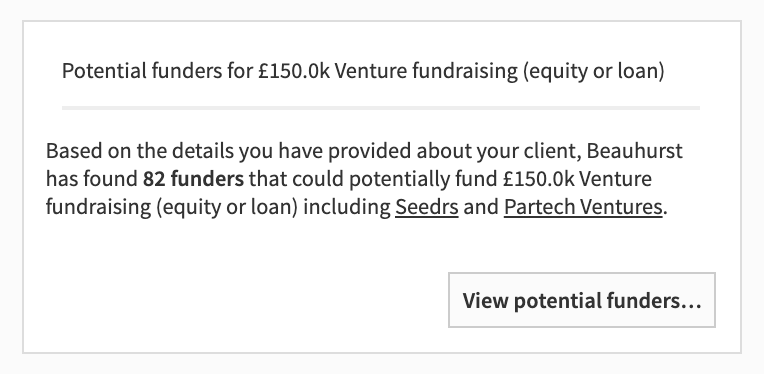

Finding appropriate funding options for your clients

Now that you have a solid selection of companies that need finance, it’s time to find the funders that will back them. Our nifty My Clients tool allows you to find these in a flash, walking you through simple questions about your new client and resulting in a tailored list of all the relevant funding options.

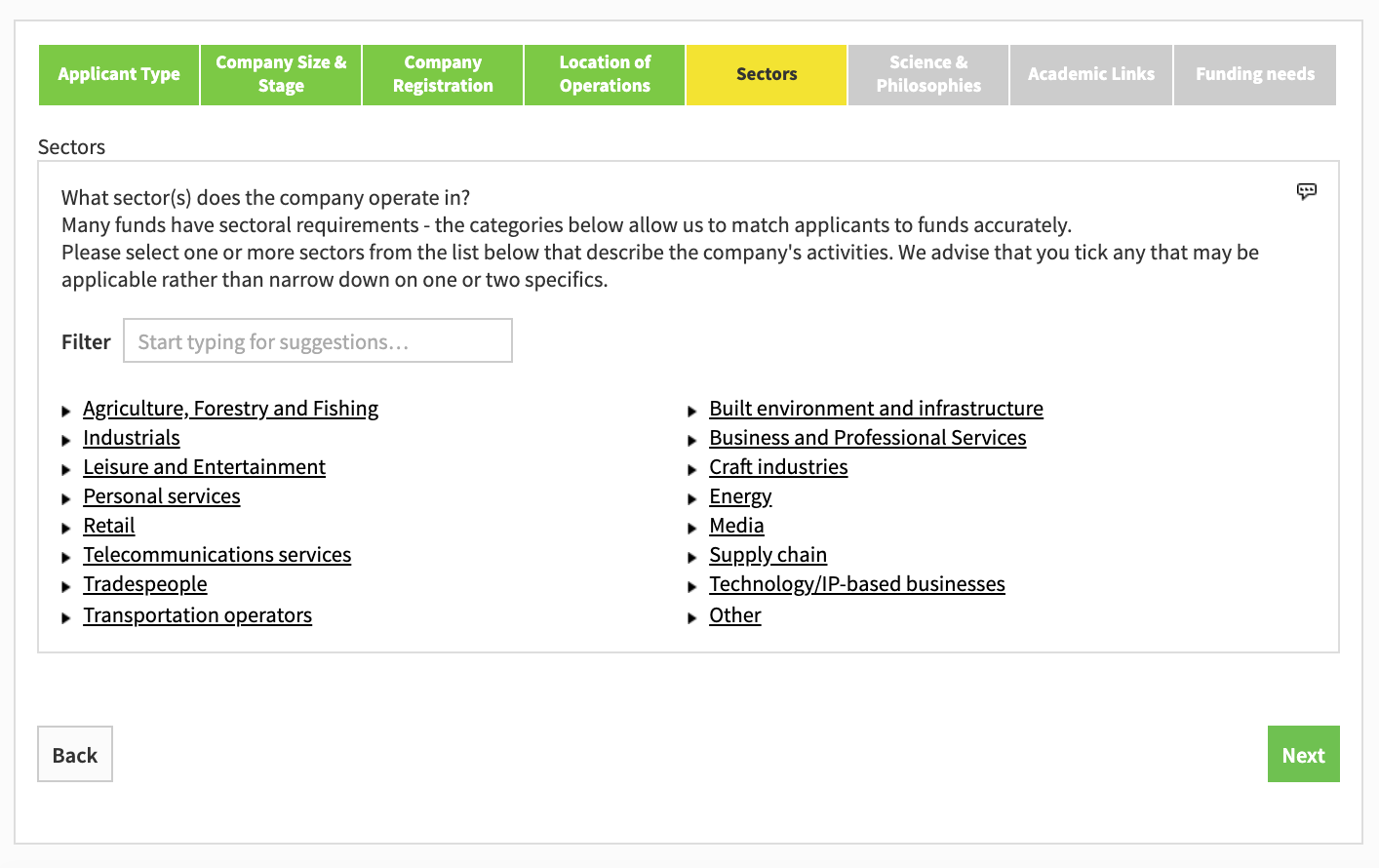

You’ll be asked a series of questions about your client, such as the number of employees, revenue and profit over the last year, location, sectors of operation and any social aims of the company. You’ll even get to specify if the company is female-founded, as some funds focus on investing in women.

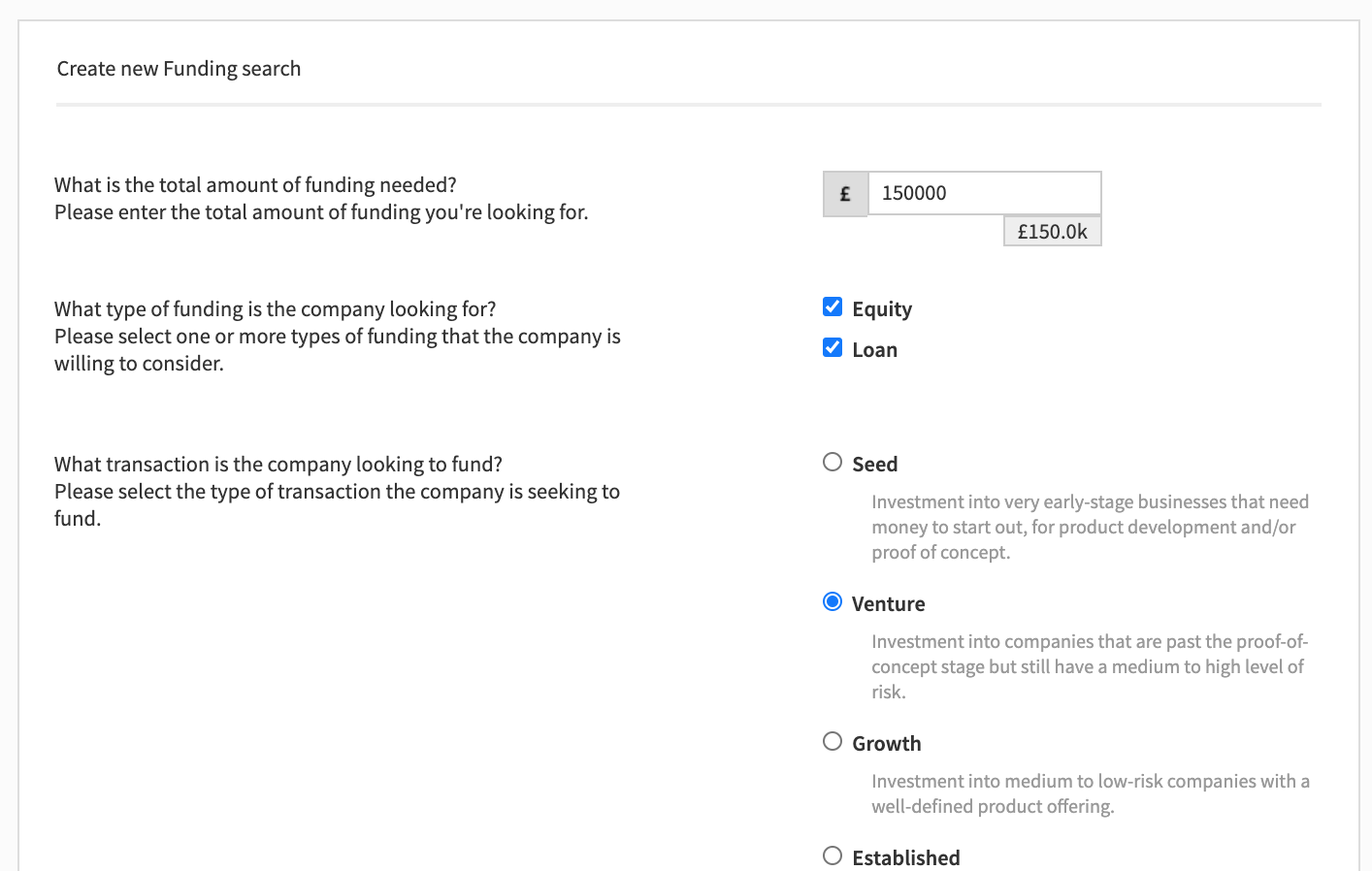

Once the company profile is completed, you’ll be asked a few questions about their funding needs. How much money are they looking for? Are they looking for equity or loan finance? Are they willing to consider investment from more than one fund?

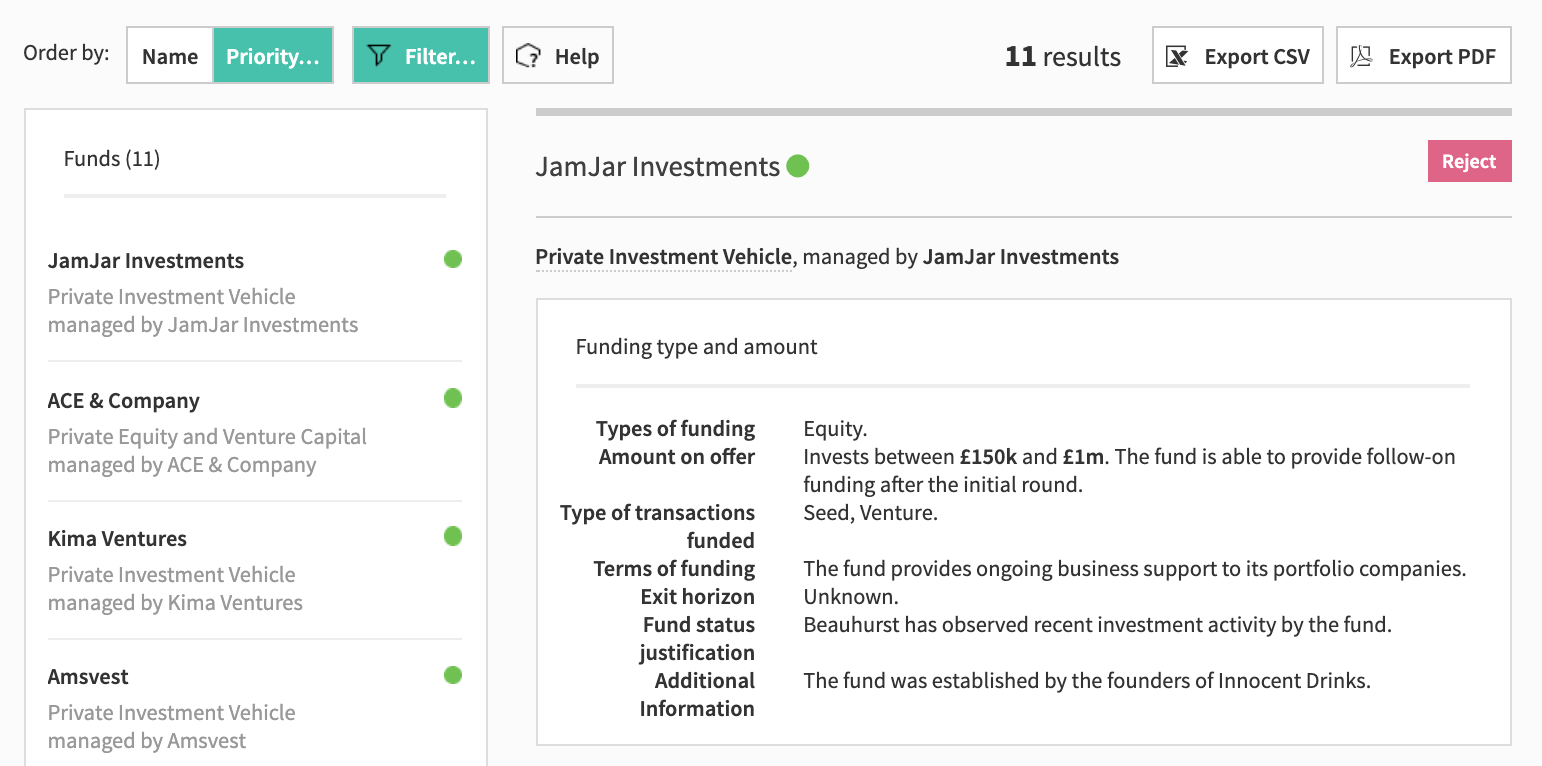

Filter the list by the activity status and type of fund (e.g. just look at VC funds that are confirmed to be actively investing). Click on the name of a fund to see full details, and ‘reject’ any that don’t seem to be a good fit for your client. Once you’re happy with the results, start reaching out with verified contact details, or export the list to csv or pdf.

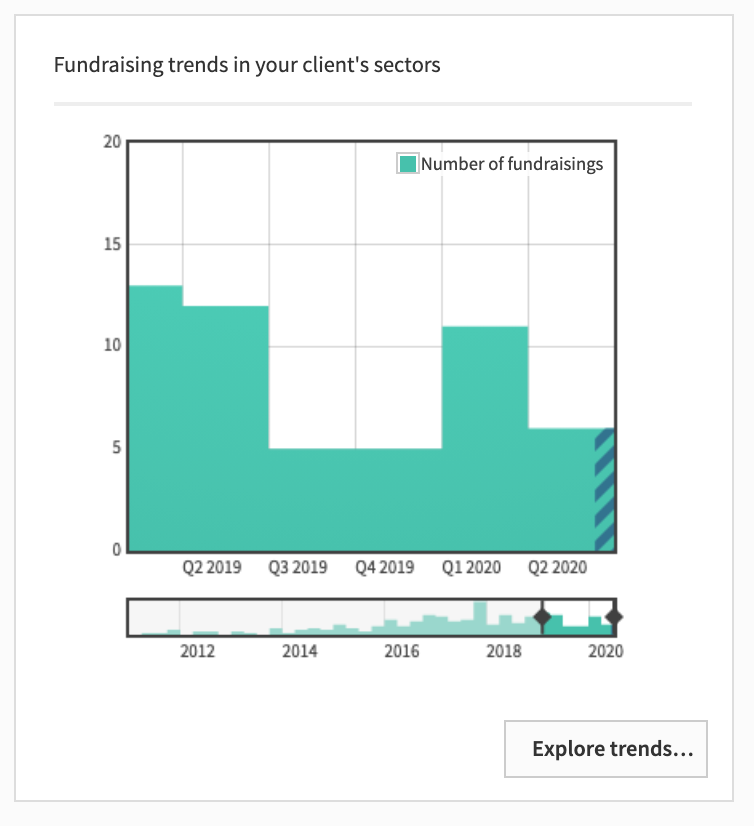

Your client dashboard will also show data on similar funding rounds and trends within your client’s sectors of operation, so you can quickly become an expert in the space – however niche it may be.

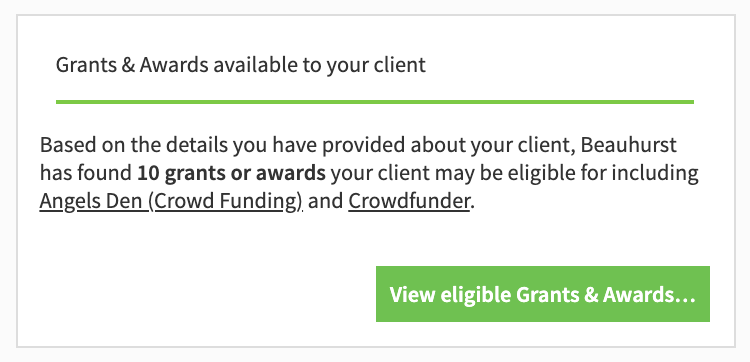

Lastly, you’ll see the grants and awards that the company is eligible for.

Now that you understand how the platform works and how you can use Beauhurst to find appropriate funders for your clients, it’s time to explore the platform for yourself!

Easily match startups to the perfect fund.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right companies at the right time.

Book a 40 minute demo today to see all of the key features as well as the depth and breadth of data on the Beauhurst platform.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.