How can investors find and filter new opportunities?

Category: Uncategorized

The venture capital, private equity and wider funding landscape is evolving. Investment opportunities are plentiful, with more high-growth and ambitious companies entering the scene than ever before, but there’s also increasing competition – everyone wants a slice of the next big thing. Relying on personal networks for deal origination is fast becoming insufficient, and comprehensive data is now crucial to finding and reviewing the best fitting investments for your fund criteria.

With Beauhurst, deal origination and filtering become easier, quicker and more automated. Investors use Beauhurst to source, research and monitor new prospects, and receive alerts about existing portfolios.

How investors use Beauhurst for deal origination

Our platform gives you a huge source of startups and scaleups, but most importantly, a comprehensive and intelligent way to filter through them all. Users can search across 100s of variables including our own sector matrix, buzzwords, and companies’ stages of evolution. You can even filter companies that haven’t received funding recently, to identify those that will be on the lookout for their next round.

Search across unannounced deals

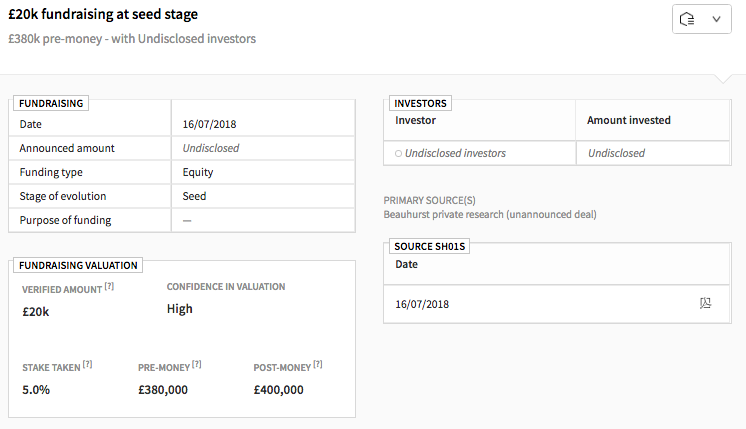

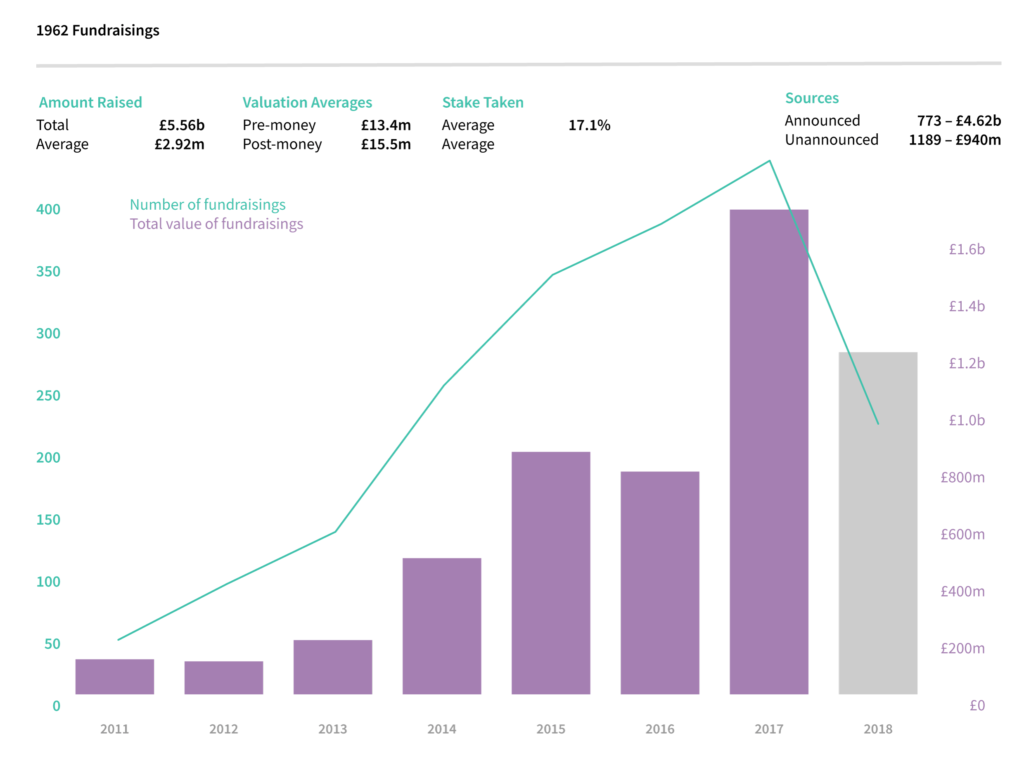

Uniquely, Beauhurst also tracks unannounced deals, which means you can identify ambitious companies in their earliest stages, after just friends and family rounds. Our data shows that over 50% of fundraisings in to UK companies are not announced to the press, giving you unparalleled insight into the early-stage market.

How investors use Beauhurst for due diligence

But perhaps you already have a steady flow of inbound deals and are struggling to sift through them. One study found that ‘the median VC reviews 87 opportunities before making 1 investment’, meaning reviews have to be thorough and time effective. Beauhurst can add great value to this process, with powerful tools for due diligence.

The market

Evaluate a company’s market position with an advanced search of the relevant sector. See data on all the companies and fundraisings across the industry, including the best funded companies and the most active funds, and a comprehensive picture of sector growth.

Total fundraisings into UK FinTech companies

The company

Our Company Timeline and Financials tab compile data from Companies House in a clear and exportable format, allowing you to easily assess past performance. See past investors in to the company, all their previous fundraisings, credit scores, and people. Use the Similar Companies tab to build a comprehensive list of competitors based on sectors, buzzwords and descriptive text.

You can explore the people behind the companies further with our new Networks feature, which shows all of their directorships, shareholdings, and C-suite appointments at any high-growth company.

the portfolio

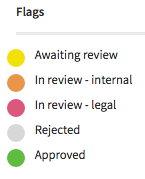

Collections allow you to stay up to date with all your new prospects, sending you an email alert whenever they hit the news. Use a custom flagging system to indicate how far along the screening process each company is. You can also set up a Collection for your existing portfolio, to track news mentions and check stats at a glance, or monitor a Collection of competitors.

Read the full case study here.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.