All The Future Fund Recipients We’ve Identified So Far

Category: Uncategorized

In May 2020, HM Treasury announced the launch of the Future Fund, a convertible loan scheme, to support UK companies through COVID-19. The UK taxpayer now has a stake in 1,190 startups and scaleups, worth £1.14b. Despite the fund now being closed to new applicants, we still don’t know everything about the investees. The British Business Bank has so far announced 158 Future Fund recipients, but we’ve been able to identify a list of 320.

Here, we take a closer look at the Future Fund and answer some FAQs on the scheme. Using Beauhurst data, we also analyse where the £1.14b worth of Future Fund investment has gone, including the most common sectors and growth stages of recipient companies, founder gender stats, and top co-investors. And we profile five of the innovative businesses not yet mentioned to the public that have secured funding via the scheme. You can even download our full list of identified companies (as a spreadsheet), should you want to run your own analysis.

Download the data on all 320 Future Fund recipients we’ve identified so far.

What is the UK Government’s Future Fund?

The Future Fund was a matched funding scheme that the Government introduced to support UK businesses during the pandemic. Delivered by the British Business Bank, it saw eligible companies secure between £125k and £5m via convertible loan agreements (CLAs), to match funding from private investors. The Future Fund scheme first launched in May 2020, before being extended in November that year. The application process closed in January 2021.

What is a convertible loan?

A convertible loan note is a form of debt that can later be converted into equity shares. In the case of the Future Fund, investors can choose to have their loan repaid on maturity (36 months), at an exit event, or on default of the business. The terms of the repayment include accrued interest and a redemption premium. Otherwise, the loans will convert to equity upon the company’s next funding round or exit.

What were the Future Fund’s eligibility criteria?

To qualify for the Future Fund scheme, a business had to have raised at least £250k worth of equity investment between April 2015 and April 2020. It also needed to have no shares or securities listed on a regulated market, exchange or listing venue (i.e. it was a private limited company).

Qualifying businesses had to be incorporated in the UK before the start of 2020, and a parent company if part of a corporate group (although certain non-UK parent companies were eligible, if they had a substantial UK presence but incorporated abroad in order to take part in an accelerator programme).

On top of this, they needed to have met one or both of the following criteria: at least 50% of employees based in the UK; at least 50% of revenue from UK sales. According to our analysis, 7,629 UK companies were eligible for the Future Fund.

How did the Future Fund matched funding scheme work for investors?

As an investor-led scheme, applications to the Future Fund were submitted by the Lead Investor, on behalf of all other matched investors and the investee company. These were then processed on a first come, first served basis, regardless of the investment size.

Whilst government contributions were limited to a maximum of £5m, the amount that could be invested by third party investors via the scheme was not capped. Upon conversion of the loan, the amount of interest paid must be at least 8%, but the actual interest rate was agreed between investors and recipients before applying.

The Future Fund CLAs were not eligible for the UK Government’s Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) tax relief programmes. But any previous SEIS or EIS-qualifying rounds will not be affected when the loans convert.

What can the convertible loans be used for?

Under the terms of the Future Fund, loans are intended for the sole purpose of financing companies’ operating or capital expenditure. They can’t be used to repay shareholder loans, nor can they be used to pay dividends, bonuses or discretionary payments. They also can’t be used to cover advisory, placement or corporate finance fees in relation to the CLA, or to finance external ventures or parties.

These regulations were designed to ensure that the Future Fund supports business innovation and growth during the coronavirus pandemic. Companies that had already claimed other forms of COVID-19 government support, such as The Coronavirus Business Interruption Loan Scheme (CBILS), were still eligible for new funding via the Future Fund.

What the British Business Bank has released about the Future Fund so far

Altogether, the UK Government’s Future Fund issued 1,190 convertible loans during the scheme, worth £1.14b in total. At the end of August, the British Business Bank reported that more than half of convertible loan agreements were in the £125k-£500k bracket, and published aggregated diversity statistics on Future Fund investee companies.

The Government has not set out any diversity and inclusion criteria or targets for the matched funding scheme, but the gender and ethnicity demographics of each recipient’s senior leadership team were self-reported when they first applied, as well as where in the UK they’re based.

According to this data:

- 68% of convertible loans went to mixed-gender senior teams, but just 1% to all-female teams

- 46% of convertible loans went to businesses with mixed-ethnicity senior teams, but just 5% to all-BAME teams

- 55% of convertible loans went to companies headquartered in London, 23% to the South, 13% to the North, 4% to the Midlands, and just 5% to Scotland, Wales and Northern Ireland combined.

As of 31 August 2021, 158 of the Future Fund’s CLAs had converted to shares. At the time, the British Business Bank released a list of these businesses that the Future Fund now has an equity stake in (to be updated at the end of each quarter, as more loans convert).

What about the companies they haven’t mentioned yet?

Since the British Business Bank’s latest release over two months ago, many more companies have converted their Future Fund loans into equity shares. By analysing press releases, and searching across ownership filings made to Companies House, our Data team has identified a further 162 Future Fund investee companies. This is now the most complete, publicly-available list of Future Fund recipients.

So, where has our £1.14b of public funding gone?

As more Future Fund loans convert, we’ll learn more about where public money has ended up via the scheme. Using the 320 companies we do know about, however, we can get a general idea of the types of companies and founding teams being backed by our £1.14b worth of funding.

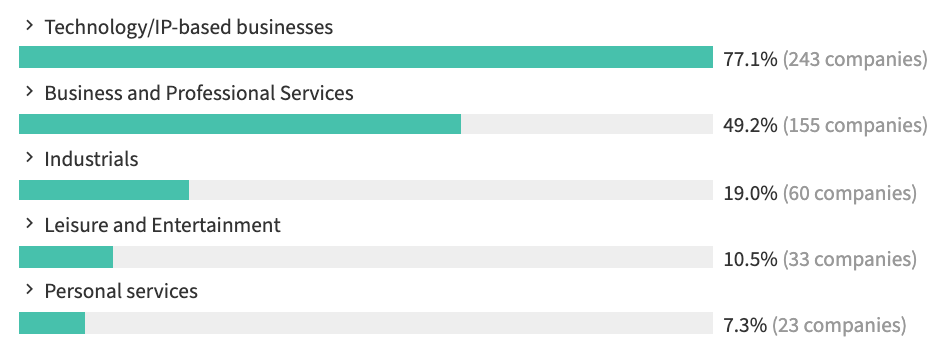

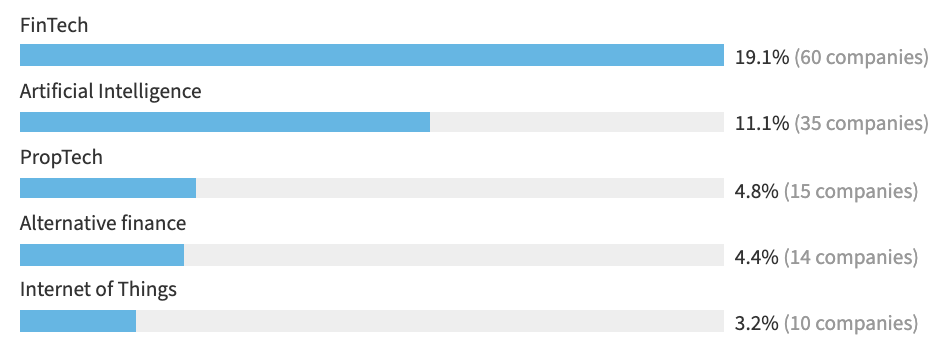

By far the most popular sector for participants in the Future Fund, for instance, is Technology & IP-based businesses. Tech companies account for more than 77% of our known Future Fund cohort, which comes as no surprise, given the dominance of tech in the UK equity market. In fact, all five of the top verticals for convertible loan recipients are subsets of the tech industry: primarily fintech (19%) and artificial intelligence (11%), ahead of proptech (5%), alternative finance (4%) and IoT (3%).

Future Fund investee companies: by sector

Future Fund investee companies: by vertical

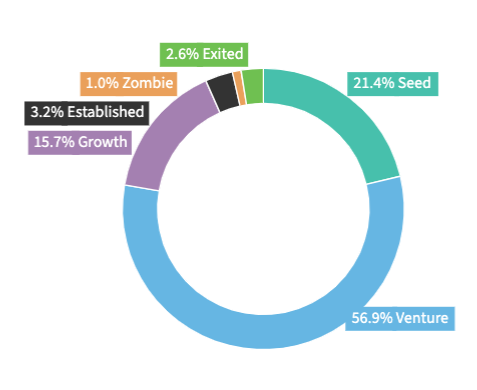

Meanwhile, given the scheme’s eligibility criteria, it’s also unsurprising that the majority of Future Fund investees are early-stage companies. Whilst 21% of recipients are currently at the Seed stage of evolution, most are operating at the Venture stage (these startups have been around for a few years now and were more likely to have secured the minimum level of equity funding required prior to April 2020). In comparison, later-stage firms are far less common within the Future Fund cohort, with 16% operating at Growth stage and 3% at Established stage, whilst 1% are inactive (Zombie) and 3% have exited the private market.

A total of eight companies that secured CLAs through the Future Fund have since carried out exit events—via an IPO or acquisition. These include two pharmaceuticals companies (BiVictriX Therapeutics and Vaccitech), supplements manufacturer Nell Health, three fintech firms (Oval Money, RoosterMoney and Aix), one of the Future Fund’s 22 cleantech recipients (SulNOx), and Warwick Audio Technologies.

Future Fund investee companies: by stage of evolution

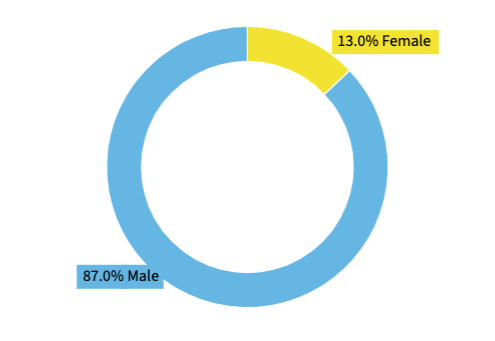

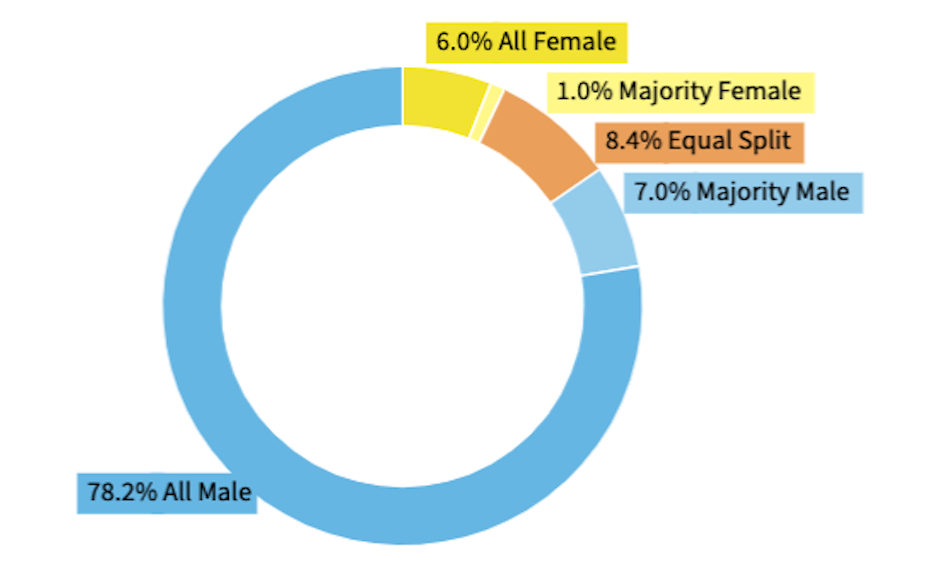

The British Business Bank’s data indicates the all-female, all-male or mixed-gender breakdown of senior leadership teams at Future Fund investee companies. But thanks to the Beauhurst platform’s people data, we can also get a sense of the gender split of individual startup founders that secured CLAs via the Future Fund. For the 320 companies we’ve identified so far, just 13% of founders are women, while only 7% of companies have all-female or majority female founding teams. In contrast, 87% of founders are men, and 85% of companies have all-male or majority male founding teams.

Future Fund investee companies: by founder gender

Future Fund investee companies: by founder gender balance

The Future Fund’s top co-investors

Using our collection of known Future Fund rounds, we’ve also tracked 202 third party investors that matched funding as part of the scheme. These co-investors span a wide range of fund types, including private equity and venture capital firms, angel networks, and corporate venture arms. The investors known to have backed the most Future Fund rounds so far, however, are crowdfunding platforms Seedrs and Crowdcube, alongside numerous funds managed by Maven Capital Partners and Mercia Asset Management.

5 UK startups that secured convertible loans via the Future Fund

From the brand behind easyGym (Fore Fitness Group) to 10 of the most valuable growth companies in the UK (including Paysme and Ultraleap), we track hundreds of ambitious businesses that have secured money via the Future Fund. Here are five of the companies that are yet to be announced to the public.

Habito

Headquartered in London, Habito provides consumers with tools to easily compare and apply for mortgages, as well as offering support with the legal work and property surveys attached to buying a home. The company incorporated in 2015 and has since gone on to raise £60.5m worth of equity investment, across five funding rounds. It’s also one of 16 proptech startups identified so far that have secured a convertible loan through the Future Fund.

Habito’s raised £35m through its Future Fund and Series C extension round, to support product development, at a pre-money valuation of £118m. The round’s co-investors included London-based VCs Atomico, Augmentum Fintech, Mosaic Ventures, and Volution, alongside Japanese firm SBI Insurance Group, Luxembourg-based Mojo Capital, and US fund Ribbit Capital.

Kraydel

Founded in 2016, eHealth startup Kraydel has developed an internet of things (IoT) platform to support elderly individuals living alone. It combines video calling with remote monitoring, using machine learning to predict people’s daily routines and alert carers when certain triggers are met.

The Belfast-based company has secured seven equity fundraisings so far, totalling £3.67m, alongside £969k worth of innovation grants. Kraydel’s £1.44m Future Fund round, which saw co-investment from Seedrs, will be used to fund the company’s product roadmap delivery and bridge to a Series A round.

XR Games

XR Games develops a range of immersive games, using virtual reality (VR) and augmented reality (AR) tech. Founded in 2017, the Leeds-based game development studio has raised £5.42m in equity investment to date, across four funding rounds. The latest of these rounds was secured via the Future Fund scheme, and totalled £1.5m.

One of three startups operating in the AR and VR space to secure a loan via the government scheme, XR Games is using this influx of capital to further develop its products and expand its team. The Future Fund round saw participation from Maven Capital Partner’s NPIF Equity Finance fund and Irish firm ACT Venture Capital.

KisanHub

KisanHub has developed fresh produce supply management software, with technology to track and analyse data on soil-water balance and local weather conditions for farms. The agritech company helps suppliers to increase profitability through greater visibility over their supply chain.

Founded in 2012, Cambridge-based KisanHub has secured £7.12m in equity funding so far, across five rounds. It’s also received four separate innovation grants, amounting to £299k. Its latest raise, a £1.07m Future Fund round, will be used to help the company expand in the UK and Europe. The Future Fund’s co-investors included Notion Capital, Cambridge’s IQ Capital Fund and Cambridge Angels, and Norwich-based VC Low Carbon Innovation Fund.

Orka

Founded in 2016 and based in Manchester, Orka develops recruitment software designed to give shift workers access to temporary roles, with tracking and payment options via a mobile app. The company is one of 10 companies operating in the recruitment technology space that secured investment via the Future Fund.

Orka has raised £30.9m in equity fundraisings to date, across four rounds. Most recently, the company secured a £29m Future Fund deal, intended to double its headcount and grow its product range. The round included funding from angel investors and debt financing from invoice finance firm (and fellow Beauhurst-tracked company) Sonovate.

Want to find out how we collected the data in this article? Send us an email at info@beauhurst.com for more information.

Download the data on all 320 Future Fund recipients we’ve identified so far.