Is EIS Still Relevant? (Updated Figures 2020)

Category: Uncategorized

The Enterprise Investment Scheme (EIS) is a tax relief scheme designed to encourage investment in small, high-risk and often knowledge-intensive companies by individual private investors, by providing them both income tax relief and capital gains tax relief. Last year we examined statistics released by HMRC, today we’re reviewing their latest statistics to see if the trends we highlighted previously have continued, and discuss the future of EIS in the UK high-growth economy.

As with last year, we are continuing to see a decline in the proportion of investments using EIS, starting from a high of 46% in 2011-12, and falling to a new low of 13% in 2018-19.

Perhaps more troublingly, we have also seen a reduction in the amount raised through the scheme, falling from £2.00b raised in 2017-18, to £1.82b in 2018-19. This marks the lowest amount of funds raised through the scheme since the 2014-15 period, breaking the trend of EIS backed investments raising over £1.90b each year.

However, this is against a backdrop of increased limitations to what kinds of companies can be funded through EIS. Changes to the EIS made in April 2018 encouraged investors towards knowledge-intensive ventures and away from capital preservation (asset-backed) ventures. Nearly 10% of companies raising in 2018-19 were knowledge-intensive.

Chart compiled using data from www.gov.uk

In 2018-19 the UK reached new heights of investment. Private businesses raised £13.8b, £12b of which without EIS assistance, highlighting the ever-widening pool of investment available to the UK’s ambitious companies.

The UK continues to attract investment from international investors, funds, and institutions, none of whom can take advantage of this state aid. Coupled with this, we are also seeing larger and larger deals, meaning that many investors are contributing levels of investment that would exceed yearly EIS allowances; £1m for investors and £5m for companies in a given tax year.

Considering this, it may look like the decline in the use of the EIS is not something with which we should be concerned. Investments are still going ahead in larger than ever figures and EIS is playing its role. But EIS is most important at a company’s earliest stages and it is this stage that is suffering during the pandemic, so at any rate, we do need to see more investment through SEIS and EIS.

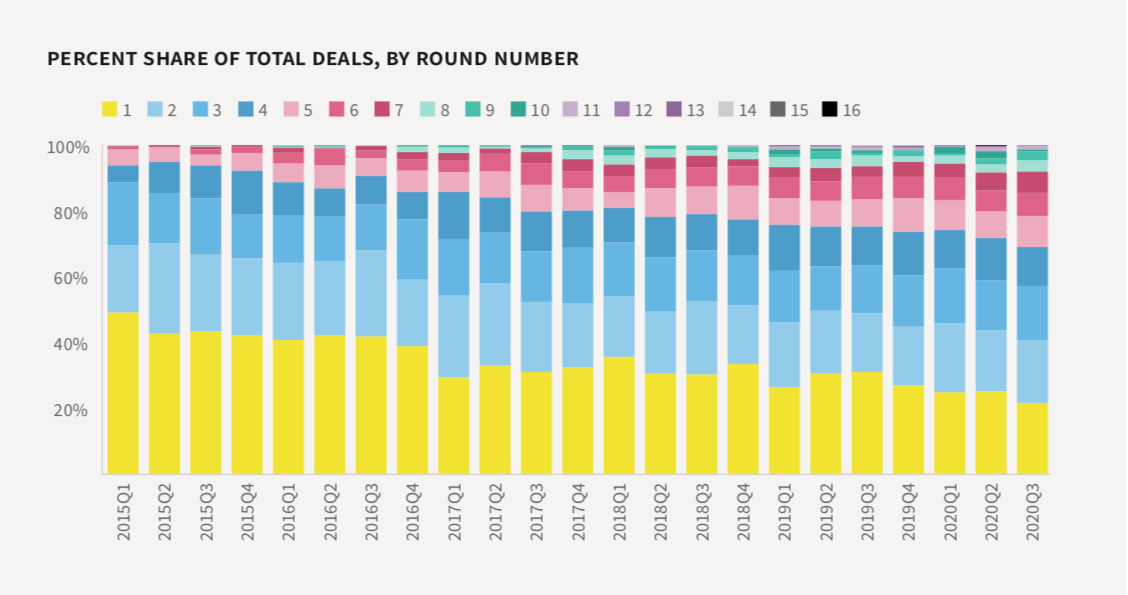

In Q3 of 2020 first-round deals hit their lowest ever number in terms of the proportion of deals done in the UK. This reflects the trend of investment shifting to larger and larger deals and accounts further for the reduction of EIS investment. The decline in investment through the scheme has fallen almost in lockstep with first-round deals, highlighting the importance of the scheme on early-stage funding.

“When a company raises its first round of investment, it is at its riskiest stage. But if companies don’t get their first round, the pipeline for the venture and growth stages will collapse. EIS may be a smaller proportion of the market now than previously, but SEIS (Seed Enterprise Investment Scheme) and EIS are needed more than ever.”

Henry Whorwood, Head of Research & Consultancy, Beauhurst

The EIS tax relief scheme was designed to incentivise investment into the smallest, riskiest, and most vulnerable early stage businesses in the UK. We see larger and larger deals today because those companies that received EIS funding in the past were able to grow and mature, going on to attract further investment and eventually raise megarounds. Without the EIS, some of these investee companies may not have survived past the Seed stage, and the landscape of ambitious companies might not be as vibrant as we’re happy to see it is today.

Given the turbulence of the few last years, and especially the last nine months, it is not surprising that investors are less likely to shoulder the higher-risk, even when offset by EIS, of investing in the earliest-stage companies, and instead look for less risky investment opportunities. But with news of Covid vaccines on the horizon and Brexit negotiations (hopefully) reaching their conclusion, the global economic outlook is starting to improve.

This positive turn may cue investors to take on more risk and return to utilising EIS in more significant numbers. Indeed, Octopus has already returned to the early-stage market with a new EIS fund. A renewed increase in investment in small and ambitious startups would benefit not only the investors and the companies themselves, but also the broader high-growth ecosystem, both now and in the future.