EIS Scheme Funding Data

Category: Uncategorized

The Enterprise Investment Scheme (EIS) is a tax relief programme designed to encourage individual investors to support small, high-risk companies. Today, HMRC released their latest statistics on companies raising funds using this scheme. Working with our friends at Newable, we’ve taken a closer look at how EIS fits into the wider funding landscape for ambitious companies in the UK.

Looking at the figures for the amount raised by using EIS alone paints a gloomy picture for the UK’s early-stage businesses. Investment peaked in 2015-16 with £1.98B raised through EIS; in 2017-18 this fell to £1.93B.

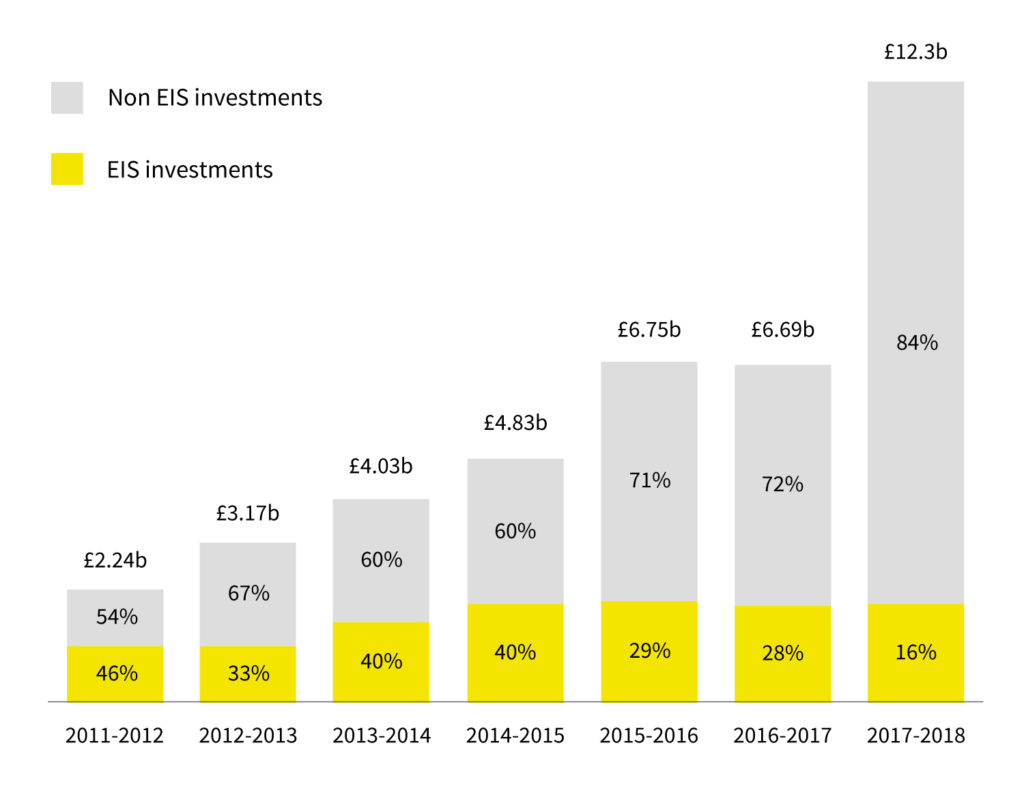

amount invested into ambitious uk companies

But EIS represents its smallest ever proportion of the funds raised by the UK’s growing private companies. In 2011-12, 46% of equity investment into the UK’s private businesses was EIS investment – by 2017-18 that had fallen to 16%. But private businesses raised more than ever before: £12.3B.

This is because there’s a wider and deeper pool of investment available to the UK’s ambitious companies. UK businesses are increasingly attracting investment from overseas investors and funds, who can’t take advantage of EIS relief. Moreover, investors are contributing volumes of investment that immediately exceed EIS allowances.

The amount of capital available to businesses outside the Enterprise Investment Scheme is a great thing and a testament to the appeal of UK businesses to a wide range of investors. EIS is instrumental in supporting those businesses that go on to raise these megarounds.

Chris Manson, CEO of Newable, notes that the decrease in the proportion of funds raised with EIS also shows a more troubling trend.

“British tech entrepreneurs are acknowledged as being amongst the world leaders in AI, Med Tech and Space enabled businesses. It is no surprise that they attract capital from overseas investors.

However, EIS is an excellent way for British private investors to support British companies. From an investor’s point of view, putting capital into EIS-accredited companies can be both exciting and highly rewarding. For the patient investor, returns have the potential to far exceed traditional quoted stocks whilst EIS mitigates some of the down side risk.

The Enterprise Investment Scheme is the envy of the world and funds like Newable’s EIS Evergreen Tech Fund are available as a vehicle to access these excellent British businesses.”

Indeed, although a record number of companies raised funds using EIS in 2017-18, the number of new businesses raising through EIS has been falling since 2014-15. This tallies with our analysis that has shown seed-stage deal numbers falling dramatically, as individual investors appear to be avoiding this riskiest of asset classes. Even with lucrative EIS and SEIS incentives, investors are holding back. We hope that a resolution to the political and economic uncertainty the UK has been experiencing – whenever it might come – will put these investors back into overdrive. We’ll be watching closely.