COVID-19 & The High-Growth Space—Were We Right?

Category: Uncategorized

Earlier in the year, we laid out several predictions for how we thought COVID-19 would impact the high-growth ecosystem. Now that the pandemic has progressed, and as a second national lockdown commences, we’re revisiting these, to see whether the results matched up to our expectations. We’ll review how investment patterns have changed since the start of the pandemic, and discuss which high-potential UK companies and sectors have seen success.

The effect of coronavirus on UK investment

Q1 2020 saw a shift in UK investment patterns with the arrival of COVID-19. Despite an increased demand for equity finance from high-growth companies, there was a marked change in investor behaviour. Funds were exhibiting a greater focus on their existing portfolios, reduced capacity or lack of interest in new deals, as well as a rise in investors delaying and withdrawing from open—sometimes even late-stage—deals.

But how would COVID-19 impact investment trends in the months that followed? Drawing on existing data, we predicted that:

- The overall number of deals completed would plummet, with seed stage funding taking the hardest hit

- The overall amount invested would also decline, with fewer megadeals being secured

- A larger proportion of deals would be follow-on rounds, with investors doubling-down on existing investments and putting up more capital for their portfolio companies that were struggling during the pandemic

- Finally, there’d be a renewed focus on venture stage funding (that is, investments into companies less risky than seed stage businesses, as they have already proven to have a viable product or service).

Fast forward several months, we’ve now analysed every publicly-announced equity investment into high-growth, private companies between Q1 and Q3 2020. Let’s see which market trends have met our expectations, and why others may not have…

Prediction 1: Fewer deals would be completed

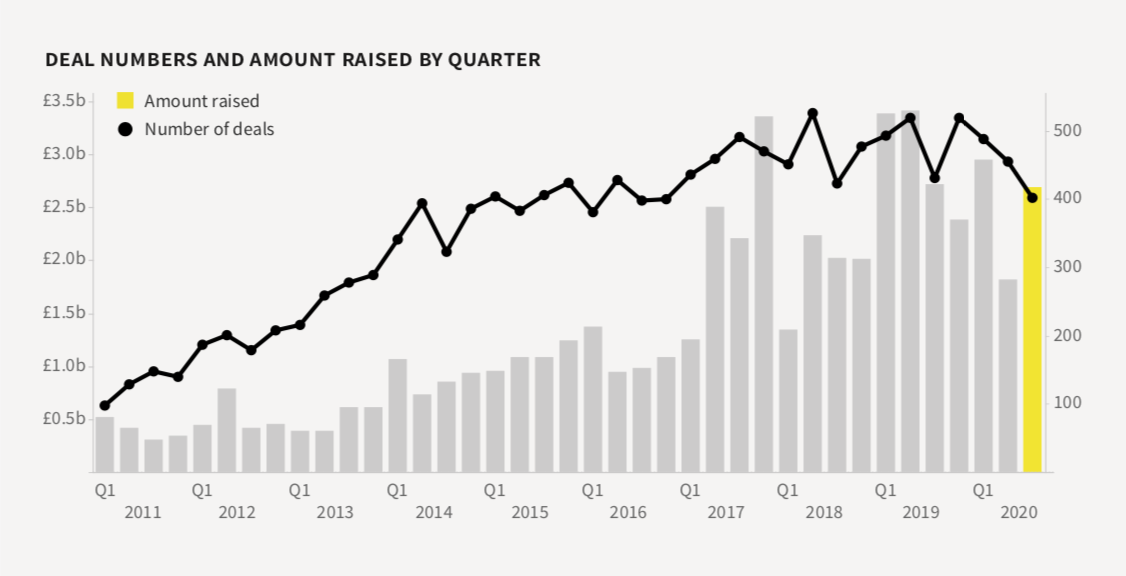

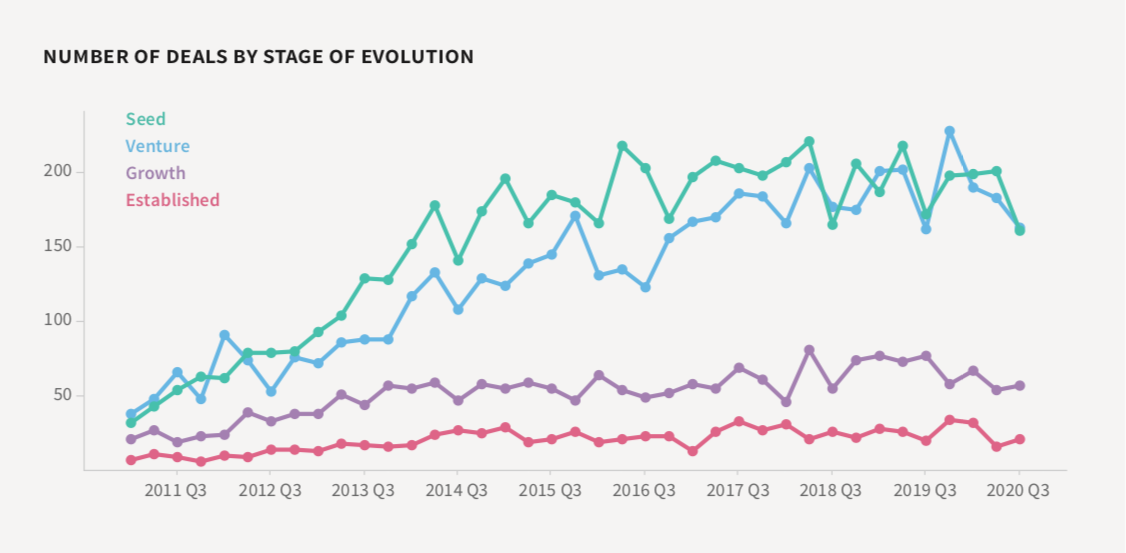

In line with our predictions, last quarter saw deal numbers decline to their lowest point since Q4 2016. Just 402 investments were announced during Q3 2020, a 7% drop from Q3 2019. Whilst quarterly fluctuations in investment figures are normal, we’ve seen a three-quarter-long drop in deal numbers— which is the most prolonged on record.

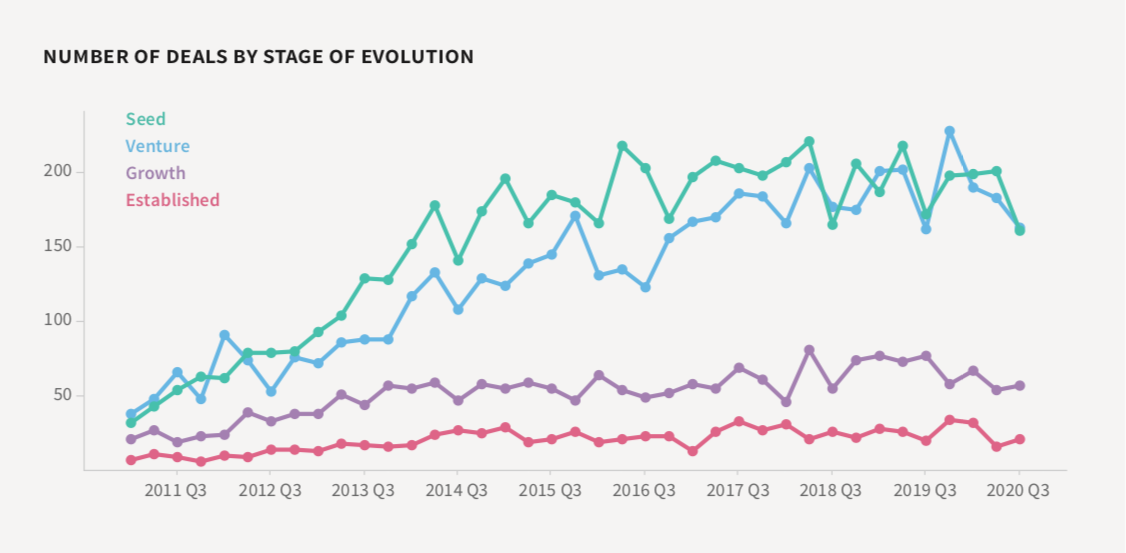

Meanwhile, as expected, seed stage funding has plummeted—but only as of Q3. The number of seed stage deals actually remained steady at around 200 deals per quarter between Q4 2019 and Q2 2020, but dropped 20% from Q2 to Q3 2020, as investors looked to put their money into lower-risk ventures.

Prediction 2: Total amount raised would fall

Despite falling between Q1 and Q2, the overall amount raised in Q3 2020 remained relatively high, totalling £2.7b—just 1% lower than Q3 2019. This rebound went against expectations that the total amount invested would drop during the COVID-19 outbreak.

Similarly, the number of megadeals secured also bucked our predictions, as the increase in amount raised was due, in part, to a rise in average deal size during Q3.

Just 27% of equity deals in Q3 2020 were worth less than £500k (the lowest proportion since our records began back in 2011), with nine megadeals taking place throughout the quarter—the same number as Q3 2019.

Prediction 3: A larger proportion of deals would be follow-on rounds

Investors have been giving greater focus to their existing portfolio companies, many of which have required additional support during COVID-19.

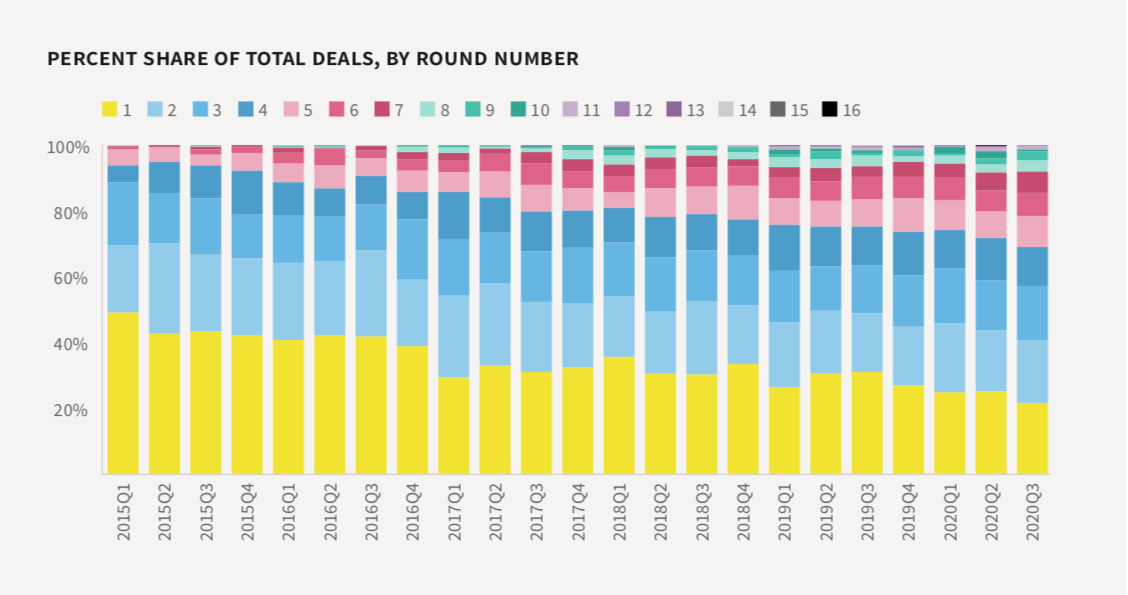

The number of companies that completed first-time fundraisings grew between Q1 2019 and Q3 2019. But in Q3 2020, just 22% of announced deals were a first-round raise, compared with 31% in Q3 2019. As predicted, a greater proportion of deals were follow on rounds. First-time raises have, however, remained the most common round.

But, whilst first-time fundraising has fallen to a new low, this decline is in keeping with trends seen well before the outbreak of the pandemic, as the market continues to mature and a larger number of later-stage businesses raise finance.

Prediction 4: Focus would be on venture stage funding

Whilst we predicted a renewed focus on venture stage funding, the number of venture stage deals last quarter was on par with Q3 2019. The total amount invested into venture stage businesses reached a new high in Q3 2020, however, at £897m. Whereas, by the end of September, the number of seed stage deals had landed at 161, marking a 6% drop from Q3 2019.

On the whole, we forecasted that deals this year would be less risky— which started to play out in Q3—but many investors have begun shifting their money towards companies at later stages of growth than we expected. There was a small increase in both growth and established stage funding between Q2 and Q3 2020, in terms of deal numbers and amount raised, as early-stage businesses lost out.

The effect of coronavirus on individual sectors

Back in March, we laid out our expectations for the sectors and niches that would flourish during the pandemic, spotlighting eight technologies that would transform the way we live in 2020…

Video conferencing

From team meetings for remote working to virtual gatherings between friends and family, video conferencing software was an early champion in COVID-19 technology. In May, we named Hopin, an online platform where users can create and host live events for up to 100,000 attendees at a time, as one of the early-stage startups beating the odds during COVID-19. And this week, Hopin’s latest $2.1b valuation has added them to the growing tally of startups that have reached unicorn status—just eight months since launching the business.

Despite Hopin’s impressive news, other ambitious startups have not had the same level of success in disrupting the video conferencing sector, with industry incumbents like Zoom and other large tech companies still dominating the market. In fact, from Q2-Q3 2020, there were just three fundraisings involving businesses in the video conferencing space, worth £7m in total, the largest of which was secured by Visionable.

Founded in 2015, Visonable’s conferencing software, designed specifically for the healthcare industry, was noted as one to watch during COVID-19. Since March, the company has received a £6m fundraising from West Hill Capital, at a pre-money valuation of £74.5m. We also mentioned StarLeaf, a Watford-based business providing online video meeting and messaging solutions which, in September, was featured in this year’s Fast Track Tech Track 100 high-growth list.

eHealth

Earlier in the year, as strict lockdown measures forced people to stay home, there was a surge in demand for healthtech to support the sick, elderly, and vulnerable. Emerging technologies sought to address some of the issues surrounding COVID-19, for instance minimising the need for face-to-face contact between medical staff and patients.

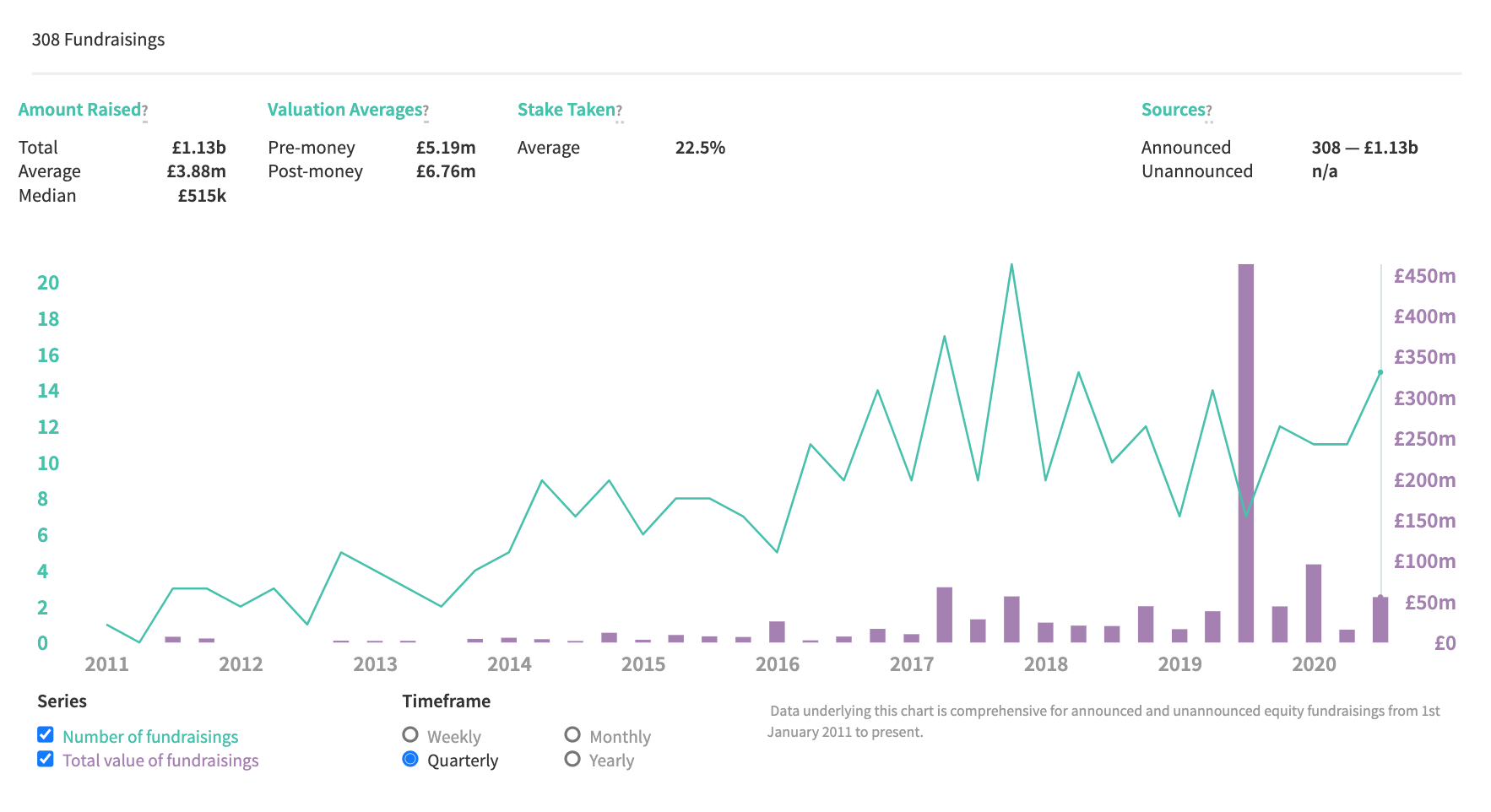

As predicted, eHealth companies had good quarters in Q2 and Q3, with 11 and 15 deals, respectively. Q3 deals were worth significantly more, however, totalling £55.6m. Much of this increase can be attributed to Lumeon’s £23m round in August. Based in Lambeth, Lumeon develops software for medical practitioners to track the progress of patients and keep up to date with admin tasks.

Both of the ambitious eHealth companies that we spotlighted have done well since the start of the year. Cera, which provides pensioners with at-home carers, was featured in the Startups 100 high-growth list in June. Meanwhile, household name Babylon, whose app enables patients to book and conduct video consultations with GPs, secured a fundraising in May for an undisclosed amount with Vostok New Ventures. The company also featured in two high-growth lists: the London Tech 50 and the Fast Track Tech Track 100.

Edtech

With schools shutting down in March, and remaining closed throughout the summer term, many parents struggled to find childcare or supervise home learning alongside their own work, triggering a boom in interest for online education services.

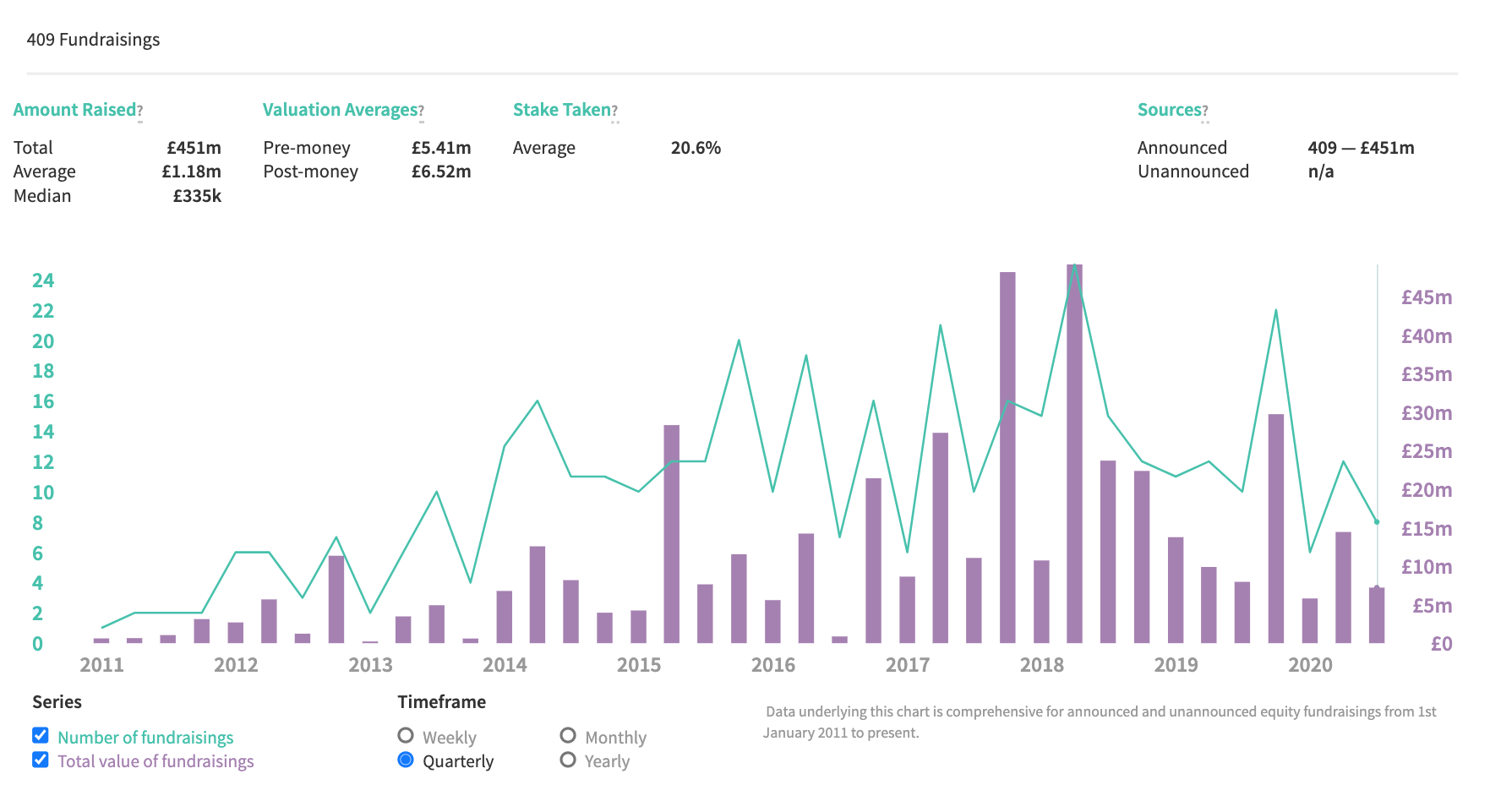

Surprisingly, investment into edtech companies has remained relatively subdued over the past few quarters. There were 12 deals completed in Q2, worth £14.4m in total, but just eight during Q3 2020 (compared to ten in Q3 2019). Q3 fundraisings totalled £7.2m, much of which came early on in the quarter, with £5.7m secured through five funding rounds in July.

One possible explanation for this is that schools reopened in September, and as the second national lockdown gets underway, the Government has said it will prioritise keeping them open from now on.

Nonetheless, computer-building edtech Kano has continued to excel during the pandemic. Having already joined forces with Microsoft last year to build a modular Windows computer kit, ‘the Kano PC’, the company successfully secured a £797k equity fundraising with M12 (formerly Microsoft Ventures) in July.

Community sharing

Heightened by the wave of panic-buying that took over the country following the outbreak of COVID-19, there were calls for people to become more community-minded and reshape their attitudes towards waste.

In July, food waste reduction app Olio, one of the community sharing ventures that we said to look out for, was featured in 2020’s London Tech 50 high-growth list. Meanwhile, Farmdrop, whose website allows consumers to buy and pay for produce directly from the source, secured a £6m equity fundraising in June, from funds Atomico and Wheatsheaf.

But after the initial panic that followed the arrival of COVID-19 subsided, the need for new technologies in the food sharing sector also waned, with supermarket shelves quickly returning to their pre-hysteria stock levels. Having said that, there were notable fundraisings in several other areas of the UK’s sharing economy, including peer-to-peer car hire networks like Drover, HiyaCar, and Zoom EV, as well as the sustainable clothes-sharing app The Nu Wardrobe.

In addition, the recipe box business Gousto, another ambitious company seeking to minimise waste in the food sector, also reached unicorn status during COVID-19. Gousto doubled its monthly meal deliveries from 2.5m to 5m during the first national lockdown, and joined our list of billion dollar companies following the company’s £25m funding round with Perwyn and BGF at the start of November.

Closing thoughts

COVID-19 has reshaped the nation’s habits and made us more reliant on emerging technologies, with verticals such as eHealth and community sharing coming out on top. Despite fears that the entrepreneurial spirit of the country was under threat, and a notable drop in overall number of deals, investment into the UK’s high-potential companies has continued during the pandemic, with overall amount invested returning to near pre-COVID levels.

Small sums of capital are now harder to come by, with investors moving towards larger deals with later-stage businesses and less risk. But this trend has been apparent for several years now, only catalysed by the current economic uncertainty. And whilst seed stage funding has been the worst-affected this year, it is often said that the most successful and resilient companies are born out of crises—hence we remain optimistic about the future of the high-growth space. For the latest data on UK equity investment trends, in full, read our market update for Q3 2020.