What 8,000 high-growth companies look like (and why you should care)

Category: Uncategorized

We have just reached the significant milestone of eight thousand high-growth companies with a “deep data” profile. Our Head of Research, Pedro Madeira, explains what that means, how we got here and why this is so important.

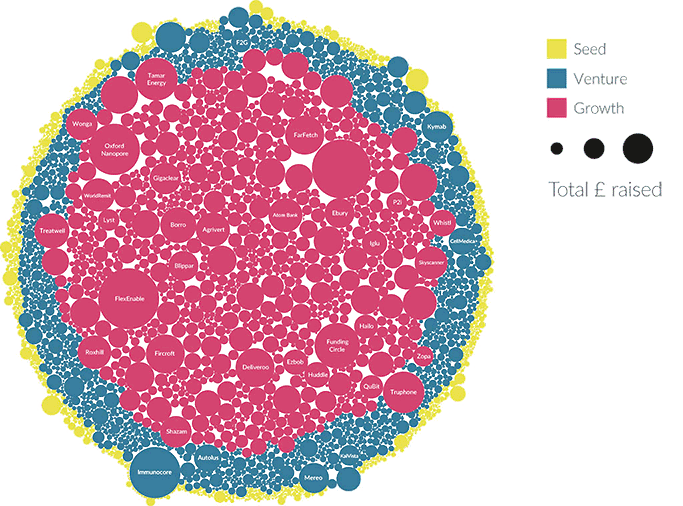

We have completed eight thousand “deep data” profiles of UK high-growth companies. The image below gives you some idea of the scale of the data – showing all 8,000 companies, grouped by stage of their evolution and in proportion to amount raised.

This is a significant achievement for our research team; to celebrate I want to help readers understand how we identify and find these companies and what detailed access to these businesses means for those using our data.

Most of these 8k companies are actively tracked by our Research team – meaning that we constantly monitor thousands of sources and data points on businesses that are still working their way towards an exit or simply towards becoming leaders in their field.

How (and why) did we pick these 8k?

According to recent Companies House statistics as at February 2016, there are 3.7m companies in the UK. But many (possibly most) of these are lifestyle businesses (that will never grow that much) or asset management companies, whose sole purpose is to hold assets such as real estate, cash or intellectual property (and therefore aren’t “companies” in the ordinary sense of the word).

We have created “deep data” profiles on a specific set of 8k companies because we want to shine a light on the companies that show the potential and ambition to grow, innovate, create jobs, contribute to GDP and invest into (and acquire) smaller companies. These will probably be companies in need of advice, investment and an exit route. They are also companies that academics and government bodies want to know about and monitor for a range of reasons. Each of the 8k companies meets at least one of the following “growth triggers”:

- The company has announced it has received genuine equity investment;

- The filings the company has submitted to Companies House show it has received genuine equity investment, irrespective of whether or not that has been announced;

- The company has undergone a management buy-out or management buy-in (MBO/MBI);

- The company has received certain types of grant/debt.

All of these companies also meet both of these pre-conditions:

- It has operational headquarters in the UK;

- It has no securities listed on a stock exchange.

How did we find these 8k?

We use a variety of methods to find interesting companies and monitor the ones we’re currently tracking, including proprietary machine learning software, algorithms, manual research and direct contact with both entrepreneurs, investors and advisors.

We monitor any public news/press releases about genuine equity investments, MBOs and other announced deals using proprietary software that trawls through thousands of websites.

Over the course of around a year, we developed an algorithm that analyses large amounts of data in order to try to find evidence of genuine unannounced equity investment.

We also liaise directly with entrepreneurs, investors and advisors to make sure our deal data is accurate. If you would like more information, please speak to Adam Boyle, our Research Relationship Manager.

Finally, we occasionally do some old-school investigative work and get on the telephone to companies directly. We tend to currently do this mostly when we are trying to decide what their stage of evolution should be (you can read more about why we’re particularly proud of our work on stage-of-evolution taxonomy and criteria).

The reason I’m mentioning this in such detail is to make it clear that, in every case, our research analysts manually approve and investigate each data point to ensure accuracy. As you can imagine, this requires a huge amount of work and dedication, and I’m immensely proud of the team.

Deeper and broader

Reaching 8k is a great achievement. But this is just the beginning. We are continuously seeking to increase our depth and breadth.

We will increase our depth by collecting additional types of information for each “deep data” profile. For example we recently started displaying data on whether companies have spun out from universities or attended interesting accelerator programmes.

We will increase our breadth by adding to our existing list of triggers. The next one on our list is attendance at interesting UK-based accelerator programmes (even if the company has not received any sort of investment).

By the time we reach our next milestone, you can bet we will have deepened and broadened our data several times!

We’d love to hear from you. Get in touch with me directly to hear more about our data and approach, or take a tour of our product to see how your business can directly benefit.