Investment into the UK’s Spinout Companies

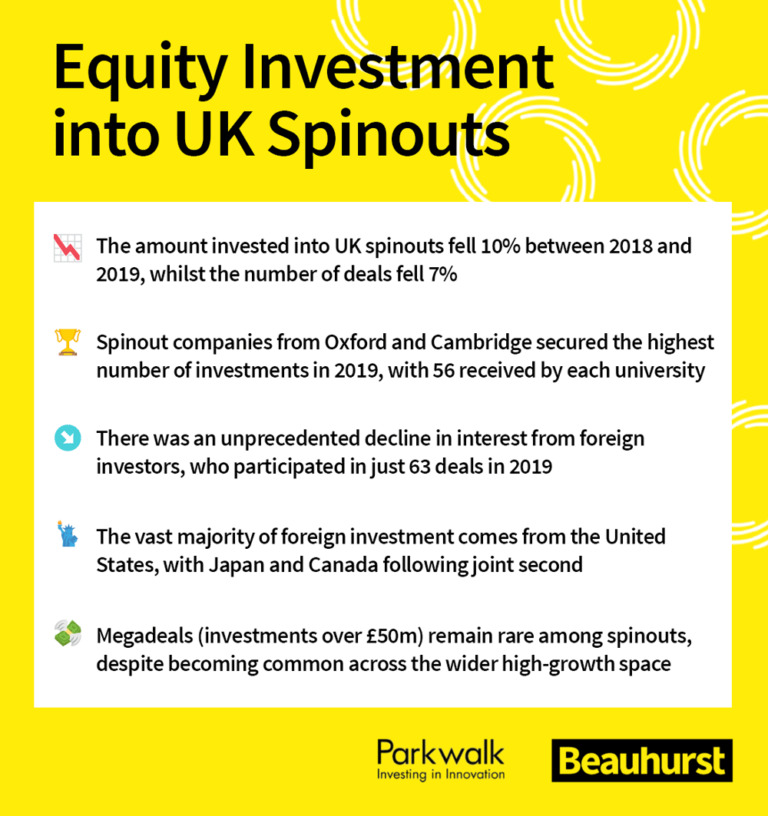

In collaboration with Parkwalk, we’ve analysed the equity investments made into UK spinouts to spot emerging trends and patterns.

Parkwalk comments

“This report reinforces our view that despite world-leading research, UK “Deep Tech” is still hugely underfunded at the scale-up stage. Time and again we see extremely innovative companies raising early stage funding and then hitting the “Valley of Death” at Series B or C. This leads to huge lost opportunities for the UK: The successful companies often lose their technical lead to better funded international rivals or are sold to international acquirers, losing the benefits to the UK: the knowledge, skill sets, employment and taxes.”

The key findings from 2019

About the authors

henry whorwood

Henry leads Beauhurst’s research and consultancy, and is an expert on equity finance and high-growth business. He has worked on briefs for clients including Barclays, Syndicate Room, Innovate UK, Smith & Williamson and the British Business Bank. Henry regularly gives presentations on finance and market trends at events around the country. Henry studied Classics at the University of Oxford.

Ava scott

Ava is an expert data cruncher and business analyst in the Research & Consultancy team. She provides research and insights for multiple clients, including the Royal Academy of Engineering, Syndicate Room and Penningtons Manches. She holds a BA in Human Sciences from the University of Oxford.

Explore the data for yourself

Book a 30 minute demo to see all of the key features as well as the depth and breadth of data on the Beauhurst platform.