What’s next for mobile apps?

Category: Uncategorized

Anecdotal evidence suggests mobile app companies are having difficulty raising finance – but we’ve seen impressive amounts invested into the sector from sources including venture capital, private equity and crowdfunding.

In October 2016, Time Out acquired events app YPlan for £1.6m. There was nothing unusual about this – except that YPlan had previously been valued at £41.6m. It had been backed by Octopus Ventures, Nokia Growth Partners, Qualcomm Ventures and others. The business had struggled with its value proposition, structure, and financials, at one point laying off around a third of its staff, and pivoting from direct sales to a self-service model – in which event organisers manage their own listings.

In the following weeks, Beauhurst received information suggesting that YPlan was far from the only app headed down this path. An unnamed source, whose company was at the time advising three app-based companies with a combined valuation of £75m, contacted Beauhurst to divulge that all three were insolvent, had rapid cash-burn problems, and were “running out of road” when it came to their investors. So what’s happening to the app market?

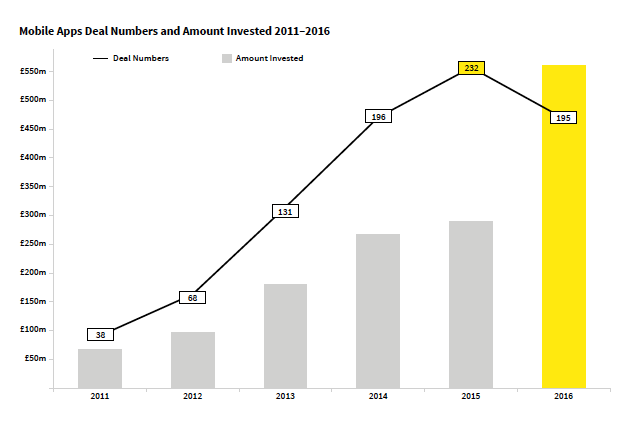

In brief, the rumours don’t stack up. The amount of cash invested into the app industry has rocketed since 2011, from £67m to just over £560m. This is also true, however, of the number of fundraisings into the space, which has accelerated from a mere 38 in 2011 to 195 in 2016. The average amount invested per fundraising, therefore, has also changed. In 2010 the average invested in each was £1.8m. The number of fundraisings by app companies peaked at 232 in 2015 (at an average of £1.24m each). And in 2016, the trend reversed: the value of fundraisings increased whilst their volume decreased.

This latest development could suggest several things: investors became more willing in 2016 to plough finance into consumer-orientated technology, previously-funded app companies gradually became self-sustaining and no longer needed or wanted equity backing, or prospective entrants to the market were put off by what they saw as relatively limited finance available and steep competition to get it – or some combination of these factors.

What is clear, however, is that the amount invested is growing while the number of deals is shrinking – with the average deal size in 2016 rising to £2.87m. It’s also interesting to note that the most prolific funders behind this capital are not exclusive or difficult to access: the two top spots are held by Seedrs and Crowdcube .

That said, the real money is not from crowdfunders but institutional and governmental investors: the largest funders by value of fundraisings were Skyscanner’s backers at the start of 2016 (Artemis, Baillie Gifford, Khazanah Nasional Berhad – the sovereign wealth fund of the Malaysian Government – Vitruvian Partners, and Yahoo! Japan). This £128m investment has inevitably pushed up the averages under discussion (without it, the average investment into a 2016 app company would diminish to £2.23m, a 22% fall from the actual average, but nonetheless a steep increase from the average of £1.36m in 2015).

Then why are app companies so concerned? All the above goes to suggest that, in fact, there has never been a better time for young app-based companies. So are we to discard the anecdotes above as just that – anecdotal? Not quite so fast.

In 2013, 70% of investment into mobile app companies came whilst the companies were still in their seed stage. That figure held constant throughout 2014. But in 2015, it fell to 65%; venture-stage companies had picked up the slack. By 2016, only 62% of fundraisings reached app companies at their seed stage; the rest were into venture-stage (31%) and growth-stage (7%) companies. The anecdotes hit on something true, then, which is that very early-stage companies had a harder time finding backing in 2016 than in any year since 2011. The higher-value fundings we saw in 2016 remained the preserve of companies which had already succeeded to some degree.

There’s plenty of money to go around – more than ever, in fact – but young app companies are having a harder time finding it than they have done for at least five years.

Get a free tour of the platform.