UK University Spinouts: who are they and their investors?

Category: Uncategorized

This week, we’ve analysed the top investors in UK university spinouts from 2011 onwards. Recent events have the brought the media’s attention to this sector, such as the acquisition of Ziylo, a spinout from the University of Bristol. Britain’s higher-education sector is world-leading, so it’s understandable that the IP being developed in university labs is of high interest to investors. At Beauhurst, we now track every company that has spun out of a higher education institution in the UK.

The 10 most active overall investors of UK University spinouts since 2011*

*Based on minority stake equity investments that have been announced in the press or privately disclosed to Beauhurst. Excluding acquisitions, IPOs or majority stake investments.

Important note: these stats only include those investments that have been announced in the press or privately disclosed to Beauhurst. A large amount of deals will not have been announced to the press. These figures should be taken as indicators only.

A university spinout is essentially a company that has been developed from a university’s research. Usually, the management team will be former or current researchers, sometimes even PhD students. The university, or one of its connected venture funds, will provide the company with startup capital, and will usually act as a significant shareholder in the company from the start. Additionally, the company will frequently continue to have access to the academic institution’s workspace facilities.

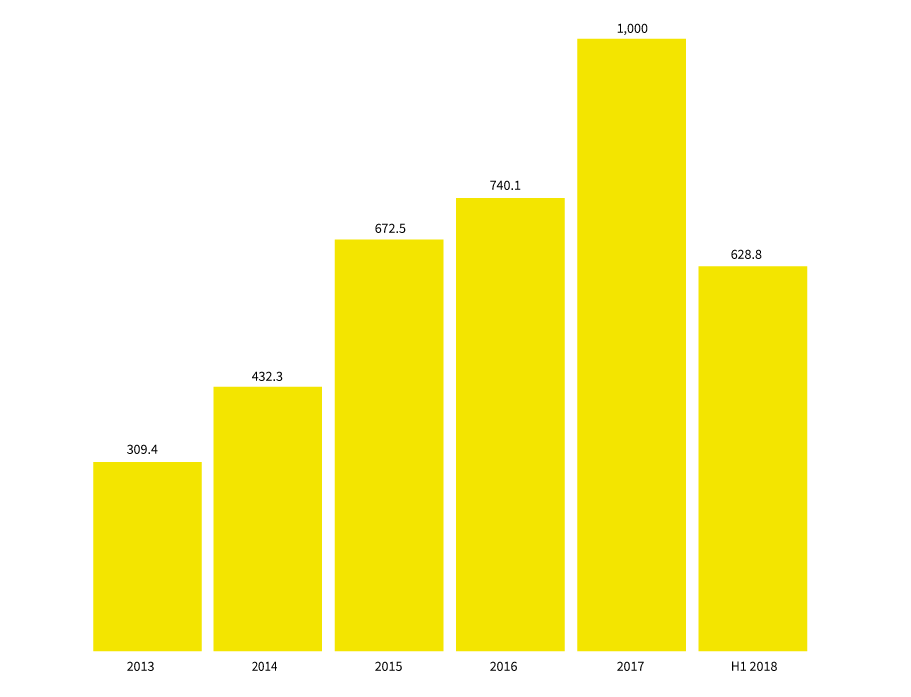

A lot has changed since 2010, with the UK’s tech scene becoming well-established on the global stage. Venture capital activity has shown a marked increase, as has investment into the UK university spinouts, both in terms of number of deals and amount invested.

Equity investment into UK university spinouts, 2011 – 2018 (£m)*

*Based on minority stake equity investments only. Excluding acquisitions, IPOs and majority-stake equity investments.

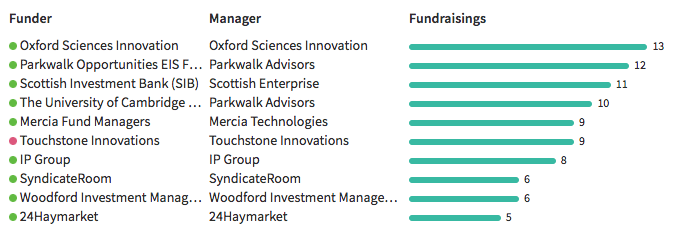

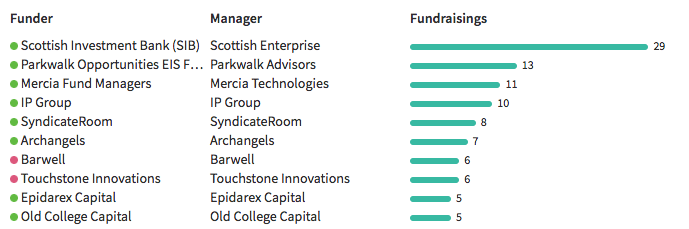

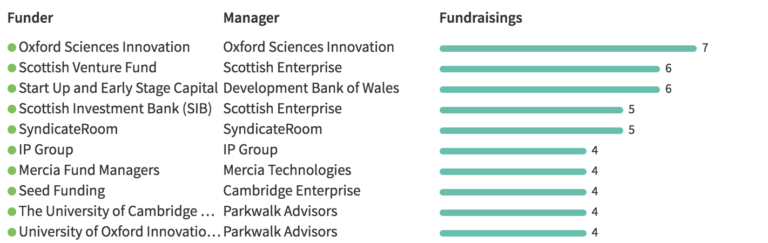

yearly breakdown of Top investors in UK university spinouts since 2016*

2016

2017

h1 2018

*Based on minority stake equity investments that have been announced in the press or privately disclosed to Beauhurst. Excluding acquisitions, IPOs or majority stake investments.

IP Group increases dominance in the UK university spinout market

As these stats make clear, the UK’s IP commercialisation market is dominated by several firms. Chief among these is the IP group, an investment vehicle designed to help spinout potentially valuable life science and technology IP from the UK’s research labs.

Touchstone Innovations were also very prominent in this sphere, until their acquisition by IP Group in late 2017. IP Group also acquired Parkwalk Advisors in the same year.

There are close links between many of the UK’s commercialisation agents. For instance, IP Group own a stake in both Oxford Sciences Innovations (OSI) and Cambridge Innovation Capital. OSI are backed by funds including Oxford University, the university’s endowment management firm, and Neil Woodford, who heads Woodford Investment Management.

Indeed, OSI have recently become much more active. As we mentioned in our recent piece on the Oxford’s tech scene, Cambridge has historically been regarded as the better university for spinning out startups. The tide may be turning in this particular regard.

Through these acquisitions IP Group has established its position as a prime mover in Britain’s spinout sector. That being said, other firms have played an important role. Crowdfunding/angel investor platform SyndicateRoom has featured in the top 10 list since 2015. Old College Capital, the venture arm of the University of Edinburgh, made five investments in 2017, following its foundation in 2011.

Scottish Enterprise has also played a prominent role. Through its various sub funds, this economic development agency has backed a considerable number of UK university spinouts. In 2018, their Scottish Venture Fund backed several spinouts north of the border, such as Causeway Therapeutics, which is developing a new therapy to help treat joint injuries, and BiogelX, which develops cell cultures that can better mimic organic tissues.

As for the future, it will be interesting to see whether UK university spinouts continues to enjoy access to increasing levels of funding. Brexit could affect this either way. Several groups seem worried that the UK will lose access to important sources of funding and human capital in a post-Brexit world. This could translate into a lower throughput rate of valuable IP in the UK’s research labs.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.