Tech trends in the Golden Triangle Part 2: Silicon Spires

Category: Uncategorized

Earlier this year we co-produced a report with Penningtons Manches on the levels of investment from the United States reaching the UK. One of the findings of the report stood out – since 2011, the number of deals involving West Coast investors and UK tech companies has increased by 252%. Further research revealed that in the same period, 79% of US investment went to technology firms headquartered in the UK’s “Golden Triangle”, a prosperous cluster formed around the academic centres of Oxford, Cambridge and London. When it comes to American investors, they clearly see this area as the tech heartland of the UK.

As such, we wanted to dig a bit deeper and explore the broader technology trends within the cluster, particularly the differences existing between each centre. In the first post, we profiled the tech scene of Cambridge (otherwise known as the Silicon Fen), revealing in terms of per capita funding, the city outperforms London’s tech scene by a considerable margin. Is the situation the same for Oxford, the city of “Silicon Spires”?

Silicon Spires tech funding

Since 2011, £1.06b of equity investment has reached the hands into Oxford’s high-growth tech companies (HGTC), over 248 deals.* (See here how we define high-growth enterprises).

This is somewhat less than the £1.6b raised by Cambridge tech companies over the same period. However, it’s worth comparing these figures on a per capita basis, to adjust for differences in city size:

As of 2011, Oxford’s metropolitan population was around 244,000. Cambridge’s was around 280,000. So for every Oxford inhabitant, there has been £4,344 of tech investment since 2011, whilst for Cambridge there has been around £6,557 (assuming the population has stayed roughly the same). This decade, Cambridge has clinched the top spot in terms of tech funding.

*Excluding acquisitions, majority stake investments, and money raised through IPOs.

For Greater London, with a population estimate of 8.25m and a tech scene which has raised £14.5b since 2011, the figure is much lower, at £1,643. However, whilst London’s tech scene is centred around the so-called “Silicon Roundabout”, over the past eight years it has spilled out across “Inner London“. Tech companies in this area have raised £13.9b since 2011. With a population of 3.23m, this comes out at roughly £3,374 of funding per capita.

This is a blunt measure of tech activity, but it does help illustrate the amount of investor interest each tech scene is generating, relative to the city’s immediate human capital.

Sectors

Much like Cambridge, and in contrast to London, the Silicon Spires tech scene focuses primarily on drug development and research, rather than software. 13% of HGTCs in Oxford deal in drug development, whilst 11% develop research tools for the life science sector. Less than 1% of Oxford HGTCs operate in the financial sector, compared with 5% in London.

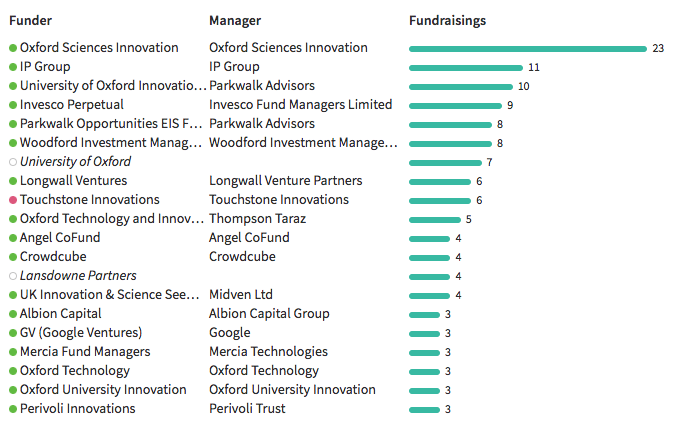

Top Silicon Spires Investors by deals backed since 2011*

*Based on equity investments reported in the press. Excluding acquisitions.

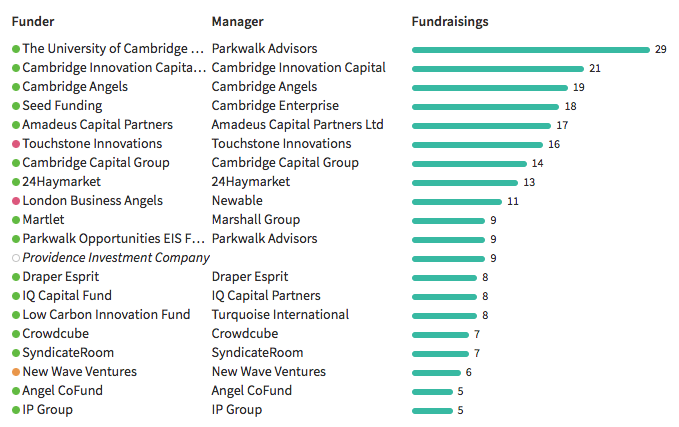

Top Silicon Fen investors by deals backed since 2011*

*Based on equity investments reported in the press. Excluding acquisitions.

When we compare the investment ecosystems of Cambridge and Oxford side by side, key similarities appear. Local investors in the Silicon Spires, much like the Silicon Fen, are prolific, and play an important part in supporting the city’s tech scene. This is in contrast to the nationwide tech scene, where crowdfunding platforms have backed the most deals. Parkwalk Advisors are key players in both ecosystems, managing parallel funds for both Oxford and Cambridge University.

Chief amongst Oxford’s home-grown investors is Oxford Sciences Innovation (OSI), which has backed 21 publicly announced tech deals since 2011. This is a specialist commercialisation vehicle, operating solely to help spin out technological ideas from the university’s research. From their website:

Silicon Spires spinouts

In a recent interview Tom Hulme, a partner at GV (formerly Google Ventures, which also sponsors OSI) stated that historically Cambridge University had the edge over Oxford when it came to spinning out successful tech startups.

In terms of tech-funding (though this is by no means the only metric of success) this no longer seems to be the case. Spinouts from the University of Oxford have raised £1.18b since 2011, whilst Cambridge spinouts have raised £832m. If we look at spinouts from the two institutions which have incorporated on or after 1st January 2011, Oxford has produced 64. The University of Cambridge, meanwhile, has produced 44.* **

*Disclaimer: some companies do not publicise their spinout origin, nor do they always have evidence of university support on their company filings, so these figures are likely underestimates. These figures also exclude money raised from acquisitions and IPOs.

**You may have also noticed the slight disconnect between the figures for how much tech spinouts from Oxford University have raised (£1.18b) since 2011, and how much all tech companies with a HQ in Oxford have raised (£1.06b). This is because some of Oxford’s spinouts have moved elsewhere in the UK, and gone on to raise sizeable chunks of funding.

Interestingly, both Oxford and Cambridge have spun out a so-called “unicorn startup” – a company valued at $1b+ or more. In Cambridge, it’s the AI cyber security startup Darktrace, whilst in Oxford, it’s Oxford Nanopore. This company develops DNA sequencing hardware for use in laboratories.

The funding success of these companies is anomalous, and skews the spinout investment data. If we exclude them, Cambridge spinouts have raised £697m, whilst spinouts from Oxford have raised £737m.

The Silicon Spires ecosystem

OSI’s other sponsors include funds from the university itself and IP Group, which are important investors in Oxford’s tech scene in their own right. This shows the dynamic links that exist between actors in a tech ecosystem. Indeed, Hulme believes that a dynamic, cooperative ecosystem is key to a cluster’s tech success: “in many ways I think Cambridge’s [spinout] funnel was more efficient historically because of Cambridge Angels and Cambridge Innovation Capital”.

It’s hard to draw comparisons based on funding alone, but the local commercialisation and investment network in Oxford is clearly becoming more conducive to a high spinout throughput, which is a promising sign. OSI, their backers, and other local investors, have played no small part in this. However, the broader tech scene in Cambridge, not just relating to spinouts, seems more established, with a stronger local network of investors and commercialisation agents.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.