UK Defence Tech 2023: A Summary

Sam Peckett, 28 September 2023

Earlier this year, we published “UK Defence Tech 2023” in collaboration with MD One Ventures. This report dove into the heart of national security innovations, exploring the high-growth companies advancing the defence technology landscape in the UK, along with the challenges they face. Take a look at our summary below.

Defining national security technology

Defence technology is technology critical to national security at all levels—states, companies, and individuals. These technologies span a wide spectrum, from the traditional arena of robotics used in security operations to cybersecurity software safeguarding sensitive information. The UK Ministry of Defence is actively fostering innovation in this sector and has pledged £800m from 2015 to 2025 to fund private sector companies developing strategic technologies.

The data in this report encompasses 251 UK-based defence technology companies, including both currently active, private companies and those that have previously been a part of this group but have since exited via an acquisition or IPO, or have ceased operations.

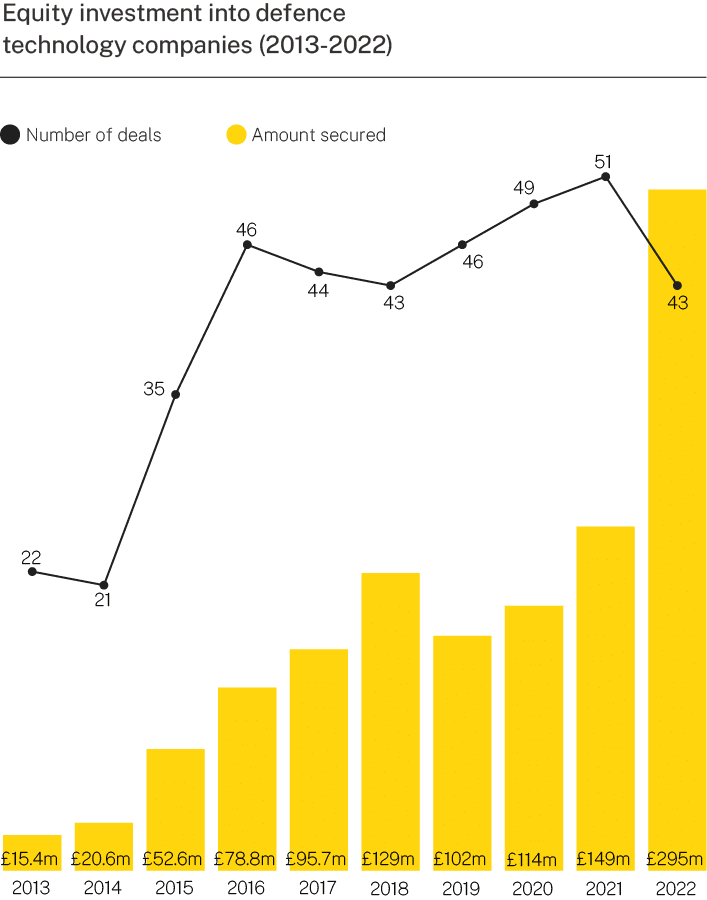

Investment landscape in defence tech

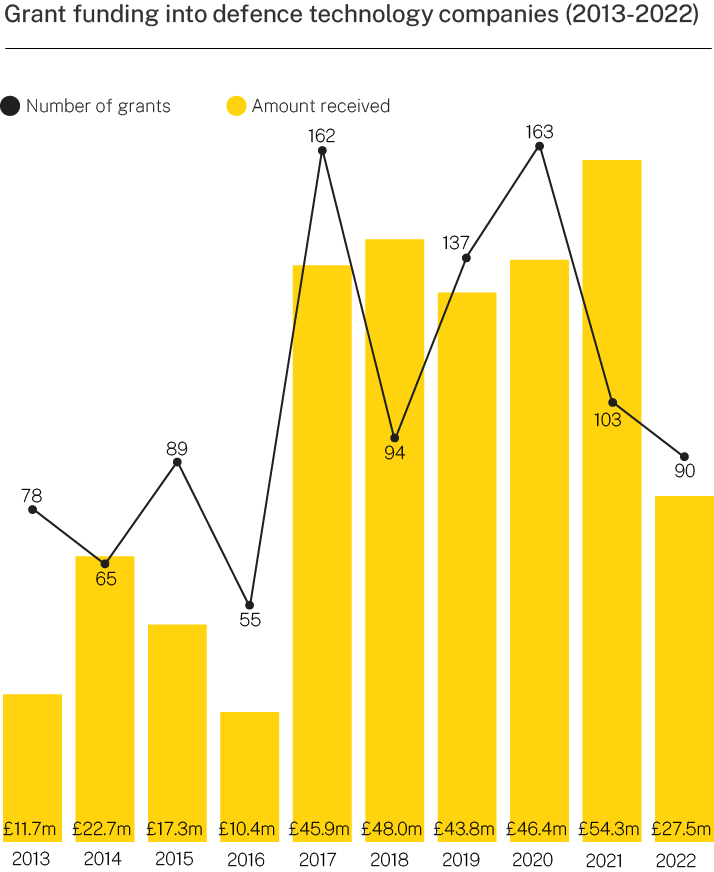

Public grants in defence tech

The UK defence spend from 2012 to 2022 has steadily increased from £34.3b to £45.9b. Defence tech companies in the UK experienced peak grant activity from 2017 to 2021, reaching a high of £54.3m in 2021, including a substantial £20m grant for GKN Aerospace.

Between 2013 and 2022, the sector secured 1,036 grants. Of these, Innovate UK supported 68.1% and the Defence and Security Accelerator contributed to 23.8%, demonstrating a strong government-private sector synergy vital in the UK’s national security efforts.

Defence spinouts

Spinout companies, rich in innovation, play a crucial role within the UK’s security sector for national security interests. From the 251 defence tech entities in the UK, a substantial 19.1% (48) originated from academic institutions, a figure significantly over the 7.6% average for the greater technology industry.

Leading the pack in spinout generation is the University of Oxford, contributing 14.6% (7) to the defence tech sector. Prominent among these is Oxbotica, an autonomous vehicle software company, which since 2014 has raised £185m in equity investment and £14.6m grant funding.

Following Oxford’s lead, the University of Cambridge is the second-most prolific in producing defence tech spinouts, accounting for 8.33% (4) aligning with the University’s ranking as the second-most frequent origin university for spinouts.

Fasting growing companies in defence tech

Over the past three years, Alloyed has had the highest compound annual growth rate (CAGR) in turnover of any defence tech company in the UK, growing its CAGR by 293%. In terms of headcount growth, LuffyAI, Herotech8 and Flare Bright are the fastest growing, having grown 52%, 71% and 55% respectively.

Take a look at our full report to see our case studies on five exciting companies in the sector, including mobile app company Worldr, analytics, insights and tools company Januus and AI company Mind Foundry.

Grow your business.

Get access to unrivalled data on all the companies you need to know about, so you can approach the right leads, at the right time.

Book a demo today to see all of the key features of our platforms, as well as the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations that match your ideal customer profile.

Beauhurst Privacy Policy