Top UK Tech Startups: 2020 and Beyond

Category: Uncategorized

A world-renowned centre of innovation and a hot destination for venture capital, the UK is home to a host of top tech startups, from Monzo to Oxford Nanopore, Deliveroo to Darktrace. As these companies further cement their place on the global stage, stealing business from incumbents and establishing themselves as household names, more and more promising startups are entering the scene.

This post pays special attention to those fledgling tech companies that have recently gained the attention of investors and raised their first round of equity funding during 2019. Successful implementation of this capital, especially with the guidance of big-name investors, will help these promising startups compete with more established disruptors, as well as industry incumbents – these are the top tech startups to watch in 2020.

Investment trends: first round fundraisings into UK tech startups

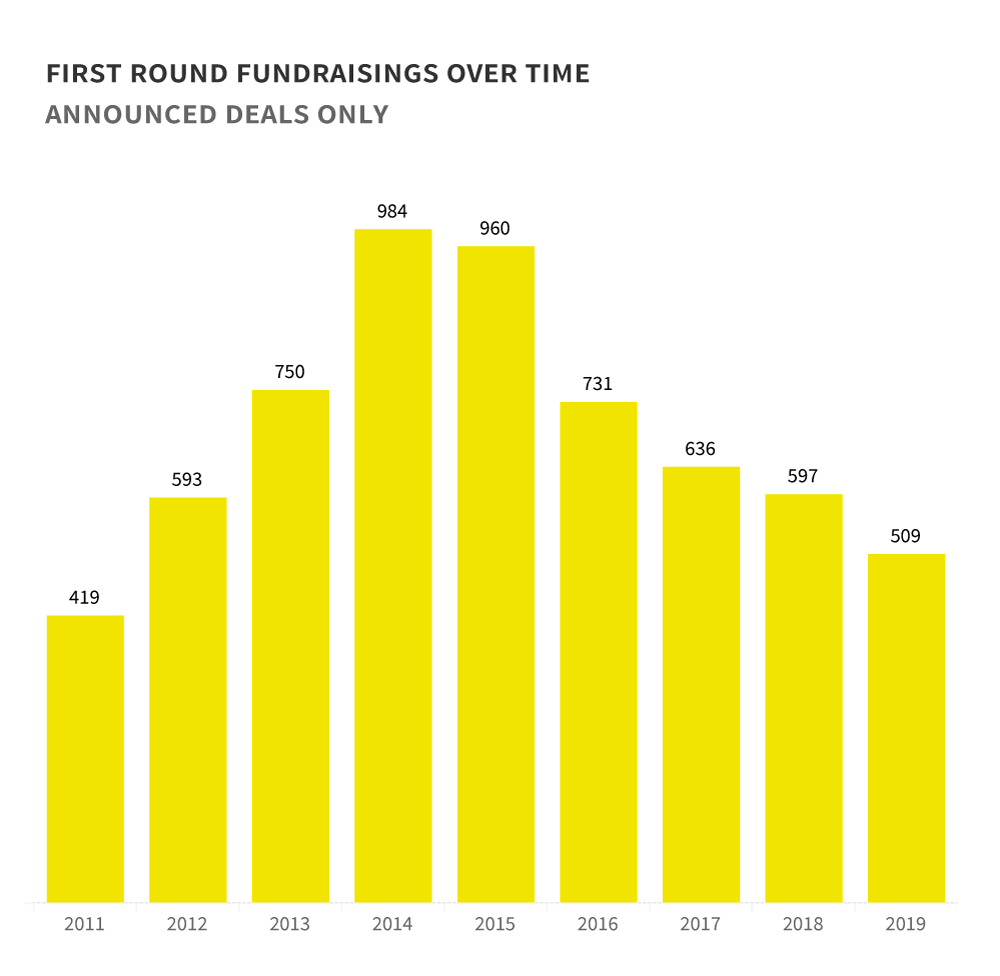

First, some context. Just how hard is it for a startup to secure its first round of equity finance? There is now more capital available in the UK than ever before, but in recent years the number of deals completed has started to decline, meaning that more capital is going to fewer companies. This is great news for the select number of businesses that are scaling well and able to take on large sums of money (we’re looking at you, Deliveroo), but means that younger startups are being left in the lurch; investment activity at the smaller end of the scale has tailed off since 2017. Indeed, 2019 saw the number of first time fundraisings return to levels last seen towards the beginning of the decade, with just 509 UK companies announcing their first round of equity finance in the last 12 months.

This downtrend makes it all the more impressive when a very young startup gains the confidence of private investors, who believe they have the right founding team, market, mission and ambition to generate significant returns further down the line.

Top Tech Startups in the UK 2020

Ad-Lib Digital

Ad-Lib Digital provides a creative management platform that enables marketing teams to personalise ads more efficiently. Driven by proprietary AI, the adtech platform generates thousands of creative assets to help deliver tailored adverts across a range of channels. Ad-Lib offers real time insights into performance of different assets, and automatically reformats these assets based on which ones work best across different audiences and locations.

Ad-Lib already has an impressive client list, including John Lewis, L’Oréal, HSBC and Tesco to name a few. Registered in 2017, the company closed 2019 with a $6m funding round to develop its technology, make new hires to its senior leadership team and launch its US headquarters. Investment was made by San Francisco Private Equity firm Fog City Capital, which took a stake of just over 36%.

ANNA

An acronymization of Absolutely No Nonsense Admin, ANNA provides current account banking services for SMEs, specialising in invoice management. The challenger bank offers a number of time saving solutions for creative industries and freelancers. One of its main features sees employers give their staff their own ANNA debit card with a spending limit. The ANNA app automatically sorts their expenses, cutting out the need to reimburse employees for business costs.

The four year old fintech is based in Cardiff and led by serial entrepreneur Eduard Panteleev. ANNA first raised equity finance in February 2019 with a £8.5m equity round backed by VC fund Kinetik, with the purpose of expanding its customer success team. A slightly smaller round followed not long after, when the company raised £3.53m in equity and loan funding via crowdfunding platform Seedrs. This capital will be used to continue development of proprietary AI and to advance its financial services offering.

Apricity

Incorporated in mid-2018, AI company Apricity is one of the youngest companies on our list. Apricity operates the world’s first virtual fertility clinic, which uses data to try and increase success rates and make fertility treatment less arduous. AXA’s Kamet Ventures invested €6m of equity in June 2019 to accelerate Apricity’s journey to market. At the same time, Apricity acquired Altrui, the UK leader in egg donation services, to strengthen its route to market and help realise its vision.

Apricity’s online fertility predictor allows users to quickly see their chances of a live birth with different fertility treatments, depending on age and causes of infertility. Customers can then schedule a call with a specialist advisor to explore various treatment options further and discuss different packages. Apricity provides tailored treatment plans that fit with each customer’s lifestyle and schedule, offering complementary benefits including seven day support and a treatment app.

Autopaid

Autopaid develops technology for SMEs that allows them to receive payment for their invoices on the day that they are issued for 95-97% of the value. Developed to ease cash flow for young companies, Autopaid takes on 90% of the credit risk on invoices and takes care of the credit control.

Autopaid was established in Manchester in late 2017. Originally led by serial entrepreneur turned investor Paul Haydock, Autopaid is a follow on project from one of Haydock’s previous ventures, DueCourse. The small team is now under the guidance of CEO Nicola Weedall, and is currently part of AG Elevate accelerator’s June 2019 cohort.

The alternative finance startup secured £6.25m of equity fundraising in March 2019. Although investors were undisclosed, the company’s cap table reveals participation from various Business Angels along with venture capital fund Global Founders Capital, managed by Rocket Internet. This is an impressive fund to have on board, given its previous success with Skyscanner, Funding Circle, Slack and Revolut amongst many other household names. We’re excited to see how Autopaid continues forward in 2020.

Subscribe to our weekly newsletter for

free analysis of the UK’s high-growth space.

EMMAC

EMMAC Life Sciences Group is a pioneering cannabis company with a range of unlicensed products for medical use. Formed in early 2018, the company quickly established a long-term research partnership with Imperial College London to investigate cannabis-based medicinal products. This collaboration was extended in September 2019, when EMMAC announced that it would “fund a post-doctoral research fellow for an extendable one-year period, to explore the efficacy of EMMAC products in neuropathic pain to support their development towards clinical trials”.

Aside from spearheading new research exploring the potential benefits of cannibinoids for patients with acute pain, the team at EMMAC have also raised a significant amount of capital to acquire and build a fully functioning supply chain across Europe.

The company began 2019 with a bang, completing a £6m private placement on the 1st January. This capital helped fund the acquisition of Medalchemy, a GMP certified laboratory in Spain, and Swiss wellness CBD company Blossom.

Another £11m private placement followed swiftly after in March, with the purpose of funding future research and acquisitions, including British Specials manufacturer Rokshaw and French wellness company Greenleaf. BusinessWire reported that this round valued the company at £66m pre-money.

In July 2019, EMMAC acquired Portuguese genetics and cultivation company Terra Verde, which held the oldest cannabis cultivation license in Portugal. According to EMMAC’s press release, this acquisition completed ‘the full integration of EMMAC’s supply chain’, making it ‘the largest vertically integrated European cannabis company and a leader in the industry’. The company also has licensed distribution channels for medical cannabis in the UK, Germany and Italy.

Most recently, £15m was injected into the company in October 2019 in the form of Convertible Loan Notes. This capital will further the company’s position in the European market. CEO Antonio Costanzo said “we now have an established presence in all aspects of the cannabis supply chain and are well placed to meet the rapidly growing demands of the market, driven by regulatory change and consumer demand.”

The speedy execution of this buy and build strategy is very impressive, and places EMMAC in an incredibly strong position in a burgeoning market.

Immo

Immo provides an online house buying service, aiming to increase the efficiency of the sales process. The company buys properties from individual home sellers at a ‘fair price’ on a fixed date, offering convenience and certainty with no agency fees. The properties are then refurbished and let out to new tenants. Immo was founded back in 2017 by CEO Hans-Christian Zappel, who has since grown his team to almost 40 people, according to LinkedIn.

The proptech market took a bit of a hit in 2019, with both the number and amount of investments made into private UK proptech companies decreasing from 2018. Despite this, Immo raised an impressive first round in November 2019 of £9.47m. Participants of the funding round included Talis Capital (a fund backed by a number of high-net-worth entrepreneurs), along with German firm Holtzbrinck Ventures and other undisclosed investors. At the same time, Immo announced that it had raised more than €60m in “buyer capital” to fund the acquisition of properties.

M:QUBE

M:QUBE aims to transform the mortgage market by providing customers with a sense of certainty and control over their deal, as well as speeding up the process through an online platform. The company was founded in 2017 by experienced financial services executives, Stuart Cheetham and Richard Fitch.

M:QUBE raised its first round of equity finance in October 2019 with participation from an impressive selection of investors. IQ Capital Fund, AV8 Ventures (the corporate venturing arm of Allianz) and JamJar Investments supplied a combined £5m of working capital at a pre-money valuation of £8.3m. Debt will be supplied by a ‘select number’ of partner institutions, in order to finance mortgages.

RHEON Labs

Working with active polymers, RHEON Labs has created a material which is soft and malleable in its natural state but hardens on impact, claiming to ‘give your product reflexes’. The technology has a number of uses across a wide spectrum of sportswear, from cycling to snow sports and equestrian.

A £55k grant from Innovate UK in February 2018 provided the company with capital to reinvent the shin guard, replacing the traditional one-size-fits-all model with soft and flexible protection moulded onto knitted socks to move with the musculature of the body.

Founded by mechanical engineer and CTO Dan Plant in 2017, RHEON Labs is now led by CEO Stephen Bates. The company’s first equity raise was completed in July 2019 and totaled £7m. Investors remain undisclosed, but a press release stated that the private placement attracted ‘a unique and prestigious group of private investors.’

Vive

A new entrant to the fast expanding group of UK challenger banks, Vive provides loans to customers with low credit scores, alongside developing a money management mobile app. CEO Nick Anthony leads a team of industry experts in credit, risk, operations, marketing and technology.

Incorporated in 2017, the bank is still in its early stages, but ended 2019 with a healthy £10.9m equity raise in mid-December. This deal was unannounced to the public and investors remain undisclosed.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.