Investor Types: where are they investing?

Category: Uncategorized

The UK is home to over 30,000 high growth companies, of many different shapes and sizes. To match this diversity, the country has many different types of investors offering a variety of funding options, expertise and support to young ambitious companies. This is the final part of our “investor type” blog series, with the first blog assessing the market share of these investors, and the second taking a more granular look at the average deal profile that they each are involved in. This third and final part takes a step back to look at where the equity is going, and into what sectors.

Geographically, we see an undeniable bias towards London, with 47% of all deals in 2018 secured by companies in the capital. The series of maps highlights the different regional strategies of investor types. Looking at the top sectors of each investor, we see certain strong sectors, such as Software-as-a-service, attract investment from all types of investors. University funds, more exclusive by nature, show slightly different sectoral preferences, primarily supporting companies in the medical and research sectors.

Private Equity and Venture Capital

Private equity (PE) and venture capital (VC) firms conduct most of their investments into organisations within London. London and the South East are consistently the top regions for this type of investor, and the top five local authorities have been London boroughs since our records began.

There are many forces that reiterate this London bias within the entrepreneurial ecosystem. While the capital is home to a large proportion of the UK’s active high-growth firms (37%), the majority of PE and VC firms (77%) are also located within the city. The prolific activity and potential within this region can easily blind investors to the masses of potential outside the country’s capital city.

While the growth in deals backed by PE and VC firms has been primarily driven by investment into London companies (which secured 47% of all deals backed by this investor type last year), there has been some improvement in regional areas, with PE and VC firms backing 3x more deals in Scotland in 2018 than in 2011.

Crowdfunding

What is most striking when observing the geographical spread of deals backed by crowdfunding platforms over time is the sheer increase in the number of deals. Backing just eight deals in 2011, activity has grown hugely, with these platforms backing 368 deals in 2018. However, the bias towards London is even more pronounced than in PE and VC firms, with 58% of all deals secured by companies in the capital. Bristol was the local authority outside of London to secure the most deals backed by crowdfunding platforms, with 10 deals in 2018. It is interesting to see that, despite its digital and arguably delocalised model of investment, crowdfunding is still investing largely in London-based entrepreneurs and their ideas, which only represent 37% of the UK’s active ambitious companies.

Angel Networks

Angel networks are often established by high-net-worth-individuals (HNWIs) to support and accelerate growth in their local area, and hence, this investor type demonstrates stronger activity in areas outside London than the previously described investor types. However, Scottish angel networks tend to be more open to disclosing their deal data than networks in other regions, which emphasises their activity when looking at the national picture. Using the data available for angel networks, strong networks in Scotland are highlighted, with Edinburgh securing the most deals out of all local authorities for five out of six years in a row. Scottish companies secured 37% of the announced deals backed by angel networks in 2018, while London companies secured 30%.

Devolved Government

Devolved government bodies, as may be expected, invest primarily into regions outside of London, and England more generally. High-growth companies in the East of Scotland secured the most deals backed by devolved government funds in 2018 (34%), followed by Wales (29%) and then the West of Scotland (14%). These three regions have attracted between 61% and 85% of the deals backed by devolved government bodies since 2011, with the major hubs of activity being Edinburgh, Cardiff and Glasgow.

Corporate

54% of all corporate investments were made into London-based companies in 2018, and with a further 10% made into companies based in the East of England. Edinburgh also secured five investments backed by corporate funds in 2018 (7%). In 2017, the City of Bristol was the top local authority, securing 6 deals backed by corporate funds; two of these were funding rounds held by the recent unicorn, Graphcore.

Of all the corporate funds who made at least one investment into a UK high-growth company in 2018, 54% were headquartered abroad. The globally recognisable names of Cambridge (which secured 6 of the 7 deals in the East of England in 2018) and London help attract corporate investors, domestic and international, to these regions, as well as the pull of the intellectual property of their University’s spinouts.

Central Government

Investment activity by central government funds increased by more than 400% between 2016 and 2018. Northwestern companies secured the most deals of all regions in 2018 (38%), with enterprises based in Manchester accounting for 17% of this. This region seems to have been a recent strategic focus for government investment; in 2013, northwestern companies secured just 7% of deals. The West and East Midlands pulled in the second and third largest number of announced deals in 2018, though neither secured any in 2017. Last year, London companies received the smallest number of investments (5 deals) from central government since 2011. This centralised source of equity funding could help to address the regional imbalance of investment, helping to support ambitious businesses that may currently fall below the radar of private equity investors based in London.

University

As expected, companies that share their home with large universities are the most successful at securing deals from university funds. In 2018, South Cambridgeshire secured 18.38% of all deals backed by universities, followed by the City of Cambridge, and then by Edinburgh. Companies in the East of England have secured 37% of all university-backed deals since 2011, while London companies secured 17%.

Interestingly, these figures do not closely correlate with the number of spinouts in each city. The University of Cambridge has spun out 117 companies, while London universities combined have founded 139 spinouts. Oxford University alone has established 133 spinouts, but only secured 2.17% of University deals in 2018. This is partly because universities have other funding bodies through which they support their spinouts. For example, Oxford University has dedicated commercialisation companies and EIS funds (managed by Private Equity and Venture Capital firms) that invest into their spinouts; these indirect investment vehicles reduce the occurrence of direct investment from the university itself.

Sectors

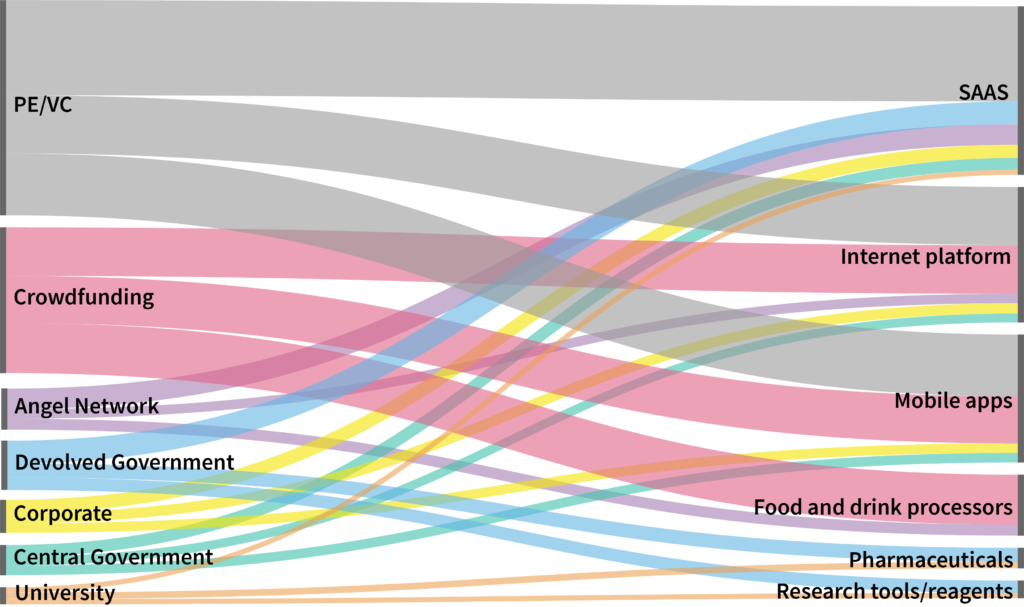

This graph shows the top sectors for each investor type in 2018, by the number of announced deals made into companies operating within these sectors.

While the seven investor types exhibit notable difference in their geographical activity, their sectoral preferences are less distinct. The top three sectors for each type of investor are one of six different sectors; Software-as-a-Service (SaaS), Internet Platform, Mobile apps, Food and drink processors, Pharmaceuticals and Research tools/reagents.

The SaaS sector is one of the broadest categories of business, encompassing a huge variety of companies, including analytics firms, online retailers, payment processors and more. Crowdfunding platforms were the only type of investor where SaaS does not feature as one of the top three sectors. To read more about this vital and eclectic sector, have a look at our recently published SaaS report.

Notably, university investors are focused primarily on Pharmaceuticals and Research tools/reagents; this is a reflection of the drive to commercialise and employ the pioneering medical and life science technology developed in the UK’s academic institutions.

In summary...

The UK has a vibrant and growing equity ecosystem, and the first step to understand its various and complex dynamics is to identify the key players and their differing strategies. The first blog in this series introduces the top seven types of investor, and the second explores the average size and stage of deals of these funds. To complete this series on different investor types in the UK, this blog has reviewed the data with a top-down approach, describing nation-wide trends. This data gives investors a chance to benchmark their own activity, while encouraging improved transparency across the industry to help policy makers, businesses and investors better exploit the areas of opportunity within the high-growth sector.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.