Top Companies & Investment Trends in the UK Healthcare Sectors

Category: Uncategorized

The healthcare and life sciences sectors have come under increased scrutiny during the pandemic. Global and national bodies, as well as private healthcare providers, have called for increased focus and government spending into healthcare services, encouraging widespread digital transformation of the healthcare industry.

But public money isn’t the only channel of finance for healthcare companies. Healthtech startups are increasingly in need of equity investment to drive such digital transformation. In addition to the COVID-19 focussed innovations, there is ongoing development of novel technologies and medical services to support a variety of health conditions, both in terms of physical and mental health.

Several of these have attracted investors whose money can support further research and scaling to meet pandemic demand. While 2020 was a record high for investment into UK pharmaceutical companies, the year was also interesting for other health sectors for investment both related and unrelated to COVID-19. Unlike pharmaceuticals, not all sectors of the healthcare industry fared well over 2020, such as MedTech, while alternatively, health technology (healthtech) is on the rise.

In this article, we look at the medtech and healthtech sectors, examining the startups that raised the largest funding rounds in 2020 and whether that capital will go towards fighting the pandemic or for other healthcare endeavours.

An overview of MedTech and the top companies in the sector

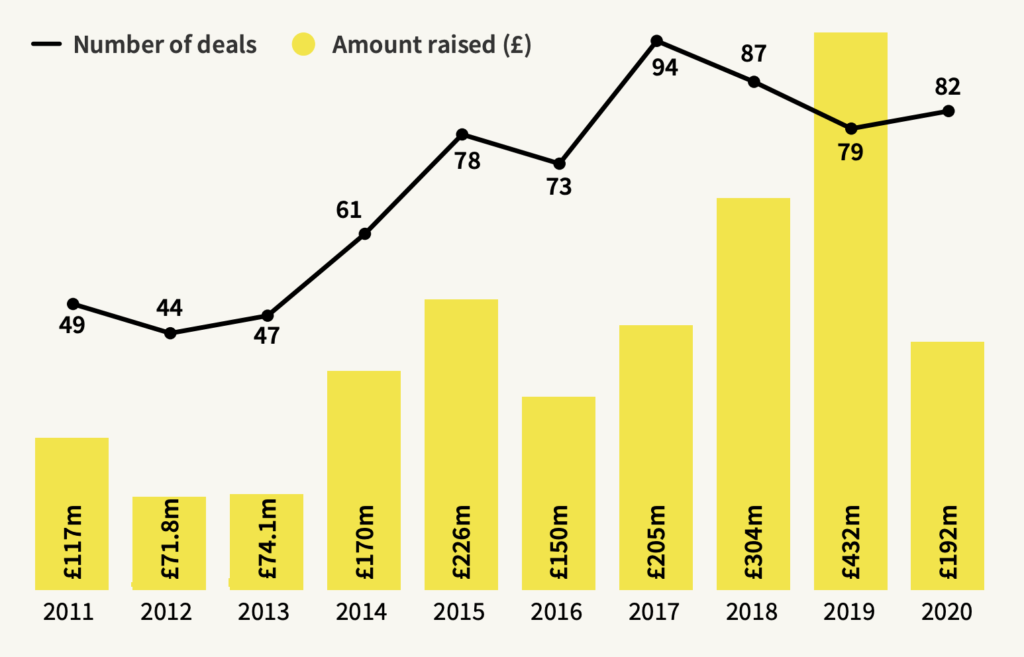

Covering clinical diagnostics, medical devices and instrumentation (but not drug discovery and pharma, which remains a separate sector outside this analysis), MedTech is vital to all stages of healthcare, from prevention and diagnosis to treatment and care. Without counting the government’s Future Fund, the sector raised £193m of investment across 82 funding rounds in 2020.

Some of these investments were indeed secured by technology companies with innovations that fight the pandemic. One such innovator is Iceni Diagnostics, a University of East Anglia spinout which has developed a rapid lateral flow test for COVID-19 that gives results in just 15 minutes. The test resembles a pregnancy test with its ‘red line’ functionality, and was first backed by a small Innovate UK grant in May 2020. In December, Iceni Diagnostics received £2m of equity investment to build commercial infrastructure and take on more staff. Co-founder Professor Rob Field stated that “There’s a vast, global potential in the application of our unique technology. We are using it to tackle COVID now, but it will also produce better vaccines and new diagnostic and therapeutic products in the future.”

Cambridge Respiratory Innovations has received eleven grants since founding in 2013, but 2020 was its first year for equity fundraising, securing £1.7m across two rounds last year. The company is currently working with NHS Trusts to supply its handheld monitoring device, N-Tidal, for use across the health system, helping to identify when a patient with COVID-19 is deteriorating and signalling to care teams if they require ventilator support.

Surprisingly however, it seems that the largest investment rounds into MedTech in 2020 were not related to COVID-19. Biotech and life sciences firm Bit Bio raised £32.6m in June, at a pre-money valuation of £77.6m. The company is developing research tools and technologies where human cells are reprogrammed and produced for cell therapy. The second largest investment, worth £28.7m, went to University of Oxford spinout Perspectum, which delivers technologies to aid in the diagnosis and care of patients with liver disease.

Investment into UK Medtech Companies 2011–2020

A total of £193m was invested into UK MedTech companies over the course of the year, the lowest it’s been for the sector since 2016, despite a great number of innovative products, services and solutions in development. Investors into MedTech usually look for companies with clinical evidence to prove their novel product or technology is valuable, as well as regulatory approval and patents. With many non-coronavirus laboratory projects and clinical trials shut down in the first lockdown, and as regulatory approval continues to be a difficult process for early-stage companies, these criteria have been all the more challenging to meet and may explain the slowdown in investment.

An overview of Healthtech and the top companies in the sector

The healthtech sector refers to the use of information and communication technology in relation to healthcare and wellness practices. It includes a range of services and systems such as health platforms, telemedicine, and electronic health records. One of the biggest names in the healthtech ecosystem is Babylon Health, which uses artificial intelligence and machine learning to power a diagnostic chatbot, among other products. The company has secured over £500m in equity finance and has reached a valuation of more than $2b.

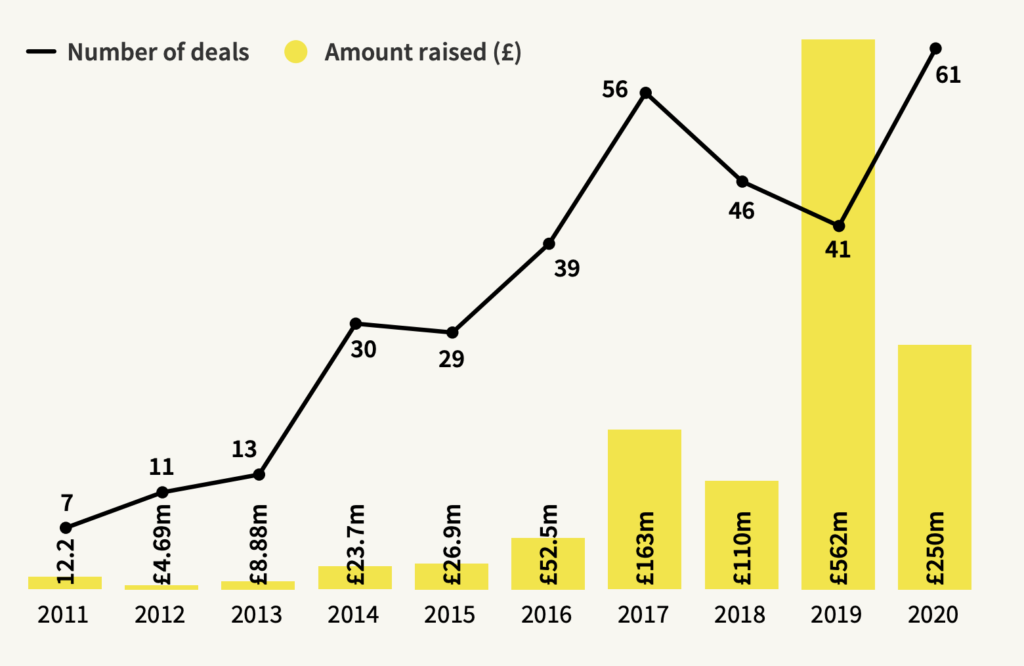

There were 61 equity fundraisings into healthtech companies in 2020, totalling £250m. This compares with £52.5m over 39 rounds in 2016 and £110m over 46 rounds in 2018.

The largest investment of the year was £53m and secured by Cera* to fund expansion. The digital health company offers technology that arranges home care for the elderly. Based in London, Cera has certainly shown promise since its early days, attending three accelerators in its first couple of years. In 2020, the company featured on the Startups 100 and Deloitte Fast 50 high-growth lists.

Other notable deals in the healthtech sector in 2020 include £23m for Lumeon and £22.7m for Your.MD, also both London-based. Used by clients across Europe and the US, Lumeon’s software improves administrative efficiency and helps track the progress of patients. Meanwhile, Your.MD offers an app called Healthily that uses artificial intelligence, allowing users to check their symptoms before seeing a doctor and providing plans and advice for ‘self-care’.

A significant chunk of investment, £95.7m, into healthtech occurred in Q1 2020, suggesting that growing interest and demand for the sector was occurring even before the pandemic hit the UK. On a global scale, the WHO has certainly urged the importance of healthtech for a number of years before the pandemic, believing that “the use and scale up of digital health solutions can revolutionize how people worldwide achieve higher standards of health, and access services to promote and protect their health and well-being.” A multiyear upward trend and the strength of pre-pandemic 2020 for healthtech investment indicates it is not solely COVID-19 driving the rise of the sector.

Investment into UK Healthtech Companies 2011–2020

Yet COVID-19 may mean this already rapidly growing sector will expand even faster. While the value of investments actually dropped quite sharply in Q2 and Q3 of 2020, it climbed back up to £86.4m in Q4. In October, Push Doctor received £13.7m of investment for its product: an online GP service where patients can have video consultations with NHS-trained clinicians. In 2021, healthcare professionals continue to face an unprecedented level of pressure as millions are still not receiving care outside COVID-19, meaning that healthtech and digital services may become not only desirable, but essential to society.

Increased demand may require startups to take on new investment to support further research, as well to allow for rapid and effective scaling. One such example is Welsh company Bond Digital Health, which has been developing the digital element of a rapid testing system to help authorities track and monitor positive cases and hotspots of COVID-19. With the backing of Wealth Club and the Development Bank of Wales, the company raised £700k in April for research and development, and £1.2m in November to fund product development and expansion into new markets.

The Overall Diagnosis for the Healthcare Industry

COVID-19 has presented the MedTech industry with many challenges, ranging from huge pressures on supply chain and delivery, as well as being unable to access resources and laboratory space when research is not coronavirus-related. Going forward, however, MedTech will play an even more crucial function in disease diagnosis and care, especially as the population ages. Investment opportunities may indeed go on the rise again, particularly as artificial intelligence, nanotechnology and robotics emerge in the sector. In 2020, nine of the 82 fundraising rounds into MedTech were secured by companies using AI.

Turning to healthtech, the future looks promising. Although the NHS has been viewed as slow to work with healthtech companies and adopt their technologies, the sector is rapidly growing. With COVID-19 changing how the UK conducts its health and patient care permanently, and with secure digitised health services more in demand than ever, it is safe to say that healthtech is here to stay.

*Cera shares significant shareholders with Beauhurst

This article was originally published in The Deal 2020.

Have you read our latest report on UK equity investment trends yet?