The Deal H1 2017: A record half for startup investment in the UK

Category: Uncategorized

We have just released the The Deal, our quarterly report on UK startup investment.

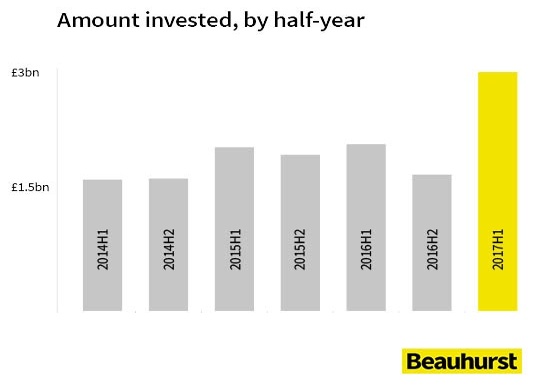

- 74.7% increase in amount invested compared to H2 2016, to a record £3.03bn.

- Two of the three largest deals on record, involving virtual reality firm Improbable (£389m) and e-commerce site FarFetch (£313m).

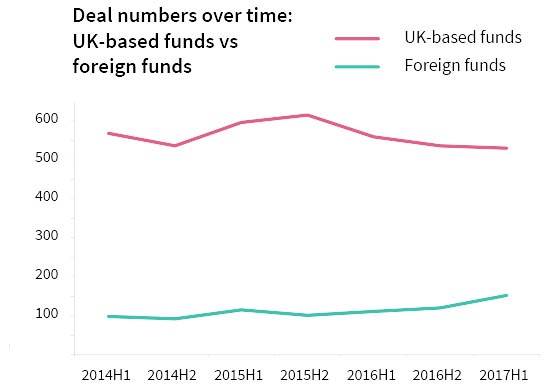

- The number of deals involving non-UK funds rose 26.7% from the previous quarter.

- Deal numbers are down 3.54% compared to H1 2016.

- Later stage companies saw a 7.6% decline in deal numbers from the previous half.

- Deal numbers from crowdfunding platforms were up slightly (2.6%) from H2 2016, but have fallen by 18% in the last three months.

For over two years we’ve been concerned at the fall in deal numbers to UK businesses. So we are pleased to see this decline abating in the first half of this year, as well as a record level of cash invested.

But, as usual, beneath the surface there are some interesting undercurrents. The fact that later stage companies are seeing a drop in deals, is still a cause for concern.

Another more recent trend is the rise of the international investor, particularly for funding the largest investment rounds. International appetite for backing UK companies, particularly from China and Japan, is stronger than ever. It is difficulty to say whether this is because of or despite Brexit. But either way we should pause to question why these companies had to look so far afield for the investment they needed.

It is not that the cash doesn’t exist in the UK – it’s that asset managers still seem shy of the venture capital asset class. It is our hope that the forthcoming Patient Capital Review, on which we collaborated with HM Treasury, will encourage movement in the right direction.