South East Equity in Numbers

Category: Uncategorized

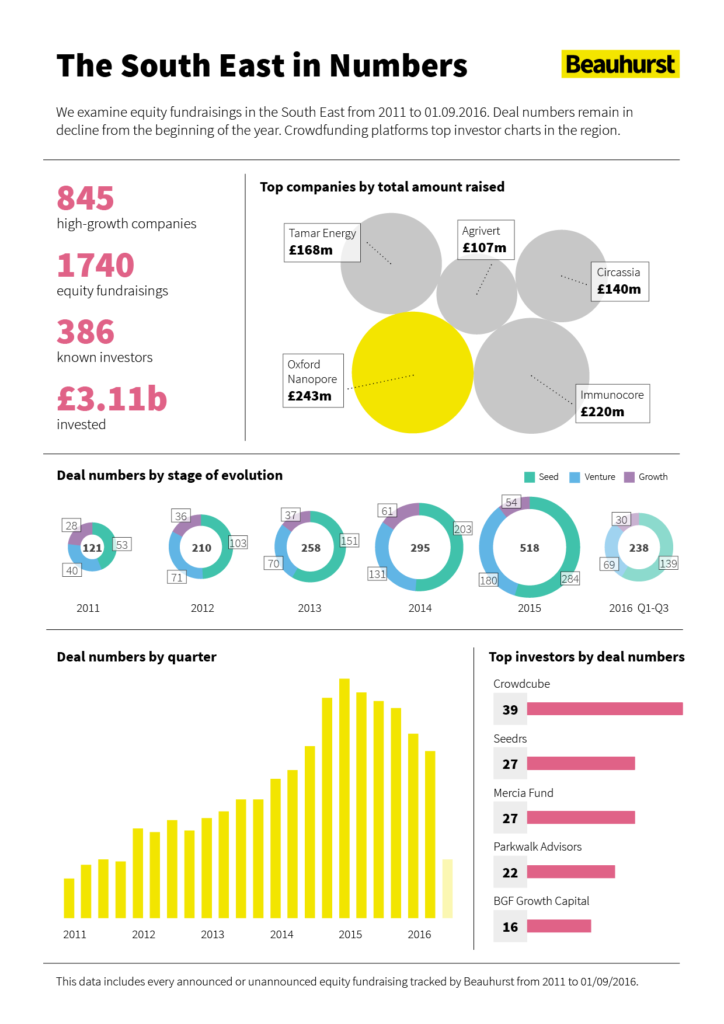

In the second of a series of regional infographics, we summarise the headline figures for South East equity investment from 2011 onwards.

South East equity takes a dip

We’ve talked a lot about the Q2 2016 investment slump we witnessed across the country. Although South East equity investment also slumped, the dip wasn’t quite as drastic as in some other regions. However, it looks like the South East is on track for a pretty poor quarter. Unless we see a sudden increase in fundraisings for the rest of the month, investment levels might be at their lowest since 2013.

Crowdfunders dominate the scene

The two biggest crowdfunding platforms take the top investor spots by number of South East equity investments made – the same positions they hold when looking at equity investment across the UK. This comes as no surprise given that crowdfunders also dominate in the capital, and the South East comes second only to London in number of high-growth companies and fundraising rounds. A few potential reasons for their success in the region spring to mind – the platforms themselves are based in the South, and a greater concentration of wealth in and around the capitals means more investors.

The data behind this infographic was generated using our advanced search.