Seeds of doubt: what’s happening with the UK’s earliest stage companies?

Category: Uncategorized

After years of seeing a steady rise in the number of investment deals completed in the UK, we started to see a drop in the number of deals during 2018. Worryingly, most of that drop happened at the seed stage, with potentially large ramifications; when seed-stage activity drops off, the pipeline of investable companies at venture and growth stages also diminishes in time. So, should we be worried?

On Thursday 11th July we put on a panel and networking event to discuss this drop in seed stage deals and its potential effects. ‘Seeds of Doubt’ was organised with the help of NatWest, and hosted in their Entrepreneur Accelerator office in Angel.

We were very excited to have Chris Kettle (Director of High Growth Business Development at NatWest), Michael Tefula (Associate at Downing Ventures) and Emma Jones (Founder of Enterprise Nation) joining our very own Henry Whorwood for our panel discussion.

We’ve summarised the key points that were discussed during the evening.

A look at the data

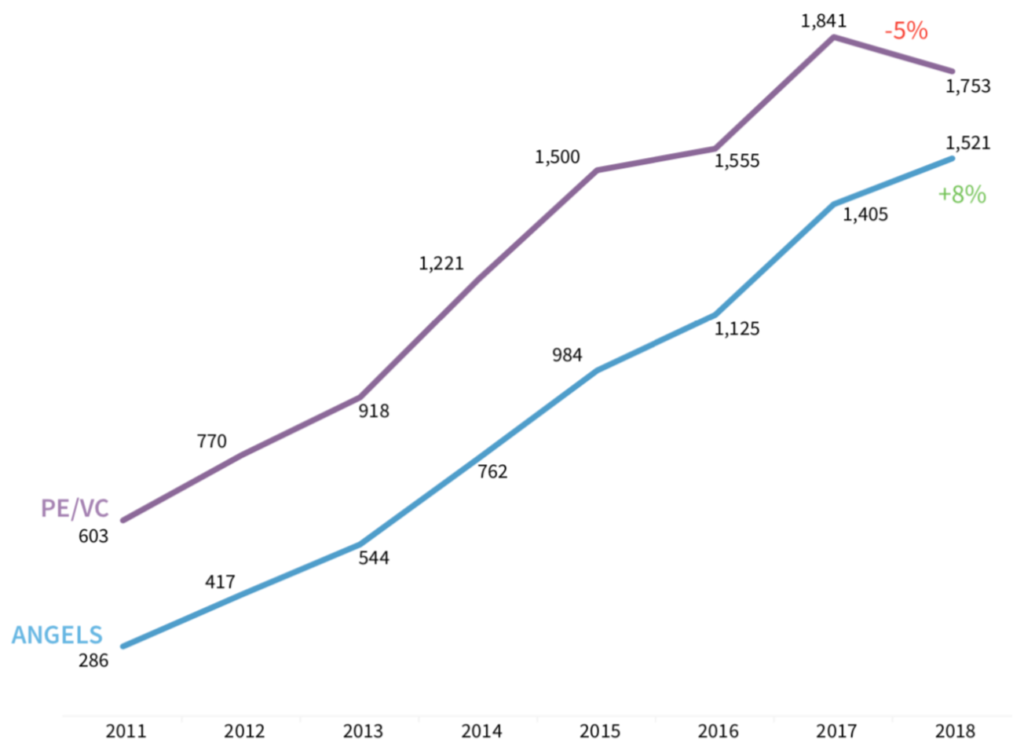

When we first saw this decline, we suspected that it was due to a decrease in angel investments. These individuals have more freedom and agility to respond to macroeconomic issues, compared to their institutional counterparts. In short, angels can respond to Brexit uncertainty more easily than Venture Capitalists and Private Equity firms, which have a set amount of capital to deploy and a clear investment thesis.

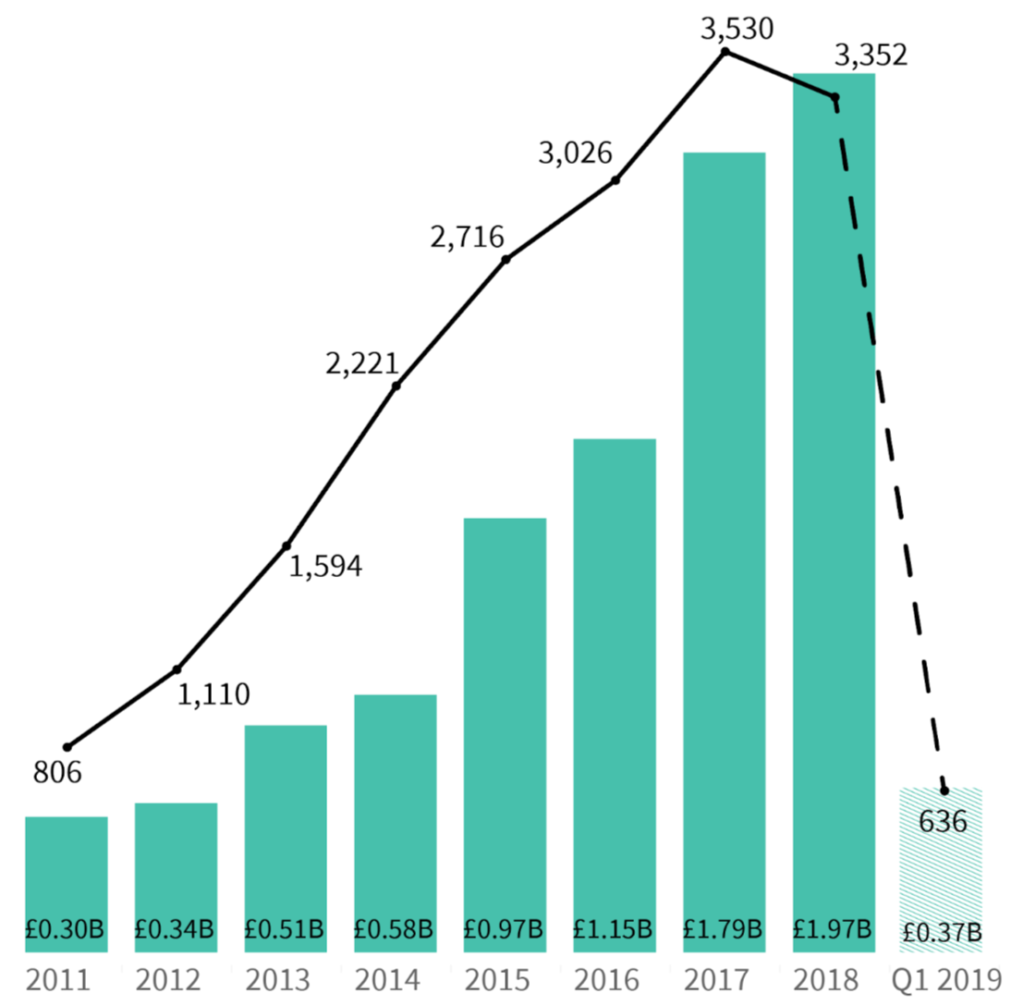

Chart of seed investment (announced and unannounced) by quarter 2011 – Q1/19 (Q1 shown as partial)

However, when we look more closely at the data, we can in fact see that PE and VC activity has dropped off at the seed stage, whilst angel investors saw an increase in the number of deals made in 2018.

Number of seed stage deals completed by different investor types (announced and unannounced)

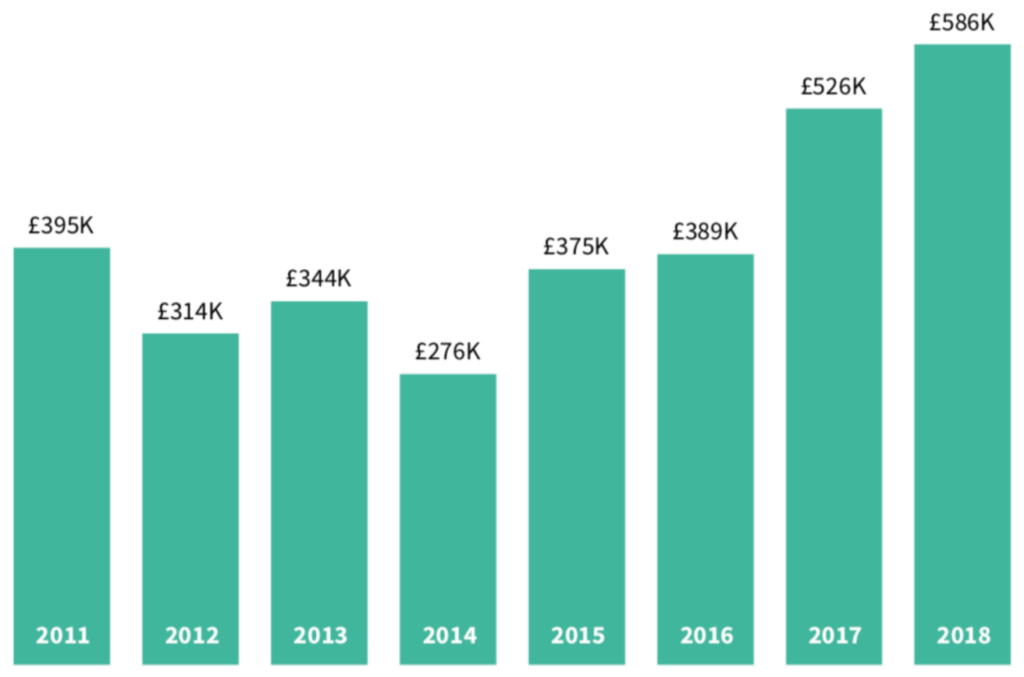

Although deal numbers at the seed stage are down, the total amount invested is up, resulting in an increase in the average deal size. Perhaps this means that companies are still getting sufficient funds, just through fewer rounds?

Average size of seed stage investment deals (announced and unannounced), 2011 – 2018

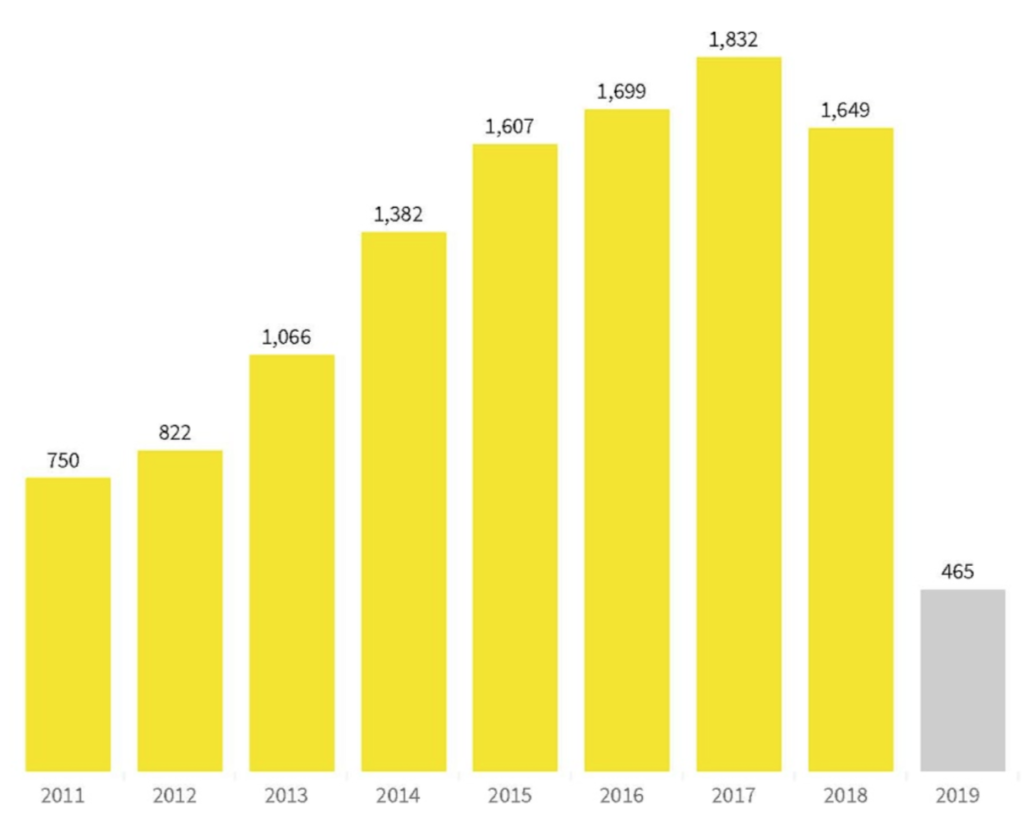

Unfortunately, we don’t believe this to be true; in 2018 we also witnessed a decline in the number of first rounds completed compared to both 2017 and 2016 – so something’s amiss.

Number of first round investments completed over time

We turned to our expert panel to discuss what the reasons for this drop in funding might be, and whether we should be worried about the knock on effects of this.

What is the reason for drop in seed stage funding; is it a matter of insufficient supply, demand or both?

The panel was in agreement that there is still a strong entrepreneurial spirit in the UK, which is visible in the consistent birth rate of new companies each year and the increasing prevalence of “side-hustle” projects – where entrepreneurs launch startups alongside full-time jobs. Emma Jones, Founder of Enterprise Nation, says that “hand on heart, we believe the future of entrepreneurs in the UK is bright. Young people are willing and able to embark on new projects, so we don’t need to be worried about the number of startups in the UK”.

But what about entrepreneurs’ willingness and ability to raise early-stage investment? In a recent survey, the Entrepreneurs Network found that access to finance is the number one issue for startups, but surprisingly and perhaps counterintuitively, most are not looking to raise equity.

Instead, they’re often referring to a difficulty accessing working capital, an issue that may be aided by government initiatives to stamp out late payments; if companies are being paid quicker then they’ll be able to survive longer without initial capital injections, whether that be in the form of equity or debt. And if they do need additional sources of money then the flourishing alternative finance scene is providing numerous avenues of assistance.

From the other side of the investment table, Downing Ventures Associate Michael Tefula agrees that many companies do not have enough funding to grow to their full potential. “Especially in the current economic climate, investors should be providing as much capital as possible to create a solid runway for our most promising companies.” Instead, he has a sense that some of the more traditional VCs are pulling away from early-stage deals in favour of slightly less risky and later stage deals into companies who have more evidence of traction.

The knock on effect of this is that the average size of seed stage deals is steadily increasing, so there’s an expanding gap opening between early stage and mid stage venture companies. It remains to be seen how far this chasm will continue to grow, and extent of the effects on the pipeline of companies for the longer term future.

Should we be worried, or are companies accessing other channels of funding?

There are lots of alternative avenues of funding to a traditional VC equity raise, from accelerator programmes to grants and loans. The NatWest Entrepreneur’s Accelerator is a fully funded programme that gives early stage companies the tools they need to propel themselves through to the next stage in their growth journey. The attendees receive a number of benefits including office space, mentorship, and access to the bank’s expansive connections – without having to relinquish any equity.

Chris Kettle, Director of High-growth Business Development at NatWest, also highlighted the importance of alternative finance for the whole market, including larger corporates. “We see alt finance as a great force in driving large banks to change and innovate. NatWest now has a number of modern channels to help small businesses access finance, including Esme Loans and Mettle.” These pathways can seem more approachable for – and are thus proving popular with – fast growing and ambitious businesses.

Grants are also a great way of raising money for research-intensive and innovative companies, and Innovate UK and BEIS are deploying plenty of capital into the economy via small businesses. Through partnerships with VCs, some programmes are now even introducing an equity element, where investors have to commit to multiple rounds of funding. Our previous research has shown that a mixture of funding types can be hugely beneficial to company growth.

However, Emma Jones posits that grant applications are often too laborious and time intensive. In order to have a chance of success, companies have to dedicate significant resources to the process, a commitment that many cannot afford. On top of this, businesses are reporting that the uncertainty of Brexit is putting them off looking for money. “We hope that as soon as the future becomes a little clearer businesses will come back out and look for cash, and try to tap into the well of money that’s available”.

The question remains as to whether there is more of this downward trend to come. Our H1 2019 Equity Market Update has shown a 14% increase in seed stage deal numbers, the first uptick since H1 2017. This means seed deals are finally roaming north of venture stage deal numbers again, something that we do hope to see continue in the future.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.