The changing dynamic of public and private equity investment

Category: Uncategorized

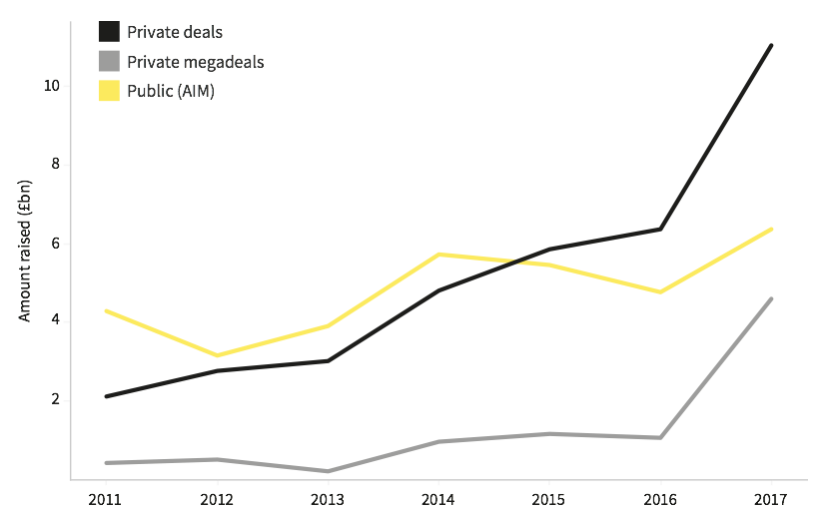

Lots of ambitious companies use external finance to fuel their growth; this can be in the form of debt, private market equity investment and public market equity. Given the rapidly increasing volume of megadeals being completed by the private market that we’ve documented elsewhere, we’ve taken a look below at the relationship between private equity raising and raises on the LSE’s junior market AIM, which is usually the first public port of call for young companies.

PRIVATE VS PUBLIC MARKETS

In 2015 the annual amount raised by companies in private deals overtook the amount raised on the public markets via AIM. Since then this gap in value has been growing, with the most recent figures from 2017 showing that 73% more (£4.67bn) was raised privately than through new and further listings on AIM. These figures hint at a number of changes within the private funding landscape over the past few years.

The first noticeable change is that there has been an increase in the provision of patient capital. This has reduced the pressure for an early exit as investors are not demanding such speedy returns on their investments, which allows the company to continue to raise privately.

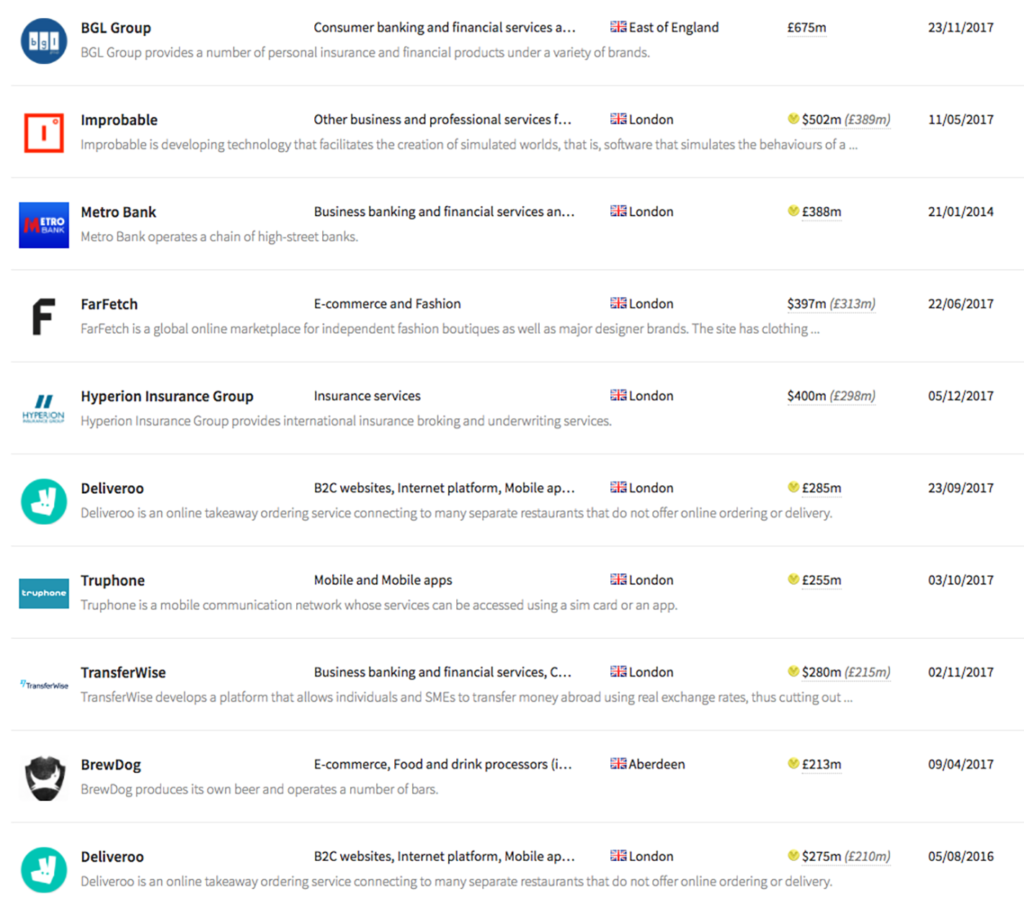

Secondly, there has been an increase in funds that are able to provide companies with large sums of capital. As we reported in our 2017 retrospective, The Deal, this has lead to the number of ‘mega-deals’ (those worth over £50m) sky rocketing. Companies are now able to secure large volumes of capital from more sources, meaning holding an IPO is no longer the only option for companies wishing to raise at these late stages.

MEGADEALS

But it seems these megadeals aren’t supplanting IPOs, merely deferring them. After securing a $280m mega-deal in November last year, the co-founder of TransferWise, Taavet Hinrikus, told Fortune that they still have an IPO horizon of three to four years.

Funding Circle, the online lending platform, has raised over £250m to-date, from private investors. Not so long ago, one could reasonably have thought that such capital requirements would make an IPO necessary. The firm is now contemplating an IPO in the second half of this year.

These companies are likely to still have large capital requirements so an IPO on the LSE’s markets looks likely. However, there are other reasons to list. Regardless of how patient your investors are and how large a supply of private capital is available, an IPO remains an obvious route for the founders of these success stories looking to cash in their shares and realise a well-earned payout. Equity release can be a key motivator for entrepreneurs making funding decisions. NEX Exchange’s low free-float requirement of 10% provides a light-touch mechanism for releasing equity through public markets. Private markets can also facilitate equity release too, so the decision for the entrepreneur is about control and finding investors.

Emma Titmus from the London Stock Exchange had this to say:

“We’re seeing an increasing number of organisations coming to the public markets like AIM later in their lifecycle, typically raising more capital and better prepared for life as a public company. Founders and management teams have a variety of reasons to use public markets as a platform for their next stage of growth. In addition to the initial capital raise, public companies have the ability to raise repeated rounds of finance through the markets to fund organic growth, use their shares as a currency for acquisitions and also benefitting from a higher profile and credibility.”

As an illustrative example, Team 17 recently announced its intention to list on AIM. This IPO will allow management to release equity, LDC to exit its stake and the company to raise additional capital; servicing these different requirements is a case in point for how the public markets can be more appropriate than private markets.

VALUATIONS

AIM is home of larger, more valuable businesses. As at March 2018, the 947 companies on AIM were worth £103.3bn whereas the 9,826 private companies using equity finance since 2011 were worth only £85.4bn. As more and more businesses mature into unicorns and beyond, we expect to see more companies listing on AIM.

KRM22

To complicate the picture, one experienced entrepreneur has rejected the convention for seeking private investment first. Keith Todd raised £10.3m listing his company, KRM22, on AIM only a few weeks after incorporating it on the 2nd March this year. Todd, who has a background in finance which perhaps informed his unconventional strategy, told City A.M “Why take three years faffing around off market?”. Given the current availability of private capital, however, it is likely that this approach will remain unconventional.

The plethora of funding options – we’ve only looked at equity here – available to ambitious businesses in the UK can only be a good thing. Entrepreneurs starting new businesses in this country have never before had such flexibility of choice in how they finance their growth.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.